Guatemala, Central America’s largest economy by GDP, runs on a currency that has quietly become one of the region’s steadier macro anchors.

For forex traders and investors scanning emerging-market risk in 2026, the Guatemalan quetzal matters because it sits at the intersection of powerful remittance inflows, conservative central banking, and a managed exchange-rate regime that tends to dampen volatility.

This guide explains Guatemala's currency, how it has performed through early 2026, and its position in today’s forex landscape. With inflation still subdued and policy rates easing, the quetzal’s path now depends less on cyclical price pressures and more on external dollar flows, trade dynamics, and shifts in global risk sentiment.

What Is the Currency of Guatemala?

The official currency of Guatemala is the Guatemalan Quetzal, symbolized as Q and designated with the ISO code GTQ. The currency is named after the quetzal bird, Guatemala's national bird and a symbol of liberty and cultural heritage.

1 Quetzal is subdivided into 100 centavos, and GTQ banknotes are issued in denominations ranging from 1 to 200, while coins include 1, 5, 10, 25, and 50 centavos and 1 Quetzal.

The Guatemalan Quetzal has been in circulation since 1925, replacing the peso, and is managed by the Bank of Guatemala (Banco de Guatemala).

Historical Context: Quetzal's Journey in Currency Markets

Initially, the Quetzal was backed by gold reserves, making it one of the most stable currencies in Central America for much of the 20th century. However, the gold standard was eventually abandoned, and the currency began to float more freely, albeit under heavy regulation by Guatemala's central bank.

Historically, the Quetzal has maintained moderate stability compared to other Latin American currencies, partly due to conservative fiscal policy, tight monetary controls, and a relatively balanced trade environment.

From the early 2000s to the 2020s, the Quetzal experienced slow, controlled depreciation versus the U.S. dollar (USD), but it remained less volatile than many of its neighbors' currencies.

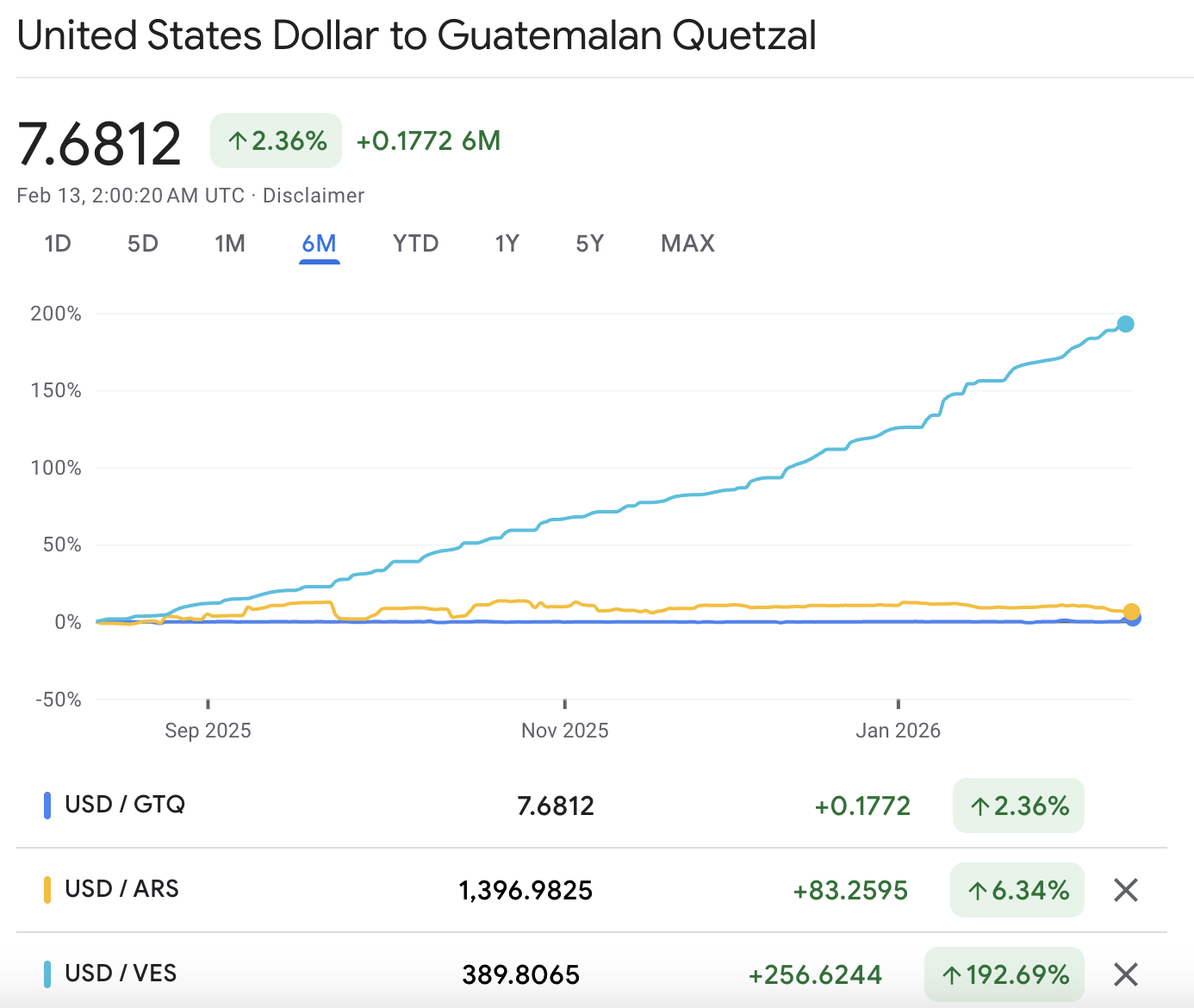

The Exchange Rate in 2026: How Is GTQ Performing?

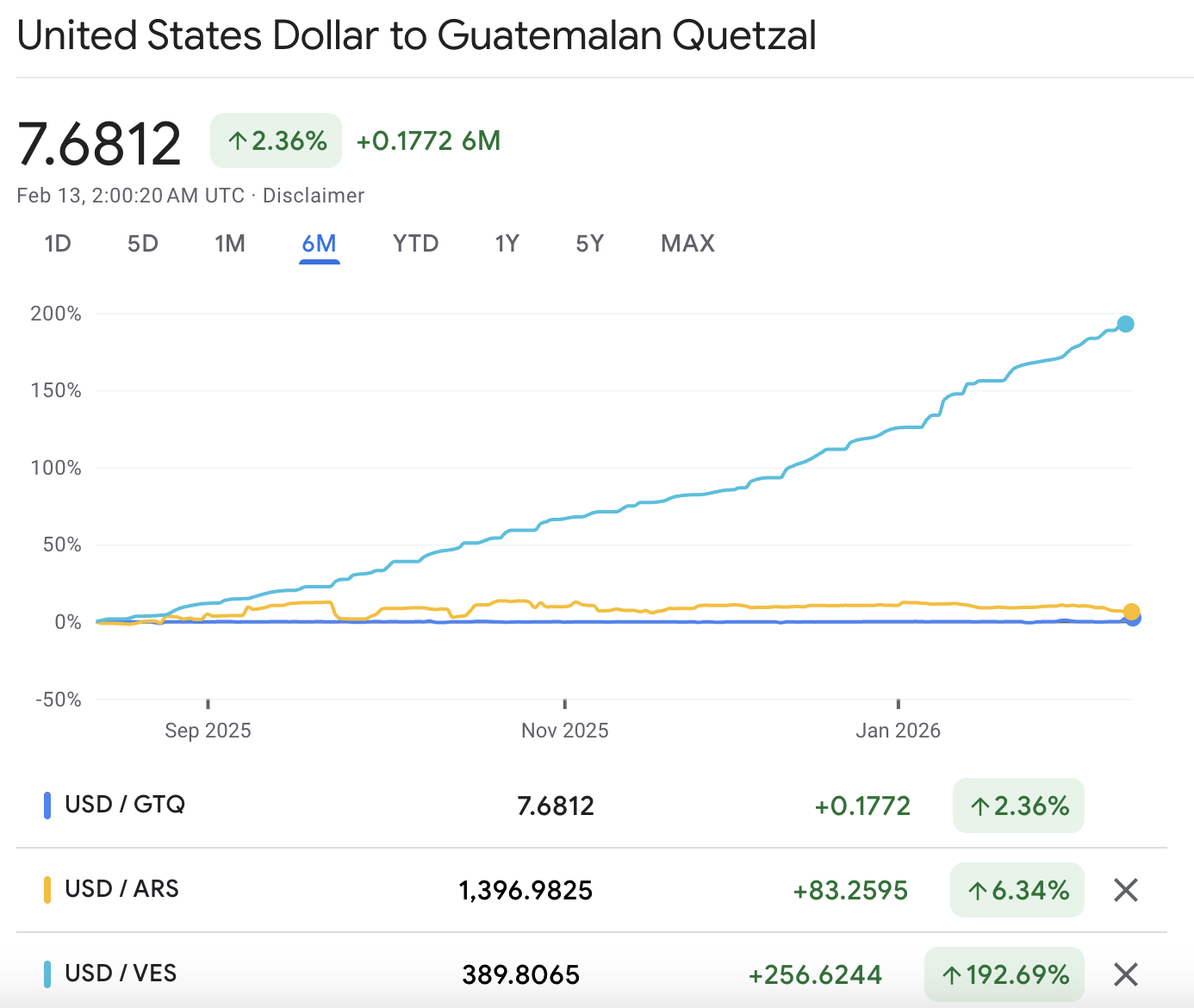

As of early February 2026, Guatemala’s official reference exchange rate is around Q7.67 per U.S. dollar, reflecting a continuation of the quetzal’s narrow trading ranges rather than a directional trend.

Over the last six months, USD/GTQ has typically traded in a relatively tight band, with reported highs around the low Q7.7S and lows in the mid Q7.5S, underscoring the currency’s lower-volatility profile among Latin American exotics.

Snapshot of GTQ-relevant macro conditions (latest available):

| Indicator |

Latest reading |

Why it matters for GTQ |

| USD/GTQ reference rate |

7.66721 (Feb 2026) |

Anchor for spot expectations and local pricing |

| Inflation (YoY) |

1.65% (Dec 2025) |

Low inflation reduces depreciation pressure |

| Policy interest rate |

3.75% (Jan 2026) |

Shapes carry appeal and credit conditions |

| Remittances (% of GDP) |

19.1% (2024) |

Structural USD inflow supports FX stability |

| GDP growth |

3.7% (2024) |

Stable growth supports confidence and inflows |

| GDP (current US$) |

$113.2B (2024) |

Scale matters for liquidity and resilience |

Key reasons for GTQ’s relative stability into 2026 include:

Persistent remittance inflows (a structural FX support)

Contained inflation versus many regional peers

Active monetary and FX management that smooths short-term volatility

Ongoing demand for Guatemalan exports such as coffee, sugar, and bananas

While the GTQ has not been a high-beta appreciation story, it has avoided the disorderly moves that often define smaller emerging-market currencies during global risk-off episodes.

Factors Affecting GTQ Value in the Forex Market

1) Remittances from Abroad

Remittances account for over 18% of Guatemala's GDP. Inflows of U.S. dollars from Guatemalan workers in the U.S. increase demand for the local currency, supporting its value.

2) Trade Balance

Guatemala's economy depends heavily on exports. Global demand for agricultural commodities and manufactured goods has a direct effect on currency stability. A strong trade balance boosts demand for GTQ.

3) U.S. Dollar Strength

Since the Quetzal is often traded against the U.S. dollar, shifts in U.S. interest rates, inflation, or economic performance directly affect the GTQ/USD exchange rate.

4) Political Stability

Investor confidence and capital flows are sensitive to political events. While Guatemala has remained relatively stable, electoral uncertainty or corruption scandals can quickly lead to capital flight and currency depreciation.

5) Central Bank Policy

The policy rate has eased to 3.75% (latest reported as of January 2026), and the central bank’s broader framework continues to prioritize inflation control and orderly market functioning. For FX markets, the signal is clear: GTQ is managed for stability rather than used as a shock absorber.

GTQ vs Other Latin American Currencies

Compared to more volatile currencies like the Argentine Peso or Venezuelan Bolívar, the Guatemalan Quetzal has been one of the more stable options in Latin America. It has even outperformed currencies from larger economies like Colombia or Chile during inflation-heavy cycles.

In terms of forex trading, GTQ:

Has lower volatility than most regional peers

Experiences tighter spreads but lower liquidity

Offers modest opportunities for long-term carry trades

Because of this, GTQ is not a primary currency pair in global forex markets but can be of interest to traders looking for emerging market exposure with slightly lower risk.

Is the Quetzal a Tradable Currency in Forex Markets?

The Guatemalan Quetzal is classified as an exotic currency, meaning it is not commonly traded like major pairs (e.g., EUR/USD or USD/JPY) or minors (e.g., GBP/CAD).

GTQ is typically only available on platforms or brokers that support exotic or emerging market currencies. Spreads are wider and liquidity is lower, making day trading or scalping less efficient.

However, GTQ trading may appeal to:

Long-term position traders

Carry traders (seeking interest differentials)

Fundamental analysts following Central America's economy

Forex traders often pair GTQ with USD in the USD/GTQ pair. This allows them to bet on macro trends between the Guatemalan and U.S. economies.

Forex Trading Strategies Involving GTQ

1) Carry Trading

Guatemala’s rates have moderated, with the policy rate reported at 3.75% in early 2026. That means carry opportunities exist, but they are less about “high yield” and more about relative stability plus incremental rate differentials versus funding currencies.

This works best in a low-volatility environment with stable policy expectations.

2) Long-Term Macro Trends

Traders can analyze macroeconomic reports such as inflation, remittance momentum, GDP trends, and central bank signals to frame the GTQ direction. With inflation reported at 1.65% in December 2025, the macro debate is now more about the durability of external USD flows than about domestic overheating.

3) Remittance-Driven Seasonal Patterns

GTQ tends to strengthen during certain months, particularly when remittances increase (e.g., during U.S. tax refunds or holidays). Traders can look for seasonal opportunities tied to these inflows.

4) Hedging Exposure to Guatemala

Investors or import-export businesses dealing with Guatemala may hedge GTQ exposure by trading forward contracts or options where available through specialized brokers.

Is the Quetzal Safe for Investment or Saving?

For Guatemalans, the GTQ is considered a relatively safe currency for savings, especially with interest-bearing accounts offering decent returns. However, due to its limited convertibility and low international demand, foreign investors may not view GTQ-denominated assets as highly liquid.

Some investors in Guatemala prefer to hold U.S. dollars for capital preservation, especially during global economic stress, though the Quetzal's stability has prevented widespread dollarization unlike other Latin countries.

For long-term forex investors, the Quetzal offers a moderately stable emerging market currency with potential for diversification.

Final Thoughts

The Guatemalan quetzal remains a stability-first currency in early 2026. A reference rate near Q7.67 per U.S. dollar, subdued inflation, and large remittance inflows continue to anchor expectations and reduce the probability of disorderly spot moves.

For forex traders, GTQ is rarely a high-frequency instrument, but it can work in longer-horizon macro views or practical hedging, especially when the goal is controlled emerging-market exposure rather than maximum volatility.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.