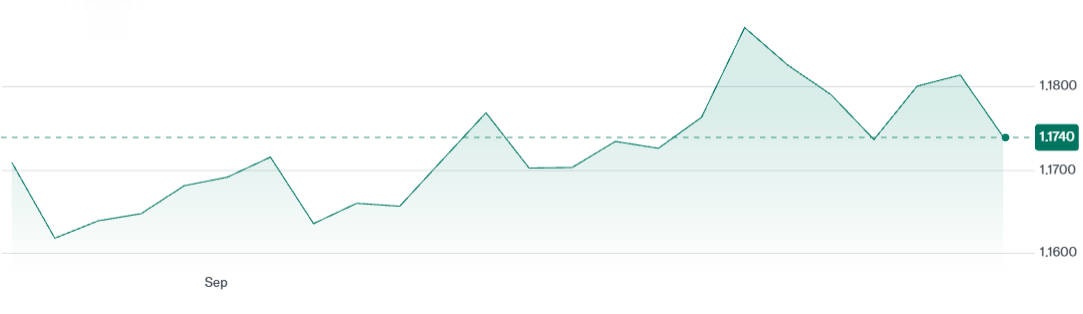

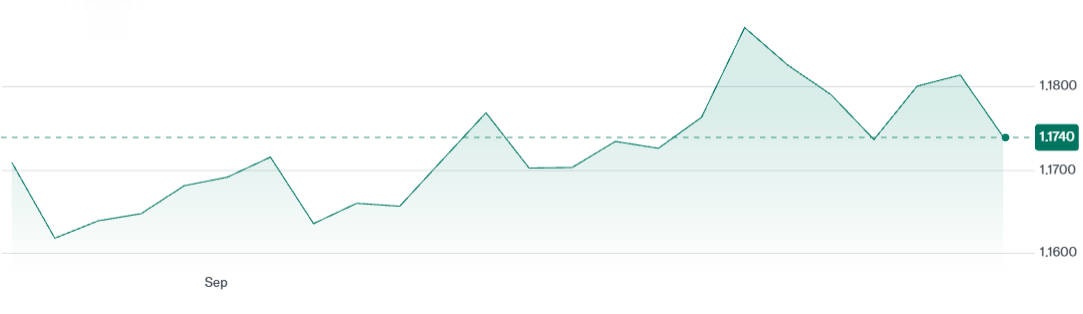

In recent weeks, the EUR/USD pair has fluctuated within a somewhat constrained range, as markets grapple with conflicting signals from central banks, fresh macroeconomic data, and evolving investor sentiment.

The euro has come under mild pressure following disappointing business surveys in Germany and renewed strength in the U.S. dollar.

Meanwhile, the Federal Reserve appears to be taking a more cautious tone on further rate cuts, which has bolstered expectations of a firmer USD short term.

On the European side, the ECB is signalling potential further rate cuts, but recent analyst surveys suggest the central bank may now be near the end of its easing cycle.

This article delves into the key drivers behind the EUR/USD outlook, provides technical analysis, and offers scenario-based projections.

Recent Trends and Market Influences on EUR/USD

1) Central Bank Policy Signals

ECB

According to a Reuters poll (1–4 September 2025), the majority of economists predict the ECB will pause further rate cuts, holding its deposit rate at 2 % in the near term.

In its September meeting, the ECB published new projections showing inflation is expected to decline modestly — from ~2 % currently, to 1.7 % in 2026. and 1.9 % by 2027.

Some ECB policymakers, such as France's governor Villeroy de Galhau, have kept the door open to additional easing, citing downside risks from energy prices, external demand, and a strong euro.

However, with inflation hovering close to target and labour markets relatively stable, market expectations are shifting toward a more stable ECB policy path.

Federal Reserve (U.S.)

The Fed's communications have become more cautious. Some officials are expressing concerns about inflation persistence and the potential risks of easing prematurely.

Markets are currently pricing in two additional 25 basis point cuts for 2025. potentially in the latter meetings.

The forthcoming PCE (Personal Consumption Expenditures) inflation report is viewed as a critical input that may either cement or derail those expectations.

In sum, the diverging trajectories (or possible divergence) between the ECB and the Fed are central to the EUR/USD outlook.

2) Macroeconomic Data Shocks

German / Eurozone Business Sentiment

U.S. Data Trends

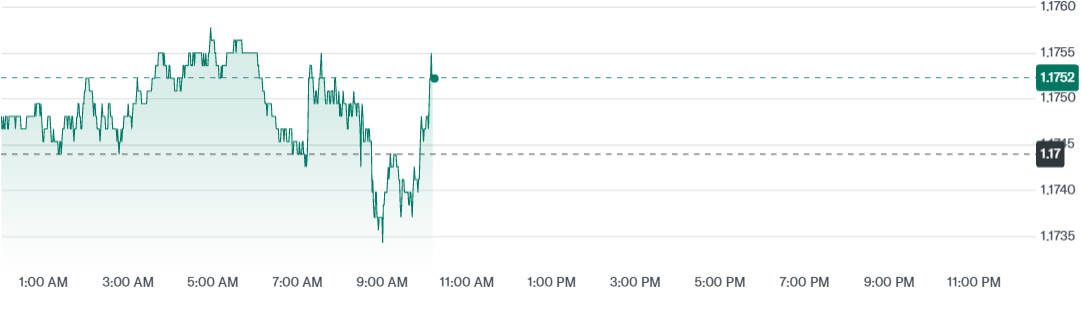

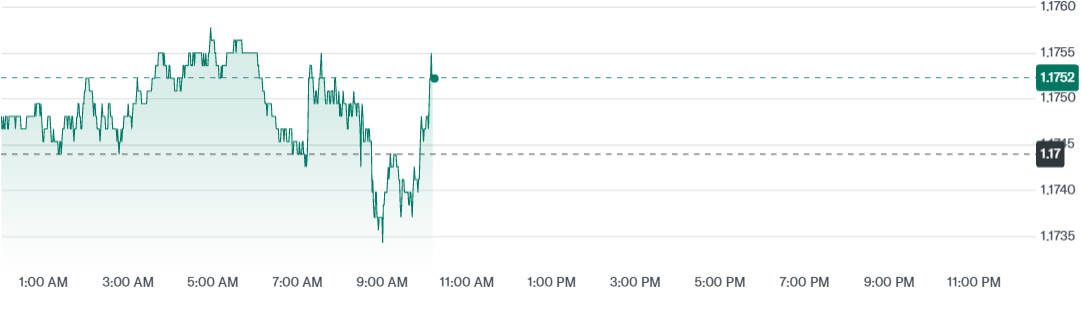

The U.S. dollar recently came under pressure, and EUR/USD managed to reclaim parts of its downside, reaching ~1.1804 on Tuesday in one report, as markets reacted to weaker USD momentum and uncertainty over Fed policy.

However, that rally has met resistance; the USD remains sensitive to inflation data, labour figures, and other macro surprises.

These mixed data signals create an environment of uncertainty, especially for short-term EUR/USD traders.

3) Market Sentiment & Risk Appetite

On the EUR side, central bank discourse matters too: for example, Bundesbank President Nagel recently commented that while the euro cannot realistically replace the U.S. dollar as the global reserve currency, its global role should be reinforced.

In aggregate, sentiment remains fragile and reactive to news and policy divergence.

Technical and Quantitative Analysis for EUR/USD

1) Chart Structure & Key Levels

As of the latest reports, EUR/USD is trading around 1.1737. down slightly on the day.

In one technical view, EUR/USD had broken above a falling trendline, reaching a 2025 high near 1.1915. but then pulled back below 1.18.

Resistance zones to watch include 1.1830 (the July high) and 1.1915 (multi-year high).

Support levels: 1.17 (round number), 1.1580 in a deeper downside scenario.

Moving averages (e.g. 50-, 100-, 200-day) may be offering dynamic resistance or support, but specific alignments vary by timeframe.

2) Momentum & Sentiment Overlays

The RSI and MACD indicators show moderating momentum with some crossovers potentially hinting at a retracement.

Technical summaries on sites like Investing.com currently lean toward “Neutral / Sell” in medium timeframes.

Sentiment metrics (e.g. CFTC net positioning, retail flow) are not openly published in every report, but traders often reference those data to detect extremes or contrarian setups.

Implied volatility and skew in EUR/USD options could reflect market fear of downside or tail risk, though accessing live data may require a subscription.

3) Modeling & Forecasting Techniques

In academic work, machine learning frameworks combining news sentiment and quantitative features have been applied to EUR/USD forecasting with promising results.

For example, one study built an interpretable ML model (XGBoost) that used sentiment metrics derived from news feeds as features to predict next-day returns of EUR/USD. It reported strong out-of-sample Sharpe ratios.

Another model (PSO-LSTM) fused textual sentiment analysis with financial indicators and showed outperformance over traditional econometric approaches.

Nevertheless, such models have limitations: they may lag in fast-moving regimes, suffer from overfitting, or fail when news flows deviate drastically from historical patterns. They should be used as complements — not replacements — to conventional analysis.

Scenarios & Price Projections for EUR/USD

1) Base Case Scenario

Assumptions: U.S. inflation moderates, allowing the Fed to cut twice in 2025; the ECB holds rates steady with no further cuts; no major geopolitical shock.

Under this scenario, EUR/USD may drift toward 1.1750–1.1850 over the coming months, with a possible test of 1.1830 resistance.

Time horizon: 1–3 months for moderate moves; 6–9 months for more ambitious ranges.

2) Bearish / Downside Scenario

Triggers: Strong U.S. employment or inflation surprises; Fed refrains from cutting further; surprise hawkishness from D.C. or tax policy uncertainty.

In that case, EUR/USD could break below 1.1700. perhaps extending toward 1.1580 or lower.

A break below the trendline support would validate a deeper downside thrust. Technical momentum (e.g. MACD) may turn more decisively negative.

3) Bullish / Upside Scenario

Triggers: A dovish Fed pivot, weaker U.S. growth, or a surprise stimulus; dovish commentary from ECB; geopolitical risk boosting demand for the euro as a safe-haven.

Potential resistance zones would then include 1.1830. 1.1900. and an eventual retest of 1.1915 or higher.

To invalidate the bullish view, EUR/USD would have to fail convincingly above 1.1830 or reverse sharply from that zone.

Risk Factors & Watchlist

1) Policy surprises:

Unexpected statements or decisions from Fed or ECB members could trigger volatility.

2) Macro data surprises:

Inflation metrics (especially PCE), labour market data, consumer sentiment, and industrial activity all have outsized influence.

3) Geopolitics:

Trade disputes, energy shocks, or geopolitical conflicts in Europe could shift flows abruptly.

4) Market flows / liquidity:

Sudden repositioning by large funds, stop runs, or FX intervention (less likely in EUR/USD but possible) could distort price action.

5) Model risk:

Reliance on algorithmic or sentiment models may fail in regime changes or black-swan events.

Implications for Traders & Strategies

In trading EUR/USD, disciplined use of stop-loss and take-profit levels is essential, especially under volatility.

Traders might place limit orders at technical levels (resistance or support) confirmed by indicators (e.g. trendlines, Fibonacci levels).

Because EUR/USD is liquid, one might consider scaling positions or using laddered entries to manage risk across multiple levels.

For more sophisticated traders, options (puts, calls, collars) can provide asymmetric exposure or hedges — especially near inflection zones.

Position sizing is crucial: avoid overexposure to a single currency bet, use correlation hedges (e.g. EUR/GBP, EUR/CHF), and monitor intraday liquidity.

Conclusion

EUR/USD currently faces a tug-of-war between cautious Fed expectations and a potentially stabilising eurozone outlook. While short-term volatility may persist, the medium outlook leans toward a moderate range between 1.1700 and 1.1850. barring surprises.

Key catalysts — especially U.S. inflation, central bank communications, and sentiment shifts — will determine whether EUR/USD breaks to higher or lower ground.

Traders should maintain flexibility, keep a close eye on data releases, and use prudent risk controls. The insights from machine learning and sentiment models may offer an edge, but only when combined with traditional analysis and risk discipline.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.