The Nasdaq 100 ETF is a staple for traders and investors seeking exposure to the world's most innovative and fastest-growing companies. In 2025, these ETFs remain at the forefront of global markets, offering a blend of technology, consumer, and healthcare giants within a single, highly liquid product.

Whether you're an active trader or a long-term investor, understanding how these ETFs work and what sets them apart is crucial. Here are 10 essential facts every trader should know about the Nasdaq 100 ETF.

10 Facts About Nasdaq 100 ETF Trader's Should Know

1. The Nasdaq 100 ETF Tracks the Top 100 Non-Financials

The Nasdaq 100 ETF is designed to replicate the performance of the Nasdaq 100 Index, which includes the 100 largest non-financial companies listed on the Nasdaq Stock Exchange.

This means you gain exposure to a diverse mix of sectors, but with a strong emphasis on technology, consumer discretionary, healthcare, and industrial leaders. Financial stocks are deliberately excluded, making the index more growth-oriented.

2. Technology Dominates the Index

As of mid-2025, technology companies make up over 50% of the Nasdaq 100 Index. The largest holdings include Nvidia (9.19%), Microsoft (8.80%), Apple (7.17%), Amazon (5.66%), and Broadcom (5.00%).

This tech-heavy focus is a key driver of the ETF's long-term growth and also its volatility, as the sector can experience rapid swings based on innovation cycles and market sentiment.

3. Strong Long-Term Performance

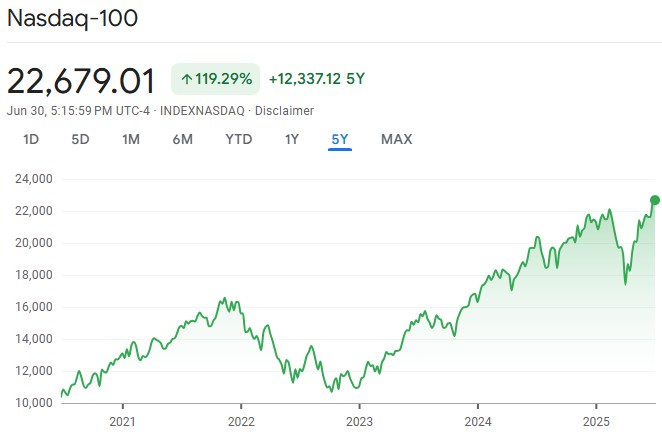

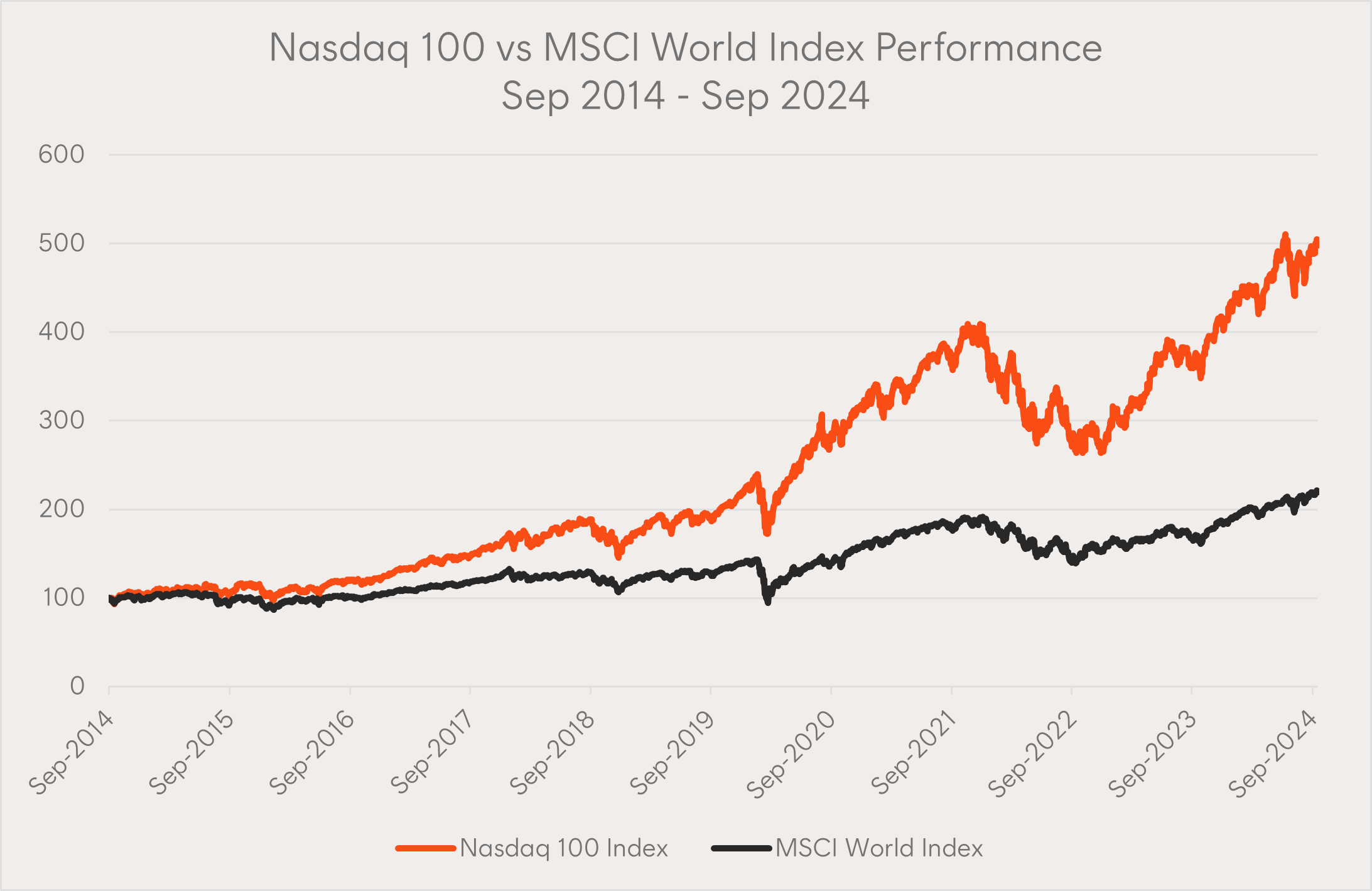

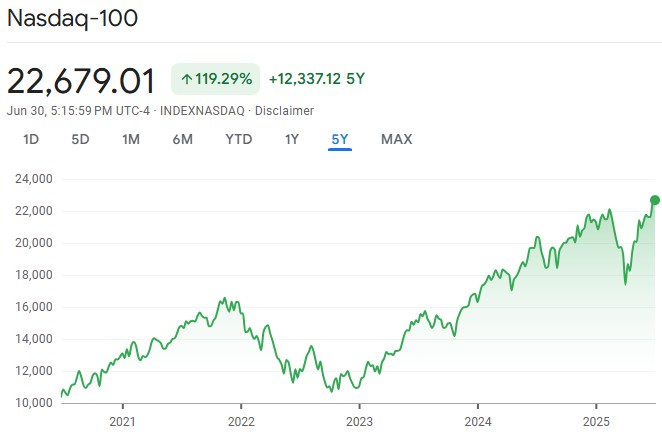

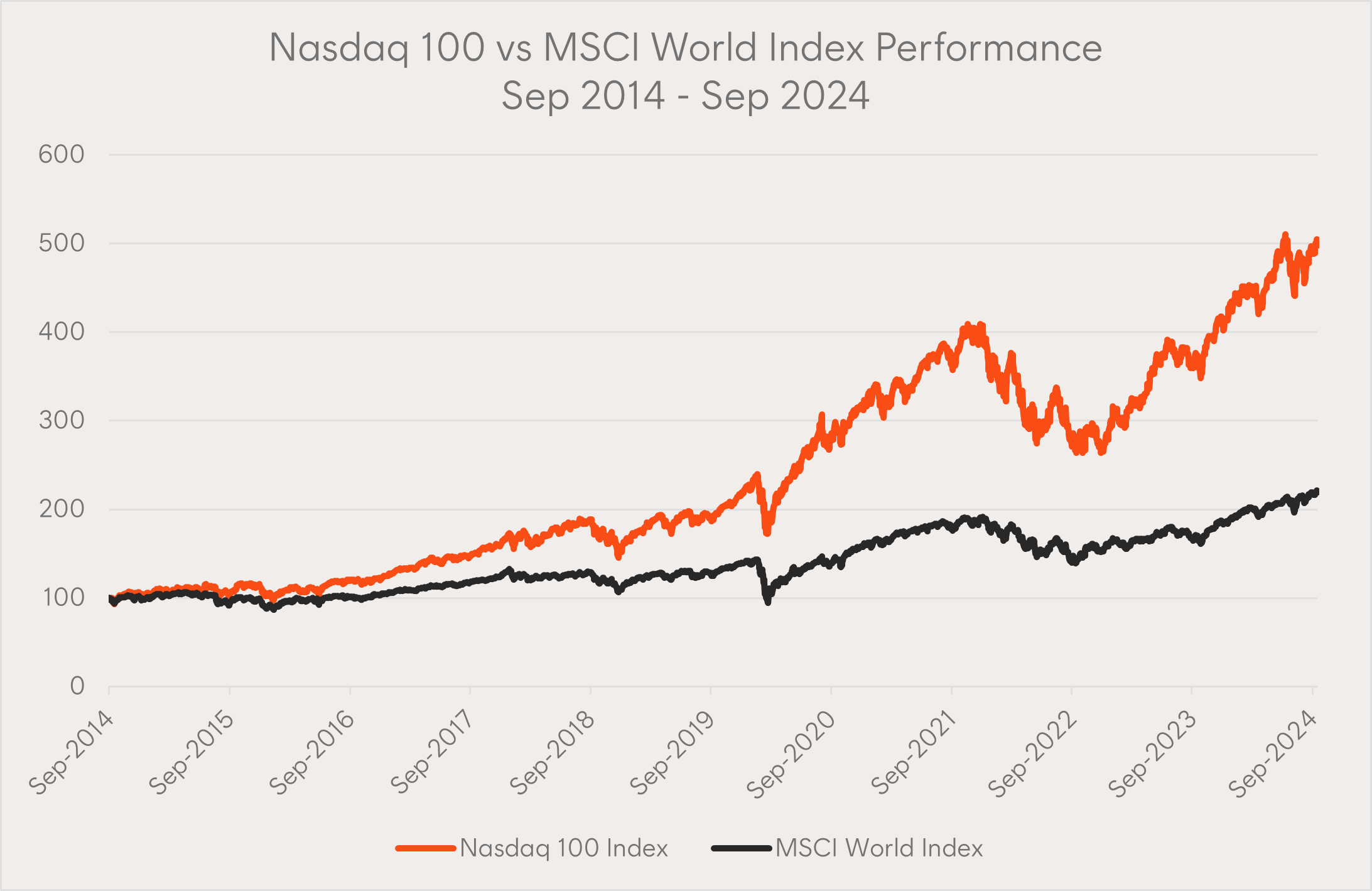

The Nasdaq 100 Index has delivered a stellar 13.92% annualised return since its inception in 1985, and approximately 18% per year over the last decade.

This outpaces most other major indices, including the S&P 500 and Dow Jones, making the Nasdaq 100 ETF a preferred choice for growth-focused traders and investors who can tolerate higher volatility.

4. Multiple ETF Choices

There are several Nasdaq 100 ETFs available to global investors. The most widely traded are the Invesco QQQ Trust (QQQ), Invesco Nasdaq 100 ETF (QQQM), and iShares Nasdaq 100 UCITS ETF (CNDX) for European investors.

All these funds track the same index but may differ in expense ratios, liquidity, and distribution policies. Traders should compare these factors before choosing the right ETF for their needs.

5. Quarterly Rebalancing and Annual Reconstitution

To ensure the ETF accurately reflects the latest market trends, the Nasdaq 100 Index is rebalanced every quarter and reconstituted annually. This process adjusts the weights of the underlying companies and introduces new entrants that meet the index's criteria.

For traders, this means the ETF remains aligned with the most current and liquid non-financial stocks on the Nasdaq.

6. Dividend Payments

Despite its growth focus, the Nasdaq 100 ETF pays dividends, usually on a quarterly basis. For example, QQQM distributed around $0.31 per share each quarter in 2024–2025.

Dividend yields are typically modest (around 0.5%–0.7%), as most constituent companies reinvest profits into growth rather than paying high dividends. However, these payments can provide a small but steady income stream for investors.

7. High Liquidity and Tight Spreads

Nasdaq 100 ETFs are among the most liquid ETFs globally, with millions of shares traded daily and tight bid-ask spreads. This makes them ideal for both short-term traders who require fast execution and long-term investors who value cost efficiency. High liquidity also means lower trading costs and easier entry and exit, even with large orders.

8. Volatility Can Be Higher Than Broader Indices

Because of its concentration in technology and growth stocks, the Nasdaq 100 ETF can be more volatile than broader market ETFs like those tracking the S&P 500.

While this volatility can present opportunities for active traders, it also means larger price swings during market corrections or tech sector downturns. Risk management is essential when trading this ETF.

9. Global Reach and Currency Considerations

Many Nasdaq 100 ETFs, such as the iShares Nasdaq 100 UCITS ETF, are available to international investors and may be denominated in currencies other than USD. This introduces an additional layer of currency risk or opportunity, depending on your home currency. Traders outside the US should factor in exchange rates and potential currency hedging strategies.

10. Accessible for All Types of Traders

Most major brokers offer access to Nasdaq 100 ETFs with low minimum investments, and commission-free trading is widely available. This accessibility makes the ETF suitable for a wide range of traders, from those making regular small investments to institutional players executing large trades.

Conclusion

The Nasdaq 100 ETF stands out as a powerful tool for traders and investors seeking growth, liquidity, and exposure to the world's top technology and innovation leaders. Its strong historical returns, high liquidity, and focus on market-leading companies make it a compelling choice for those comfortable with higher volatility and a tech-heavy portfolio.

As always, review each ETF's structure, fees, and holdings to ensure it aligns with your trading strategy and risk tolerance. By understanding these 10 key facts, traders can make more informed decisions and better capitalise on opportunities in the dynamic Nasdaq 100 space.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.