Microsoft reports fiscal year 2026 second-quarter earnings today, January 28, 2026, after the US market close. The company's earnings conference call is scheduled for 2:30 p.m. Pacific Time (5:30 p.m. Eastern Time), led by CEO Satya Nadella and CFO Amy Hood.

This Microsoft earnings print is vital because the company is sitting at the center of two powerful forces that often move the stock more than headline beats:

Azure growth versus capacity limits, which tells investors whether demand is still outpacing supply.

AI infrastructure spending versus near-term margins, which tells investors how expensive the next leg of growth will be.

Traders are gearing up for a significant move, as options pricing suggests the market is expecting a swing of approximately 5% following the report.

What the Market Is Pricing in Before the Microsoft Earnings Report?

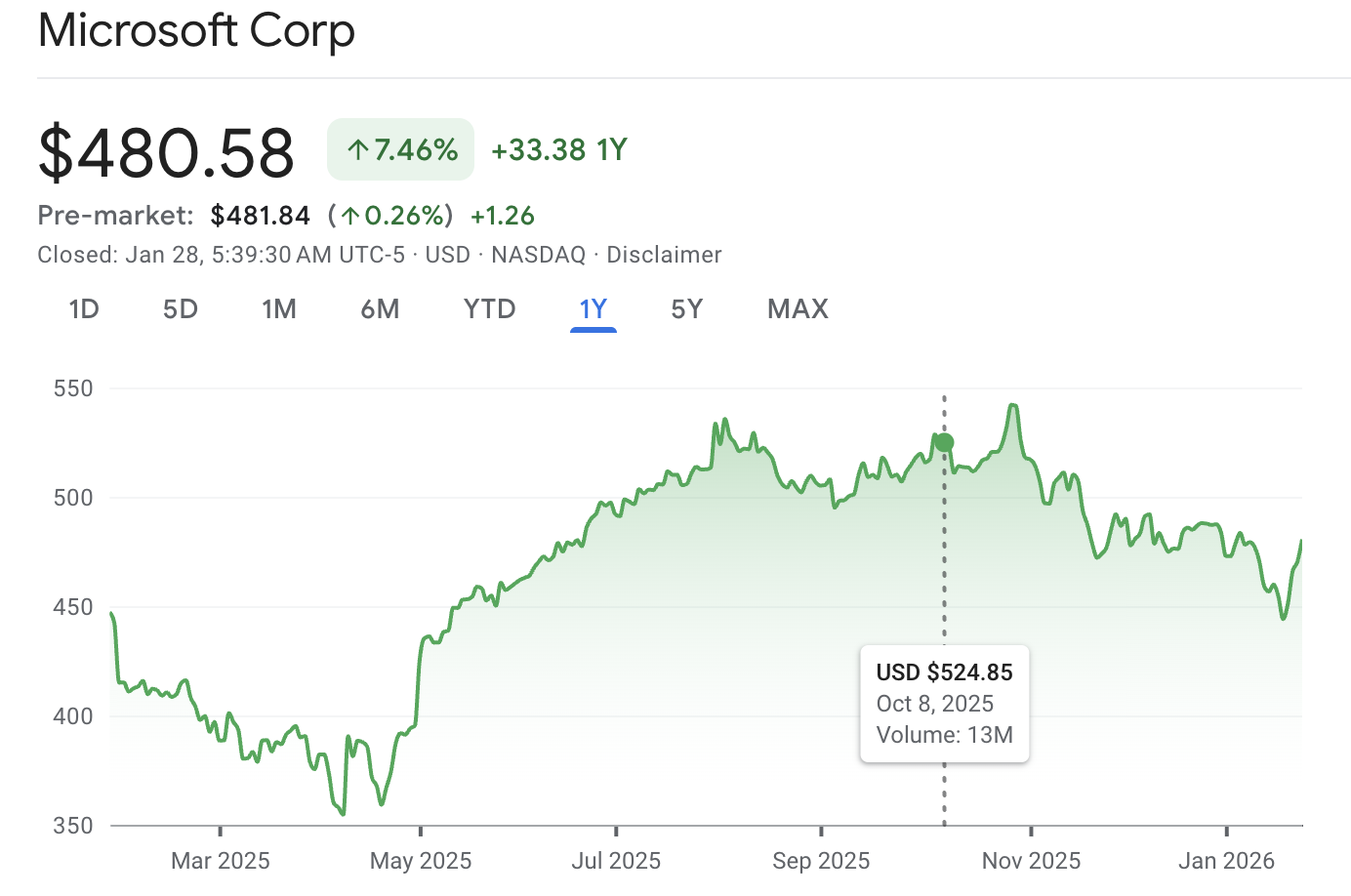

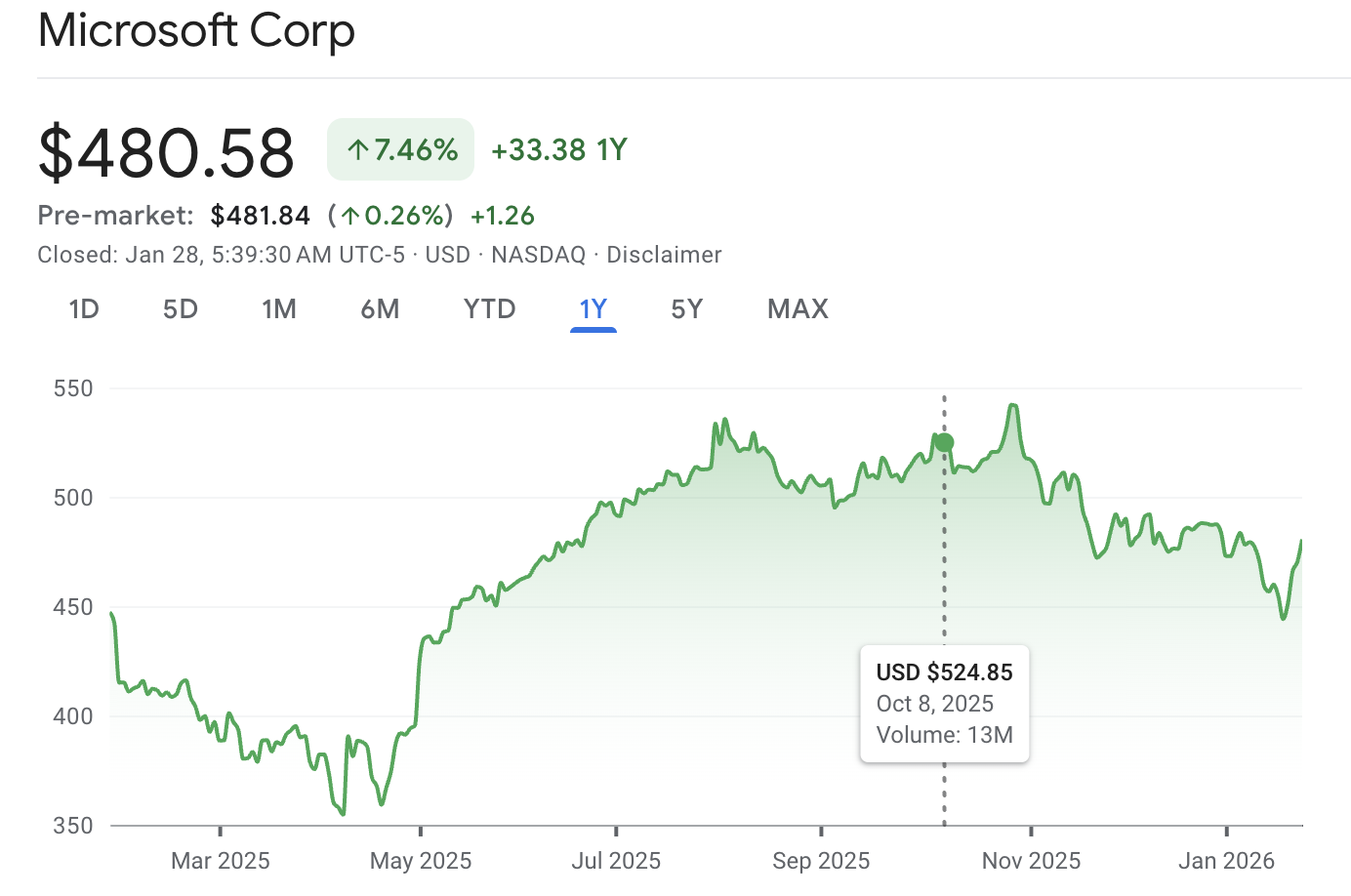

Currently, MSFT shares are priced around $480.58, and options market data suggests that traders anticipate a notable movement following the earnings report.

For example, options markets imply a ±5% move after earnings, which corresponds to a post-earnings range of roughly $459 to $502, given a recent close near $481.

That implied range is a useful checklist because it tells you this is not just an "EPS day." It is a guidance, Azure, and capex day, where one line in the outlook can do more work than the quarterly numbers.

Wall Street Expectations: What Analysts Expect for Fiscal Q2 2026

| Metric |

Market expectation |

| Revenue |

About $80.3 billion

|

| EPS |

Around $3.87 to $3.91

|

| Intelligent Cloud revenue |

About $32.39 billion

|

| Azure growth (y/y) |

High 30% area |

Different data vendors publish slightly different consensus figures.

However, the message is consistent: analysts expect solid year-over-year growth and want confirmation that Azure growth stays strong while AI spending remains explainable.

Why Azure Matters More Than the EPS Line in the FY26 Q2 Microsoft Earnings?

Microsoft has become a "cloud plus AI infrastructure" stock in the eyes of many investors. That is why Azure's growth rate often matters more than a small EPS beat.

Last quarter (FY2026 Q1, ended September 30, 2025), Microsoft reported:

Total revenue: $77.673 billion

Non-GAAP EPS: $4.13.

Microsoft Cloud Revenue: $49.1 billion, up 26% YoY.

Productivity and Business Processes revenue: $33.0 billion

Intelligent Cloud revenue: $30.9 billion, up 28%.

More Personal Computing revenue: $13.8 billion

Azure and other cloud services revenue growth: +40%

Commercial remaining performance obligation (RPO) up 51% to $392 billion, which investors often read as a forward demand signal.

Those figures explain why the market's focus has narrowed. Microsoft already proved it can grow quickly. Now investors want to know whether the cost of delivering AI and cloud growth remains manageable as the company scales capacity.

6 Results and Signals That Can Move MSFT Stock After the Close

1) Azure Growth: The Single Number That Can Reprice the Quarter

Traders will not just ask, "Did Azure grow fast?" They will ask, "Did it grow fast without getting more expensive to deliver?"

Analysts are monitoring whether Azure's growth is in the mid-to-high 30% range and whether management commentary suggests capacity constraints are easing or persisting.

Bullish Tone Usually Sounds Like:

Azure growth holds up well, and management signals capacity is improving.

AI workloads continue to expand across industries, not just a narrow set of early adopters.

Bearish Tone Usually Sounds Like:

Growth is fine, but management hints that supply and power constraints are limiting what Microsoft can ship.

Costs are increasing faster than revenue, and margin pressure will likely continue.

2) Intelligent Cloud Revenue: The Segment That Carries the Report

Intelligent Cloud is a key focus area for Microsoft, with estimated earnings of $32.39 billion.

If this number is missed, markets often interpret it as a slowdown in Azure demand or a delay in execution. If it exceeds expectations, the next question will be about margins.

3) AI Capex: The Market Wants a Plan, Not a Promise

Microsoft's spending on artificial intelligence has been a significant topic of discussion since last quarter.

In the FY2026 Q1 earnings conference call materials, Microsoft reported capital expenditures of $34.9 billion, primarily driven by demand for cloud and AI services. About half of this expenditure was allocated to short-term assets, including GPUs and CPUs.

As a result, investors will likely focus on management's outlook for capital expenditures this quarter, particularly regarding AI investments and rising infrastructure costs, which are viewed as significant risks to their guidance.

What Can Move the Stock:

4) Cloud Margins: The AI Tax

Microsoft can grow cloud revenue quickly, but if AI delivery costs ramp even faster, the market can still sell the stock.

Microsoft's Q1 press release reported cloud revenue of $49.1 billion, highlighting strong demand across the platform. However, the segment notes noted challenges related to margin pressure from scaling AI infrastructure.

Later tonight, traders will be looking for a clear answer to one key question: Is the margin pressure in the cloud business easing, remaining steady, or getting worse?

5) Copilot and Microsoft 365

The Productivity and Business Processes segment is often the "stability anchor." In Q1, it grew strongly, with Microsoft 365 and Dynamics supporting the result.

Investors want to know whether AI features are:

Lifting average revenue per user over time

Driving higher retention and usage

Expanding into more departments for large customers

You may not get all of that in one quarter, but management's tone on adoption and pipeline can still move sentiment.

6) Guidance

A lot of "earnings night" volatility fades by the next day. Guidance tends to last.

Markets will watch for:

Any change in cloud growth tone for the next quarter

Operating margin commentary under higher depreciation and AI costs

Signals about demand durability in enterprise spending

Recent Performance of MSFT Stock

MSFT closed at $480.58 on January 27, 2026.

Using recent closes, MSFT rose about 5.7% from $454.52 (January 20 close) to $480.58 (January 27 close).

Over the last month, MSFT was down about 1.5%.

| Period |

Approx. move |

| 1 week (5 trading days) |

+5.7% |

| 1 month |

-1.5% |

| Since October earnings |

About -11% |

Moreover, MSFT stock has declined approximately 11% since the October earnings report, prompting this call as an opportunity to reset sentiment.

MSFT Stock Technical Analysis: Key Levels Traders Are Watching

Short-term technicals matter more in earnings because they shape stop placement, hedging behavior, and whether buyers feel forced to chase.

| Indicator |

Level |

How traders often interpret it |

| Pivot point (classic) |

~$481.76 |

A "line in the sand" around the current price. |

| Resistance 1 |

~$485.69 |

First upside test if earnings triggers a squeeze. |

| Resistance 2 |

~$491.36 |

A follow-through level if momentum builds. |

| Support 1 |

~$476.09 |

First downside check if guidance disappoints. |

| Support 2 |

~$472.16 |

Often where dip-buyers look for stabilization. |

| 50-day moving average |

~$479.63 |

A widely watched trend filter near spot. |

| 200-day moving average |

~$485.00 |

A longer-term reference level close to spot. |

| RSI (14) |

~70.98 |

Strong momentum, but vulnerable to post-event cooling. |

Key Takeaways:

For earnings night, traders often treat these zones as reference points rather than hard rules. The key factor is the tone of the guidance provided.

Frequently Asked Questions

1. What Time Is Microsoft's Earnings Today?

Microsoft reports after the US market close today, and the earnings conference call is scheduled for 2:30 p.m. PT / 5:30 p.m. ET.

2. What Is Wall Street Expecting From Microsoft Earnings This Quarter?

Estimates indicate $80.31 billion in revenue and $3.87 in EPS, with Intelligent Cloud revenue expected to be around $32.39 billion.

3. What Is the Most Important Result?

Azure's growth is most crucial. It is the clearest single read on Microsoft's cloud and AI momentum.

4. How Much Could MSFT Stock Move After Earnings?

Options pricing suggests a potential movement of approximately 5% in either direction, resulting in a price range of $459 to $502 based on a recent close near $481.

Conclusion

In conclusion, Microsoft's earnings today focus less on meeting quarterly targets and more on whether management can maintain market confidence in the cloud growth trajectory while clarifying its AI spending strategy.

Microsoft stock has already shown strong cloud demand, including Azure growth of 40% in the prior quarter and RPO of $392 billion.

Now, MSFT stock's next move likely depends on whether Azure stays strong, capex remains understandable, and guidance keeps the margin narrative intact.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.