In financial markets, prices often move in unpredictable ways—but sometimes, the spaces between prices tell the most crucial story. These spaces are known as gaps, and they occur when the price opens significantly higher or lower than the previous day's close.

For active traders, particularly those involved in intraday or swing trading, gap trading is a popular strategy used to profit from sudden market movements.

But what is gap trading exactly? How can traders identify gaps, and most importantly, how can they profit from them? This guide offers a comprehensive overview of gap trading, including the types of gaps, the psychology behind them, and strategies for profitable opportunities.

What Is Gap Trading?

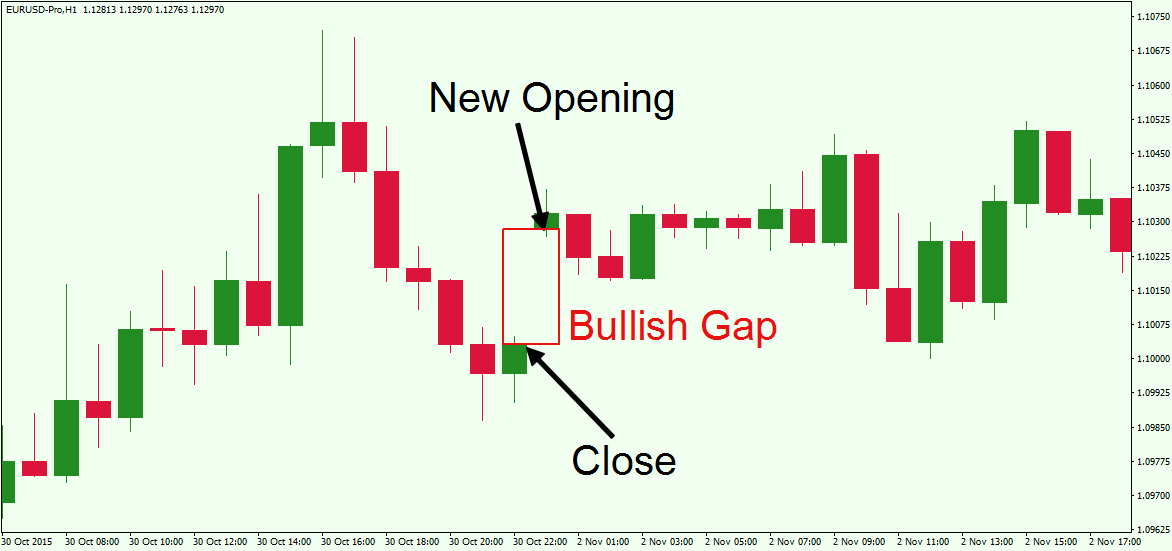

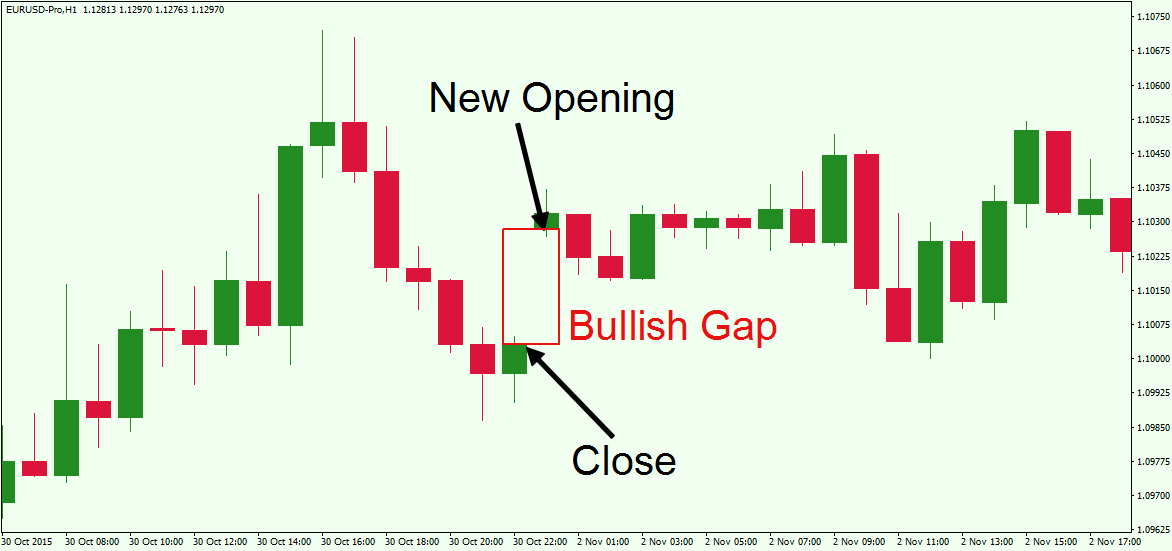

A gap in trading refers to a break or space between two trading periods with no trading activity. It usually happens on a price chart when an asset opens at a significantly different level than its previous closing price. Gaps are clearly visible as empty spaces on candlesticks or bar charts.

Gaps most frequently appear on daily charts but can also occur in lower time frames, especially in volatile or news-driven markets. They can be caused by earnings reports, economic data releases, geopolitical events, or overnight sentiment changes.

Gap trading is the practice of identifying these gaps and placing trades to benefit from their potential continuation or reversal.

Types of Price Gaps

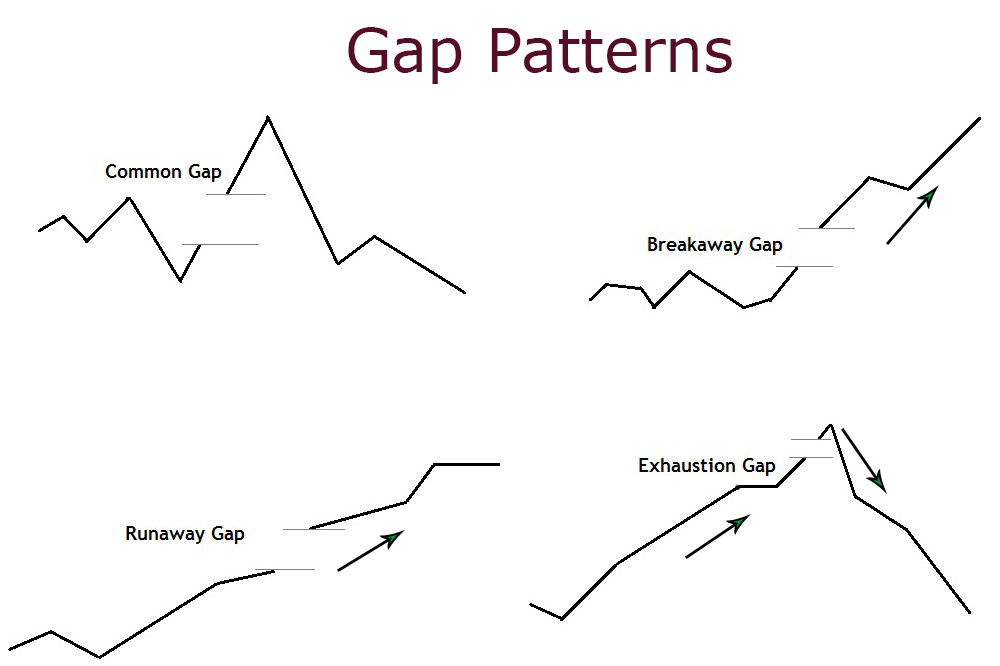

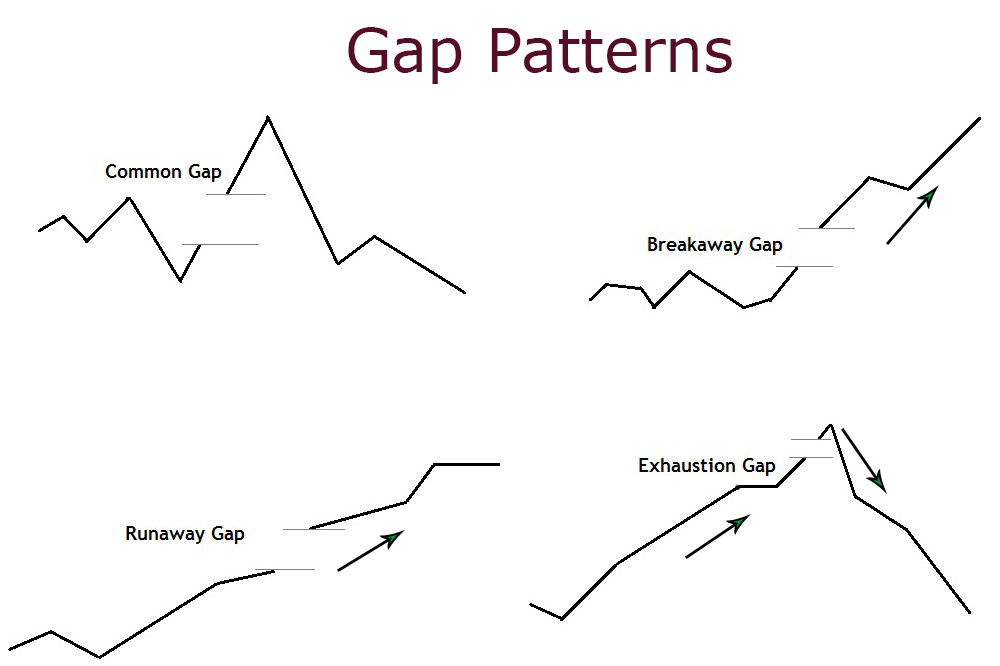

1. Common Gaps

These are small gaps that occur frequently and usually get filled quickly. They often happen in low-volume trading environments or during consolidation periods. Common gaps are generally not associated with major news and don't offer strong trading signals.

2. Breakaway Gaps

Breakaway gaps occur when the price breaks out of a well-defined support or resistance zone or price pattern, such as a triangle or channel. They are high volume and represent a strong directional move. These gaps often do not get filled quickly and signal the start of a new trend.

3. Runaway (or Continuation) Gaps

These gaps occur mid-trend and signal a continuation of the current momentum. They are fueled by increasing interest in the asset as the trend strengthens. Often seen in rapidly moving markets, runaway gaps confirm trader confidence and reinforce the existing direction.

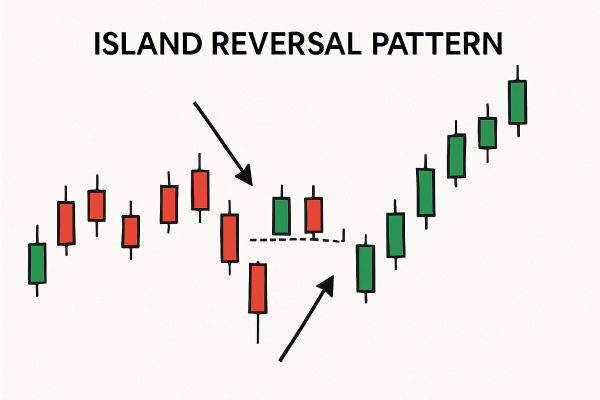

4. Exhaustion Gaps

Appearing near the end of a strong trend, exhaustion gaps suggest that the current move may be running out of steam. These gaps are often followed by a reversal, as late traders rush in before the market corrects.

Why Do Gaps Occur?

Typically, gaps are driven by an imbalance of supply and demand. They often reflect a sudden change in investor sentiment or new information that alters the market outlook. Here are some reasons gaps occur:

Earnings reports that exceed or miss expectations

After-hours news releases that impact market perception

Economic announcements, such as interest rate decisions

Mergers and acquisitions

Upgrades or downgrades by analysts

Geopolitical events, such as wars or trade sanctions

When a gap forms, it signals urgency—a rush to reprice the asset based on new information.

How to Identify Tradeable Gaps

Before placing a trade based on a gap, traders must filter for high-probability setups. Here are the typical conditions that suggest a tradeable gap:

The gap is accompanied by volume expansion, especially in breakaway and runaway gaps.

The stock has broken out of a technical pattern or price level.

The gap aligns with a broader market trend or news catalyst.

The gap follows a clear price structure (e.g., bull flag, retest).

There is minimal overhead resistance or support near the gap zone.

Charting tools such as moving averages, RSI, or Fibonacci retracements can also help confirm whether the gap is a potential entry point.

Popular Gap Trading Strategies

Let's now explore some proven strategies to trade price gaps.

Gap and Go Strategy

It is a momentum strategy that takes advantage of gaps that don't fill but instead continue in the direction of the gap. It's most commonly used by day traders.

Entry is placed after the market confirms the direction with volume and follow-through.

Stop loss is typically placed below the gap or breakout level.

Profits are taken as the trend extends, often using intraday highs as targets.

Gap Fill Strategy (Fade the Gap)

This strategy assumes the gap was an overreaction and that the price will revert back to its previous closing level.

Traders look for signs of reversal patterns, such as bearish engulfing or pin bars.

It is ideal for common gaps or exhaustion gaps where momentum fades quickly.

Stop losses are placed beyond the recent highs or lows, and targets are set at the gap-close level.

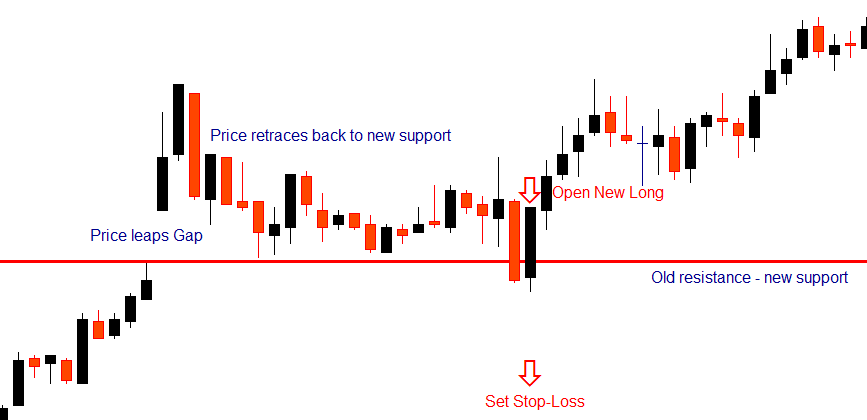

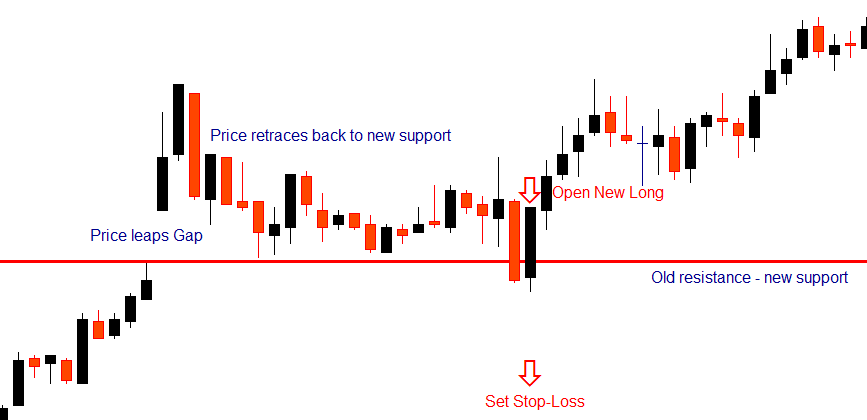

breakaway gap Strategy

It involves entering a position immediately after a breakout gap, assuming it marks the start of a new trend.

Used when there's a strong news catalyst or technical breakout.

Entries should align with broader market sentiment.

These gaps often do not fill, so traders ride the momentum.

Best Markets and Assets for Gap Trading

Gap trading isn't limited to just stocks. Here are the markets where price gaps commonly occur:

stock market: Particularly effective in mid- and small-cap stocks with news catalysts.

Forex Market: Gaps happen after weekends or during major economic announcements.

Commodity Futures: Gaps appear after global supply/demand news or weather events.

Traders should choose instruments with high volatility, news sensitivity, and volume liquidity for gap-based strategies.

Examples

Example 1: Breakaway Gap After Earnings

A stock closes at $70 and gaps up to $75 after strong quarterly earnings. Volume spikes and price continues to climb. The breakaway gap holds, and the stock reaches $82 within two sessions.

Trade Plan: Enter after confirmation above $75 with a stop at $73. Ride the momentum to $80+.

Example 2: Common Gap Fills

A stock closes at $40 and opens at $41.5 on low volume without any news. The price starts to fade, and within hours, the stock returns to $40.

Trade Plan: Short at $41.3 with a target of $40.2. Exit at the previous day's close.

Example 3: Exhaustion Gap Reversal

A stock surges for five consecutive days and gaps up from $55 to $60. The price rejects $60 and closes back at $56.

Trade Plan: Enter short as price rejects $60 and use $61 as a stop loss. Profit target at $55.

Conclusion

Gap trading remains a compelling strategy for traders who understand market psychology, price behaviour, and risk management. The key lies in distinguishing which gaps to trade and which to avoid. Not every gap deserves attention, but the ones that align with volume, technical setups, and broader market sentiment can be golden opportunities.

As with any strategy, backtesting, discipline, and ongoing learning are essential. If you're new to gap trading, start by paper trading different setups and develop a rule-based system that works for your style and risk tolerance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.