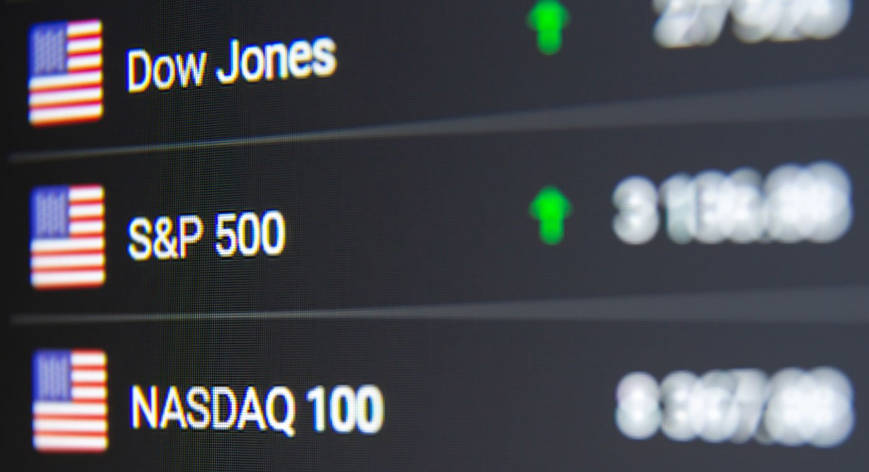

Indices are concise, numerical summaries of groups of financial instruments that allow investors, economists and policymakers to measure market performance quickly and consistently.

They convert thousands of market prices into single values that reveal broad trends, sector strength and risk concentration.

Today, indices underpin the majority of passive investment vehicles and act as the primary benchmark by which investment managers and investors judge success.

Below, this article will explain what indices are, their types, weighting, coverage, investable products, market signals, limitations, trends, and practical guidance for investors.

What Are Indices and Why They Exist

An index is a statistical measure that tracks the performance of a defined set of securities. Indices were invented to provide objective, repeatable measures of market performance.

They exist to simplify complex markets, enable benchmarking, support the creation of investable products and signal changes in investor sentiment. Index rules ensure that an index remains transparent and replicable through a defined methodology covering selection, weighting and rebalancing.

How to use Indices in Market Measurement

When someone quotes an index value, they refer to an aggregated number derived from the prices of the individual components according to a published formula. Indices use one or more weighting schemes to determine the contribution of each constituent to the index value.

Common weighting schemes include market-cap weighting, price weighting and equal weighting. The methodology defines eligibility criteria such as liquidity, domicile, free-float and minimum market capitalisation. Index administrators calculate values continuously during market hours and publish reference levels after market close.

How to Use Indices For in Portfolio Construction and Analysis

Indices serve several practical purposes in finance. They are benchmarks for active managers, templates for passive investment products, reference points for derivatives pricing and inputs into risk models.

Investors use indices to construct diversified portfolios, to measure relative performance and to define exposure to market segments such as large-cap US equities or emerging-market small caps. Policymakers and economists also use indices as timely indicators of economic resilience or stress.

Indices Categorized by Type, Methodology and Market Coverage

| Index Category |

Typical Constituents |

Main Purpose |

| Equity Indices |

Stocks from national, regional or global universes |

Track stock market performance and create equity products |

| Bond Indices |

Government and corporate bonds |

Benchmark fixed-income portfolios and underpin bond ETFs |

| Commodity Indices |

Commodities or commodity futures |

Provide exposure to raw materials and inflation hedges |

| Currency Indices |

Baskets of currencies |

Measure currency strength and underpin FX products |

| Sector/Thematic Indices |

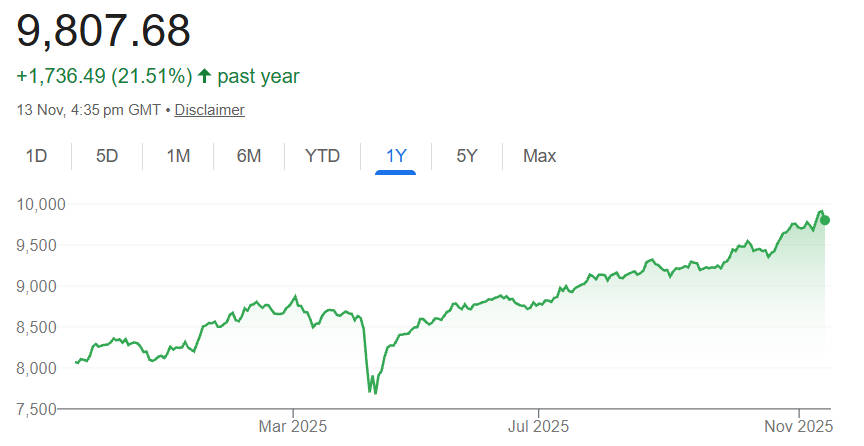

Firms within a sector or theme |

Targeted exposure to sectors such as technology or renewables |

| Factor and Smart Beta Indices |

Stocks weighted by factors such as value or momentum |

Capture alternative risk premia with systematic rules |

The Weighting Model of an Indices and How They Shape Performance

The weighting model of an index materially affects its behaviour. Market-cap weighting gives larger firms more influence and therefore concentrates returns in major companies.

Equal weighting treats each constituent the same, which increases exposure to smaller names. Fundamental weighting uses company fundamentals, such as earnings or book value, to determine weights.

Price-weighted indices give higher-priced shares more influence regardless of company size. Index users must understand weighting because it changes volatility, concentration and the sources of return.

| Weighting Model |

Behavioural Consequence |

Typical Use Case |

| Market-Cap Weighting |

Concentrates exposure in largest firms, lower turnover |

Broad market passive funds |

| Equal Weighting |

Higher exposure to smaller constituents, higher turnover |

Alternative index strategies |

| Fundamental Weighting |

Tilts to firms with stronger fundamentals |

Smart beta products |

| Price Weighting |

High-priced shares dominate regardless of size |

Historical indices with legacy rules |

How Indices Represent Global, Regional and Local Markets

Indices are defined to represent different geographical scopes, allowing investors to choose the market exposure they need.

| Index Example |

Coverage |

Notable Data Point |

| MSCI ACWI |

Global developed and emerging markets |

Covers around 85% of the investable global equity universe with over 2,500 constituents. |

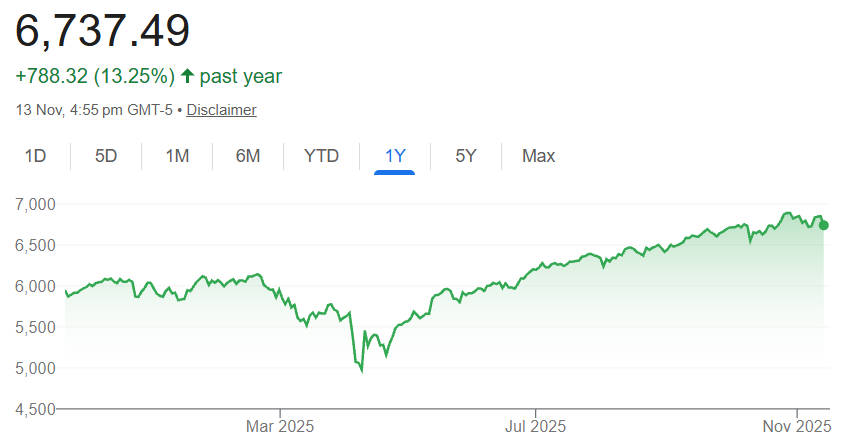

| S&P 500 |

Large-cap US equities |

Represents roughly 80% of available US market capitalisation and is a primary US benchmark. |

| FTSE 100 |

UK large caps |

Tracks 100 largest UK-listed companies by market capitalisation. |

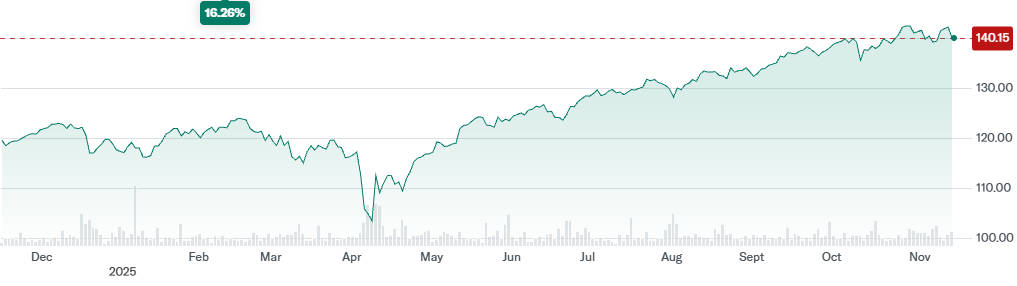

Large-cap US indices such as the S&P 500 account for a substantial share of global equity capitalisation. The S&P 500 market capitalisation recently measured in the tens of trillions of US dollars, reflecting the heavy influence of US mega-cap firms on global markets.

Indices Products and How Investors Access Them

Investors access indices through a range of financial products that replicate or track an index. These include mutual funds, index funds and exchange-traded funds (ETFs). In addition, derivatives such as index futures and options provide leverage and hedging.

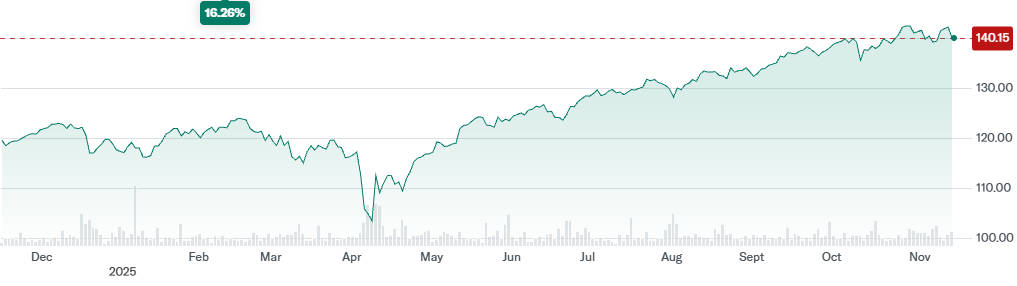

Structured products and certificates often promise bespoke payoffs tied to index performance. The growth of the ETF industry has made index exposure highly liquid and low cost, with global ETF assets reaching record levels in 2025.

Conclusion

In summary, indices will remain central to market structure and investment management. Index providers will keep adapting methodologies to capture new investable themes and to respond to market participants' demands for transparency and low cost. ETF asset totals and index-linked AUM have set new records in 2025. reinforcing the enduring role of indices in capital markets.

Frequently Asked Questions

Q1: What exactly is an index in financial markets?

An index is a rule-based statistical measure that aggregates prices of selected securities to represent a market segment. It provides a transparent benchmark for performance measurement, product creation and economic signalling within financial markets.

Q2: How are indices constructed?

Index providers publish a methodology specifying selection criteria, weighting rules and rebalancing schedules. Constituents must meet liquidity and market-cap thresholds. The methodology ensures consistency, transparency and repeatability in how the index is calculated.

Q3: Why do investors compare portfolios to indices?

Indices provide objective benchmarks that reveal whether managers deliver excess returns after fees. Comparison helps separate skill from luck, guide asset allocation and evaluate strategy effectiveness against a clearly defined market proxy.

Q4: Are all indices investable?

Not all indices are investable. Some are purely observational and unsuitable for replication. Investable indices are designed with tradable constituents and practical weighting to allow funds and ETFs to track them closely.

Q5: Do indices guarantee diversification?

Indices often provide broad exposure but do not guarantee diversification. Some indices concentrate in a few large companies or dominant sectors, creating concentration risk despite the appearance of broad coverage.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.