Japan's central bank has finally pushed interest rates to a level that would have sounded impossible a few years ago. The Bank of Japan lifted its short-term policy rate by 0.25% to around 0.75%, the highest level since 1995.

On paper, higher rates should support the currency. However, the yen didn't elicit the "stronger yen" reaction many people expected after the hike. In fact, instead of strengthening on the hike, the yen depreciated, with the currency dipping more than 0.3% to about 156.08 per USD.

That immediate move tells you the market read the decision as "priced" and the messaging as not yet restrictive enough to close the rate-gap story.

What Did the BoJ Meeting Announce Today?

The Interest Rate Decision

Policy rate raised: 0.75% from 0.5%.

Vote: unanimous, which matters because it signals strong internal alignment at an important turning point.

Why it is historic: the policy level is the highest in around three decades, last seen in 1995.

The Backdrop

Inflation: Japan's core inflation has been above the 2% goal for an extended period, with core CPI reported at around 3% in November.

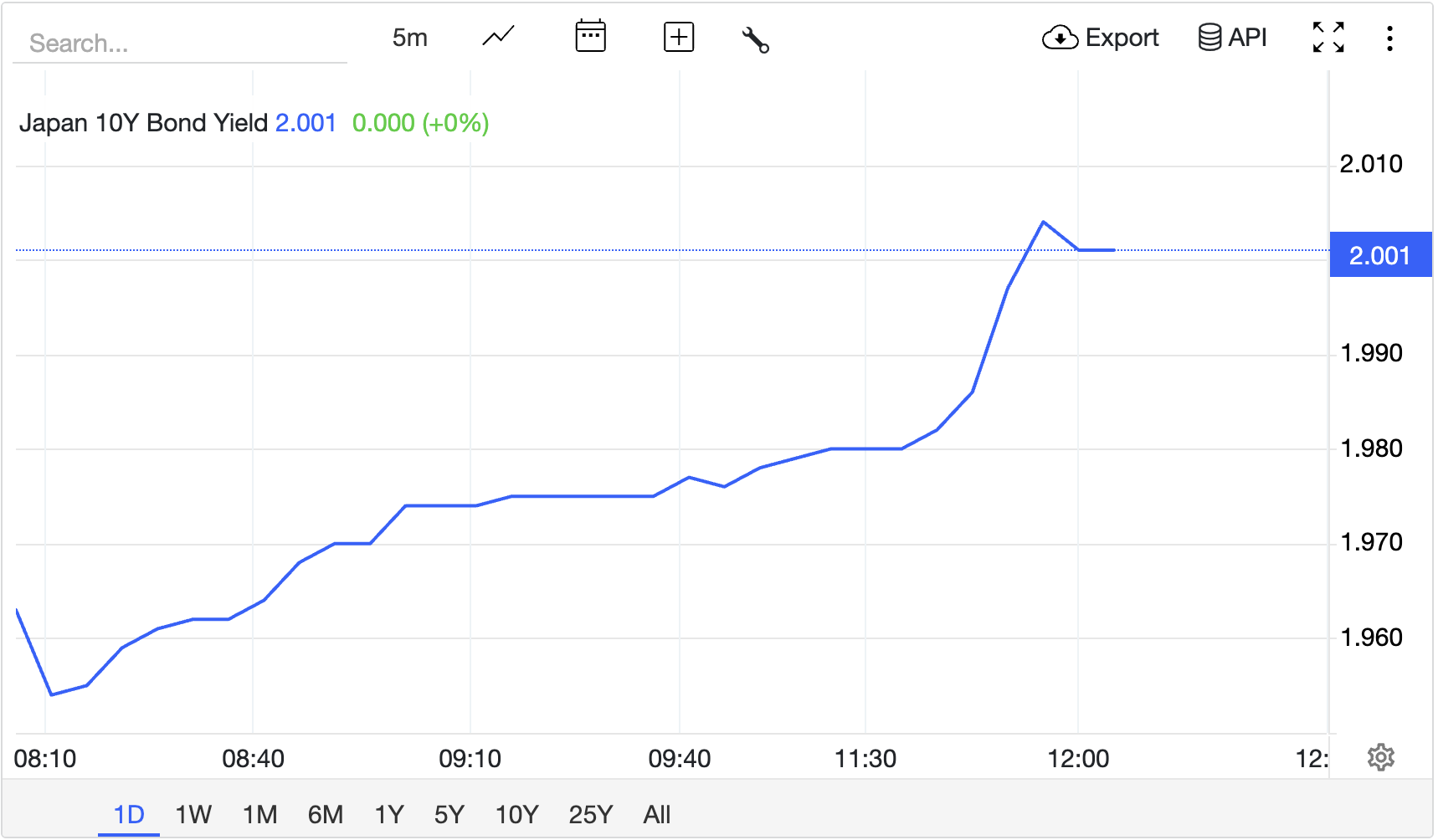

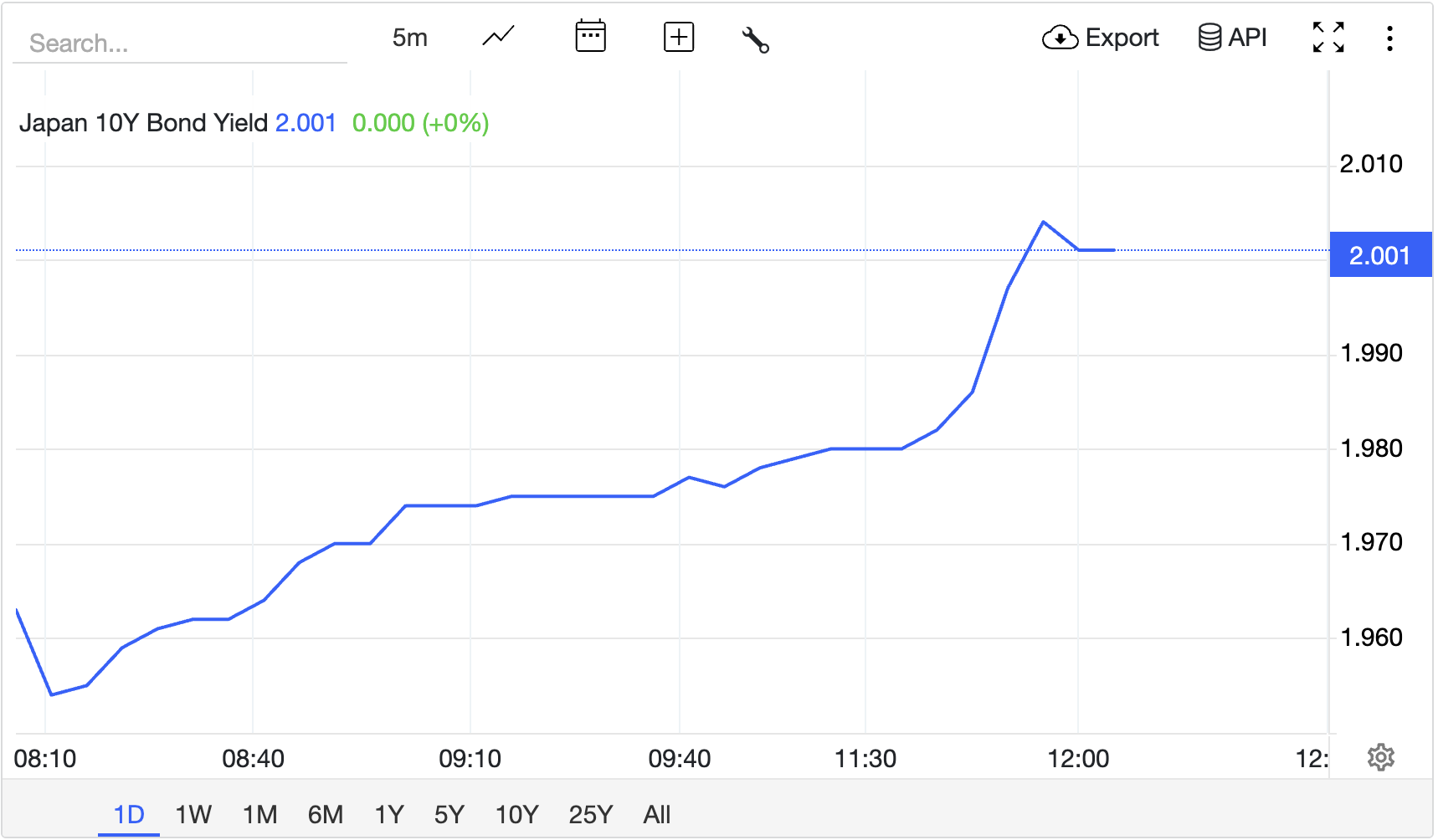

Bond yields: Japan's 10-year government bond yield has climbed sharply, reported at around 2%, an 18-year high.

This is why the hike matters, even if the level still looks low compared to other countries. The BoJ is no longer holding rates at emergency settings, and that changes the price of money across Japan's economy.

The Policy Message Traders Heard

BoJ's stance remains confident that inflation can be sustained around the target, supported by wages, while also signalling that further hikes could follow if conditions hold.

That combination is why markets immediately shifted focus from the hike itself to Governor Ueda's tone and forward guidance.

Immediate Market Reaction After BoJ Interest Rate Hike

1) USD/JPY

The yen did not rally on the headline, but weakened after the decision, slipping more than 0.3% to 156.08 per dollar.

It is the classic reaction when:

The hike is fully expected

The statement does not sound urgent

The market continues to believe that the interest rate gap compared to the United States remains significant.

Furthermore, the market may view this decision as dovish, leading to short-term volatility and potentially a weaker yen at first.

2) JGB Yields

Japan's 10-year government bond yield is nearing 2%, a threshold that traders view as significant because it affects hedging costs, fiscal perceptions, and the sentiment towards domestic risk.

In fact, the Japanese 10Y Bond Yield surpassed its 18-year high of around 1.98% after the announcement.

Why the Yen Depreciated Even After a BoJ Rate Hike?

1) The Hike Was Already "In the Price"

Markets don't move on headlines. They move on the gap between expectations and reality. A 0.75% policy rate had been widely expected before the meeting.

By the time the decision arrived, investors had already been treating a 0.75% move as certain.

2) A "Dovish Hike" Is Still Dovish

The yen continued to decline against the dollar after the decision, indicating that the market views the hike as cautious rather than the beginning of a rapid tightening cycle.

Market commentary echoed that point: the market can treat the move as dovish if officials imply the next hike is "some distance away."

J.P. Morgan strategists quoted that they did not expect the hike to spark a yen rally because the messaging would likely suggest the next move is not imminent.

3) Fiscal Risk Remains a Yen Problem

Even if interest rates increase, investors still take into account Japan's fiscal situation. For context, Japan's public debt is about 250% of GDP, and a sizable supplementary budget is being financed largely through new debt issuance.

This situation continues to put pressure on both the Japanese Government Bond (JGB) market and the currency.

This matters because currency markets do not trade "rates" in isolation. They trade the full package: policy credibility, inflation risk, and the government's ability to fund itself without destabilising the bond market.

What Today's BoJ Decision Changes for Traders in 2026

1) The Carry Trade Is Less Comfortable, but It Is Not Dead

Japan's rate is rising, but the yen can still weaken if the rate gap versus the United States stays wide enough and if risk appetite stays firm.

For carry traders, Japan's low rates have long supported carry trades, and higher Japanese rates can reduce that incentive over time.

The key phrase is "over time." A single 25bp hike does not unwind years of positioning by itself.

2) Japanese Yields Are Rising, but the BoJ Must Avoid a Bond Shock.

One reason the BoJ cannot sound too aggressive is that higher yields feed directly into government funding costs.

The JGB market remains fragile, with longer-dated yields hovering near their highs. Policymakers are facing pressure from politics, the bond market, and the currency simultaneously.

That balancing act is exactly why the yen can struggle: the BoJ wants a stronger yen to reduce imported inflation, but it cannot trigger a disorderly sell-off in JGBs.

3) Inflation Is Above Target, but Real Rates Can Still Be Negative

Japan's inflation has remained above the BoJ's 2% target for an extended period, and core inflation at 3.0% in November.

Even after hiking, if inflation stays above the policy rate, real rates remain negative. That keeps financial conditions looser than the headline rate suggests, which can limit yen support.

USD/JPY Technical Analysis

After the interest rate announcement, USD/JPY has been trading around ¥155–¥156 per $1.

USD/JPY Technical Indicators

| Indicator |

Value |

Signal / Action |

| RSI (14) |

68.729 |

Buy |

| Stochastic (9,6) |

50.487 |

Neutral |

| StochRSI (14) |

100 |

Overbought |

| MACD (12,26) |

0.08 |

Buy |

| ADX (14) |

25.329 |

Buy |

| Williams %R |

−13.75 |

Overbought |

| CCI (14) |

216.8551 |

Overbought |

| ATR (14) |

0.1936 |

Less Volatility |

| Highs/Lows (14) |

0.3107 |

Buy |

| Ultimate Oscillator |

65.569 |

Buy |

| Rate of Change (ROC) |

0.367 |

Buy |

| Bull/Bear Power (13) |

0.296 |

Buy |

Momentum has leaned upward, but the market is stretched in the short term. Overbought doesn't mean "must drop." Chasing strength becomes riskier unless the price continues to make higher highs.

Moving Averages

| Moving average |

Value |

| SMA (5) |

¥155.39 |

| SMA (10) |

¥155.69 |

| SMA (21) |

¥155.70 |

| SMA (50) |

¥154.64 |

| SMA (200) |

¥148.43 |

| EMA (12) |

¥155.55 |

| EMA (26) |

¥155.38 |

| Ichimoku baseline (9/26/52) |

¥156.12 |

USD/JPY is trading far above the 200-day area, implying the broader trend has been yen-weak for a long time. Near-term averages are clustered around ¥155–¥156, which often leads to choppy trading unless a new catalyst breaks the range.

Key USD/JPY Levels Traders are Watching

| Level type |

Zone |

Why it matters |

| Resistance |

¥156.00 to ¥156.20 |

Repeated test zone, nearby baseline level |

| Resistance |

¥156.50 |

Next psychological area if ¥156 clears (short-term) |

| Support |

¥155.00 |

Big round level that’s been in play |

| Support |

¥154.70 to ¥154.80 |

Recent reaction zone before rebounds |

| Support |

¥153.00 |

A deeper support target discussed as a "break" level |

In short, if USD/JPY remains above ¥155 and approaches ¥156, the market indicates continued yen weakness. If it breaks below the mid-¥154s and fails to reclaim it, the tone can change quickly.

What Traders and Investors Should Watch Next?

1) The BoJ's Pace From Here

A single hike is one thing. A series is another.

2) Japan's Bond Market

The sharp rise in long-term yields is a pressure point.

3) Intervention Risk

When the yen gets too weak too quickly, officials often start talking tougher. This is crucial as the yen has hovered near levels that raise intervention sensitivity.

4) How the Global Rate Backdrop Evolves

The yen's path also depends on what other central banks do next, because the yen struggles when global yields remain attractive elsewhere.

Frequently Asked Questions (FAQ)

1. What Is the Bank of Japan's Interest Rate Now?

The BoJ raised its key policy rate by 0.25% to 0.75% on 19 December 2025, the highest level since 1995.

2. Why Did the Yen Weaken After the BoJ Hiked Rates?

Because the hike was widely expected, and the market focused on guidance.

3. What Is Japan's Inflation Rate Right Now?

Japan's core consumer inflation rose 3.0% year-on-year in November 2025, staying above the BoJ's 2% target.

4. Does a Higher BoJ Rate End the Carry Trade?

Not immediately. It reduces the attraction over time, but carry trades depend on the whole yield gap and risk appetite.

Conclusion

In conclusion, today's BoJ hike to 0.75% is historic, but the first market verdict was blunt: the yen weakened, not strengthened. That suggests the market believes Japan is still tightening too gently to change the global rate-gap trade in a meaningful way, at least for now.

For traders, the takeaway is practical. Do not trade the headline. Trade the message and the levels. If USD/JPY does not fall below ¥155, the market will remain comfortable maintaining a short position on the yen. If it breaks and holds, the BoJ has finally started to change expectations in a way that matters.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.