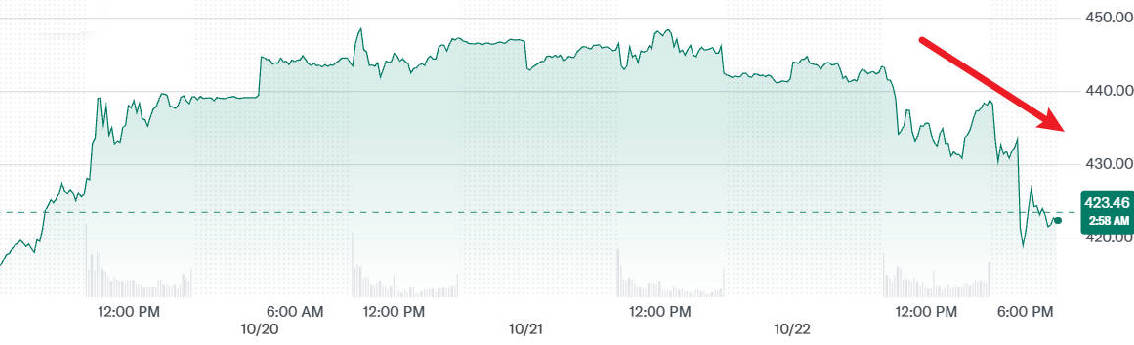

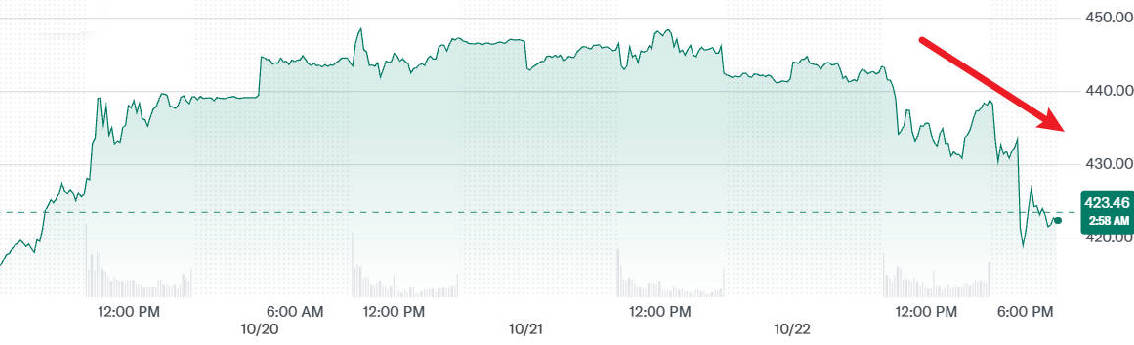

The share price of Tesla Inc (ticker TSLA) is currently around US $423.46. having declined slightly after the company reported third-quarter results in which revenue rose but profits fell short of analyst expectations.

In this context, the stock's trend reflects a recalibration of growth expectations and valuation risk, which the market is currently processing.

This article reviews the market reaction to Tesla, its key financial results, main challenges, and what investors should monitor going forward.

What happened to Tesla stock price after the earnings report

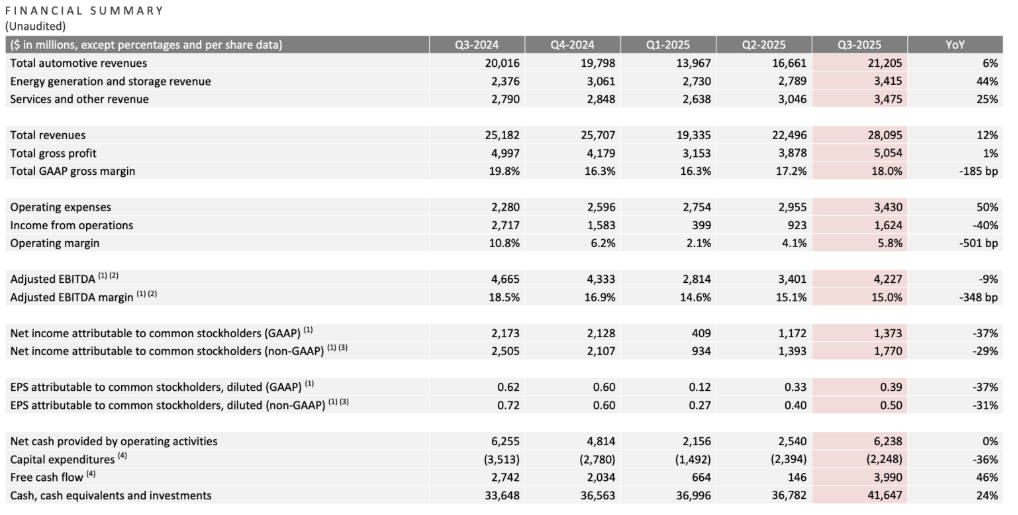

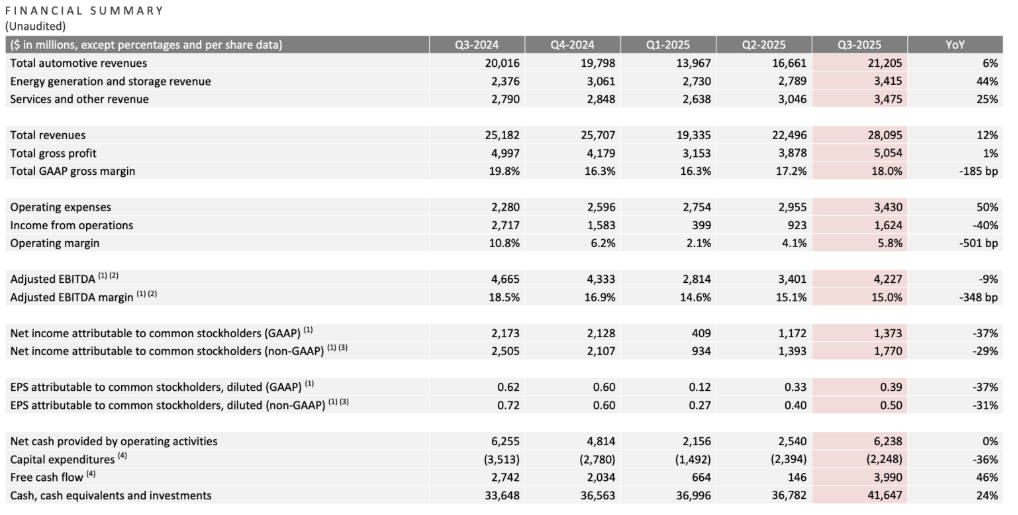

Tesla reported record quarterly revenue and record vehicle deliveries for Q3 2025, yet its profit and margins disappointed the market.

The immediate market response was negative, with shares slipping in after-hours trading and into the next session as investors digested the margin compression and management's warnings about near-term challenges.

Tesla Q3 2025 results: the key numbers that moved its stock price

Below is a concise summary of the principal figures from Tesla's Q3 2025 release and related reporting. These are the most market-sensitive metrics and form the backbone of investor reaction.

| Metric |

Q3 2025 (reported) |

Comment / relevance |

| Revenue |

US$28.1 billion |

Revenue up year-on-year, exceeded forecasts and showed demand resilience.[1] |

| Net profit (reported) |

~US$1.8 billion (down ~29% YoY) |

Profit declined materially and fell short of many analyst expectations, creating immediate concern over margins. |

| Adjusted EPS |

~US$0.50 per share |

Slightly below consensus estimates, contributing to downward pressure on the share price.[2] |

| Vehicle deliveries |

497,099 units |

A quarterly delivery high that demonstrated consumer demand before certain US tax credits expired.[3] |

| Operating margin |

~5.8% |

Operating margin compressed significantly compared with prior periods, a principal driver of investor disappointment. |

Why profits missed and why that matters for Tesla stock price

1. Margin pressure from rising costs.

Management flagged increased expense items, including tariffs and higher import costs, which eroded operating profit. Reports attributed roughly US$400 million of quarterly cost impact to tariffs. This materially reduced the cash flow cushion investors expect from a capital-intensive firm.

2. Regulatory credit revenue decline.

Income from emissions and regulatory credits, a once-important margin contributor, dropped notably year-on-year, removing a tidy margin buffer.

3. Elevated investment in AI and robotics.

Tesla is scaling up investment in data centres and AI infrastructure, including large GPU deployments and chip development, which represent significant near-term capital outlays and R&D spending. Those investments increase short-term costs even if they may be transformative later.

4. Competitive and regional demand softness.

While deliveries were strong in the quarter overall, Tesla has faced continued weakness in some geographies, notably parts of Europe and China in earlier months, which raises concern about sustainability of growth once temporary incentives expire.

Because a company's valuation is sensitive to both growth and margin assumptions, the combination of slower margin recovery and elevated capital intensity makes the stock more vulnerable to downward re-rating.

Investors often pay a premium for growth only if margin expansion or stable cash flows are credible; in this quarter those signals were weaker.

Market reaction and analyst commentary on Tesla stock price

Analyst tone:

Several sell-side and independent analysts emphasised margin risk and revised near-term profit forecasts downwards.

At the same time, some long-term investors reiterated a positive view based on Tesla's leadership in electric powertrain, software and potential AI/robotics monetisation.

Headwinds versus mitigants that will influence Tesla stock price

| Headwinds (negative for stock price) |

Mitigants (positive for stock price) |

| Expiry of certain EV tax incentives and reduced credit tailwinds. |

Record deliveries show residual consumer demand, indicating product desirability. |

| Tariff and import cost hit that compressed margins by an estimated US$400m. |

Large investments in AI, custom chips and robot-related projects could create new, high-margin revenue streams over time. |

| Intensifying competition in China and Europe, where Tesla has shown sales softness. |

Management's stated roadmap for cheaper models and renewed Model Y variants may help sustain volumes. |

| Short-term investor concern over proposed executive compensation and governance questions. |

Strong brand, vertical integration and scale advantages in battery, software and Supercharger networks. |

Investors will weigh whether the mitigants are likely to offset headwinds within their time horizon; for shorter horizons, headwinds may dominate sentiment and hence the stock price.

What analysts and management said about the outlook

1. Management tone:

2. Analyst revisions:

Following the report, many analysts trimmed profit estimates and adjusted target prices to reflect lower near-term margins and higher capex expectations, which tends to put downward pressure on share valuations.

Some analysts, however, kept higher long-term forecasts that assume successful monetisation of Autonomy and Optimus projects.

For the stock price, investor confidence in management's execution timeline for AI/robotics and the capacity to restore margins will be decisive.

If milestones slip or capex increases faster than revenue, downside risk to the share price increases. Conversely, demonstrable progress on high-value initiatives could re-ignite multiple expansion.

Key events and data points to watch next that could move Tesla stock price

Quarterly and monthly delivery updates, which will indicate whether the Q3 demand surge is sustainable.

Progress reports on AI, Optimus and robotaxi pilots and any commercialisation milestones.

Further detail on capital expenditure guidance for 2026 and beyond, especially related to data-centre and chip investments.

Any regulatory or policy changes affecting EV incentives in major markets, chiefly the US, Europe and China.

Analyst note revisions and updates to target prices, which will reflect shifting expectations for margins and capex.

Conclusion

Tesla's recent results present a mixed picture that explains the current uncertainty in its share price. On one hand, record revenue and deliveries demonstrate continued demand.

On the other hand, profit shortfalls, compressed operating margins and heavy near-term investment requirements have reduced the clarity of the company's near-term cash-flow outlook.

Market participants are therefore re-assessing the balance between Tesla's potential as a transformative technology platform and the execution risks inherent in its lofty ambitions.

Frequently Asked Questions

Q1. Why did Tesla's stock price fall?

Tesla's shares declined because, despite record deliveries and revenue growth, net profit and margins came in below expectations. Rising costs, lower regulatory credit income and cautious guidance on near-term challenges caused investors to reassess the company's profitability and its near-term valuation potential.

Q2. What are the main pressures on Tesla's earnings?

Key pressures include higher tariffs and import costs, declining revenue from regulatory and emissions credits, and significant investment in AI, robotics and chip development. These factors have compressed operating margins, increased capital expenditure, and reduced near-term profitability despite strong vehicle delivery numbers.

Q3. Is Tesla still viewed as a growth stock?

Tesla remains a growth stock, but confidence has been tempered. Its valuation depends on successful execution of AI, autonomous driving and robotics projects. Investors weigh potential long-term gains against near-term margin pressure and cost challenges, which have raised questions about the sustainability of rapid profit growth.

Q4. What factors could move Tesla's stock next?

Key factors include future vehicle delivery and revenue numbers, margin recovery, progress on AI and robotics initiatives, and changes in EV incentives or tariffs. These elements directly influence investor confidence, valuation assumptions and the short-to-medium-term price direction of Tesla's shares.

Q5. Is now a good time to buy Tesla shares?

For long-term investors, the current pullback may offer an entry point if they have confidence in Tesla's AI, robotics and autonomous driving roadmap. Short-term traders or cautious investors may consider waiting for clearer margin recovery and more predictable execution before increasing exposure.

Sources:

[1]https://www.ft.com/content/8476bce8-fa5c-4476-bfff-e7cc742a105a

[2]https://www.businessinsider.com/tesla-q3-earnings-report-live-updates-tsla-stock-2025-10

[3]https://www.theverge.com/news/790046/tesla-q3-2025-sales-production-delivery

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.