AVGO stock has just given traders a classic earnings surprise: the numbers were strong, the outlook was positive, and yet the share price fell in after-hours trading.

Broadcom reported fiscal Q4 2025 revenue of about $18.02 billion, up roughly 28% year on year, and adjusted earnings of $1.95 per share, clearly ahead of analyst estimates of $17.5 billion in revenue and $1.87 in earnings.

The company also guided the next quarter's revenue to about $19.1 billion, above market expectations, with AI chip sales expected to double to around $8.2 billion.

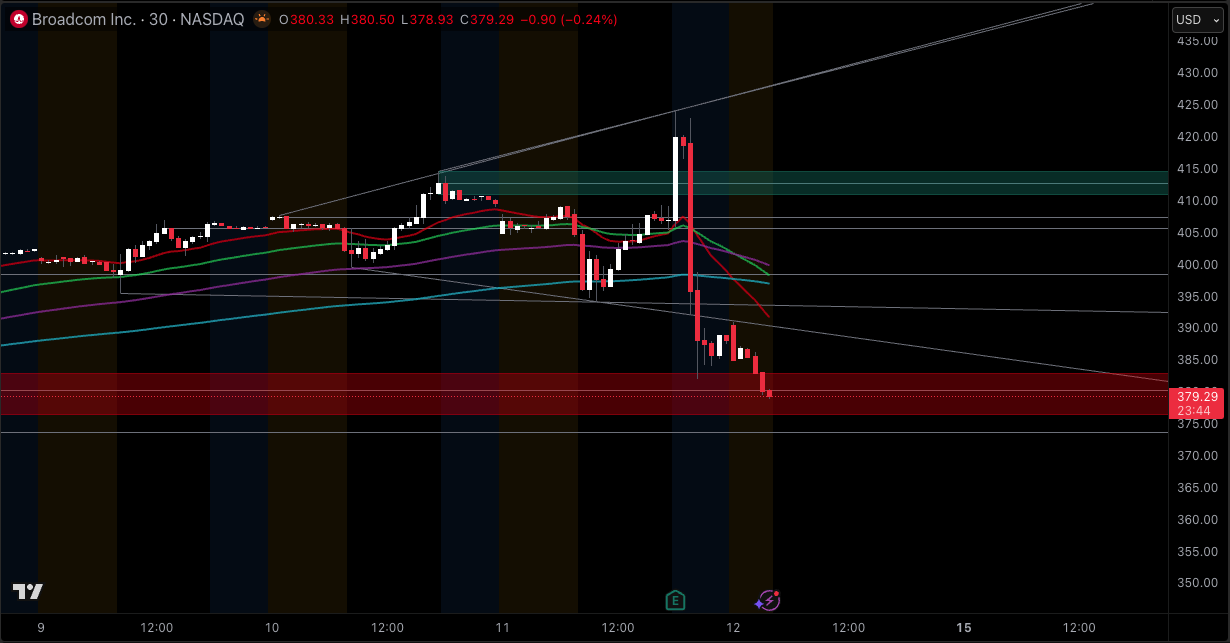

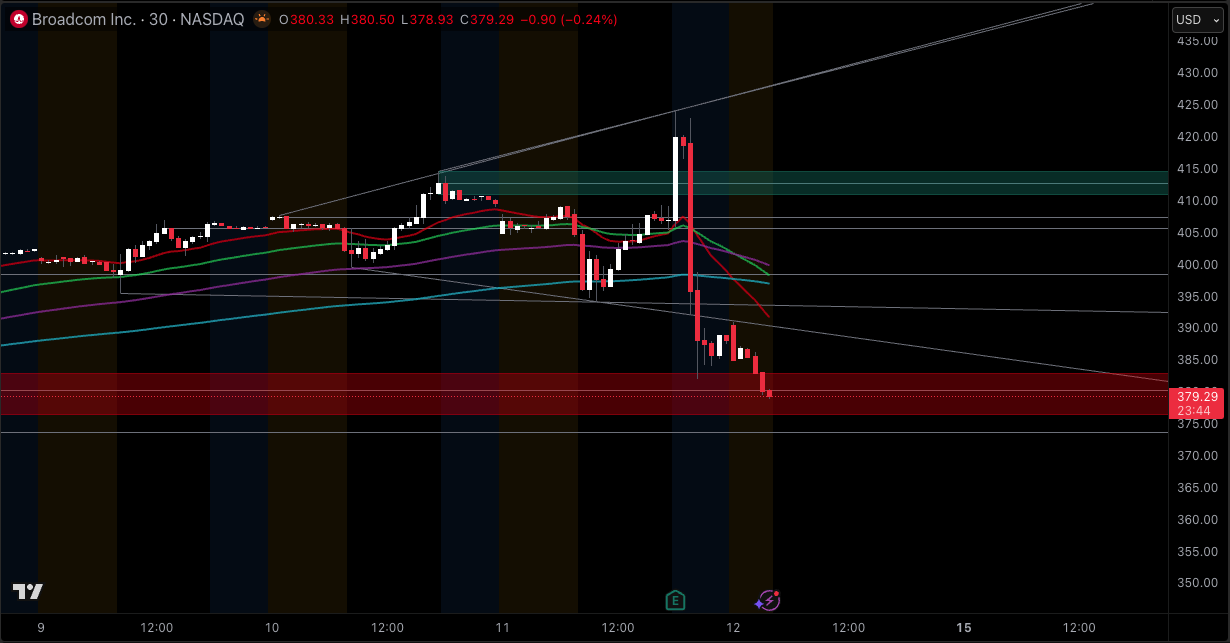

Despite this, AVGO stock reversed after an initial bounce and fell about 3–5% in after-hours trading, sliding from a regular-session close near $406 into the high-$380s to low-$390s before stabilising. For traders, the key question is simple: why did AVGO stock drop after hours despite the headline numbers looking so good?

AVGO Stock Drops After Hours: What Actually Happened

In the regular session before earnings, AVGO traded in a wide range of roughly $382–$424, closing near $406.37 on very heavy volume exceeding 45 million shares. The stock had already touched a new 52-week and all-time high near $414.61 earlier in the week.

After the earnings came out:

The stock initially jumped more than 3% in after-hours trading.

As investors digested the details, AVGO reversed lower, trading roughly 3–5% below the close, around the high-$380s to low-$390s.

This move came after a run of roughly 75–80% year-to-date gains, which had already pushed valuations to very high levels.

So the after-hours drop was not the market "punishing" bad results. It was a classic case of excellent numbers meeting even higher expectations, with many traders opting to lock in profits after the big run.

Key points on the current price context:

Regular close before earnings: about $406

After-hours trading range: roughly $390 ± a few dollars, with lows in the high-$380s

52-week range: about $138.10 – $414.61

Market cap: around $1.9 trillion at recent prices

AVGO Q4 Earnings Snapshot

| Metric |

Q4 FY25 result |

YoY change |

Street expectation (approx.) |

| Revenue |

$18.02B |

+28% |

~$17.5B |

| Adjusted EPS |

$1.95 |

+37% |

~$1.87 |

| Full-year revenue |

$63.9B |

+24% |

- |

| Net income |

$8.52B |

~+92% |

- |

| AI semiconductor revenue (Q4) |

n/a |

+74% |

- |

| Q1 FY26 revenue guidance |

$19.1B |

+~24% vs Q1 FY25 |

~$18.3B |

| Expected AI revenue in Q1 FY26 |

$8.2B |

Roughly 2x |

- |

| New quarterly dividend (FY26) |

$0.65 |

+10% |

- |

The quarter itself was clearly solid by almost any standard. According to the official release:

Q4 revenue: $18.02 billion, up about 28% year on year

Full-year revenue: about $63.9 billion, up roughly 24% year on year

Adjusted EPS: $1.95, up around 37% from last year and above the consensus of $1.87

Net income: roughly $8.5 billion, almost double the prior year's figure

Adjusted EBITDA: about $43.0 billion, up around 35% year on year

Free cash flow: about $26.9 billion for the year

AI semiconductor revenue: up about 74% year on year in Q4 and expected to double to about $8.2 billion in the next quarter

Dividend: quarterly payout lifted by 10% to $0.65 per share starting fiscal 2026

The message from management was clear: AI infrastructure remains the main growth engine, with large orders for custom chips and high-speed networking products, and that trend is expected to continue into next year.

Given that backdrop, it is natural to ask why AVGO stock dropped after hours at all.

Why AVGO Stock Fell After Hours Despite Robust Q4 Numbers?

1. Expectations and Valuation Were Already Very High

Before earnings, AVGO had already climbed to record highs, gaining about 75–80% this year. Meanwhile, valuations had reached well-off territory:

Those multiples are the kind you only see when investors already believe in a long, strong growth runway. When a stock is priced that high, even a "beat and raise" quarter can be treated as "not good enough" if the market was quietly hoping for something even better.

While AI revenue is growing fast, it tends to carry slightly lower margins than some traditional segments, which can limit long-term margin expansion if the mix shifts too far. That is not a disaster by any means, but it is enough to trigger a rethink when valuations are stretched.

2. Guidance Met a High Bar Instead of Smashing It

Broadcom guided Q1 FY26 revenue to about $19.1 billion, clearly above the roughly $18.3 billion that the market had expected. That is a strong outlook in absolute terms.

However, after a year of powerful AI headlines and a huge share price run, many investors were hoping for an even bigger upside surprise in forward guidance, especially given the size of the AI order backlog.

So the market did not dislike the guidance. It simply treated it as "good but already priced in", which is often enough to knock a very high multiple down by a few points.

3. Profit Taking After a Long Run in AI-Linked Names

Another driver of the AVGO after-hours drop is simple positioning. After months of strong gains across AI-linked stocks, traders have become more sensitive to any sign that the story might be maturing or that the easy part of the move is over.

The print noted that:

AVGO had just made fresh all-time highs.

Short-term traders were sitting on large unrealised gains.

Some investors are now more cautious about how much further AI-driven valuations can stretch in the near term.

In that environment, even a robust quarter can trigger a sell-the-news event, as traders conclude the risk-reward no longer looks attractive at current prices.

4. Wider Tech Sentiment Remained Fragile

The after-hours session also reflected wider nerves around technology and AI-heavy names. Several reports pointed to concerns about growth quality, backlog visibility, and competition across the sector.

AVGO's numbers did not fully calm those worries. Instead, the stock became a place where traders could take some risk off the table while still respecting the long-term story.

Technical Analysis: Where AVGO Stands After the After-Hours Drop

| Indicator / Level |

Approximate value |

What it means for traders |

| Last regular close (pre-earnings) |

$406–$407 |

Starting point before the after-hours drop. |

| After-hours last / range |

Around $390 (high-$380s to low-$390s) |

About 3–5% below the close; classic sell-the-news move. |

| Day’s regular range |

$394.19 – $409.30 |

Wide intraday range, showing elevated volatility. |

| 52-week range |

$138.10 – $414.61 |

Price remains very close to the top of its one-year range. |

| Market cap |

~$1.9T

|

One of the largest chip makers by value. |

| 20-day simple moving average |

≈ $373-$375

|

Price is still above this trend line even after hours. |

| 50-day simple moving average |

≈ $360-$361

|

Medium-term trend support; still well below price. |

| 200-day simple moving average |

≈ $315-$316

|

Long-term trend remains firmly upward. |

| RSI (14-day) |

≈ 65-67 pre-earnings

|

Momentum was near overbought; after-hours selling should pull this closer to neutral. |

| MACD (12,26) |

Positive, around 10–12

|

Uptrend still intact, but a further drop could trigger a momentum slowdown. |

| Volume (regular session) |

40-45M+ shares |

Much higher than usual volume around 23M, highlighting strong participation. |

| Nearby support zone 1 |

Around $390

|

Psychological level and near the after-hours lows. |

| Nearby support zone 2 |

Around $370–$375

|

Close to the 20-day moving average and recent breakout area. |

| Major support |

Around $360

|

Near the 50-day average, a key level many swing traders watch. |

| Overhead resistance |

$410–$415 |

Recent high band and 52-week peak. A retest would require fresh buying. |

Even after the post-earnings pullback, AVGO's chart still reflects a strong longer-term uptrend, but the short-term picture has become choppy and emotional.

Simply put, the longer-term trend remains up, but the stock has moved from a "steady climb" into a more two-way trading environment where both buyers and sellers are active. The after-hours drop pulls AVGO back from the top of its range, giving the chart room to breathe.

How Traders and Investors Could Approach AVGO Now

Short-Term Traders

Near term, focus on three tactical points:

1. Does $375–$380 hold?

That's the first important support zone. If AVGO stabilises there on decent volume, the dip looks like a standard post-earnings shakeout.

2. Watch how quickly the gap fills

A fast reclaim back above $400 would show strong dip-buyers; a grind below $375 would hint at a more drawn-out consolidation toward $355–360.

3. Respect volatility.

ATR near 4% of price tells you this is a big, fast mover for a mega-cap. Stops need to be logical, not snug.

For aggressive traders, buying into support bands with tight invalidation below $340 offers a reasonable play on AI trend continuation, provided you accept that a valuation flush can be sharp.

Longer-Term Investors

If you're thinking in years, not weeks:

The bull case is clear: dominant AI infrastructure player, hefty software cash flows, and a management team that has executed for a long time.

The danger lies in paying for future returns at 40–100 times earnings and 30 times sales upfront, as any letdown in AI orders, margins, or regulations could swiftly alter the multiple.

In that context, the after-hours drop isn't a sign the story is broken. It's a reminder that even the best stories have a price where the market starts to push back.

Frequently Asked Questions (FAQ)

1. Did Broadcom actually beat Q4 expectations?

Yes. Q4 FY25 revenue came in at around $18.0–18.02B, roughly $500M above consensus, with adjusted EPS of $1.95, topping forecasts of $1.87–1.90. Guidance for Q1 at $19.1B is also ahead of pre-earnings estimates.

2. How Big Is Broadcom's AI Business Now?

AI semiconductor revenue grew 74% YoY in Q4 and now makes up more than half of Broadcom's chip sales. Management expects AI chip revenue to double again in Q1 to around $8.2B, with a total AI order backlog near $73B.

3. Did Tech Sector Sentiment Play a Role in the Selloff?

Yes. Oracle's earnings miss and worries about its AI-related deals had already shaken confidence in the AI trade earlier in the day.

4. Is the Uptrend in AVGO Stock Broken?

Not yet. Even after the after-hours hit, AVGO remains in a clear uptrend, trading above its main moving averages and sitting not far below all-time highs.

Conclusion

In conclusion, AVGO's post-earnings drop isn't about bad numbers; it's about lofty expectations colliding with reality. Broadcom just reported record revenue, a healthy EPS beat, AI growth that would make most peers jealous, and a strong guide.

For traders, this looks like a classic "great quarter, crowded trade" shakeout inside a still-bullish structure. For longer-term investors, the message is more subtle: the AI infrastructure story is intact, but so is the risk of multiple compression from elevated levels.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.