Exchange-traded funds, or ETFs, are now among the fastest-growing investment choices worldwide. They combine the simplicity of stock trading with the diversification of mutual funds, allowing investors to gain exposure to entire markets, sectors, or themes in a single trade.

Their flexibility and accessibility make them appealing for both long-term investors and active traders.

What Is An ETF?

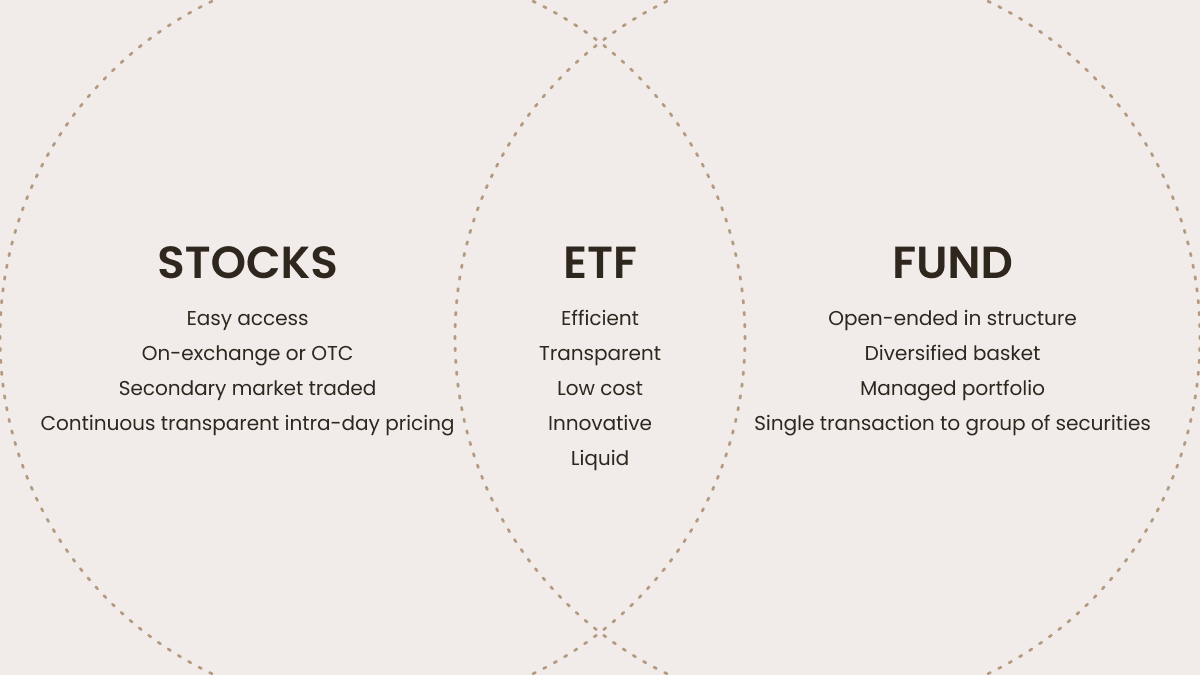

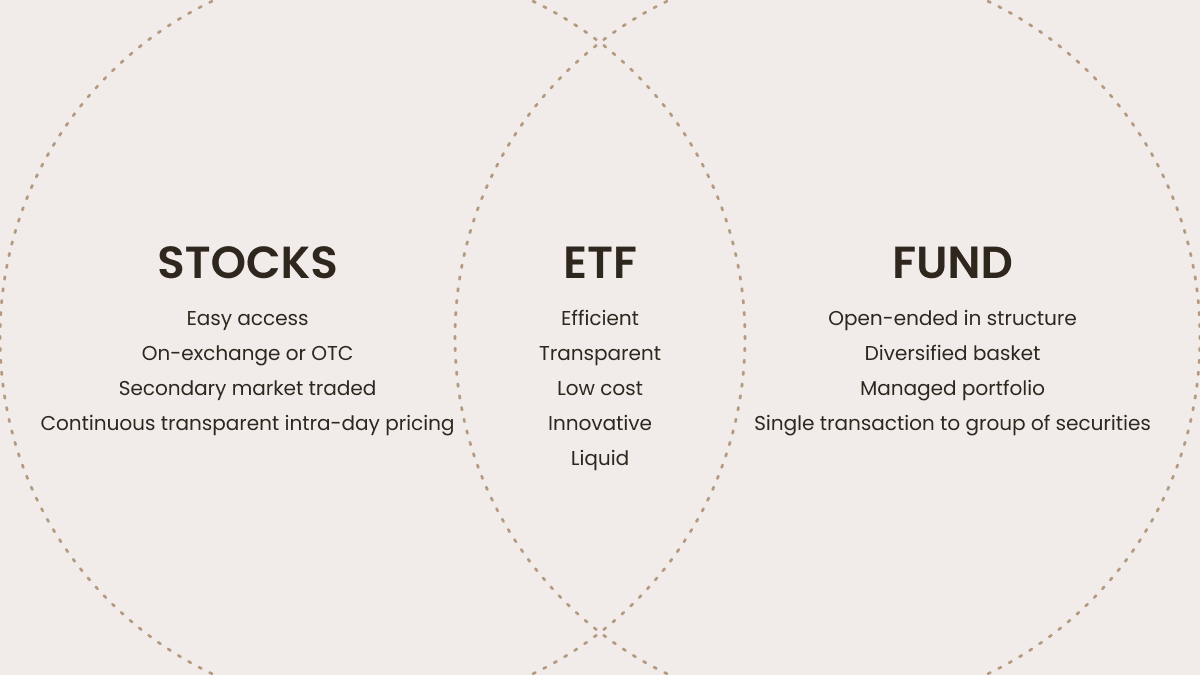

ETF stands for exchange-traded fund. It is an investment vehicle that pools money from multiple investors to buy a basket of assets such as stocks, bonds, or commodities. Each share of an ETF represents a proportional interest in that basket.

Because ETFs are listed on stock exchanges, they can be bought and sold throughout the trading day at market prices, offering liquidity and transparency.

This structure gives investors an efficient way to diversify their holdings without managing individual securities.

How Does An ETF Work?

Once you understand what an ETF is, it helps to look at how these funds operate behind the scenes.

An ETF works by tracking the performance of an underlying index, sector, or group of assets.

For example, an S&P 500 ETF mirrors the movements of the S&P 500 Index by holding the same stocks in the same proportions.

When the index rises or falls, the ETF’s price moves accordingly.

For investors, the experience is straightforward. You can buy and sell ETF shares through a brokerage account, just like regular stocks.

This gives you instant diversification, flexible trading options, and exposure to different markets or investment themes without the complexity of managing multiple securities.

Types Of ETFs

ETFs come in multiple categories, each designed to meet specific portfolio objectives and risk profiles. Understanding these distinctions helps investors allocate efficiently across asset classes.

| ETF Type |

Description |

Key Use / Advantage |

| Stock ETFs |

Track major equity indexes or specific sectors. |

Diversified stock exposure; ideal for core equity holdings. |

| Bond ETFs |

Invest in government, corporate, or municipal bonds. |

Provide steady income and portfolio stability. |

| Commodity ETFs |

Mirror prices of assets like gold, oil, or agricultural goods. |

Hedge against inflation; diversify beyond equities. |

| Sector & Industry ETFs |

Target industries such as technology, healthcare, or energy. |

Enable focused exposure to growth or cyclical sectors. |

| International & Global ETFs |

Cover markets outside the investor’s home country. |

Offer global diversification and reduce domestic risk. |

| Thematic & Smart Beta ETFs |

Follow specific factors or themes such as AI, clean energy, or low volatility. |

Combine passive investing with strategic, rule-based exposure. |

Each ETF type serves a different role in a portfolio. The right mix depends on your investment horizon, risk tolerance, and market outlook.

Benefits and Risks of ETFs

While ETFs offer accessibility and efficiency, investors should weigh their advantages against potential drawbacks before investing.

| Benefits |

Risks / Limitations |

| Easy diversification across asset classes and regions. |

Market volatility can still impact returns. |

| Lower costs compared with mutual funds. |

Some niche or leveraged ETFs carry higher risk. |

| Liquidity, it can be traded throughout the day. |

Prices may deviate slightly from net asset value (NAV). |

| Transparent holdings allow better risk assessment. |

Performance depends on underlying index or asset quality. |

ETFs are powerful tools when used strategically, but understanding both their structure and potential pitfalls is key to long-term success.

How to Choose the Right ETF

Choosing an ETF isn’t about finding the flashiest name on the market. It’s about matching the fund to your investment goals and risk tolerance.

Start by looking at its objective and benchmark such as what index or theme does it actually track? That ensures you know what exposure you’re buying.

Next, check the expense ratio, which is the annual cost of owning the ETF. Even a small difference, like 0.10%, compounds significantly over time. Liquidity and trading volume also matter; the more active the ETF, the easier it is to buy or sell without big price gaps.

A well-managed ETF should have a low tracking error, meaning it closely follows its benchmark’s performance.

Finally, consider the issuer’s reputation of established providers like iShares, Vanguard, or State Street often come with better fund governance and stability.

In short, a good ETF:

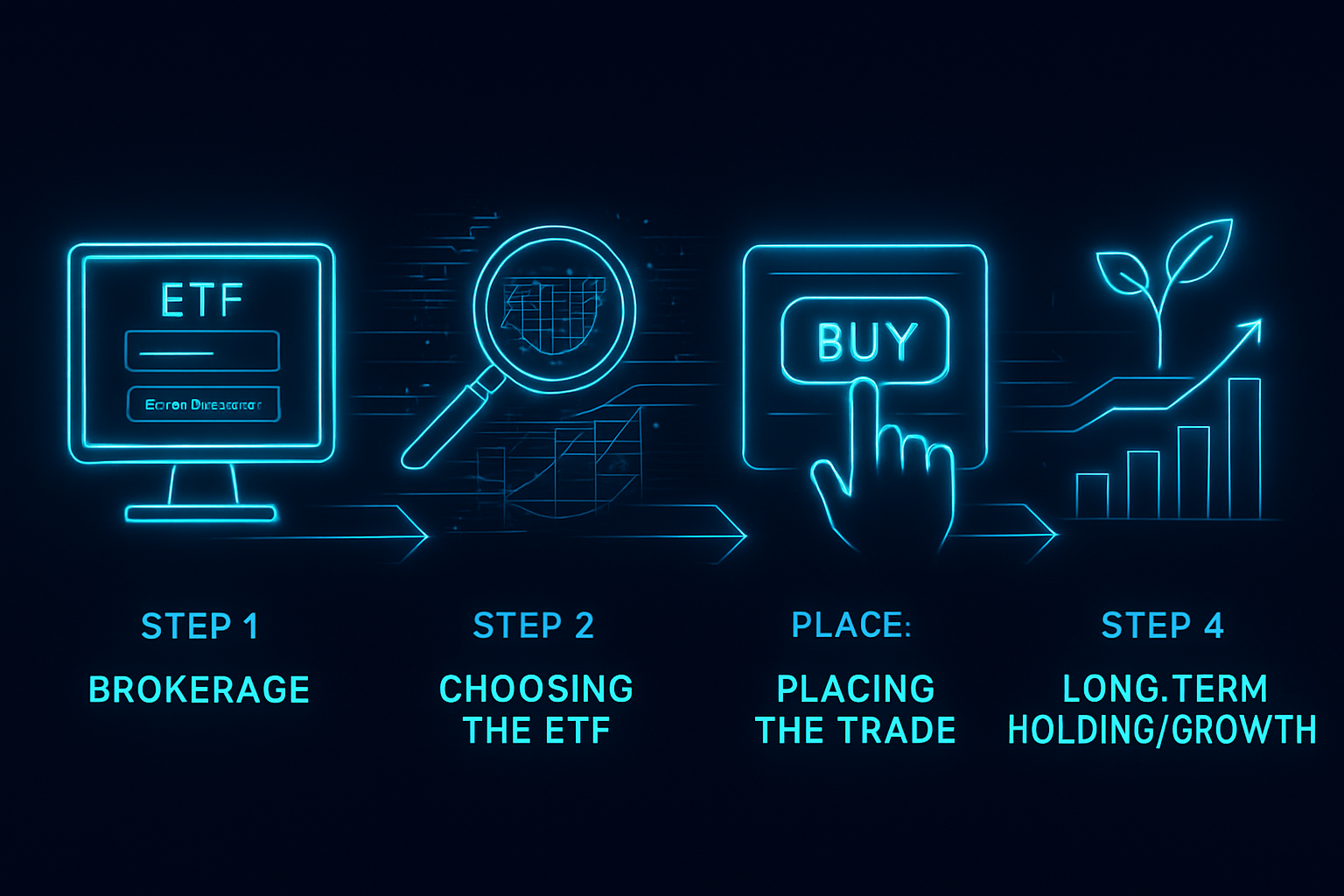

How to Invest in ETFs

ETFs offer investors a straightforward, low-cost way to build diversified portfolios without needing to pick individual stocks. Their simplicity and flexibility make them one of the easiest entry points into investing.

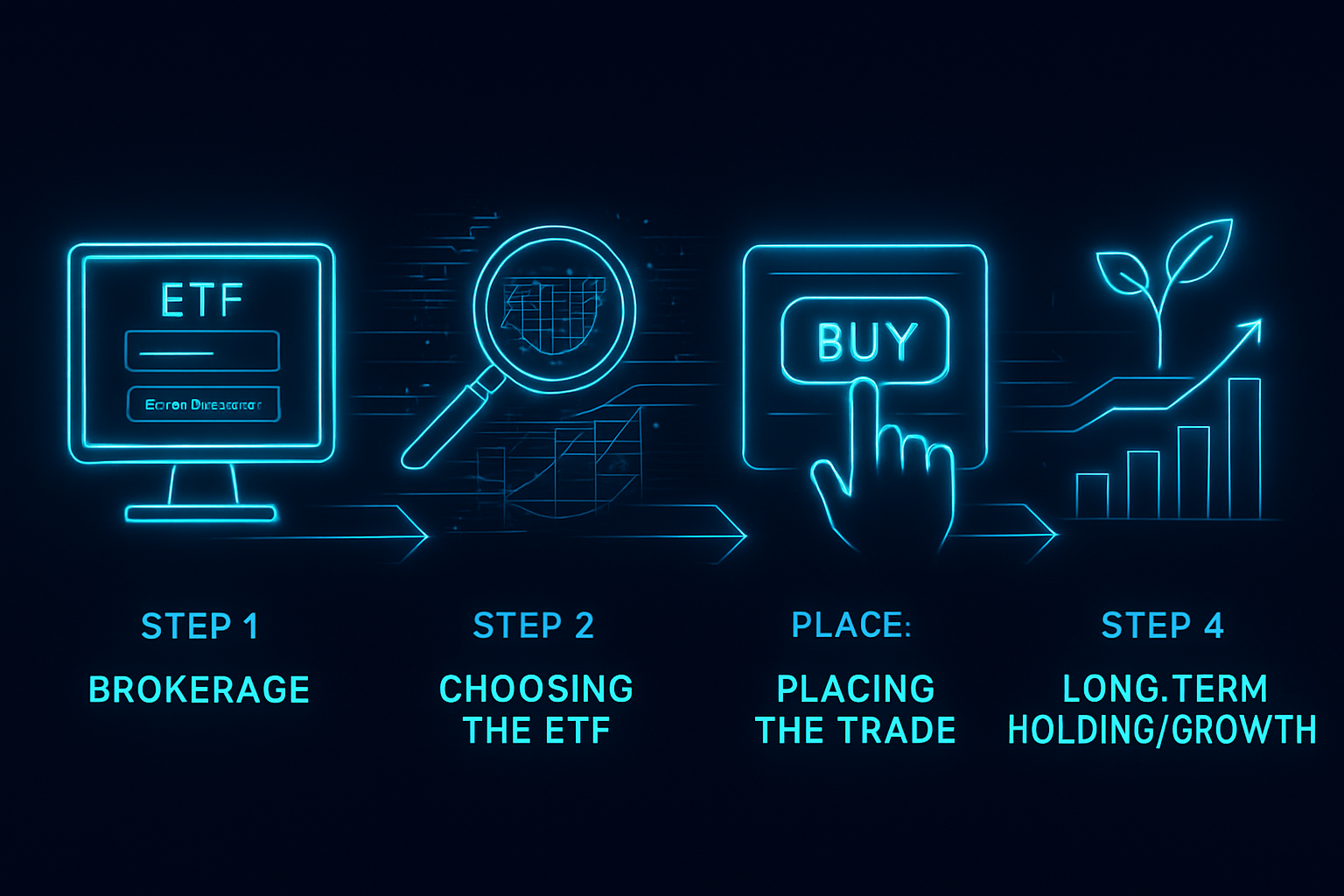

1. Open a Brokerage Account

Choose a regulated brokerage platform such as Fidelity, Interactive Brokers, TD Ameritrade, or your local provider. This is where you’ll buy and sell ETFs.

2. Fund Your Account

Deposit money into your brokerage account. You can often start with a small amount, though some brokers set minimums.

3. Research ETFs

Find ETFs that align with your investment goals. For example:

For general market exposure: S&P 500 ETF (IVV or SPY)

For technology focus: Nasdaq-100 ETF (QQQ)

For stability: Bond ETFs

Review each ETF’s holdings, expense ratio, and performance history before investing.

4. Place Your Order

Once you’ve chosen an ETF, enter its ticker symbol (for example, SPY) and decide how many shares to buy.

5. Monitor and Manage Your Investment

Track your ETF’s performance regularly. You can hold it long-term for diversification or adjust your holdings as market conditions change.

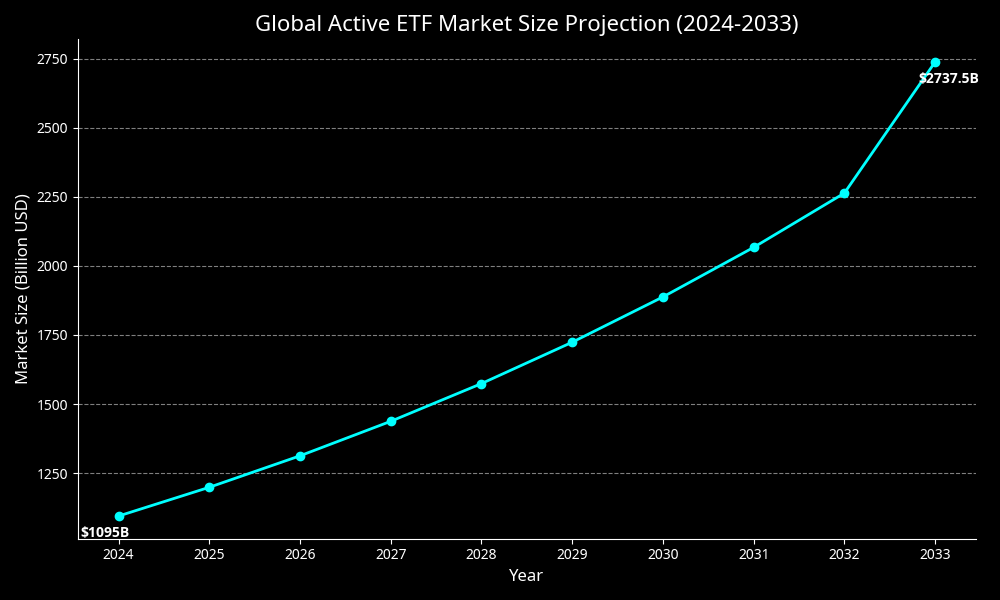

Future Outlook and Global Market Outlook for ETFs

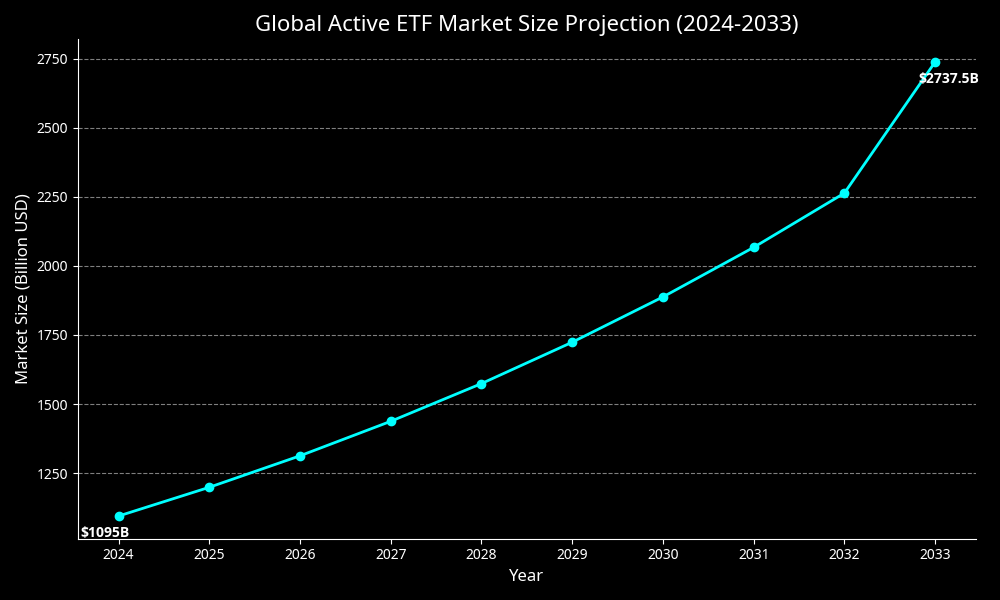

The global ETF market continues to expand rapidly, driven by rising investor demand for transparency, liquidity, and diversification.

The industry has nearly doubled in five years and could top $20 trillion before the decade ends.

The next phase of ETF growth is being shaped by three major forces:

AI and Thematic Innovation

New ETF products are emerging around artificial intelligence, clean energy, cybersecurity, and other fast-growing sectors.

These thematic ETFs appeal to investors seeking targeted exposure to long-term trends without the need to pick individual winners.

Expansion in Emerging Markets

Asia-Pacific and Middle Eastern ETF markets are expanding as regulatory environments mature and investor access improves.

Countries like India and Singapore are seeing a surge in locally listed ETFs catering to domestic and foreign investors.

Institutional Adoption and Fixed-Income ETFs

Large institutions increasingly use ETFs for liquidity management and tactical exposure.

Fixed-income ETFs, in particular, have gained traction as interest rates stabilize, offering diversified bond exposure with lower trading costs.

Despite strong growth, competition and fee compression remain key challenges. As more issuers enter the market, expense ratios are expected to decline further, benefiting investors but pressuring margins for fund managers.

Frequently Asked Questions (FAQ)

1. Are ETFs good for beginners?

Yes. ETFs are one of the easiest ways for beginners to start investing because they offer instant diversification, low fees, and flexibility. You can buy them through a regular brokerage account just like stocks, with no need to manage multiple assets individually.

2. What is the difference between an ETF and a mutual fund?

Both collect investors’ money to buy a mix of assets, but ETFs trade all day like stocks, while mutual funds are priced once daily after the market closes. ETFs usually have lower fees and are more tax-efficient.

3. Can I lose money investing in ETFs?

Yes. ETFs lower risk by spreading investments across many assets, but their value can still rise or fall with the market. You can lose money if the underlying assets drop, so it’s important to research before investing.

Final Thoughts

Looking ahead, ETFs are likely to play an even larger role in portfolio construction, not just as passive investment tools, but as core vehicles for active strategies, ESG integration, and global diversification.

ETFs are reshaping how investors think about diversification, efficiency, and strategy. The next chapter of this market will be defined by innovation, transparency, and smarter tools for investors worldwide.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.