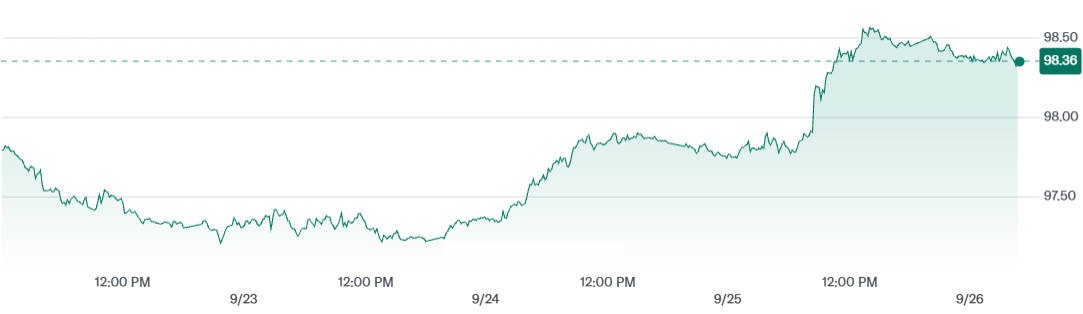

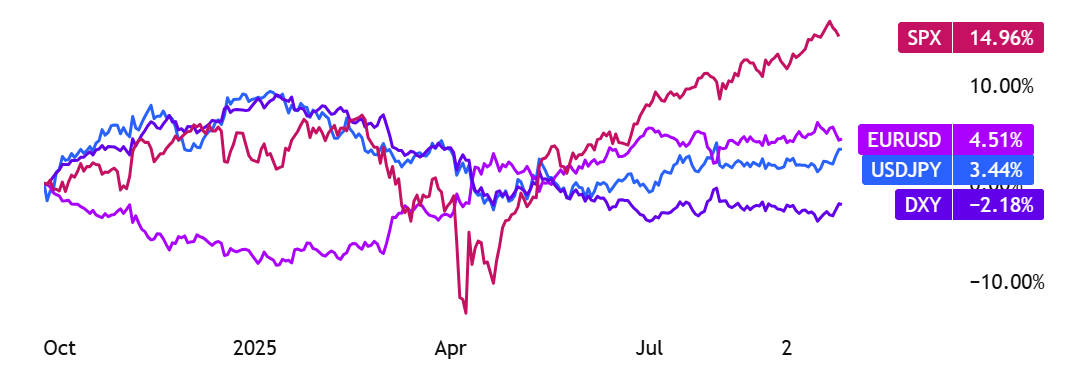

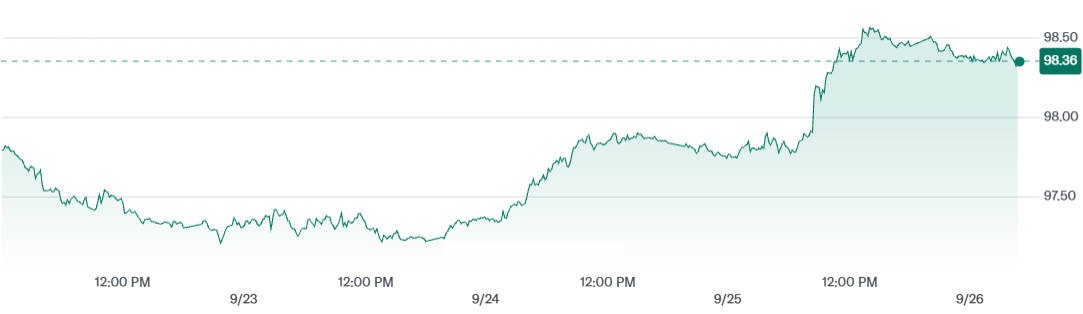

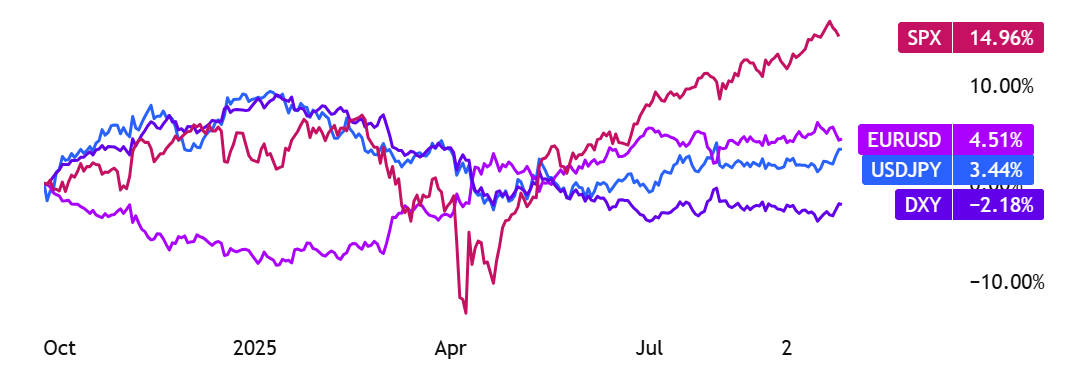

The US Dollar Index (DXY) has firmed this week to roughly 98.4. driven by a string of stronger-than-expected US economic releases and a repricing of how quickly the Federal Reserve will loosen policy.

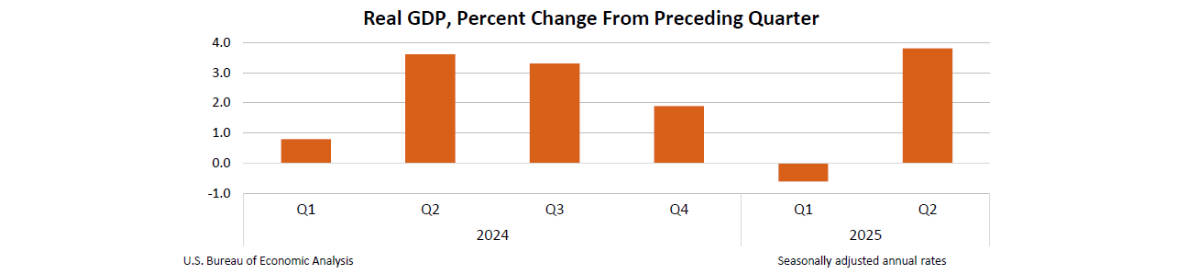

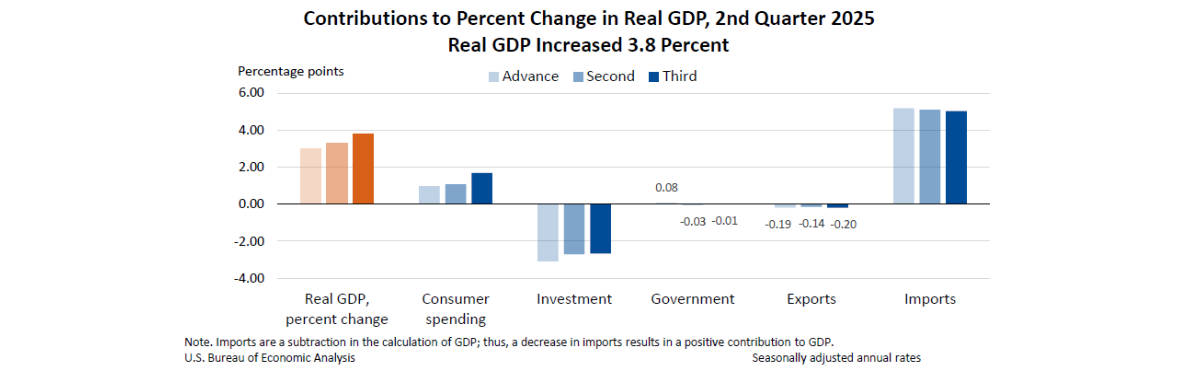

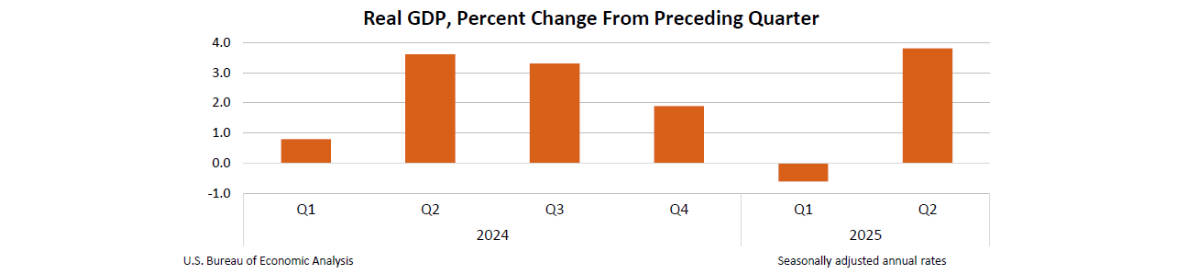

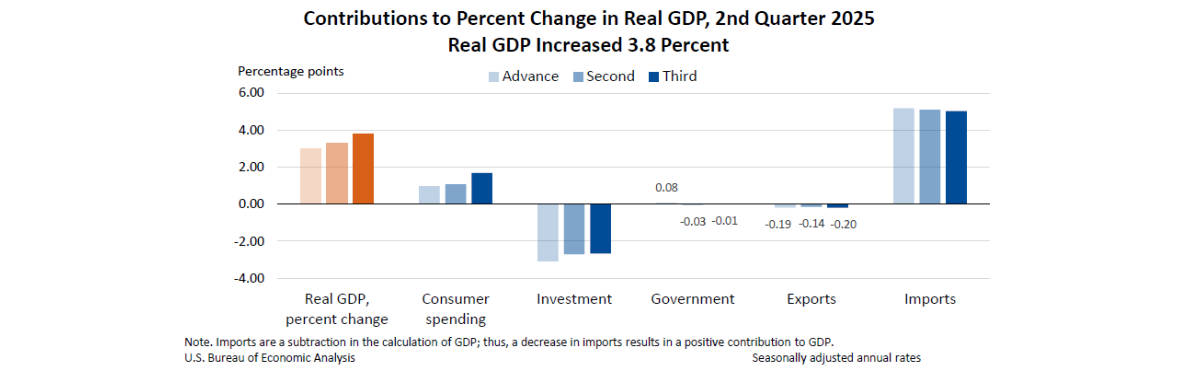

The Bureau of Economic Analysis revised second-quarter GDP sharply higher to 3.8% annualised, and markets have pared back expectations of near-term rate cuts.

Those developments have lifted Treasury yields and buoyed safe-haven demand for the greenback, while traders now turn their attention to the upcoming PCE inflation print for fresh policy clues.

What the US Dollar Index measures — a quick primer

The US Dollar Index (often shown as DXY) is a trade-weighted gauge that measures the dollar's value against a basket of six major currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc.

Because the euro has the largest weight in the basket, moves in EUR/USD typically have the biggest influence on the index. The DXY is widely used by market participants as a shorthand for broad dollar strength or weakness.

The immediate trigger: stronger US data and a GDP revision

Markets accelerated their dollar-buying after the US Commerce Department's third estimate for Q2 GDP showed real GDP rising at a 3.8% annualised rate, a meaningful upgrade from earlier estimates.

The revision was driven mainly by stronger consumer spending and helped to alter investors' expectations about how quickly the Fed might ease policy.

That upgrade — confirmed by the Bureau of Economic Analysis — is one of the principal reasons the dollar has regained traction this week.

Alongside GDP, a set of other data surprised on the firm side (including better-than-expected durable goods and lower initial jobless claims), reinforcing the narrative of economic resilience and trimming the perceived scope for large, immediate rate cuts.

Reuters and other outlets noted that the cumulative effect of these prints reduced market odds of a sizeable Fed cut later in the year.

Market mechanics: yields, positioning and policy expectations

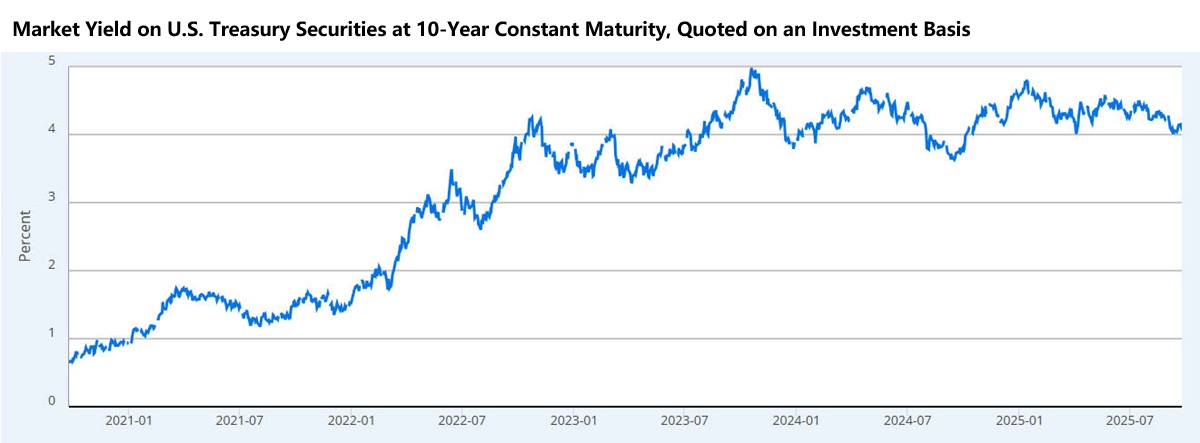

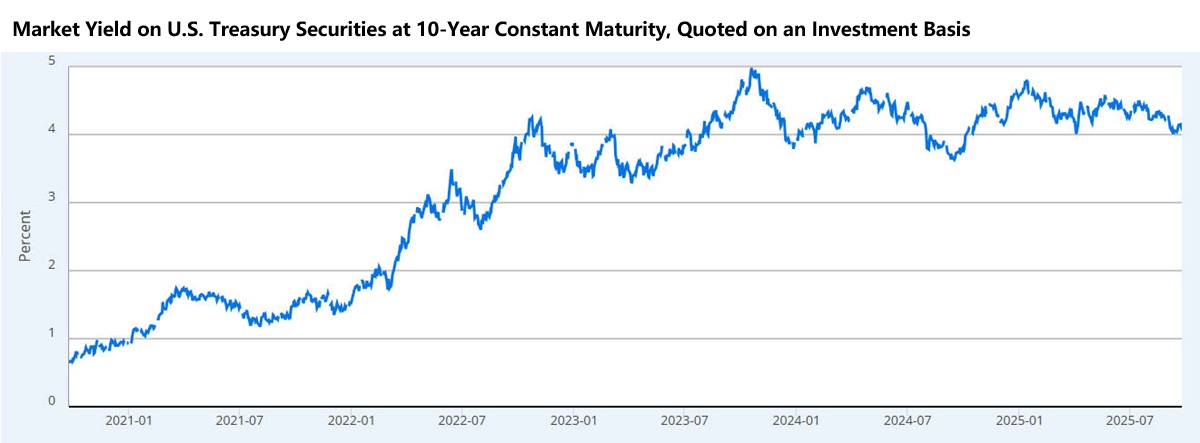

A stronger growth message in the US tends to lift Treasury yields, and yields have moved higher in step with the data this week: the 10-year Treasury yield has risen, trading around the low-to-mid 4% area on the same sessions that saw the dollar firm.

Higher real yields increase the attractiveness of dollar-denominated assets and support the currency.

At the same time, futures and options markets have re-priced the path of Fed cuts.

Reuters reported a notable pullback in market expectations for the size and timing of cuts — a dynamic that has been interpreted as dollar-friendly since lower expectations for near-term easing remove a common downward pressure on the currency.

The technical picture: short-term levels to watch

Technically, the DXY has rebounded from the mid-96s and is now trading close to the 98.3–98.6 region; breakouts above that band would open the way towards the 99.0 round number.

On the downside, short-term support sits near the 50-day moving average, around 98.0. and beneath that the ascending channel lower boundary and the 97.5 mark are the next areas to defend.

Technical analysts point out that momentum indicators are showing strength but are approaching overbought territory — so short, sharp pullbacks remain possible.

How global markets are reacting

The dollar's recent strength is not taking place in isolation:

1) G10 currencies:

The euro and yen have been among the more obvious sufferers as dollar demand rises; EUR/USD has slipped and USD/JPY has moved toward the 150 area on risk and yield dynamics.

2) Emerging markets:

A stronger dollar tends to put pressure on commodity-importing nations and on EM currencies more generally. Reuters and other wires reported fresh FX weakness in a number of Asian currencies this week amid tariff announcements and increased dollar demand.

3) Commodities:

Commodity prices frequently move inversely to the dollar; a firmer greenback typically weighs on dollar-priced goods such as oil and gold, although supply and demand fundamentals remain equally important for price direction.

Scenarios for the coming weeks — three plausible paths

1) Bullish continuation (base case)

If incoming inflation and spending indicators remain firm and the PCE print disappoints to the upside, markets could further downgrade the pace of Fed easing and push the DXY above technical resistance near 99.0. with traders buying dips into any short-term weakness.

2) Rangebound / consolidation

The dollar could settle into a trading range between roughly 97.5 and 99.0 if macro data are mixed — growth surprising against a backdrop of easing labour conditions — leaving direction to be decided by the next high-impact data prints and Fed commentary.

3) Reversal / downside risk

A significantly softer PCE or an unexpectedly weak jobs report would revive the case for more aggressive Fed easing, quickly reversing some of the dollar's gains and testing the 50-day moving average and lower-channel supports.

Risk-on flows and reduced haven demand would amplify any rollback.

Key near-term catalysts (dates and instruments to watch)

1) Personal Consumption Expenditures (PCE) Price Index — the Fed's preferred inflation gauge; markets focus on both headline and core prints. (PCE data and market expectations were central to commentary around the dollar's recent move.)

2) Fed communications and minutes — any shift in tone from the Fed will be closely parsed.

3) September employment report (US) — the monthly payrolls release can move both yields and the dollar sharply. (Expect the next employment print in early October.)

What this means for different market participants

1) Traders and investors:

A firmer dollar increases the attractiveness of dollar-based carry and short USD strategies are more exposed. Hedging FX risk becomes more important for multi-currency portfolios.

2) Corporates and importers/exporters:

Multinationals with dollar revenues will see changes in translation effects and cash-flow timing; importers face cheaper dollar-priced goods but exporters may see demand pressures in non-USD markets.

3) Commodity producers and consumers:

A stronger dollar can reduce commodity receipts in local currencies and raise costs for commodity importers. Traders in oil and metals should watch the interaction of supply fundamentals and FX moves.

4) Emerging markets:

Countries with large dollar-denominated debt or import bills will feel the strain from a firm dollar — policy responses may include FX intervention or rate moves.

Risks and things that could change the story

Inflation surprises: If PCE softens materially, the Fed could be compelled to accelerate easing, which would be negative for the dollar.

Geopolitical shocks: Escalations can boost safe-haven flows into the dollar — or, in certain circumstances, complicate trade and capital flows in ways that change currency correlations.

Policy shifts abroad: If other major central banks (ECB, BoE, BoJ) shift unexpectedly, that can alter relative rates and the DXY dynamic.

Bottom line

At present the dollar's strength is founded on firmer US growth outturns, a rise in yields and a retrenchment in the market's view of how quickly the Fed will cut rates.

The DXY sits in a technically constructive position around the 98.3–98.6 band, but short-term momentum indicators flag the prospect of corrective moves.

The immediate focus for markets is PCE data and upcoming Fed commentary — those releases will determine whether the dollar's recent ascent is sustained or merely a brief repricing.

Quick reference box — immediate data points (selected)

DXY (approx.): 98.4 (26 September 2025).

US Q2 GDP (third estimate): +3.8% annualised.

10-year US Treasury yield: ~4.1–4.2% (moving higher in recent sessions).

Key near-term data to watch: PCE (inflation), Fed minutes/comments, monthly payrolls.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.