The yen carry trade has been one of the quiet engines of global risk-taking for years. Investors borrowed in Japanese yen at very low rates, then recycled that funding into higher-yielding assets around the world. The trade worked best when two conditions stayed in place: wide interest-rate gaps and calm markets.

However, those conditions are changing. Today, the Bank of Japan (BoJ) has lifted its policy setting to around 0.75%, a clear step away from the ultra-loose era. The move matters because carry trades are often leveraged, and leverage turns "low" rate changes into "large" position swings when volatility rises.

At the same time, the US Federal Reserve has begun to ease, with the federal funds target range recently lowered to 3.5% to 3.75%. That combination narrows the rate gap that has kept shorting yen attractive.

The primary risk is not the existence of the carry trade, but rather the potential for a rapid unwinding, which can compel traders to buy yen while simultaneously selling risk assets.

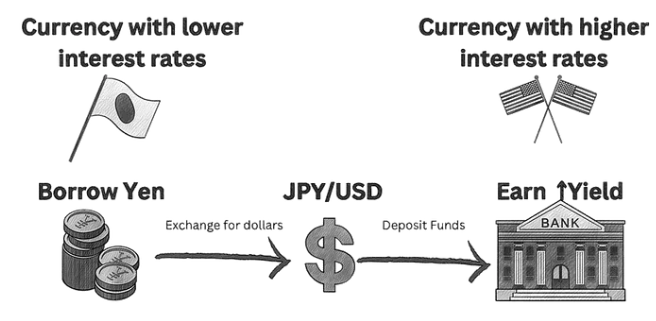

What Is the Yen Carry Trade?

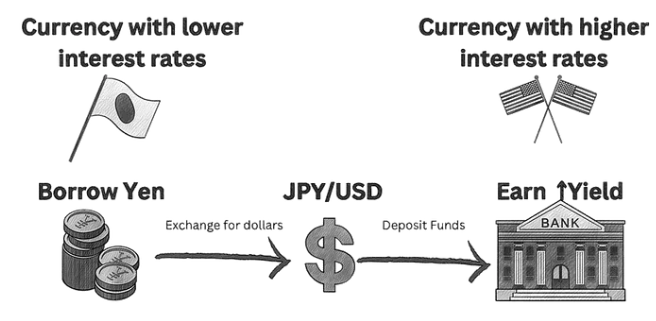

A yen carry trade is a strategy where an investor borrows yen (or sells yen short) because yen funding has been cheap, then invests the proceeds into assets that offer higher returns elsewhere.

The yen has been a popular funding currency for decades because Japanese rates were near zero for a long time. As long as Japan stays the lowest-yield corner of G10, borrowing yen to buy higher-yield assets can look "free". It never is.

The Core Profit Engine

Positive carry: You collect the yield differential every day you hold the position.

Stable FX: You need the funding currency (JPY) not to strengthen sharply.

Cheap leverage: The strategy typically involves the use of leverage, which amplifies both potential returns and losses.

What Is Carry Trade Unwind?

A carry trade unwind is not one trade. It is a chain reaction:

Funding costs rise, or risk sentiment turns.

The funding currency strengthens (yen rallies) as positions are closed.

Risk assets decline as leveraged investors sell their holdings to reduce their exposure.

Liquidity thins, and the same orders move prices further than expected.

Volatility spikes can trigger increased selling due to risk limits and margin rules.

In short, unwinding leveraged positions, including carry trades, amplified short-lived but extreme market moves in prior volatility flare-ups.

Why Carry Trade Unwinds Can Be Violent

Carry trades can unwind for two simple reasons.

The return stops paying for the risk because the funding cost rises or the yield gap shrinks.

As the market shifts to a risk-off stance, traders reduce their leverage, leading to the closure of positions.

When a carry trade closes, the mechanical flow is usually the same: investors buy back yen and sell the assets they funded. If enough players do it at the same time, correlations spike, liquidity dries up, and price moves can overshoot.

The BIS has highlighted how carry trade unwinds can ripple across currencies and broader markets during stress episodes, precisely because the positions are often leveraged and crowded.

Why the BoJ Hike Matters for Yen Carry Trades Right Now?

1) Japan Just Raised the Floor Under Funding Costs

The BoJ has raised its short-term policy rate to 0.75%, the highest in 30 years, and the BoJ is explicitly signalling that more hikes are possible if the data align.

Even if 0.75% is still "low" relative to the US, it changes the slope of expectations. Carry trades do not fear today's rate. They fear tomorrow's path.

2) The Bond Market Is Validating the Shift

Japan's 10-year yield has pushed above 2%. It changes hedging costs, repatriation incentives, and the attractiveness of owning foreign assets on a currency-hedged basis.

After the announcement, the 10-year yields reached around 2.015%, the highest since August 1999.

3) The Yen Reaction Shows the Market Is Still Sceptical

Here is the nuance traders care about: after the hike, the yen slipped to around 155.94 per dollar, with a spike as high as 156.19.

That "yen weaker on a hike" response usually means one of two things:

The hike was fully anticipated, and the guidance did not come across as surprisingly hawkish.

The market still believes the US–Japan rate gap remains large enough to keep carry attractive in the near term.

That is the set-up where positioning can get complacent again, which is exactly when the next unwind risk quietly rebuilds.

Are We In a Carry Trade Unwind Now?

| Indicator |

"Calm carry" signal |

"Unwind risk rising" signal |

Why it matters |

| USD/JPY |

Grinding higher, tight ranges |

Sharp drop (JPY strength), big intraday swings |

Unwinds often show up first as sudden yen strength. |

| Japan 10Y yield |

Stable, orderly |

Fast push above key levels (around 2%) |

Higher yields change domestic flows and hedging costs. |

| Equity volatility |

Low, steady |

Sudden spikes and repeated gap moves |

Carry is effectively short volatility. |

| Credit conditions |

Loose funding |

Tightening, wider spreads |

Leverage becomes harder to roll, forcing cuts. |

| Policy surprises |

Predictable central banks |

Hawkish shocks or guidance shifts |

Surprises reset expectations and gap FX. |

No. We are not in a classic "carry trade unwind" right now, but we are in a market where the risk of an unwind is rising, because Japan's rates and bond yields are moving up and the BoJ is signalling that further tightening is possible.

What Would Trigger a Real Carry Trade Unwind?

| Scenario |

What changes first |

What you would likely see in markets |

Crash risk |

| Orderly unwind |

The yield gap narrows slowly. |

USD/JPY trends lower over weeks, equities digest, credit spreads widen modestly. |

Low |

| Disorderly squeeze |

The yen strengthens quickly over days. |

FX volatility jumps, high-beta FX sells off, equities fall as leverage is reduced. |

Medium |

| Systemic-style shock |

A wider risk event hits during thin liquidity. |

Large yen rally, forced deleveraging, sharp equity drawdown, funding stress across markets. |

High |

USD/JPY moves lower quickly and stays lower.

The yen strengthens broadly, especially versus high-yield carry currencies, rather than only against the US dollar.

JPY volatility rises at the same time as global volatility rises, because that is when leverage becomes a problem.

Could a Yen Carry Trade Unwind Trigger the Next Market Crash?

A yen carry unwind seldom leads to a market crash on its own. It usually amplifies an existing shock.

The typical chain looks like this:

A catalyst hits, such as a sharp equity drop, a policy surprise, or a liquidity event.

Volatility rises, and risk limits tighten.

Leveraged carry positions are reduced.

The yen is repurchased quickly, and yen-funded risk positions are sold down.

Cross-asset correlations tend to spike, while thinner liquidity amplifies the move.

Why It Can Feel Like a Crash:

FX moves first, then everything else. A sharp JPY rally forces hedges and margin calls quickly.

Leverage is common. Small moves become large P&L shocks when scaled.

Liquidity can vanish. In stressed markets, the bid disappears, and price gaps appear.

Why It Might Not Become a Crash

Positioning may be less one-sided than the market narrative implies at times.

Policymakers communicate quickly when market functioning is threatened.

A well-telegraphed BoJ normalisation path can allow carry trades to unwind in an orderly way, rather than in a disorderly rush.

The key lesson from recent volatility episodes is that carry unwinds amplify moves, but markets can also stabilise quickly when the shock is absorbed, and financing remains available.

What Investors Should Do if They Fear an Unwind

1) Stop Treating "JPY Weakness" as a Permanent Feature

Japan has changed regimes. The BoJ is increasing rates and is openly addressing the trajectory concerning a neutral rate range.

If your portfolio expects perpetual yen weakness, you are essentially positing that carry can remain congested indefinitely, which is impossible.

2) Reduce Hidden Carry Exposure

Many portfolios carry without realising it:

If you don't map your currency exposures, you won't know where the unwind will land.

3) Respect Liquidity, Not Just Fundamentals

Leverage, crowded trades and volatility are the recipe for exaggerated price moves.

In an unwind, the best trade is often the one you did not over-size.

Frequently Asked Questions

1. What Is a Yen Carry Trade?

A yen carry trade typically involves borrowing yen at low interest rates and investing in higher-yielding assets or currencies to earn the interest rate differential.

2. Why Do Carry Trades Unwind in a Hurry?

They unwind quickly because many positions are leveraged and depend on stable exchange rates.

3. What Is the Biggest Warning Sign of a Disorderly Unwind?

A fast jump in yen strength alongside a sharp rise in FX volatility is one of the clearest warnings.

Conclusion

In conclusion, a yen carry unwind is one of the rare macroeconomic shocks that can simultaneously impact FX, equities, and credit due to its leverage-driven nature and forced deleveraging, and not valuation alone.

Today's BoJ hike to 0.75% is a clear signal that Japan is no longer the zero-rate anchor it was. Whether the next market crash stems from a carry unwind depends on two factors: whether the BoJ's policy path pushes the yen higher or whether global volatility rises enough to turn "steady carry" into forced deleveraging.

For now, the yen hovering near 156 says the market has not panicked. However, the move in JGB yields above 2% says the pressure is building.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.