In technical analysis, price gaps often indicate crucial turning points in market sentiment. Among the various types of gaps, the breakaway gap holds a unique and powerful role, signalling the start of a new trend.

For savvy traders, learning to identify and capitalise on breakaway gaps can result in significant profits and a sharper edge in volatile markets.

This guide explores the breakaway gaps trading strategy, why it matters, how to identify it, and how traders can profit like pros by applying this concept with discipline and precision.

What Is a Breakaway Gap?

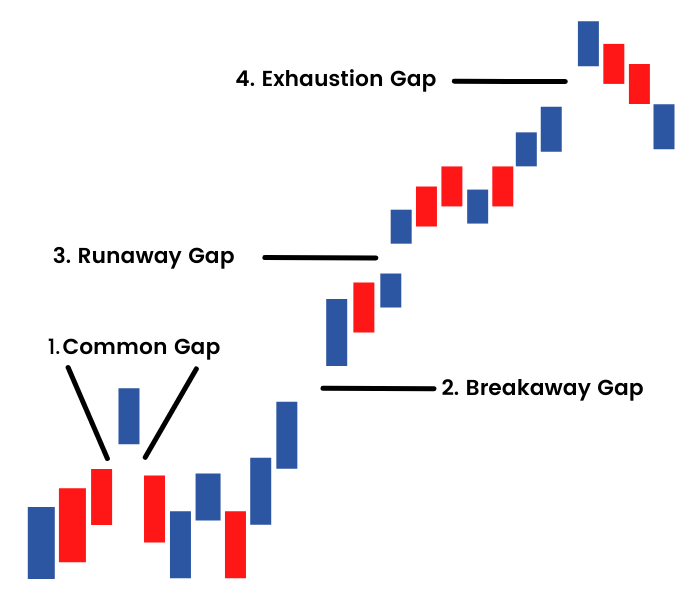

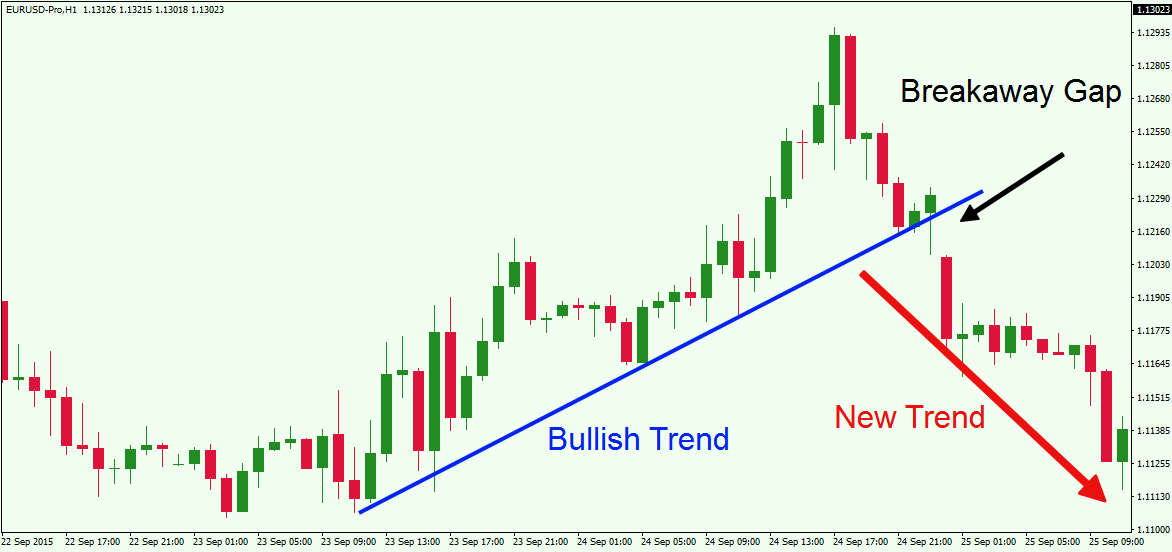

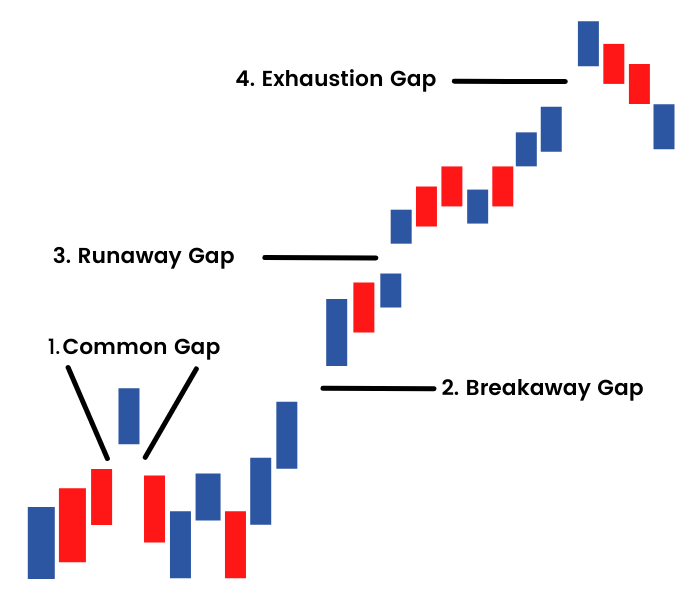

A breakaway gap occurs when the price of a financial asset jumps significantly above or below a key support or resistance level on high volume, usually marking the beginning of a new trend. Unlike common gaps that may fill quickly, breakaway gaps signal a structural shift in market sentiment, either bullish or bearish.

They typically appear after a period of consolidation, where price action has moved sideways for a while. Once traders lose confidence in the established range, a sudden burst of buying or selling pressure causes the asset to "break away" from this zone, often leading to sharp price movements.

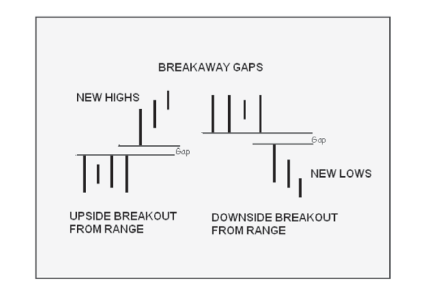

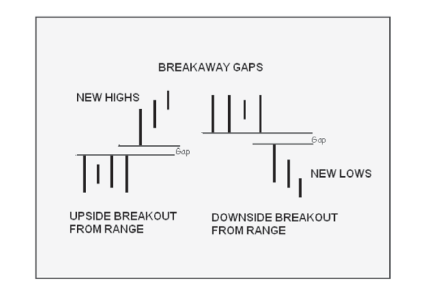

Types of Breakaway Gaps

There are two main types of breakaway gaps: bullish and bearish.

Bullish Breakaway Gap

Occurs at the end of a downtrend or during consolidation

Price gaps above a resistance level

Volume spikes significantly on the breakout

Signals strong buying interest and a potential trend reversal or continuation

Bearish Breakaway Gap

Occurs at the end of an uptrend or sideways pattern

Price gaps below a support level

High selling volume accompanies the drop

Indicates a shift to bearish sentiment and the start of a downward trend

How to Identify a Breakaway Gap?

While not every gap is a breakaway gap, specific technical characteristics can help traders confirm the pattern.

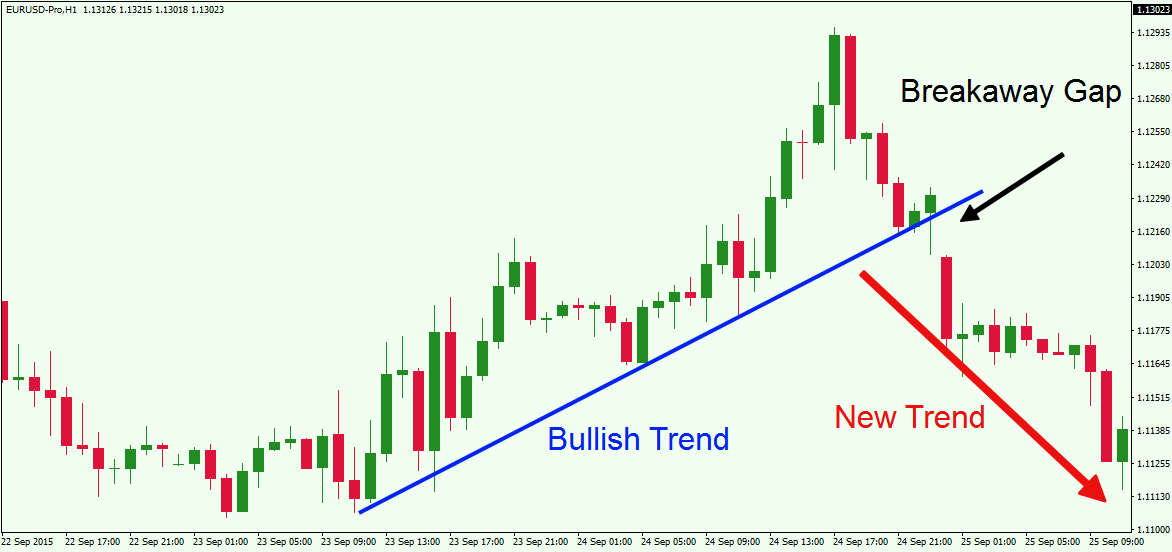

1. Clear Consolidation or Trend Line Break

Before the gap, the market should show a well-defined consolidation zone or trend line. This zone represents market indecision. A breakaway gap only has significance if it moves decisively beyond this area.

2. Large Price Gap

The actual gap should be relatively large in comparison to recent daily ranges. This abrupt change frequently happens outside of trading hours, particularly during earnings releases or economic reports.

3. Strong Volume Spike

Volume should be significantly higher than average, reinforcing the legitimacy of the breakout. In the absence of volume, the gap might indicate a misleading signal or a sign of fatigue.

4. Follow-Through Price Action

After the gap, the asset should continue moving in the breakout direction for several sessions. Sideways or immediate reversal behaviour suggests a potential gap fill or failure.

How to Trade Breakaway Gaps: Step-by-Step Strategy

Step 1: Scan for Gap Setups

Use a stock screener or trading platform to identify assets with massive opening gaps on high volume. Focus on stocks near key technical levels—resistance or support.

Step 2: Confirm with Pre-Market and News Analysis

Check for catalysts. These may include:

A breakaway gap with a strong news catalyst is more likely to hold.

Step 3: Wait for the First Pullback

After the initial gap and breakout, prices may pull back slightly. Entering on this first pullback—ideally near the breakout level—can provide a better risk-reward ratio.

Step 4: Set Stop Loss Below Gap (or Above for Shorts)

Place a stop loss just below the gap window for long trades. For shorts, set the stop just above the gap. It prevents large losses if the move fails.

Step 5: Ride the Momentum with Trailing Stop

As the price moves in your favour, trail your stop loss to lock in profits. Breakaway gaps often lead to sustained moves, so it's vital not to exit too early.

Real-World Examples

Tesla (TSLA) – Bullish Breakaway in 2020

In early 2020, Tesla gapped above $500 after strong earnings and guidance, breaking out of a consolidation pattern. Volume exploded, and the price doubled over the following months.

Zoom Video (ZM) – Pandemic Surge

Zoom gapped up significantly in March 2020, breaking away from its prior range on record volume. The move was triggered by the sudden demand for remote communication tools during the pandemic.

Alibaba (BABA) – Bearish Breakaway in 2021

After China's crackdown on tech companies, Alibaba gapped down below $200, marking a bearish breakaway. The move led to a steep downtrend that lasted several months.

Key Technical Indicators to Use

While price and volume are core to the strategy, traders often use additional indicators to confirm a breakaway gap:

Relative Strength Index (RSI): Helps confirm whether the asset is breaking away from an overbought or oversold zone

Moving Averages: Crossovers or separation from major MAs (e.g., 50-day or 200-day) provide extra confirmation

MACD (Moving Average Convergence Divergence): Bullish or bearish crossovers in tandem with a breakaway gap strengthen the trade setup

These tools should not be used in isolation but rather in conjunction with price action and volume analysis.

Common Mistakes to Avoid

1. Misidentifying the Gap Type

Not all gaps are breakaway gaps. Beware of exhaustion gaps, which appear at the conclusion of a trend and frequently reverse direction. Look for confirmation through volume and trend context.

2. Entering Too Late

Pursuing an already widened gap may result in unfavourable entry prices and increased risk. Wait for minor pullbacks or consolidations before entering.

3. Ignoring the Overall Market Trend

Even a strong breakaway gap can fail if it contradicts the broader market trend. Consider indices like the S&P 500 or sector performance before placing trades.

4. No Risk Management

Gap trades can be volatile. Always define your maximum risk and position size before entering the market.

Best Markets and Timeframes

Breakaway gaps work best in volatile and liquid markets like:

Stocks: Small caps, earnings movers, and biotech stocks.

Indices: Gaps on major indices during news events can offer huge opportunities.

Forex: Less common, but possible during major economic announcements.

The daily timeframe is most effective for identifying breakaway gaps. Intraday gaps are less reliable unless backed by fundamental catalysts.

Should You Hold or Sell After a Breakaway Gap?

The decision to hold or sell depends on your trading style.

Short-term traders may take profits within hours or days after the gap.

Swing traders often hold for a few weeks, using trendlines or moving averages as trailing exits.

Long-term investors may hold through multiple pullbacks if the gap aligns with a strong fundamental trend.

In any case, the key is to let the price action and volume guide your decision-making, rather than feelings or optimism.

Conclusion

In conclusion, breakaway gaps are among the most effective tools for identifying new trends early. They reflect powerful shifts in sentiment, fueled by news, volume, and momentum.

By learning to identify, confirm, and execute trades around these gaps, traders can significantly improve their edge and profit like a pro.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.