A maturity date is the agreed end date of a financial contract. It is the exact day when the deal ends, interest payments stop, and the original amount is paid back. You see maturity dates most often with bonds, loans, and fixed income products.

While it may look like a small detail, this date quietly shapes price movement, risk, and trade timing. As maturity gets closer, markets often behave differently. Knowing where you stand on that timeline helps traders plan exits with clarity and avoid last-minute surprises.

Definition

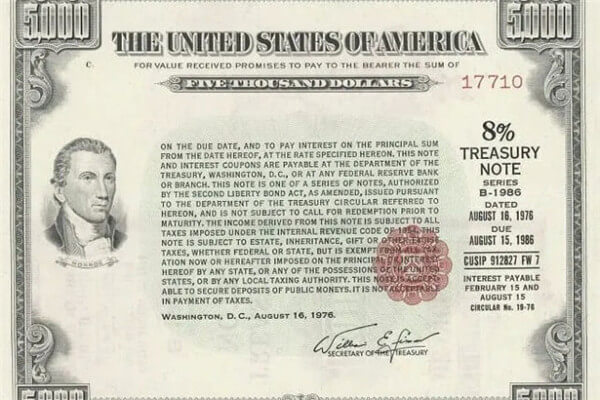

In trading terms, the maturity date is the final date of a financial instrument that has a fixed lifespan. Bonds, treasury bills, certificates of deposit, and some derivatives all come with a stated maturity date.

Until that date, the holder earns interest or yield based on the contract terms. On the maturity date, the issuer repays the face value, also called the principal.

Traders see maturity dates listed in bond descriptions, futures contracts, and fixed income market data. Portfolio managers, bond traders, and risk teams watch maturity dates closely.

They use them to plan cash flows, manage interest rate risk, and decide when to roll into new positions. Even traders who focus on short term price moves need to know maturity dates because liquidity and volatility can change as those dates approach.

What Changes Maturity Over Time

How time and interest rates shape behavior

The maturity date itself does not move, but its impact grows stronger over time. When a bond is far from maturity, its price reacts more to interest rate changes. When it is close to maturity, price movement usually slows.

Key forces that shape this process include:

Interest rate changes: When market interest rates rise, long dated bonds usually fall more than short dated ones. As maturity gets closer, that sensitivity drops.

Time passing: Each day that passes reduces uncertainty. The closer the maturity date, the more the price drifts toward its face value.

Credit conditions: If the issuer’s financial health worsens, traders may worry about repayment at maturity, which can push prices lower.

How Maturity Date Can Affect Your Trades

Entry, exit, and risk decisions

The maturity date plays a quiet but important role in trade planning. For entry, traders often prefer longer maturities when they expect interest rates to fall, because prices tend to move more. Shorter maturities are often used for steadier positions with less price swing.

For exits, the maturity date acts like a deadline. Holding until maturity removes price risk but locks in capital. Selling before maturity introduces market risk but adds flexibility.

Trading costs and liquidity also change. Bonds close to maturity often trade with tighter price ranges, but sometimes with lower trading volume.

In simple terms:

How To Check Maturity Date Before You Trade

What to look for on your platform

Before clicking buy or sell, traders should always confirm the maturity date. Most platforms show it in the product details or contract specifications.

Check these points:

Look at the instrument description to find the maturity date.

Compare the date with your planned holding period.

Notice whether the product expires or settles automatically.

Watch for rollover rules if the product is a futures contract.

A useful habit is to review maturity dates whenever you review your positions, not just when opening a trade.

Common Trader Mistakes

Ignoring the date completely, which can lead to forced exits or settlement surprises.

Assuming all products behave the same, when short and long maturities carry different risks.

Holding too close to maturity without a plan, which limits flexibility.

Confusing maturity with coupon payment dates, which are not the same thing.

Forgetting liquidity can drop, especially for less popular instruments near maturity.

These mistakes often come from treating maturity date as background information instead of a core detail.

Related Terms

Yield: The total return an investor expects to earn from a bond when holding it until the maturity date.

Accumulation: The process of interest building up over time as the bond moves closer to its maturity date.

Accrued interest: Interest that has been earned since the last payment date but not yet paid, often important when buying or selling before maturity.

Devaluation: A drop in the value of money or assets, which can reduce the real value of payments received at maturity.

Deflation: A general fall in prices, which can increase the real value of fixed payments received on the maturity date.

Liquidity: How easily a bond can be bought or sold before maturity without large price changes.

Frequently Asked Questions (FAQ)

1. What happens if I hold a product until its maturity date?

If you hold a product until its maturity date, the contract ends as agreed. Interest payments stop, and the issuer repays the original amount, also called the principal. There is no further price risk after maturity, but your capital is tied up until that date.

2. Does the maturity date guarantee I will not lose money?

No. The maturity date only defines when repayment is scheduled, not the outcome of the trade. Price risk exists before maturity, and credit risk exists if the issuer cannot repay. Market conditions, interest rates, and the issuer’s financial health all matter. The maturity date sets timing, not profit.

3. Can I sell a bond or fixed income product before maturity?

Yes. Most bonds and fixed income products can be sold before maturity in the secondary market. The price you receive depends on interest rates, remaining time to maturity, and market demand. Selling early adds flexibility, but it also exposes you to price changes that would not matter if you held to maturity.

4. Why do prices often move less as maturity gets closer?

As maturity approaches, there is less time for interest rates or market conditions to change the final outcome. Prices tend to drift toward the face value because the repayment amount becomes more certain.

5. Is the maturity date the same as expiry date?

They are related but not always the same. Maturity date is commonly used for bonds and fixed income products, while expiry date is often used for derivatives like options and futures. Both mark the end of a contract, but settlement rules and outcomes can differ.

Summary

The maturity date defines how long a financial contract lasts and when its obligations end. It is the point when interest payments stop and the original amount is returned. For traders, this date shapes how prices move, how much risk remains, and how much flexibility a position offers.

As maturity approaches, price behavior often becomes more predictable, but choices become more limited. When used properly, the maturity date helps traders align positions with their time horizon. When ignored, it can turn timing risk into a costly mistake.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.