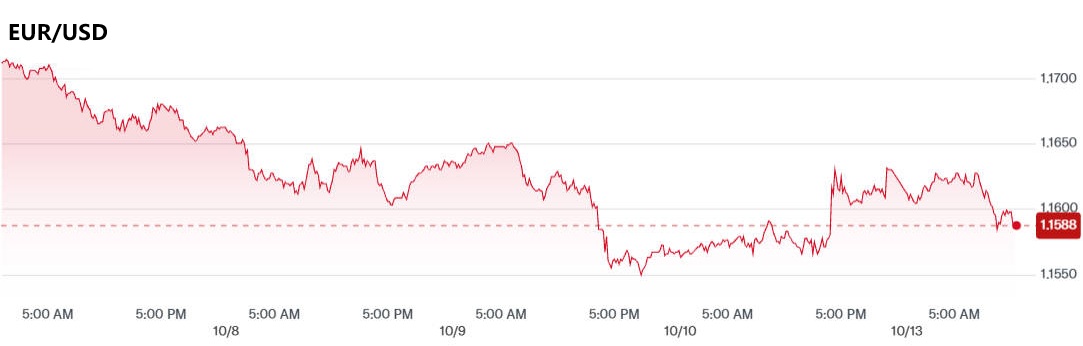

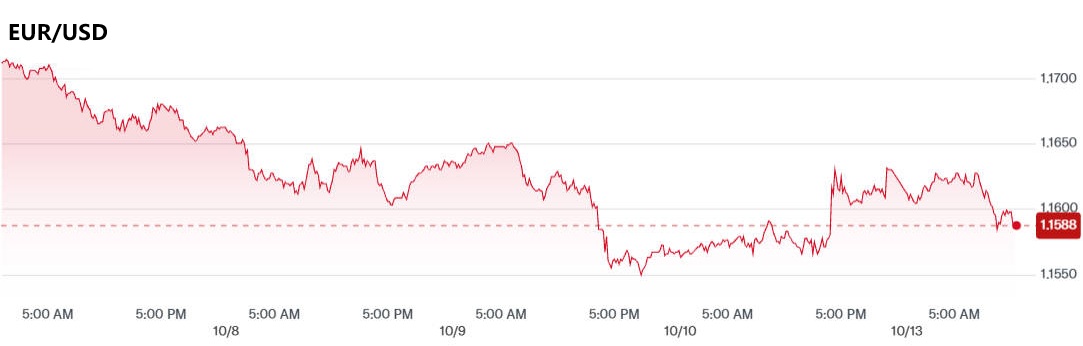

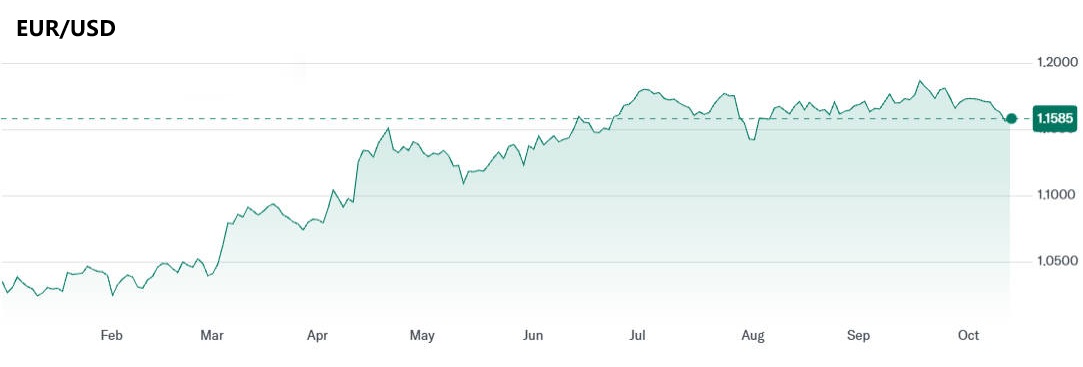

EUR/USD is trading close to the 1.16 mark as traders balance fresh U.S. trade headlines against evolving central-bank expectations.

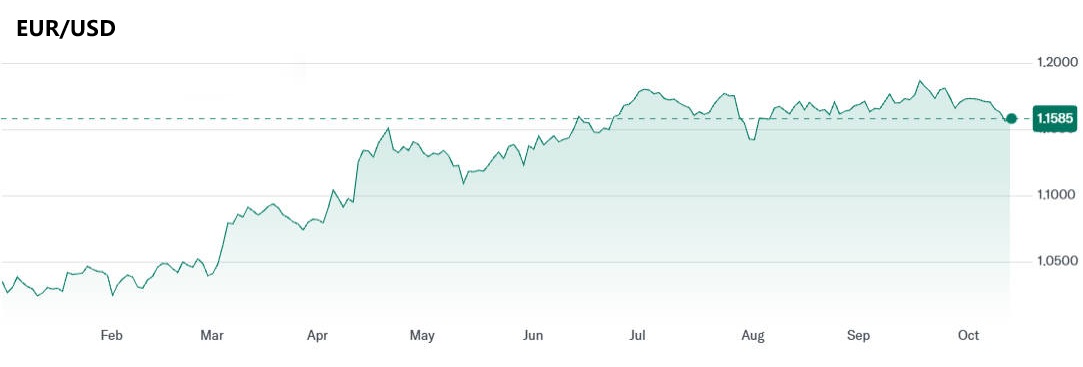

The dollar's recent softness has given the euro room to consolidate after a marked year-to-date appreciation, but clear directional momentum is absent until markets receive fresh macro data or policy signals.

Current market snapshot and primary drivers

Year-to-date context. The euro has strengthened materially against the dollar this year, with Reuters noting roughly +13–14% YTD appreciation, reflecting both dollar weakness and relative European resilience.

Fundamental analysis: what is moving EUR/USD now

This section summarises the key macroeconomic and policy factors that are currently influencing EUR/USD.

1) United States (demand for dollar, Fed outlook).

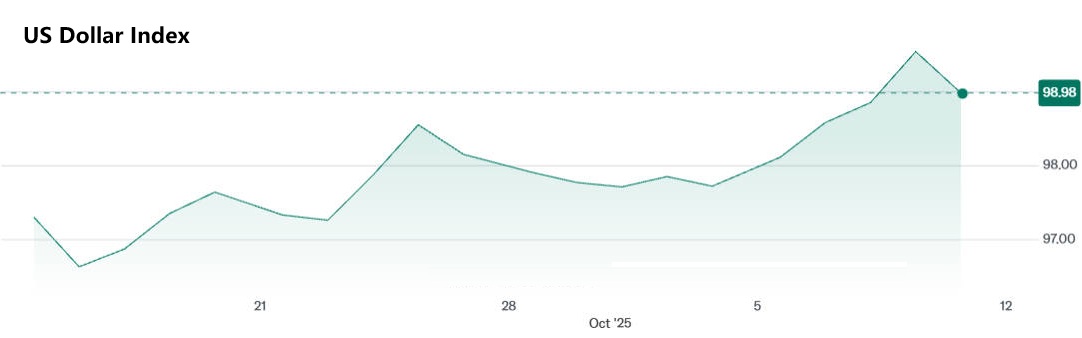

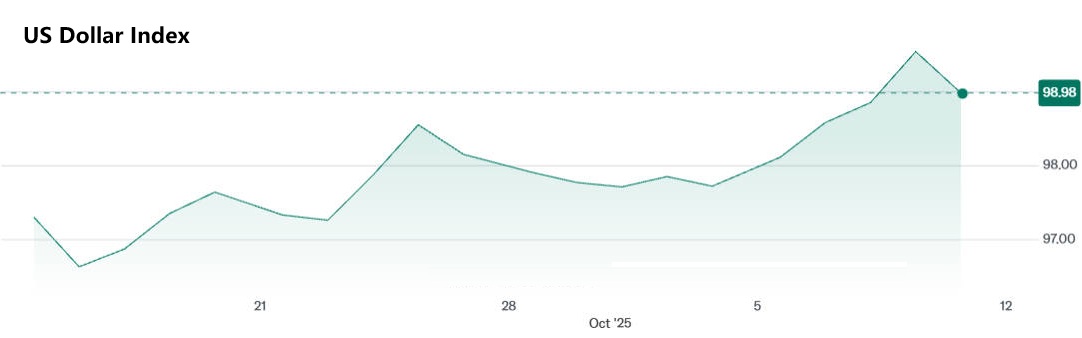

Recent U.S. inflation prints and employment numbers have created mixed signals. Softer core inflation has reduced the near-term pressure for aggressive Fed tightening, which in turn has eased some dollar strength.

Market participants are now positioning for possible Fed cuts later in the cycle, which tends to be dollar-negative if confirmed.

2) Eurozone (growth, inflation and ECB stance).

Eurozone data are uneven: manufacturing pockets show tentative stabilisation while services and some southern economies lag. The ECB remains data-dependent and cautious; any unexpected pick-up in eurozone inflation or growth would strengthen the euro's case.

3) Trade policy and geopolitics.

Sudden announcements on tariffs or export controls have produced rapid moves in global risk sentiment and currencies. Recent U.S. measures and the subsequent market reaction demonstrate how sensitive EUR/USD is to headline risk.

Traders should expect short bursts of volatility when trade prompts hit the wires.

4) Cross-market linkages.

Bond yield spreads (notably the US 10-year vs German Bund yields), equity risk appetite and commodity price shifts remain important filters through which FX markets translate macro news into directional moves.

Technical picture: range structure and triggers

Technical analysis suggests EUR/USD is consolidating within a clearly defined band. Traders should treat breakouts outside that band as conditional until volume and follow-through confirm a shift.

Key technical levels for EUR/USD

| Area |

Level (approx.) |

Rationale |

| Immediate resistance |

1.1655 – 1.1730 |

20-day EMA and recent swing highs act as near-term ceiling. |

| Secondary resistance |

1.1835 – 1.1910 |

Higher pivot zone; breakout above here would signal medium-term bullish momentum. |

| Immediate support |

1.1550 – 1.1600 |

50-day EMA and intraday demand zone. |

| Structural support |

~1.1500 |

Longer-term downside pivot and psychological support. |

1) Indicators and structure.

The 20-day EMA has capped recent rallies. The RSI is close to neutral, indicating equilibrium rather than an imminent trend bias. MACD readings show limited momentum. A sustained close above 1.1730 — accompanied by rising volume — would be the first technical signal that bulls are reasserting control.

2) Practical confirmation rules for traders.

Entry on breakout: wait for daily close outside the band plus higher than average daily volume.

Entry on pullback: buy dips toward 1.1600 with stops below 1.1550; keep risk small relative to reward.

Rejection trades: consider shorting sustained rejections off 1.1730 with stops marginally above the zone.

Scenario analysis and probabilities

Below are three conditional scenarios with suggested market triggers.

EUR/USD remains within 1.1550–1.1730 while markets digest CPI/PCE prints and ECB minutes. This is the most likely outcome absent a major data surprise.

Trigger: materially softer U.S. inflation or explicit Fed guidance that confirms a dovish pivot; limited eurozone weakness. This would narrow yield differentials and support a measured euro advance.

Trigger: stronger-than-expected U.S. growth or jobs data, or an abrupt escalation in geopolitical risk that pushes markets toward the dollar as a safe haven.

Risk register: what could invalidate the outlook

Policy surprises: unexpected hawkish or dovish turns from the Fed or ECB.

Trade escalation: new or wider-reaching tariffs and controls that sharply alter global risk sentiment.

Event risk: unforecasted political shocks in major eurozone countries or rapid energy-price swings that reshape the inflation outlook.

Liquidity shocks: a sudden liquidity squeeze in fixed income or derivative markets could produce outsized FX moves.

Trading guidance by time horizon

Trade with the band: buy near 1.1600 and sell near 1.1730 where appropriate, using tight stops. Prioritise event risk windows; reduce size into major releases.

Consider phased accumulation on confirmed dips if macro readings become more euro-friendly; use options to hedge major event exposure.

Wait for confirmed breakouts with follow-through. Hedge exposure on calendar around CPI and ECB minutes.

Key economic calendar

| Date (UK) |

Event |

Potential impact

|

| This week* |

U.S. CPI / PCE previews and releases |

High — could move USD and EUR/USD materially. |

| This week* |

ECB minutes / selected central-bank speeches |

Medium — clarifies ECB tilt. |

| Ongoing |

Trade / tariff headlines |

High — headline risk; fast moves possible. |

* Exact dates depend on the current calendar; traders should confirm local release times before positioning.

Conclusion and actionable takeaways

Immediate posture. EUR/USD is range-bound and lacks a clear trend until markets receive fresh policy or macro direction. Treat breakouts as conditional and rely on volume confirmation.

Medium-term watchlist. Track U.S. inflation metrics and Fed language for indications of easing; monitor ECB minutes and eurozone data for signs of resilience. These two policy streams will shape the pair's path.

Risk management. Given high headline sensitivity, traders should size positions conservatively and use well-defined stops. Options can be used to hedge around major releases.

Frequently Asked Questions

1. Why is EUR/USD range-bound near 1.16?

Because opposing forces balance each other — softer U.S. inflation limits dollar strength, while weak Eurozone data caps euro gains.

2. Which data releases matter most this week?

U.S. CPI and PCE for inflation trends

ECB minutes for policy signals

Eurozone activity data for growth momentum

3. How does the Federal Reserve affect EUR/USD?

A dovish Fed weakens the dollar and lifts EUR/USD; a hawkish stance strengthens the dollar and pressures the pair lower.

4. How does the ECB influence the euro?

A cautious or dovish ECB limits euro upside, while stronger inflation or confidence in growth supports it.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.