A forex broker is a financial firm that provides traders with access to the foreign exchange market. Because the forex market does not operate through a central exchange, individual traders cannot trade currencies directly with banks or institutions. Instead, they place trades through a broker that connects them to prices and liquidity.

For traders, the forex broker matters because it controls how trades are executed, what prices are shown, how much trading costs, and how smoothly orders are filled.

Definition

In trading terms, a forex broker acts as an intermediary between the trader and the wider currency market. The broker provides a trading platform where traders can buy and sell currency pairs such as EUR/USD or GBP/JPY.

Traders see the broker through price quotes, charts, spreads, and order execution on their platform. Brokers may source prices from banks, liquidity providers, or internal systems, depending on their model. Retail traders, day traders, and long-term traders all rely on brokers to access the forex market.

Think of a forex broker like a travel agent for currency exchange. You do not call every airline or hotel yourself. The agent shows available options, handles the booking, and processes payment.

In the same way, a forex broker shows live currency prices, takes trade orders, and handles the transaction behind the scenes. Without the broker, individual traders would have no practical way to access the global currency market.

What Affects The Forex Broker Day To Day

Several factors can affect how a forex broker operates during a trading day:

Market volatility: During major news or uncertainty, spreads can widen and execution can slow.

Liquidity conditions: Thin market hours, such as late sessions or holidays, can affect pricing quality.

Economic news: Interest rate decisions or inflation data can trigger rapid changes in quotes.

Broker risk controls: Brokers may adjust margin requirements or trading conditions during fast markets.

These changes can influence trade cost and execution quality even if a trader’s strategy stays the same.

How A Forex Broker Affects Your Trades

A forex broker affects trades in three main ways. First is entry and exit pricing. The spread and execution speed determine how close a trade is filled to the intended price.

Second is risk management. Margin requirements, stop-loss execution, and order handling all depend on the broker’s systems.

Third is overall trading cost. Spreads, commissions, overnight fees, and slippage all come from broker conditions.

Typical situations include:

Good situation: stable spreads, fast execution, clear pricing

Bad situation: wide spreads, delayed fills, frequent price gaps

How To Check For A Good Forex Broker

Before placing trades, traders usually check:

Regulation and licence: Confirm which authority supervises the broker.

Spreads and fees: Review typical spreads during normal and volatile markets.

Execution quality: Look for consistent fills and minimal slippage.

Trading platform stability: Ensure charts, orders, and prices update smoothly.

A good habit is to review broker conditions regularly, not only when problems appear.

Common Mistakes

Choosing a broker based only on low spreads, ignoring execution quality.

Ignoring regulation, which increases counterparty risk.

Trading during extreme news without preparation, when conditions change fast.

Not understanding margin rules, leading to forced position closures.

Assuming all brokers quote prices the same, despite different models.

These mistakes often affect beginners most.

Related Terms

Market Order: A market order is an instruction to buy or sell immediately at the best available price offered by the market.

Fiscal Policy: Fiscal policy refers to government decisions on spending and taxation that can influence economic growth and currency markets.

Bid-Ask Spread: The bid-ask spread is the difference between the price buyers are willing to pay and the price sellers are willing to accept.

A-Book Broker: An A-Book broker passes client trades directly to external liquidity providers without taking the opposite side.

B-Book Broker: A B-Book broker internalises client trades and acts as the counterparty rather than sending orders to the wider market.

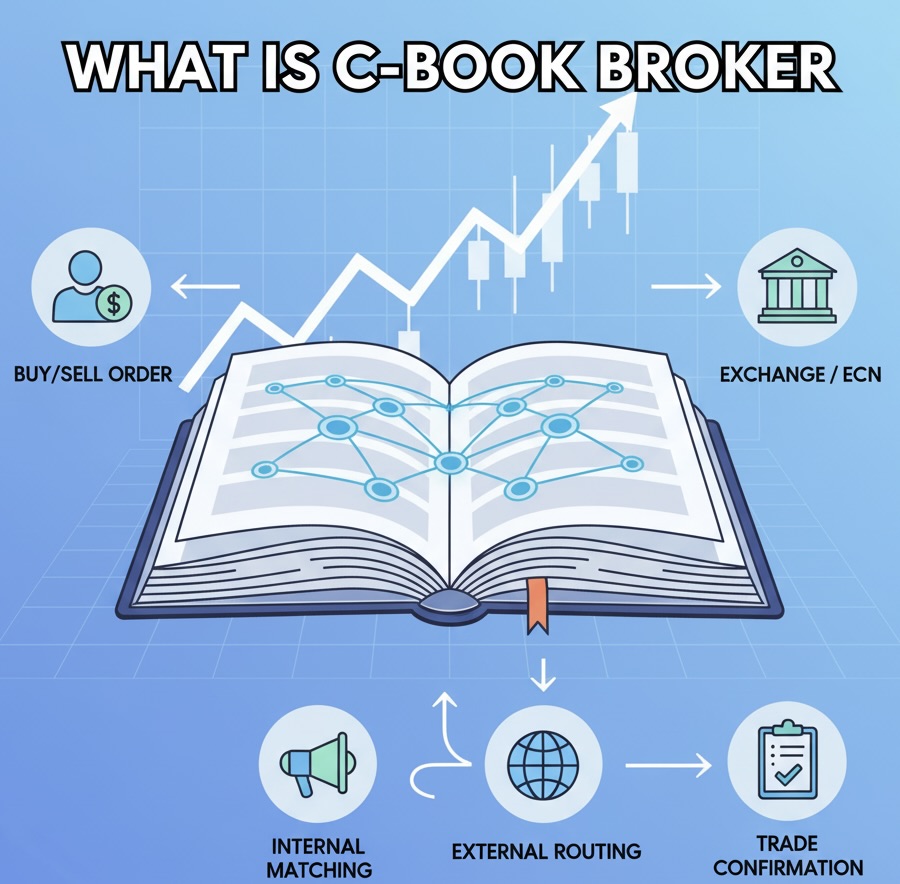

C-Book Broker: A C-Book broker uses a hybrid model, routing some trades externally while internalising others based on risk or client profile.

Demo Account: A practice trading account that uses virtual money, allowing traders to test strategies and learn how a trading platform works without risking real funds.

Frequently Asked Questions (FAQ)

1. What Is a Forex Broker?

A forex broker is a regulated financial firm that gives traders access to the global foreign exchange market through a trading platform. Brokers provide price quotes, execute trades, and handle the technical and legal processes needed for currency trading.

2. Why do traders need a forex broker?

The forex market has no central exchange, and individual traders cannot trade directly with banks or large institutions. A broker acts as the bridge, allowing traders to participate using smaller trade sizes and standardised platforms.

3. How does a forex broker affect trading results?

A broker influences spreads, execution speed, margin requirements, and trading costs. These factors can affect entry and exit prices, risk control, and overall trade performance, even when market direction is correct.

4. Are all forex brokers the same?

No. Brokers differ in regulation, pricing models, execution methods, and client protections. Choosing a well-regulated broker with clear trading conditions is an important part of managing trading risk.

5. How does regulation protect traders?

Regulated brokers must follow rules on client fund segregation, capital requirements, and fair dealing. Firms such as EBC Financial Group, which operate under recognised regulatory frameworks, are required to meet these standards to protect clients and maintain market integrity.

6. How do forex brokers make money?

Forex brokers earn revenue mainly through spreads, commissions, and overnight financing charges. These costs are part of trading and should always be understood before placing trades.

Summary

A forex broker provides the access, pricing, and execution that make retail currency trading possible. It shapes trading costs, risk, and order quality every day.

Used carefully, a good broker supports consistent trading. Used without understanding, broker conditions can undermine even solid strategies.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.