As of June 6, 2025, Palantir Technologies (NASDAQ: PLTR) had dropped 7.8% from its recent high. It was among the biggest drop among tech stocks, sending the S&P 500 and Nasdaq into negative territory.

Although the market was generally weakening at the time, Palantir performed the worst, which asks the question of whether company-specific news or more general tech trends were to blame for the decline.

This article analyses the reasons behind Palantir's current stock decline, including market reactions, contributing factors, valuation concerns, and analyst projections.

Current Palantir Stock Financial Overview

Palantir Technologies Inc. (NASDAQ: PLTR) is currently trading at around $119.91, a modest intraday drop of approximately 7.8% from the previous day.

Why Palantir Stock Is Down Today? 5 Factors Explained

1. Profit-Taking After a Strong Run

Palantir has surged around +74% YTD, driven by AI optimism, government contracts, and investor enthusiasm.

After hitting record highs near $135, traders began booking profits, common after sharp price moves.

2. Valuation Concerns Reach a Fever Pitch

Trivariate Research described Palantir as "one of the most expensive U.S. large caps ever," with trailing P/E of 565× and trading at sky-high sales multiples.

Such elevated valuations make the stock vulnerable to pullbacks when earnings or guidance don't keep pace.

3. Q1 Earnings & Muted Guidance

In May, Palantir posted solid revenue growth—roughly 39% year-over-year—with increased adoption of its Foundry platform in federal agencies. However, the company refrained from issuing strong forward guidance. This defensive tone disappointed analysts who were expecting more bullish commentary.

Thus, on May 6, Palantir stock dropped over 13% after Q1 earnings beat expectations ($884M revenue) but lacked strong forward guidance and missed high analyst estimates.

The sell-off underscores how thin the margin for error is at such rich valuations.

4. Increasing Scrutiny Over Government Ties

Heavy involvement with ICE, DoD, HHS, and other federal entities has sparked privacy and political backlash.

The surge in gov't contracts—once a growth catalyst—may now be seen as a reputational and regulatory risk.

5. Broader Tech Market Weakness

Tech shares, including Tesla, Broadcom, CrowdStrike, and Palantir, pulled back amid elevated volatility, rising jobless claims, and uncertainty.

These sector-wide pressures amplified Palantir's decline.

How Expert Analysts See the Road Ahead

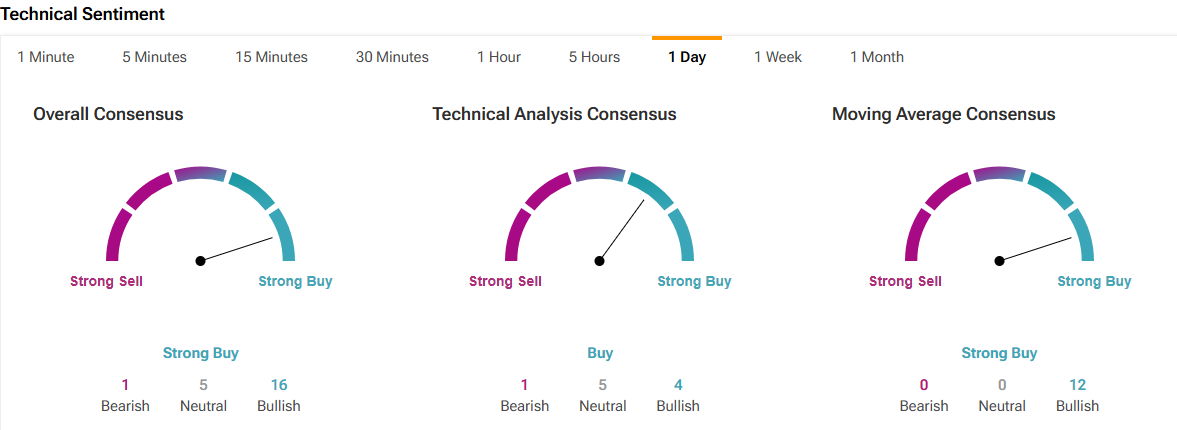

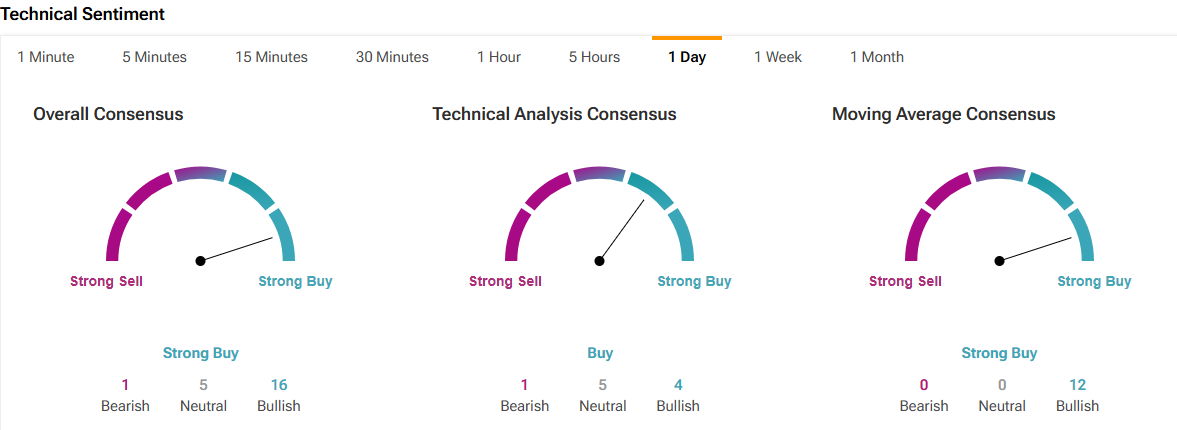

Technical Breakdown

The sharp drop arrived after Palantir broke below its 20-day simple moving average, a negative technical trend.

Today's sell-off adds to a broader distribution day across tech, signalling increased institutional selling.

A move below the 50‑day SMA ($91) could trigger further downside.

Bullish Mid‑Term Scenarios

AI adoption and federal tech budgets may drive further expansion.

Stabilising the macro environment and selective inflows into beaten‑up tech names may help sustain prices.

Price targets up to $140 are possible if growth continues.

Bearish Risks

Valuation too rich: A modest growth miss could cause steep declines.

Countries' political backlash may lead to contract slowdowns or scrutiny.

Broader tech downturns or Fed rate increases could deflate momentum.

Consensus

Experts foresee a wide range from $40 to $150, reflecting deep uncertainty.

The current average targets around $100, implying a potential downside near 20%

Historical Context: Palantir Stock's Volatility

Sep 2020–Dec 2022: PLTR tumbled nearly 84.6%, from $39 to a low of $6, underperforming the S&P 500's ~25% loss.

Oct 2024–June 2025: PLTR staged a dramatic comeback, jumping over +1,900% from lows, fueled by renewed government contracts and AI adoption.

Today's drop is a normal retracement after a parabolic run, especially given its steep valuation.

What Traders and Investors Should Do

Short-Term Traders:

Use stop-losses near the 50-day moving average (~$108).

Watch volume in Nasdaq/S&P as distribution days signal to sell pressure.

Consider hedging with protective puts if expecting a further pullback.

Long-Term Investors:

Focus and diligence on Q2 results—especially growth and guidance.

Weigh exposure based on the portfolio PLTR represents.

Monitor macroeconomic conditions such as FED moves and consumer sentiment.

Swing Traders:

Conclusion

In conclusion, Palantir's drop today reflects a convergence of profit-taking, valuation concerns, insider selling, muted guidance, and uncertainty in the tech market.

Traders should watch for technical stability around $120 and monitor upcoming catalysts. Long-term investors may consider gradual accumulation on pullbacks, provided commercial growth broadens with macro sentiment stabilises.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.