When it comes to legendary traders, few names inspire as much awe as Takashi Kotegawa, a Japanese day trader who famously turned $13,000 into over $153 million through disciplined strategies, sharp market instincts, and relentless focus.

Essentially, his strategy focuses on spotting high-volatility stocks, purchasing during market overreactions, and exiting at the right moment, all while minimising losses.

This guide will break down the methods commonly attributed to Kotegawa, show you how to apply the same ideas in modern markets, and explain the mindset behind disciplined, repeatable execution.

Who Is Takashi Kotegawa?

Takashi Kotegawa is a self-made Japanese trader who started with a modest sum and built a trading fortune in Japan's stock market. Born in 1978, he began trading in 2001 during Japan's market downturn, a time when stock volatility was high.

Known by his online alias BNF (a nod to the stock code of one of his favourite trades), Kotegawa's approach is a masterclass in precision, patience, and risk management.

Some key highlights of his journey:

Started with ¥1.6 million (about $13,000).

Specialised in day trading volatile stocks on the Tokyo Stock Exchange.

Rarely held positions overnight to avoid gap risk.

Preferred high liquidity and price momentum plays.

Takashi Kotegawa Net Worth

Takashi Kotegawa doesn't have a verified, publicly confirmed net-worth figure today. He's notably private, and unlike executives or celebrities, he isn't required to publish wealth disclosures. Thus, anything "current" you see online is typically an estimate rather than an official number.

Regarding a proper answer, his wealth is often anchored to figures from the late 2000s, commonly described as "tens of billions of yen," with a frequently repeated reference point around ¥19 billion (19 billion yen) circa 2007–2008.

Converting that to USD depends heavily on the exchange rate, which is why you'll see a wide range of dollars.

Meanwhile, more recent "net worth" numbers, such as ¥25–30 billion or ~$150–200 million, circulate online but are generally unverified and often appear to be extrapolations of older lore rather than newly documented financial data.

Core Principles of the Takashi Kotegawa Strategy

1) Trade Volatile, Liquid Stocks

Kotegawa focused on stocks with significant price swings and high trading volume. It allowed him to enter and exit positions quickly without slippage, an essential requirement for day trading.

2) Buy After Sharp Drops

His preferred opportunities occurred when stocks overreacted to news or market sentiment, resulting in significant intraday declines.

He believed these moves often created short-term oversold conditions, presenting profitable bounce opportunities.

3) Sell Quickly and Take Profits

Kotegawa avoided greed by selling after small but consistent gains. He often targeted a 1–3% profit per trade, preferring multiple small wins over risky big bets.

4) Strict Risk Management

He used tight stop-losses and rarely risked more than 1%–2% of his capital per trade. Losses were cut immediately if the trade went against him.

What Is Takashi Kotegawa's Setup?

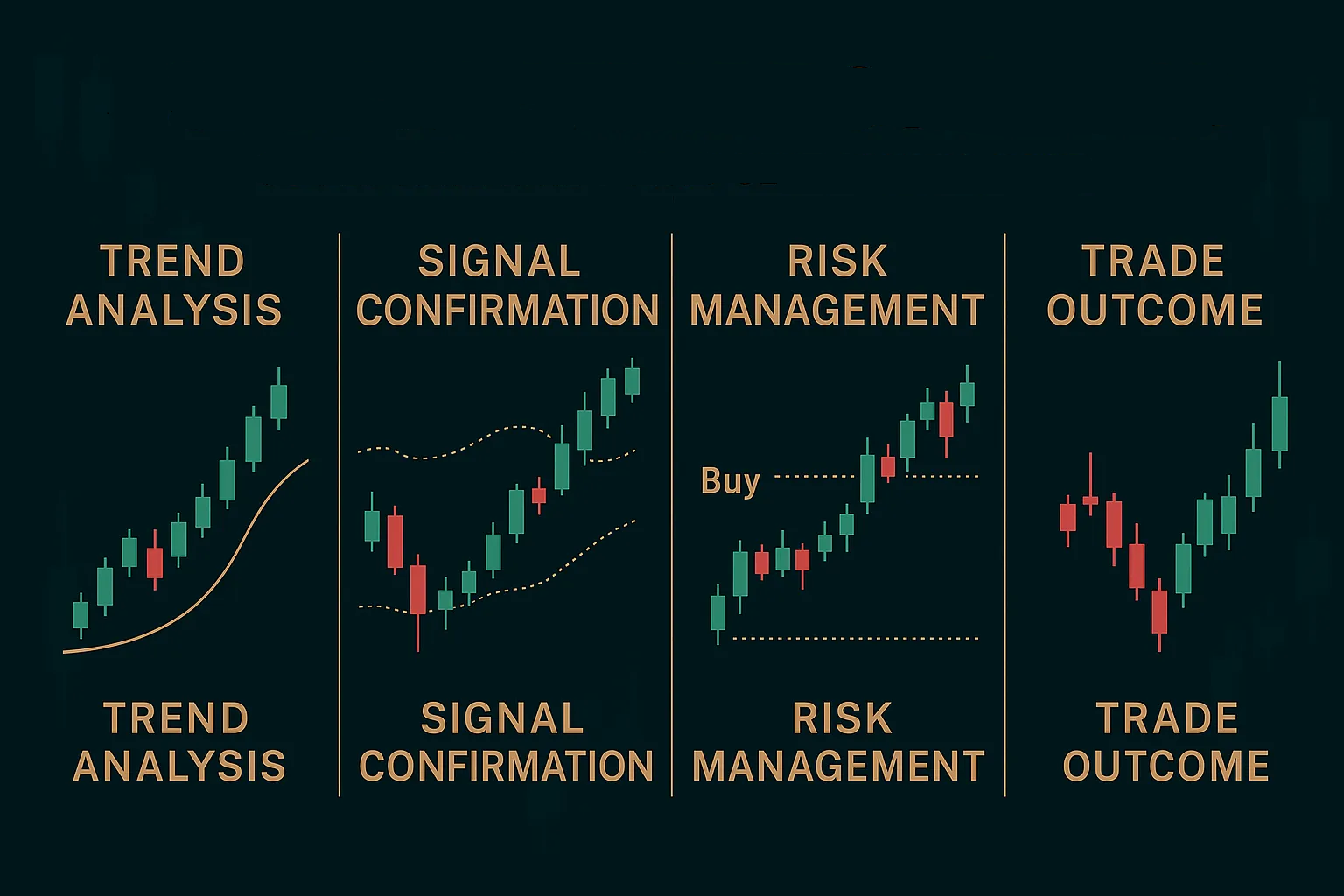

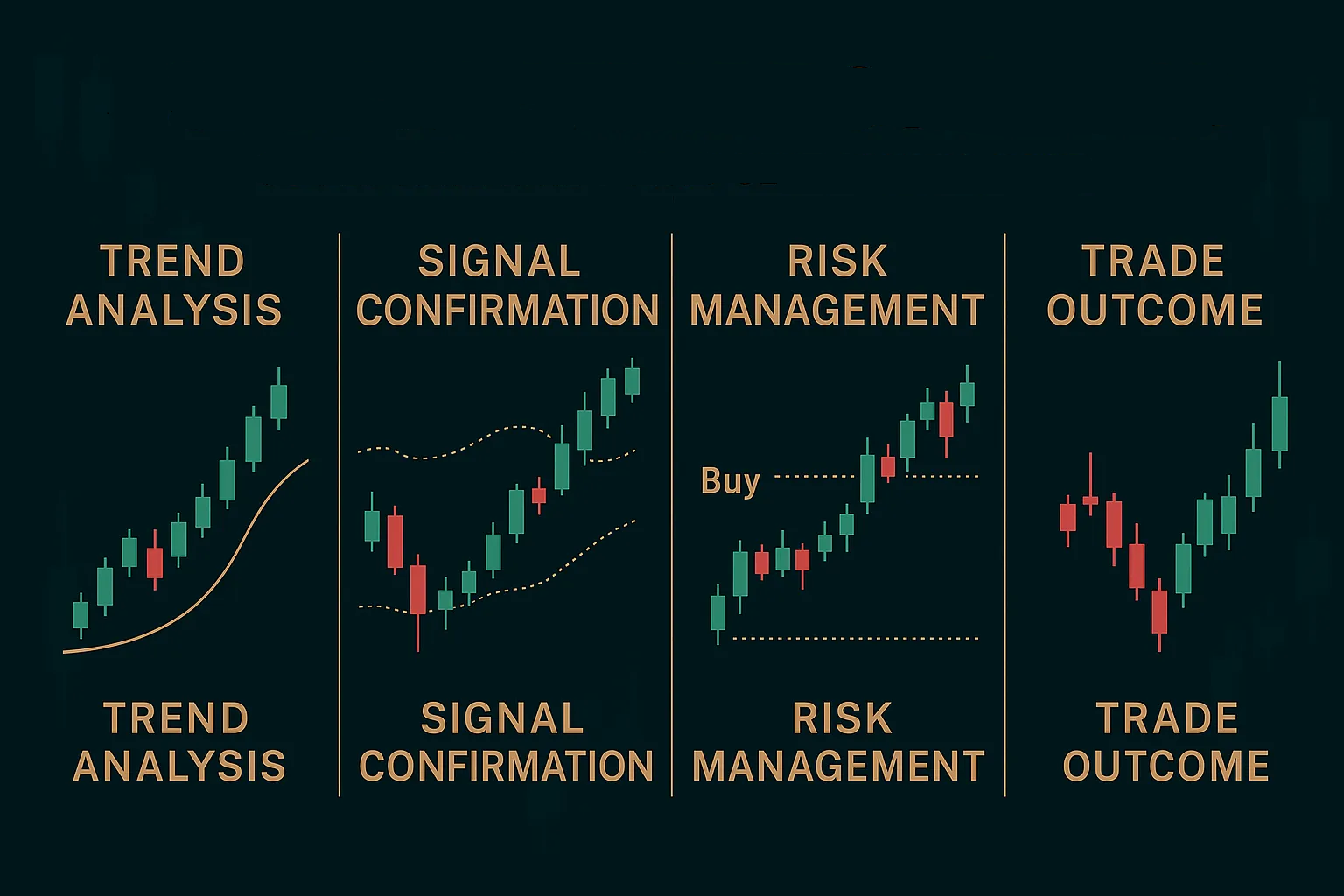

The Kotegawa Setup is a repeatable trade model:

Identify a target stock with unusually high trading volume.

Look for a sharp price drop of 5–10% in a short time.

Determine whether news causes the decline or market overreaction.

Enter at support levels or when momentum starts to reverse.

Exit quickly once the stock recovers part of its losses.

Example: If a stock falls from ¥1,000 to ¥900 due to panic selling, Kotegawa might buy at ¥905–¥910, expecting a bounce to ¥930–¥940.

Another one of Kotegawa's key rules is never holding positions overnight. The main reason is gap risk, as stock prices can open much higher or lower the next day due to after-hours news.

By closing trades before the market ends, he ensures full control over his risk exposure.

How to Adapt Takashi Kotegawa's Strategy in Modern Trading

While Kotegawa's career was built in Japan's stock market, his methods apply globally:

Here's a simple step-by-step guide:

Step 1: Build a Watchlist

Choose 10–15 high-volume, high-volatility stocks. Monitor them daily to understand their price behaviour.

Step 2: Wait for a Sharp Move

Look for sudden 5% drops or spikes within minutes or hours. These are often overreactions.

Step 3: Confirm Reversal Signs

Use simple tools such as candlestick patterns (hammer, engulfing) and volume spikes to confirm a potential rebound.

Step 4: Enter Quickly

When reversal signs appear, enter without hesitation. Speed is critical for capturing small intraday moves.

Step 5: Exit Without Greed

Take profits once you hit your target. Even a 1–2% gain per trade can compound significantly over time.

Tips for Beginners Wanting to Try Takashi Kotegawa's Strategy

Kotegawa's success wasn't just about charts; it was about mental discipline:

No emotional attachment to any stock.

Patience to wait for the precise setup.

The humility to accept small losses.

Avoiding ego-driven big bets.

He often said that trading is not about predicting, but about reacting to what the market shows you.

Thus,

Start with a demo account to practice quick entries and exits.

Limit your watchlist to a handful of volatile stocks.

Keep position sizes small until you gain confidence.

Always use stop-loss orders.

Track your trades to identify patterns in your success and failures.

Frequently Asked Questions (FAQ)

What Is the Core Idea of Takashi Kotegawa's Trading Strategy?

The strategy centres on buying during sharp intraday drops caused by market overreactions and selling quickly for small, consistent profits while keeping losses minimal.

How Does Kotegawa Choose Stocks to Trade?

He focuses on stocks that exhibit high liquidity, notable price fluctuations, and robust intraday volatility, enabling quick entries and exits with minimal price slippage.

Can Beginners Use the Takashi Kotegawa Strategy?

Yes, but beginners should start with small position sizes or demo accounts to master quick decision-making and disciplined exits before trading with larger capital.

Conclusion

In conclusion, you can win big like Kotegawa, but only if you embrace the same discipline, patience, and risk management that he mastered. His approach is not about one big win; it is about stacking small wins while avoiding massive losses.

If you can learn to control your emotions, spot volatility-driven opportunities, and execute trades with precision, you'll be one step closer to replicating his legendary success.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.