Opendoor Technologies, Inc. (OPEN) is a residential real estate platform whose reported revenue is dominated by home sales, not software subscriptions.

That single detail shapes how investors should value Opendoor stock: headline revenue can swing with housing turnover and inventory levels, while margins depend on price spreads, holding costs, and resale speed.

OPEN stock recently traded around $6.27 per share, which makes valuation unusually sensitive to share count, dilution terms, and balance-sheet financing tied to home inventory.

OPEN Valuation Snapshot: Share Count, Cash, And Dilution

Market Cap Starts With Shares Outstanding

A market cap is simply share price × shares outstanding. In its Form 10-Q for the quarter ended September 30, 2025, Opendoor reported 771,534,057 shares outstanding.

That share count matters because Opendoor has used equity issuance as part of its funding toolkit. In the first nine months of 2025, it issued 21,587,667 shares via an at-the-market program at a $9.26 weighted average price, for about $195M in net proceeds.

Liquidity: Separate Cash From Restricted Cash

Opendoor’s balance sheet includes both unrestricted cash and restricted cash tied to inventory financing structures. As of September 30, 2025, Opendoor reported $962M of cash and cash equivalents and $490M of restricted cash.

For valuation work, investors often treat restricted cash as less flexible than unrestricted cash because it can be pledged or controlled under financing agreements. That distinction becomes critical in down markets when liquidity “optionalities” get priced aggressively.

Enterprise Value Is Tricky With Non-Recourse Inventory Debt

Opendoor finances home inventory primarily through non-recourse asset-backed debt. At September 30, 2025, the 10-Q shows $374M current portion and $966M net of current portion on the balance sheet, with creditors generally having limited recourse beyond the relevant structures.

Because that debt is secured by inventory, a simple enterprise value calculation can mislead. Many investors model two layers instead:

Operating company value (technology, brand, unit economics)

Inventory warehouse economics (spread, turn speed, financing cost, loss protection)

Dilution: Warrants And Convertibles Can Move The Goalposts

In late 2025, Opendoor executed a warrant dividend that created three tradable warrant series (Series K/A/Z) with $9, $13, and $17 exercise prices, and the company registered up to 99,295,146 shares issuable on warrant exercise.

Opendoor also has convertible notes with terms that can add equity-like exposure. The 10-Q lists a 0.25% 2026 note with a $19.23 conversion price and a 7.00% 2030 note with a $1.57 conversion price, plus details of a May 2025 exchange into the 2030 notes.

Key Valuation Inputs (Most Recent SEC Filing)

| Item |

Value |

| Shares Outstanding |

771,534,057 |

| Revenue (Quarter Ended Sep 30, 2025) |

$915M |

| Gross Profit (Quarter Ended Sep 30, 2025) |

$66M |

| Gross Margin (Quarter Ended Sep 30, 2025) |

7.2% |

| Cash and Cash Equivalents |

$962M |

| Restricted Cash |

$490M |

| Real Estate Inventory (VIEs, Net) |

$1,035M |

| Non-Recourse Asset-Backed Debt (Net of Current) |

$966M |

| Operating Cash Flow (Nine Months Ended Sep 30, 2025) |

$979M |

How Opendoor Makes Money And Why Revenue Can Mislead

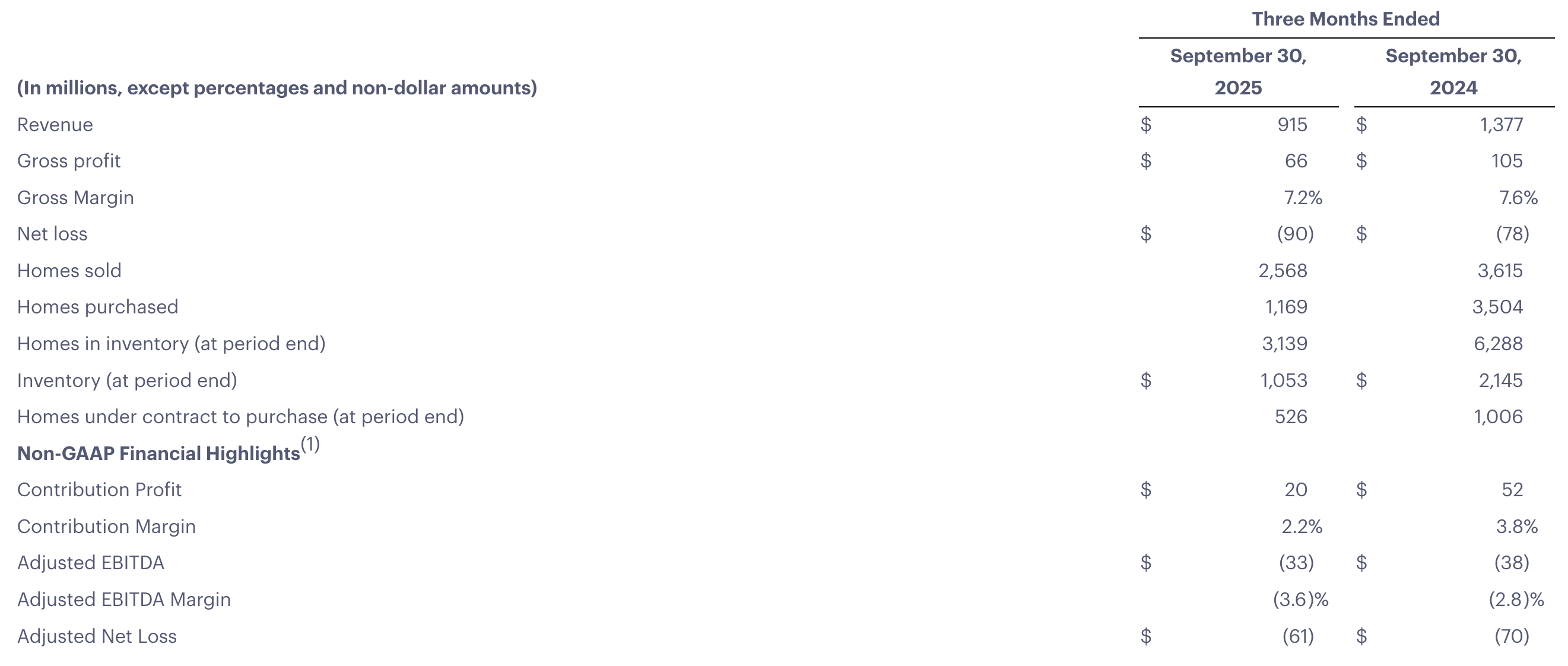

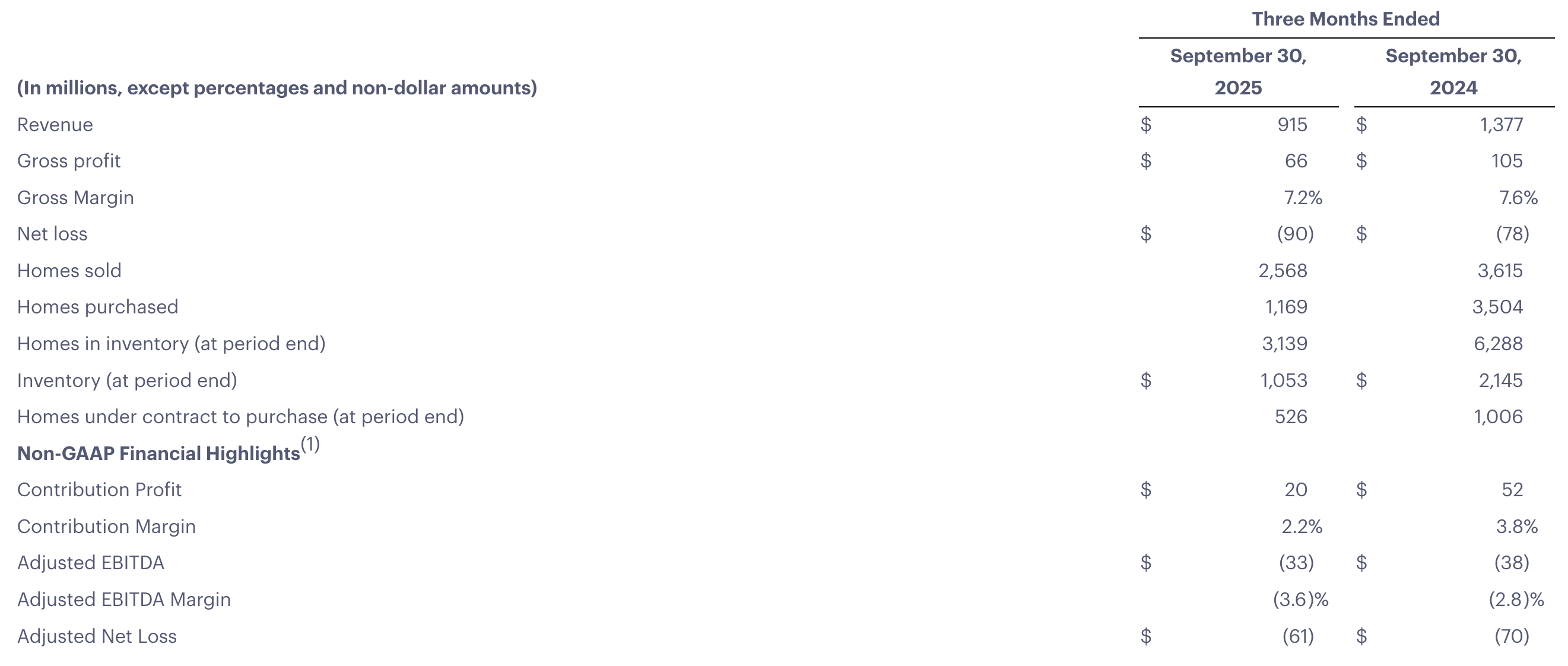

Opendoor’s GAAP revenue largely reflects homes sold, so revenue behaves more like a merchant business than a marketplace. In the quarter ended September 30, 2025, Opendoor reported $915M of revenue and $66M of gross profit (a 7.2% gross margin).

For unit economics, management emphasizes Adjusted Gross Profit and Contribution Profit, which adjust for inventory valuation timing and subtract holding and direct selling costs. The 10-Q defines Contribution Profit as Adjusted Gross Profit minus holding costs (current and prior periods) and direct selling costs.

This framing is useful for valuation because Opendoor’s business is a spread-and-speed model:

Spread: buy price vs expected resale price (plus service fees)

Speed: how quickly homes turn from purchase to resale

Cost: financing, taxes, utilities, repairs, and resale fees

Valuation Multiples That Fit Opendoor Stock

Price-To-Sales (P/S) Works Only With Margin Context

P/S is popular because Opendoor’s revenue is large, but it can be a trap. Two quarters can show similar revenue while producing very different contribution economics if resale cohorts, holding periods, or price moves differ.

A better use of P/S is comparative: track whether P/S rises when gross margin and contribution margin improve, not when revenue rises from heavier inventory churn. The 10-Q’s reconciliation shows why margin definitions matter when inventory valuation adjustments shift between periods.

EV-To-Gross Profit Can Be More Honest Than EV-To-Revenue

For iBuyer-style businesses, gross profit (and even more so contribution profit) is closer to “economic output” than revenue. In Q3 2025, Opendoor’s gross profit was $66M on $915M of revenue.

Investors often watch whether EV-to-gross profit compresses because gross profit expands (healthy) or because the stock price falls (less informative). With inventory businesses, the “quality” of gross profit depends on valuation adjustments and the age mix of inventory cohorts.

Balance Sheet Valuation: Inventory Is Not A Normal Current Asset

Inventory is real homes, not widgets. Opendoor reviews real estate inventory for valuation adjustments at least quarterly and records valuation adjustments within cost of revenue.

That makes book-value-style multiples less straightforward:

Inventory can be financed and sold quickly, but it is exposed to local price moves.

“Liquid” depends on buyer demand and mortgage availability, not just list price.

What Actually Drives OPEN Stock Valuation

Mortgage Rates Drive Liquidity And Turn Times

Housing turnover responds strongly to mortgage rates because they change monthly payments and affordability. Freddie Mac’s Primary Mortgage Market Survey shows the 30-year fixed-rate mortgage averaged 6.21% as of December 18, 2025.

For Opendoor, rates matter in three concrete ways:

Demand: buyer pool size and time-to-sale

Prices: discounting pressure when affordability tightens

Financing costs: the interest cost embedded in holding inventory

Home Price Direction Changes The Risk Budget

Opendoor is exposed to home price changes during the holding period. The FHFA House Price Index is a repeat-sales measure of single-family price movements based on transactions tied to mortgages acquired or securitized by Fannie Mae or Freddie Mac.

FRED’s U.S. all-transactions house price index shows continued movement higher through Q3 2025 (index 706.04, 1980:Q1=100). When prices rise, spreads are easier to protect. When prices flatten or fall, inventory duration becomes a valuation risk factor.

Transaction Volumes Set The Ceiling For Revenue

Even if unit economics improve, volume matters because Opendoor’s cost base includes fixed platform expenses. Government housing series are useful directional proxies for market activity.

FRED’s series for new one-family houses sold (Census Bureau and HUD source) and housing starts track demand and construction cycles that influence inventory and pricing conditions.

For investors, the practical takeaway is that OPEN stock tends to re-rate when markets believe volume can rise without sacrificing spreads.

Funding Capacity Determines How Fast Opendoor Can Scale

Opendoor’s inventory machine requires reliable funding. The 10-Q discloses $7.6B total borrowing capacity and $1.8B committed borrowing capacity under non-recourse asset-backed debt structures as of September 30, 2025.

This is a valuation driver because funding terms influence:

The Underpriced Variable: Cash Flow Can Be Inventory-Driven

Here is the valuation angle many investors miss: near-term cash flow can look “better” simply because inventory is shrinking.

For the nine months ended September 30, 2025, Opendoor reported $979M of operating cash flow, driven primarily by a $1.1B decrease in real estate inventory (partially offset by net losses).

That does not automatically mean the model is structurally profitable. A clean valuation read separates:

cash generated by reducing inventory (one-time working capital release), from

cash generated by contribution profits exceeding operating expenses (repeatable).

Common Valuation Framework For OPEN Stock

A practical way to value Opendoor stock is to build from unit economics rather than revenue:

Revenue = Homes Sold × Average Selling Price

Contribution Profit = Revenue × Contribution Margin (company-defined metric)

Core Earnings Power ≈ Contribution Profit − Operating Expenses

Free Cash Flow ≈ Core Earnings Power ± Inventory Change

Then apply a valuation range based on:

expected contribution margin stability,

a realistic “through-cycle” volume level,

and dilution outcomes (ATM issuance, warrants, convertibles).

Frequently Asked Questions (FAQ)

1. Is Opendoor Stock Valued More Like A Tech Stock Or A Real Estate Stock?

Opendoor stock sits between both. Revenue behaves like a real estate merchant because it comes from home sales, but valuation can reflect tech-like optionality if investors believe automation improves spreads, holding times, and cost per transaction.

2. What is the most useful valuation metric for open stock?

EV-to-revenue can mislead because revenue scales with inventory churn. Investors often learn more from gross profit or contribution economics, paired with inventory turns and financing cost. The goal is to link valuation to sustainable unit economics.

3. Do The Warrants Increase Dilution Risk For Opendoor Stock?

Yes. Opendoor issued three warrant series with $9/$13/$17 exercise prices and registered up to 99,295,146 shares for issuance upon exercise. The impact depends on how many warrants are exercised and at what stock prices.

4. Why Does Restricted Cash Matter In Opendoor Valuation?

Restricted cash is usually set aside under agreements linked to inventory financing, so the company cannot use it freely for day-to-day operations, debt repayment, or share buybacks. In its filings for September 30, 2025, Opendoor reported $962M in cash and cash equivalents and $490M in restricted cash.

Because restricted cash is not fully available for general corporate use, investors often treat it as less flexible than regular cash when they assess liquidity and valuation.

5. How Do Mortgage Rates Affect OPEN Stock?

Mortgage rates influence buyer demand, time-to-sale, and price sensitivity. Freddie Mac’s PMMS showed a 30-year fixed rate around 6.21% in mid-December 2025. Changes in rates can quickly change housing liquidity and Opendoor’s holding-period risk.

6. Can Operating Cash Flow Be Misleading For Opendoor?

It can. In the first nine months of 2025, Opendoor showed $979M of operating cash flow largely because inventory fell by about $1.1B. That is different from generating cash through repeatable operating profits.

Conclusion

Opendoor stock valuation works best when it starts with mechanics: share count, dilution, liquidity composition, and the economics of financing and turning home inventory. With 771.5M shares outstanding reported at September 30, 2025, even modest dilution or share issuance can materially change per-share valuation outcomes.

What ultimately drives OPEN stock is the market’s confidence that Opendoor can scale volume without giving back spreads, while keeping holding costs and financing costs contained.

Mortgage rates, house price direction, and funding capacity set the boundary conditions; contribution economics and inventory discipline decide where Opendoor lands inside them.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.