Nasdaq 100 futures are among the most popular and liquid index futures contracts in the world, offering traders access to the performance of the 100 largest non-financial companies listed on the Nasdaq Stock Exchange.

For new traders, understanding how these futures work, their benefits, and the risks involved is essential to navigating the fast-paced world of index trading.

What Are Nasdaq 100 Futures?

Nasdaq 100 futures are financial contracts that allow traders to speculate on the future value of the Nasdaq 100 Index, which tracks major tech and growth companies like Apple, Microsoft, Amazon, and Tesla. These contracts are traded on the Chicago Mercantile Exchange (CME) Globex platform, nearly 24 hours a day, five days a week.

When you buy or sell a Nasdaq 100 futures contract, you are agreeing to exchange the difference in the index's value between the time you enter the contract and its expiration date. These contracts are cash-settled, meaning there is no physical delivery of stocks—just a settlement of gains or losses.

Key Features of Nasdaq 100 Futures

Leverage: Futures contracts require only a small margin deposit, allowing traders to control a large notional value with relatively little capital.

Liquidity: Nasdaq 100 futures are highly liquid, with billions of dollars in daily trading volume, ensuring tight spreads and efficient execution.

Access: Trade nearly 24 hours a day, enabling you to react to global news and events even outside regular stock market hours.

Short and Long Opportunities: You can profit from both rising and falling markets, as there are no restrictions on short selling futures.

Hedging: Futures can be used to hedge a portfolio of tech stocks or broader market exposure.

Types of Nasdaq 100 Futures Contracts

E-mini Nasdaq 100 Futures (NQ): The most popular contract, with a tick size of 0.25 index points ($5 per tick) and relatively low margin requirements, making it accessible for active traders and day traders.

Standard Nasdaq 100 Futures (ND): Larger contract size, less commonly traded by individuals due to higher margin requirements.

Micro E-mini Nasdaq 100 Futures: Even smaller contract size, ideal for those wanting to trade with less capital or manage risk more precisely.

How Do Nasdaq 100 Futures Work?

1. Opening a Position:

You buy (go long) if you expect the index to rise, or sell (go short) if you expect it to fall.

2. Margin Requirements:

You only need to post a fraction of the contract's value as margin, but both gains and losses are magnified.

3. Mark-to-Market:

Profits and losses are settled daily, with your account credited or debited based on the index's movement.

4. Expiration and Settlement:

Contracts expire quarterly (March, June, September, December). Most traders close or roll over their positions before expiry.

Why Trade Nasdaq 100 Futures?

Speculation: Take advantage of price movements in the tech-heavy Nasdaq 100, whether the market is rising or falling.

Diversification: Gain exposure to a basket of leading US and international companies in one contract.

Hedging: Protect your stock portfolio from downside risk by taking an offsetting futures position.

Arbitrage: Exploit price discrepancies between futures and the underlying index or related ETFs.

Strategies for New Traders

1. Trend Following:

Identify the prevailing market trend and trade in its direction using moving averages or momentum indicators.

Watch for the index to break above resistance or below support and enter trades to capture sharp moves.

3. Range Trading:

If the market is moving sideways, buy at support and sell at resistance, aiming to profit from oscillations within a defined range.

4. Hedging:

If you hold a portfolio of Nasdaq stocks, you can hedge against potential losses during market downturns by selling Nasdaq 100 futures.

Key Considerations and Risks

Leverage Magnifies Risk: While leverage can boost profits, it also increases potential losses. Always use stop-loss orders and manage your position size carefully.

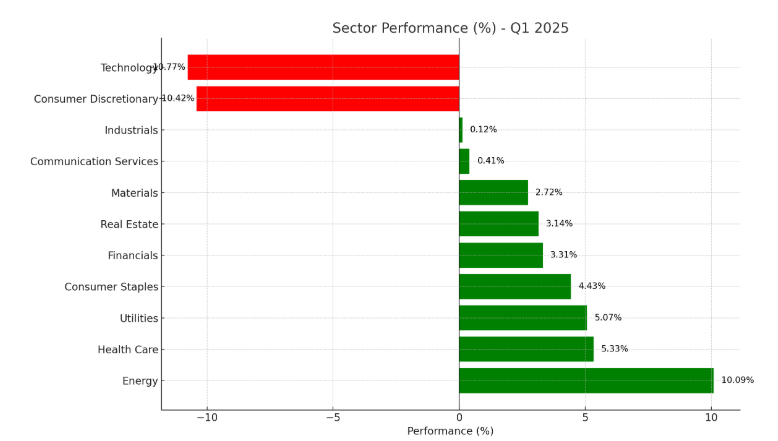

Market Volatility: Tech stocks can be volatile, leading to rapid and large moves in Nasdaq 100 futures prices.

Margin Calls: If your position moves against you, you may be required to deposit additional funds to maintain your trade.

Overnight Risk: Because futures trade almost 24 hours, news and events outside regular hours can trigger sharp price moves.

Practical Steps to Get Started

1. Educate Yourself:

Learn the basics of futures trading, contract specifications, and margin requirements.

2. Choose a Broker:

Select a reputable broker that offers access to CME Globex and provides risk management tools.

Define your goals, risk tolerance, and preferred strategies before entering the market.

Practise trading with virtual funds to build your skills without risking real capital.

Conclusion

Nasdaq 100 futures provide new traders with a flexible, efficient way to access the performance of the world's leading technology and growth companies.

By understanding how these contracts work, the benefits and risks involved, and the strategies available, traders can make informed decisions and take advantage of opportunities in this dynamic market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.