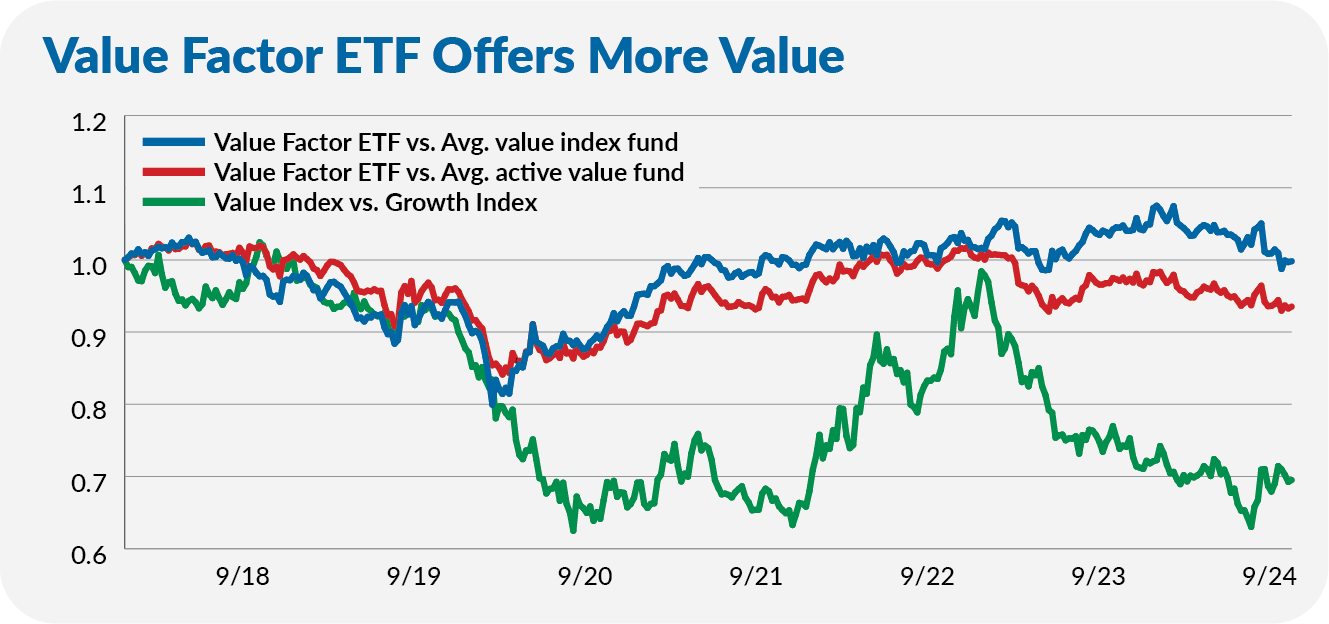

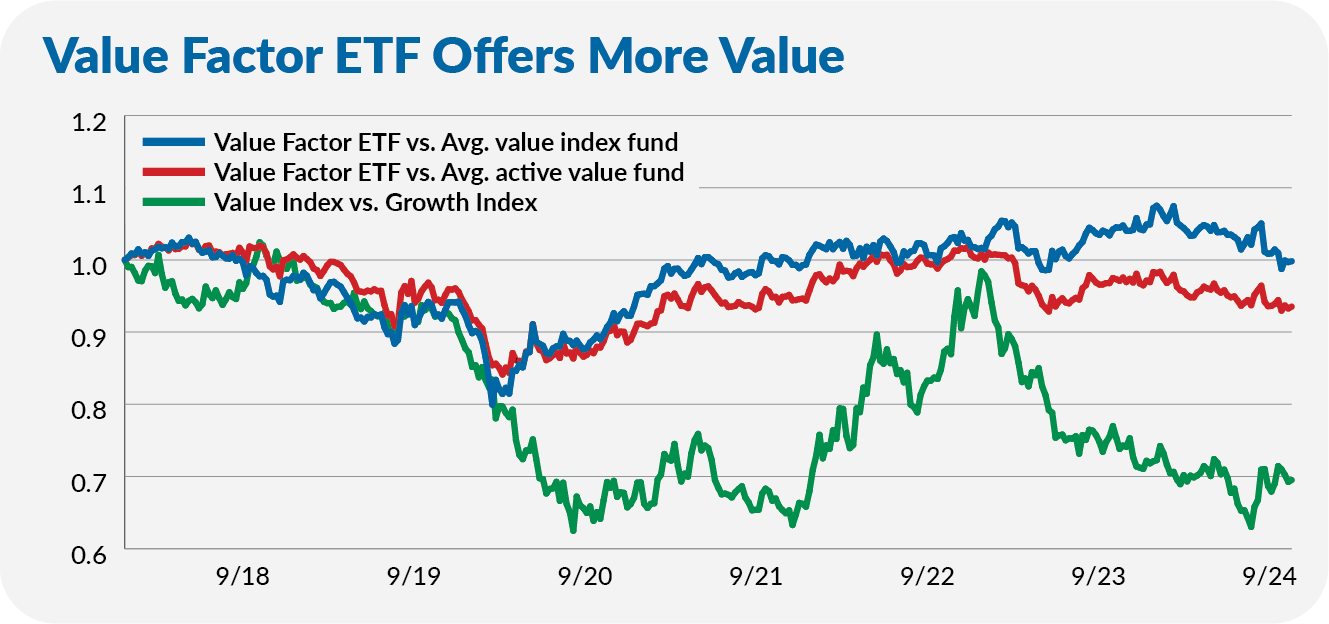

Value investing, buying companies trading below their intrinsic worth, has regained attention in recent years. Historically, value outperformed dramatic growth stocks over long periods; since 1926, dollar value stocks grew to $131,534, compared with $11,744 for growth stocks.

While growth led in the late 2010s and early 2020s, 2022 and 2023 saw renewed strength in value, signalling an opportune moment for investors focused on dividends, stability, and reasonable multiples.

This guide presents 9 of the best value-oriented ETFs for 2025, analysing their holdings, fees, performance, and role in a long-term portfolio.

9 Best Value ETFs to Buy in 2025

1. Vanguard Value ETF (VTV)

Summary: Tracks CRSP U.S. Large Cap Value Index

One of the largest and most popular value ETFs, VTV offers broad exposure to U.S. large-cap value stocks with an ultra-low expense ratio of 0.04%, making it a cost-efficient choice for long-term investors seeking stable dividend payers and strong fundamentals.

2. iShares Russell 1000 Value ETF (IWD)

Summary: Covers large- and mid‑cap U.S. value stocks via Russell 1000 Value

5‑Year Return: +12.12%

Expense Ratio: 0.19%

AUM: ~$61 billion

Dividend Yield: ~1.86%

Tracking the Russell 1000 Value Index, IWD provides diversified exposure to established U.S. companies with strong earnings potential and reasonable valuations. It's ideal for investors aiming to balance growth with reduced volatility.

3. Vanguard Small‑Cap Value ETF (VBR)

Summary: Tracks CRSP U.S. Small Cap Value Index

5‑Year Return: +13.64%

Expense Ratio: 0.07%

AUM: ~$52 billion

Dividend Yield: ~2.23%

The VBR offers focused exposure to undervalued small U.S. companies, blending the potent growth potential of small caps with value-driven stability; it's an ideal choice for investors seeking higher long-term returns through economically cyclical sectors.

4. Vanguard Mid‑Cap Value ETF (VOE)

Summary: Tracks CRSP U.S. Mid‑Cap Value Index

5‑Year Return: +12.63%

Expense Ratio: 0.07%

AUM: ~$29 billion

Dividend Yield: ~2.31%

The VOE offers a balanced mix of stability and upside by targeting mid-sized firms trading below their intrinsic value, an attractive sweet spot for investors wanting growth with less volatility than small‑caps

5. Fidelity High Dividend ETF (FDVV)

Summary: Focuses on dividend growers in large- and mid-cap U.S. stocks

5‑Year Return: +16.61%

Expense Ratio: 0.16%

AUM: ~$5.3 billion

Dividend Yield: ~3.02%

The Fidelity High Dividend ETF (FDVV) combines value characteristics with a strong income component by concentrating on established dividend growers, delivering a compelling total return through regular yield and capital appreciation.

6. SPDR Russell 1000 Yield Focus ETF (ONEY)

Summary: Targets high-yielding Russell 1000 Value stocks

5‑Year Return: +15.48%

Expense Ratio: 0.20%

AUM: $832 million

Dividend Yield: ~3.23%

The SPDR Russell 1000 Yield Focus ETF (ONEY) is designed for income-oriented investors; it prioritises high-yielding stocks within the Russell 1000 Value Index. It offers robust dividend income and potential for capital growth, making it a valuable foundation for long-term portfolios seeking yield and value.

7. Capital Group Dividend Value ETF (CGDV)

Summary: Actively managed by Capital Group, focusing on dividend-paying undervalued stocks

1‑Year Return: NAV: +14.91%

Market Price: +14.77% (as of May 31, 2025)

Expense Ratio: 0.33%

AUM: Approximately $17.65 billion as of June 9, 2025

Dividend Yield: 30‑day SEC yield: 1.73%

Trailing–12‑month yield: 1.49%

Combining dividend strength with value investing, CGDV selects high-quality stocks with rising income potential. It's actively managed, offering flexibility to adapt to market changes while maintaining a value bias.

8. Invesco RAFI US 1000 ETF (PRF)

Summary: Weights stocks by fundamental factors—book value, cash flow, sales, dividends

1‑Year Return (as of Mar 31, 2025): NAV: +6.89%, Market: +6.98%

Expense Ratio: 0.33%

AUM: About $7.78 billion (nearly $7.7 billion reported)

Dividend Yield: SEC 30-day yield: 1.88%

Using fundamental weighting instead of traditional market cap, PRF offers exposure to high-quality value stocks that rank well on key financial metrics. It appeals to investors who want a rules-based, quantitative approach.

9. Dimensional International Value ETF (DFIV)

Summary: International small- and mid-cap value stock exposure

1‑Year Total Return: +20.8%

Expense Ratio: 0.27%

AUM: Approximately $11.76 billion

Dividend Yield: Yield around 3.56%–3.89%

Providing international diversification, DFIV focuses on value stocks outside the U.S. Its strong 2025 performance and high dividend yield make it ideal for those seeking global exposure with a value tilt.

Why These ETFs Shine in 2025

1) Low Fees and Scale: Vanguard products such as VTV, VBR, and VOE maintain expense ratios ≤ 0.07%, attracting long-term investors.

2) Dividend and Yield Profiles: FDVV, ONY, and CGDV offer 2.3–3.2% yields, boosting total returns amid uncertain markets.

3) Diversified and Fundamental Bias: PRF and DFIV employ factor-driven strategies, capturing systematic value premiums.

4) Global Reach: DFIV adds international value exposure—helping hedge U.S.-specific risks.

Tips on Building a Value Core Portfolio

An example allocation could be:

40% VTV (large-cap value)

20% VOE (mid-cap value)

15% VBR (small-cap value)

10% FDVV (dividend growth)

10% PRF (fundamental value)

5% DFIV (global value)

This combines size diversification, yield potential, and geographic exposure in a full-value stance.

Conclusion

In conclusion, 2025 offers an appealing environment for value ETFs. As growth stocks mature, undervalued names offer both return and resilience.

By selecting funds such as VTV, FDVV, PRF, and others highlighted above, investors can construct a cost-effective, diversified, and income-generating portfolio destined for long-term growth.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.