Apple's stock has long been a bellwether for technology and innovation in global markets. As traders look ahead to 2030, understanding how Apple's past performance compares to current forecasts is essential for making informed decisions.

Here, we analyse Apple's price history, consensus predictions for 2030, and the factors that could shape the next chapter for one of the world's most influential companies.

Apple's Stock Performance: A Historical Overview

Apple (AAPL) went public in December 1980 at $22 per share (split-adjusted to $0.10). For decades, the stock reflected Apple's evolution from a niche computer maker to a global technology leader. Major milestones include the iPod (2001), iPhone (2007), and the rise of the App Store and Services division.

2010–2020: Apple's stock price soared, driven by iPhone adoption, services growth, and expanding hardware lines. The 2020 4-for-1 stock split made shares more accessible, with the price rising from $125 post-split to an all-time high above $180 in January 2022.

2022–2025: Apple weathered market turbulence, including a 27% decline in 2022, followed by a strong 2023 rebound (+49%). By December 2024, Apple reached a record close of $258.40. However, 2025 saw a pullback, with the stock trading around $202–$205 in June 2025, down 19% year-to-date and underperforming other tech giants.

Apple's 15-year trailing returns remain robust at over 22% per year, outpacing many industry peers.

2030 Price Predictions: Consensus and Ranges

Analysts and forecasting models offer a range of price targets for Apple in 2030, reflecting both optimism and caution:

Conservative Forecasts: Several sources predict Apple will reach an average price of $349–$356 in 2030, representing a 70–75% gain from current levels. These projections assume steady revenue growth, successful product launches, and continued expansion in services.

Moderate to Bullish Scenarios: Other models suggest Apple could hit $410–$478 by 2030, with upside potential if Apple's AI initiatives, services, and new hardware categories drive stronger-than-expected growth.

High-End Estimates: The most optimistic forecasts, based on aggressive expansion into new markets (such as AR/VR, automotive, and healthcare) and successful AI integration, see Apple reaching $500–$602 per share by 2030. Achieving these levels would require sustained innovation and strong execution.

Monthly breakdowns for 2030 show a gradual rise, with the stock averaging $349 in early 2030 and potentially closing the year near $400–$410, depending on performance and market sentiment.

Key Drivers Behind 2030 Predictions

1. Artificial Intelligence and Services Expansion

Apple's "Apple Intelligence" suite, expected to be fully integrated across all devices by 2030, is seen as a major growth catalyst. Subscription-based premium features and ecosystem lock-in could boost recurring revenue.

2. Product Innovation

The iPhone remains central, but growth is expected from wearables, AR/VR devices, and potential new categories like autonomous vehicles and healthcare tech. Success in these areas could push Apple's valuation higher.

3. Services and Ecosystem

Apple's services division (including iCloud, Apple Music, and App Store) is projected to deliver double-digit growth, providing a buffer against hardware cycles.

4. Global Expansion

Emerging markets, particularly India and Southeast Asia, are expected to drive incremental sales and market share.

Risks and Challenges

Market Saturation: The global smartphone market is maturing, which may slow iPhone growth.

Competition: Apple faces increasing pressure from rivals in AI, hardware, and digital services.

Regulatory Scrutiny: Antitrust investigations and changes to App Store policies could impact profitability.

Execution Risk: Failure to innovate or delays in new product categories could limit upside potential.

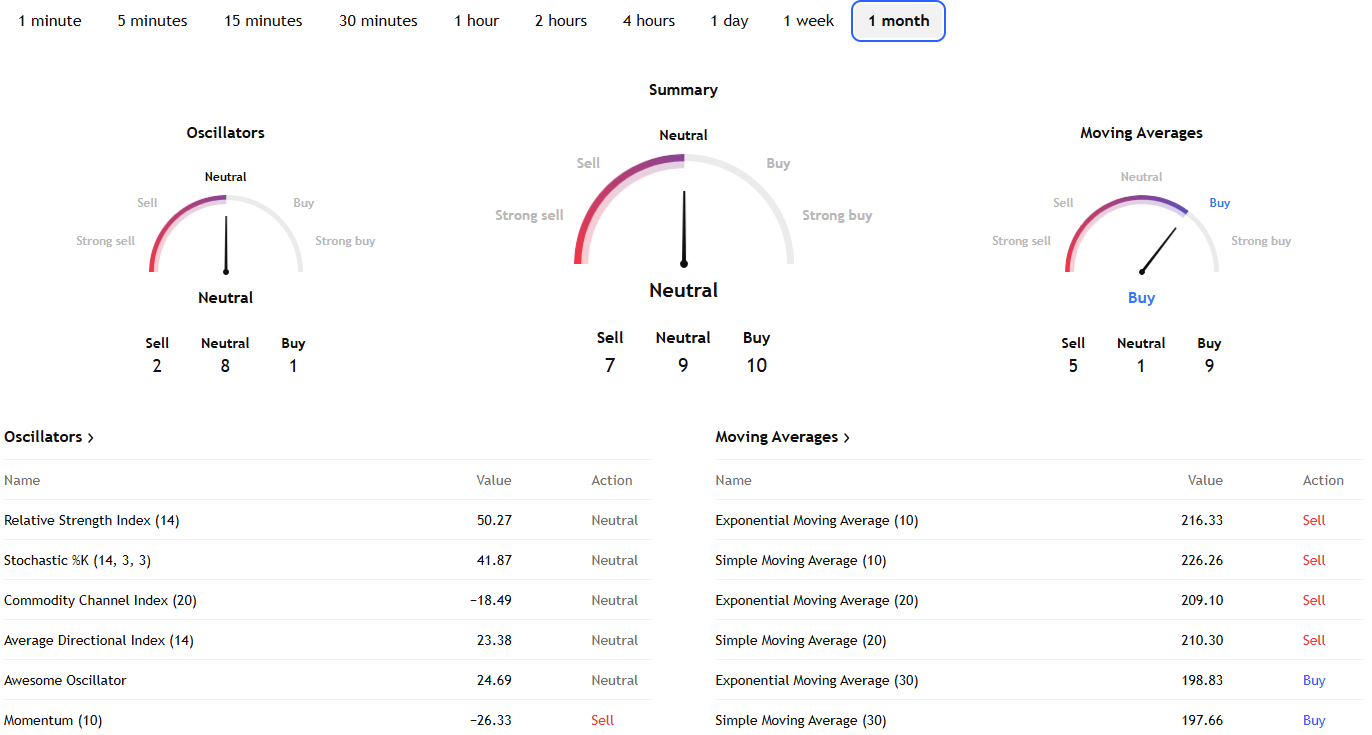

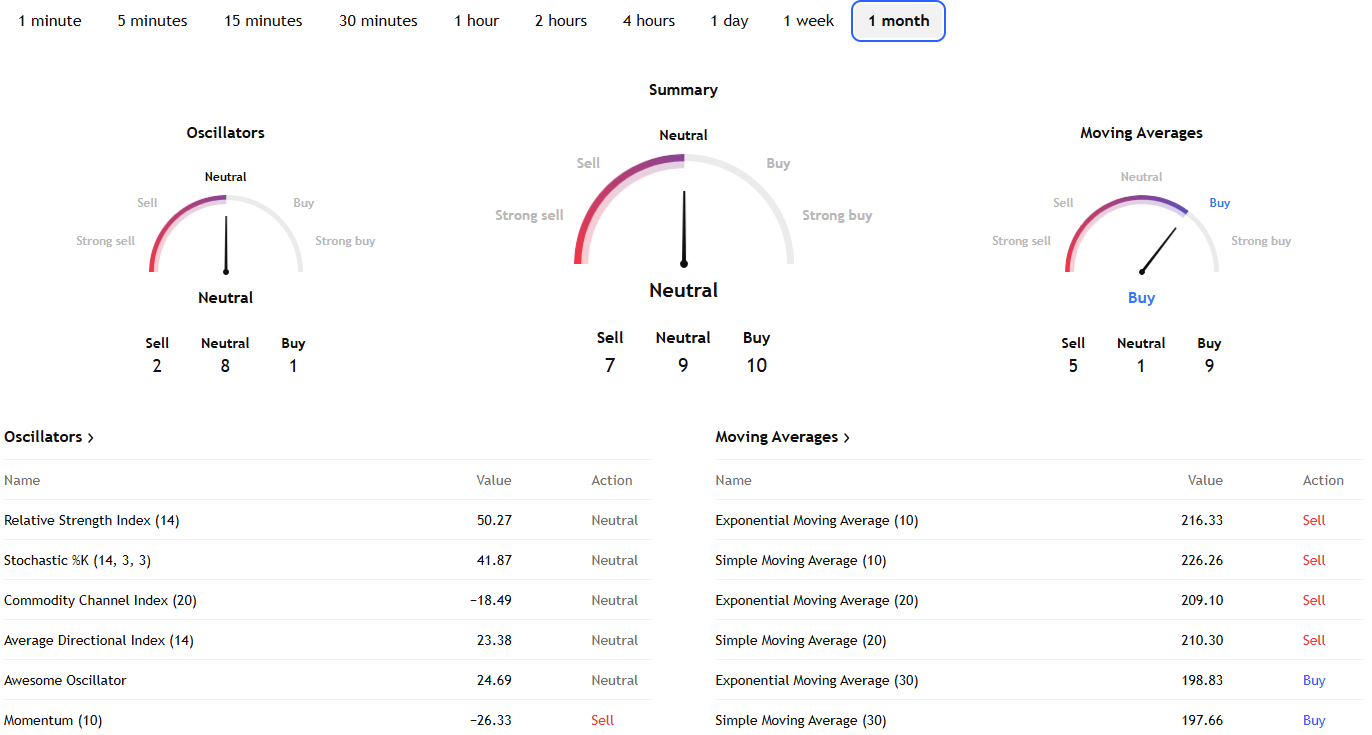

Technical and Fundamental Perspectives

Technically, Apple's stock has important support levels at $193 and $180, with resistance near $214 and $235. The stock's recent struggle to break above its 50-day moving average suggests traders should monitor momentum indicators and price action closely.

Fundamentally, Apple's robust cash flow, strong balance sheet, and history of share buybacks provide a solid foundation. However, with a forward P/E ratio near 29 and a modest dividend yield, future gains will depend on continued growth and successful product execution.

Past vs Present: What Traders Should Watch

Historical Returns: Apple has delivered outsized returns for long-term holders, but future gains may be more moderate as the company matures.

2030 Outlook: Most forecasts see Apple trading between $350 and $500 by 2030, with higher targets contingent on breakthrough innovations and successful expansion into new sectors.

Volatility and Opportunity: Traders should watch for buying opportunities during market pullbacks, especially if Apple delivers on its AI, services, and hardware roadmaps.

Conclusion

Apple's journey from a niche computer company to a global tech powerhouse has rewarded investors handsomely. Looking ahead to 2030, most forecasts remain positive, though expectations are more measured than in the past.

For traders, the key will be monitoring Apple's execution on innovation, AI integration, and services growth—while remaining alert to risks that could affect the stock's trajectory.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.