Value at risk, often shortened to VaR, is a way to estimate how much money could be lost on a trade or a portfolio over a set period of time. It answers a basic but important question. How bad could things get if the market moves against you?

For traders, value at risk matters because it puts a number on downside risk before a trade is placed. It helps turn fear and guesswork into something measurable, so decisions are based on limits, not emotions.

Definition

Value at risk (VaR) is a risk measurement tool that estimates the maximum amount of money an investment or portfolio could lose over a defined time period, assuming normal market conditions.

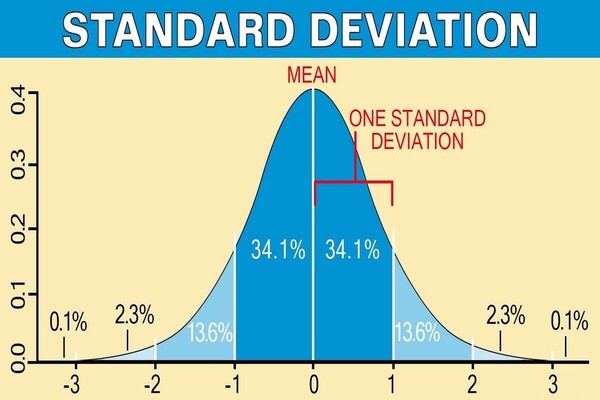

It is expressed as a single number and is usually paired with a confidence level, such as 95 percent or 99 percent. This confidence level shows how likely it is that losses will stay within the estimated amount.

VaR does not predict the worst possible outcome. Instead, it provides a realistic loss estimate based on historical price movements and typical market behavior.

By turning uncertainty into a measurable figure, value at risk helps traders and risk managers compare risk across different trades, set loss limits, and decide how much capital to put at risk before entering a position.

What Value At Risk Mean In Trading

Think of value at risk, or VaR, as a way to ask, “How much could I lose if things go wrong for a short time?” It does not try to guess the future. Instead, it looks at how prices moved before and uses that to set a loss limit.

VaR also uses something called a confidence level. This just means how sure we want to be. If a one day VaR is $5,000 at 95 percent confidence, it means that most days, losses should stay below $5,000. Only on a small number of days, about 5 out of 100, could the loss be bigger.

Traders and risk managers see VaR in risk reports, portfolio summaries, and sometimes directly on advanced trading platforms. It is closely watched by banks, funds, and institutions, but individual traders also use it to size positions, limit exposure, and compare risk across different markets.

What Affects Value At Risk

Value at risk is not fixed. It moves as market conditions change.

Market volatility: When prices swing more widely, VaR tends to rise because losses can grow faster. When markets are calm, VaR usually falls.

Position size: Larger positions increase potential losses, so VaR rises as trade size increases.

Time horizon: A longer holding period usually leads to a higher VaR because there is more time for prices to move.

Market correlations: If several positions move in the same direction, overall VaR increases because losses can stack up.

When volatility spikes or positions grow too large, value at risk often jumps quickly.

How Value At Risk Affects Your Trades

Value at risk influences how traders plan entries, exits, and overall exposure. A high VaR can signal that a trade may need a smaller position size or a tighter stop. A lower VaR can allow more flexibility, as potential losses are more controlled.

VaR also affects trading costs and risk planning. Higher risk often comes with wider spreads, faster losses, and more emotional pressure. By keeping VaR within a comfort zone, traders can stay consistent.

Good situation

VaR fits within your daily or weekly loss limit.

Position size matches current volatility.

Risk feels manageable even if the trade fails.

Bad situation

VaR exceeds your planned loss tolerance.

Volatility is high but position size is unchanged.

One trade could damage the account.

Quick Example

Suppose you trade a portfolio worth $10,000. Based on recent price movements, your one day value at risk at 95 percent confidence is estimated at $300.

This means that on most days, losses should stay below $300. If you double your position size without any change in market conditions, VaR may rise to around $600. If volatility suddenly increases, VaR could climb even higher.

The key idea is not the math. It is the relationship. Bigger positions and bigger price swings lead to bigger potential losses, which VaR helps you see in advance.

How To Check Value Of Risk

Before clicking buy or sell, traders can assess VaR using a few practical steps.

Check recent volatility on the chart, such as average daily range.

Review position size and total exposure across all open trades.

Use platform risk tools or calculators if available.

Compare the estimated loss to your daily or weekly risk limit.

A normal situation is when estimated losses fit comfortably within your plan. A risky situation is when one trade could break that plan. As a habit, check value at risk before every new position, not after losses appear.

Common Misuse Of Value Of Risk

Treating VaR as a guarantee: VaR estimates risk, it does not promise safety. Extreme events can exceed it.

Ignoring changing markets: Using old data during new volatility can lead to underestimating risk.

Relying on VaR alone: VaR should support decisions, not replace stops and risk rules.

Using too short a history: Limited data can give a false sense of stability.

Forgetting correlations: Multiple similar trades can raise total risk more than expected.

Related Terms

Volatility: A measure of how much prices move, which strongly affects VaR.

Risk management: The process of identifying, measuring, and limiting potential losses, where VaR is used to set clear risk limits before trades are placed.

Market liquidity: How easily an asset can be bought or sold without causing large price changes, which affects VaR because low liquidity can increase potential losses.

Rate of return: The gain or loss on an investment over time, which traders compare with VaR to judge whether the expected reward justifies the risk taken.

Frequently Asked Questions (FAQ)

1. What does value at risk actually tell a trader?

Value at risk estimates how much money a trader could lose over a specific time period under normal market conditions. It puts a clear number on potential downside, helping traders decide whether a trade’s risk is acceptable before entering.

2. Does value at risk predict the worst possible loss?

No. VaR does not show the maximum possible loss or extreme market events. It estimates a likely loss range based on historical price behavior and a chosen confidence level.

3. What does the confidence level in VaR mean?

The confidence level shows how often losses are expected to stay within the VaR limit. For example, a 95 percent confidence level means losses should stay below the VaR amount on most days, with only a small chance of exceeding it.

4. How is value at risk different from a stop loss?

A stop loss is an order placed in the market to exit a trade, while VaR is a measurement used before trading begins. VaR helps decide position size and risk limits, while a stop loss helps enforce them during the trade.

5. Can individual traders use value at risk, or is it only for institutions?

Individual traders can and should use VaR in a simplified way. Even a basic estimate of potential loss helps control position size, manage exposure, and avoid trades that could damage the account.

6. Is value at risk enough on its own to manage risk?

No. VaR is one tool, not a complete risk system. It works best when combined with stop losses, position sizing rules, and awareness of changing market conditions.

Summary

Value at risk is a tool that estimates how much a trader could lose under normal market conditions. It helps turn uncertainty into a measurable figure and keeps risk aligned with planned limits.

When used properly, it supports disciplined position sizing and steady decision making. When used on its own, or without other risk controls, it can create a false sense of safety.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.