The yen strengthened a bit in early trading on Thursday after minutes of the

BOJ's July policy meeting showed some board members called for resuming interest

rate hikes in the future.

Markets see a roughly 50% chance of a rate hike at the central bank's October

meeting, when the board will also release fresh quarterly growth and inflation

forecasts.

The S&P Global flash Japan PMI dropped to 48.4 in September, further

below the 50.0 threshold that separates growth from contraction to the lowest

reading since March. The service sector remains stable.

Governor Ueda has said they will continue to raise rates gradually if it

becomes more convinced that underlying inflation will durably achieve its 2%

target. At last week's news conference, he said it has yet to hit 2%.

The BOE is firming up a strategy to unload its huge holdings of risky assets

that will likely centre on a plan to gradually sell ETF in the market, said

three sources familiar with its thinking.

With the Nikkei index scaling record highs, policymakers could have seen an

opportunity to decide in coming months. However, embarking on asset sales amid

political turbulence could be risky.

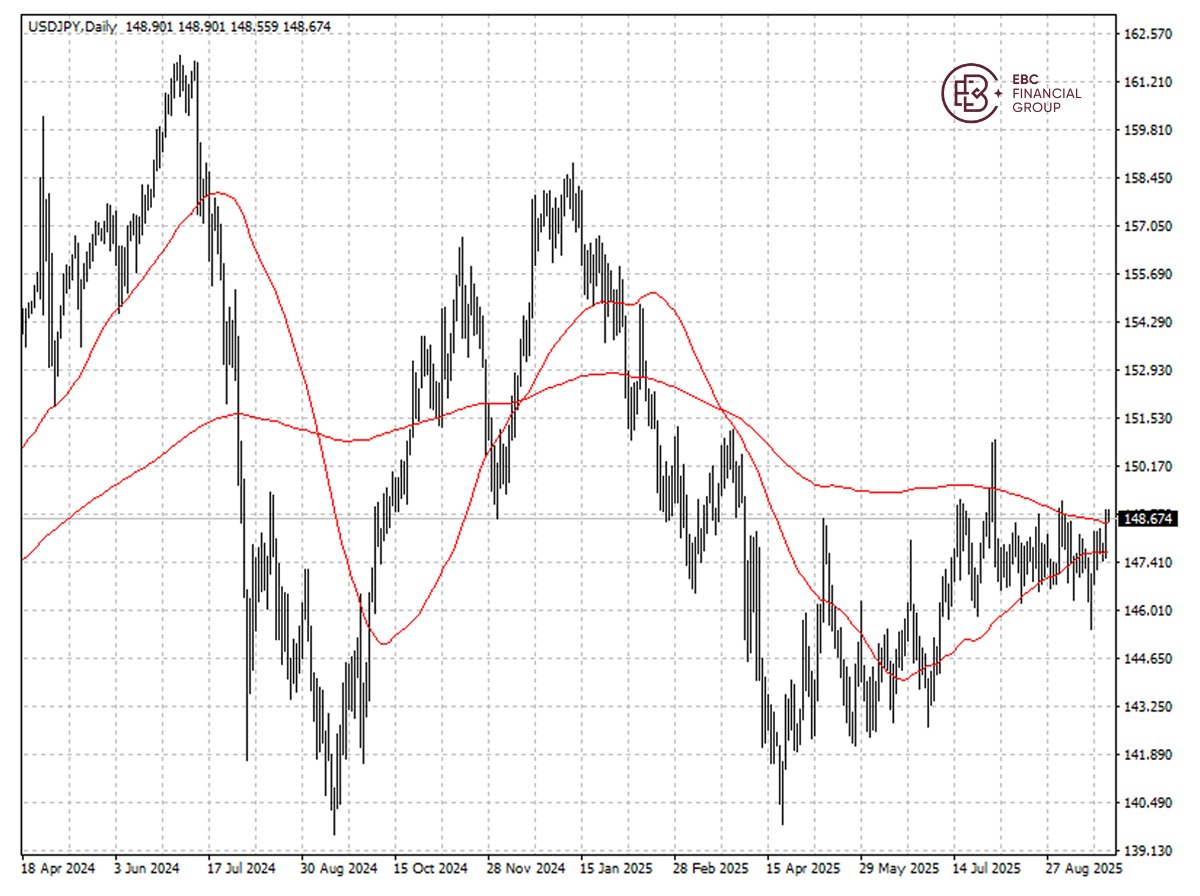

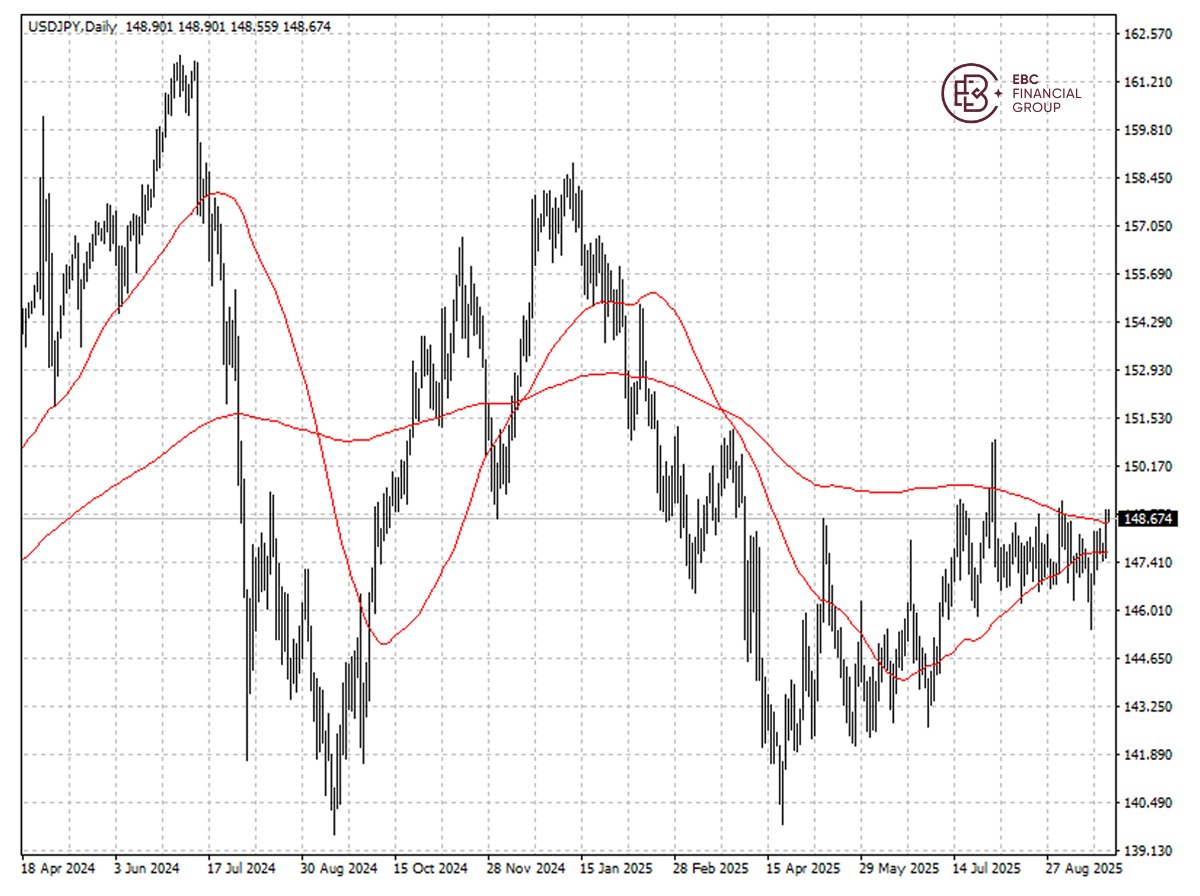

The yen has been largely stuck in a tight range since July with upper end

around 50 SMA. As the currency has entered to the area, we see it rebound

towards 146.8 per dollar soon.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.