In the world of forex trading, precision matters. Every pip, every tick, and every decision is often influenced by timing. That is why understanding the forex market opening time is crucial for traders at all levels.

With the market operating 24 hours a day during the working week, knowing when and where it opens can help you seize opportunities, manage risks and better plan your strategy. Below, we explore five key facts about forex market opening time to help you stay one step ahead.

5 Key Facts About Forex Market Opening Time

1. The Forex Market Does Not Have a Central Exchange

Unlike stock markets, which operate through specific physical exchanges, the forex market is decentralised. This means it functions over the counter via a global network of banks, financial institutions, and individual traders.

Because of this structure, the forex market opening time is not tied to a single location. Instead, it follows the business hours of financial centres around the world. When one trading centre closes, another opens, allowing continuous activity from Monday morning in Asia to Friday evening in New York.

The absence of a central exchange means no single "bell rings" to mark the start of trading. Instead, trading begins in Wellington, New Zealand, followed shortly by Sydney, Tokyo, London and then New York.

2. The Global Forex Market Opens on Sunday Evening (UK Time)

Although forex trading days are Monday through Friday, activity actually begins on Sunday evening in the UK due to the global time difference.

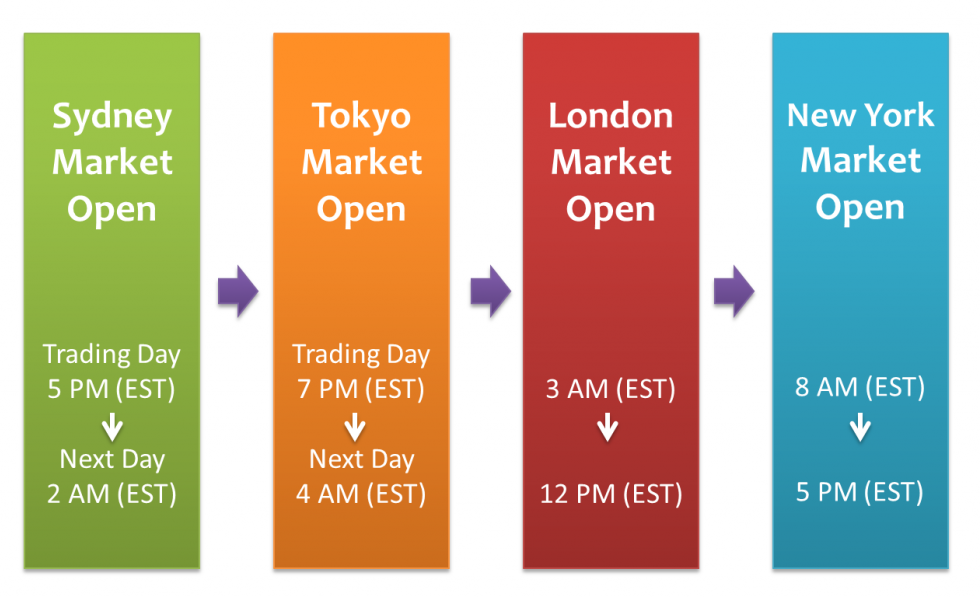

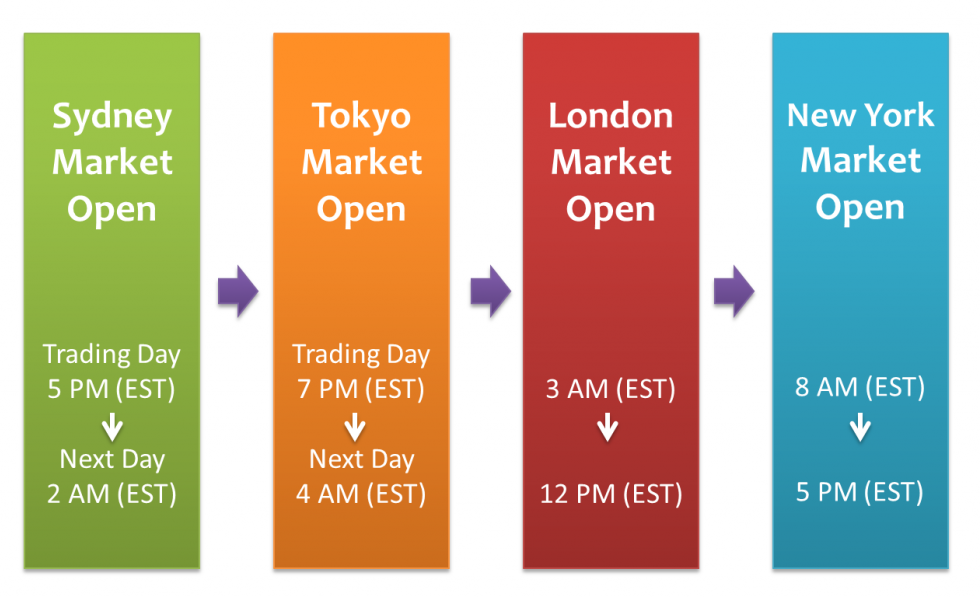

The first market to open is Wellington, New Zealand, at 10:00 pm GMT (which varies slightly depending on daylight saving time). This marks the unofficial forex market opening time for the global week.

Shortly after, Sydney joins the action, followed by Tokyo, London and New York. This rolling sequence of openings ensures the forex market remains active for 24 hours a day until it closes at 10:00 pm GMT on Friday.

If you are based in the UK or Europe, this Sunday start can be critical. Events over the weekend can cause gaps between Friday's close and Sunday night's open, which can significantly affect open positions or pending trades.

3. Each Major Session Offers Different Trading Conditions

Not all hours of the forex day are equal. Depending on the forex market opening time of various financial hubs, the market experiences different characteristics in terms of liquidity and volatility.

Asian Session (Tokyo): Begins around midnight GMT. Trading is usually slower with less volatility, though pairs like USD/JPY or AUD/USD can see more action.

European Session (London): Opens at 8:00 am GMT and is the most liquid period of the day. Many major economic announcements are released during this session, making it popular for active traders.

American Session (New York): Starts at 1:00 pm GMT. It overlaps with London for several hours, creating the most volatile trading window of the day.

Understanding the forex market opening time of each session helps traders decide when to enter or exit trades based on expected volume and price movement.

4. Overlaps Between Sessions Provide the Best Opportunities

One of the most active periods in forex occurs when trading sessions overlap. These overlaps bring together participants from multiple regions, increasing trading volume and enhancing price movement.

The most significant overlap is between London and New York, from 1:00 pm to 4:00 pm GMT. This period often sees sharp price moves, tight spreads and more favourable trading conditions for scalpers and short-term traders.

Knowing when these overlaps occur, relative to the forex market opening time, can help traders choose optimal times to monitor markets or place orders.

5. Daylight Saving Time Affects Opening Hours

A detail often overlooked by new traders is how daylight saving time (DST) shifts impact the forex clock. Since not all countries observe DST, and those that do often change at different times, it can temporarily affect the perceived forex market opening time in your region.

For example, when the United States moves to daylight saving time in March, the new york session may begin one hour earlier than usual in the UK. This means traders must stay aware of global clock changes or risk misjudging market openings and key economic release times.

Using a reliable forex trading calendar or a platform that adjusts for local time is the best way to avoid confusion.

Bonus Tip

Understanding when the forex market opens is not just about convenience, it is about strategy. For example, traders who focus on news releases may prefer to trade around the London or New York openings. Those looking to avoid high volatility may steer clear of session overlaps or low-liquidity periods.

Knowing the forex market opening time allows traders to:

Align strategies with liquidity peaks

Anticipate market volatility

Adjust for global events over weekends

Avoid spreads widening during low-activity periods

Plan trade setups more effectively

In short, the clock is your ally. Mastering its rhythm is key to trading success.

Conclusion

Whether you are a day trader, swing trader or long-term investor, understanding the forex market opening time gives you an essential edge. From planning entries and exits to anticipating price action, timing plays a central role in your trading outcomes.

By staying aware of session starts, regional overlaps and seasonal time changes, you position yourself to trade smarter, not just harder. As the market spans continents and never truly sleeps during the week, the informed trader is always watching the clock.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.