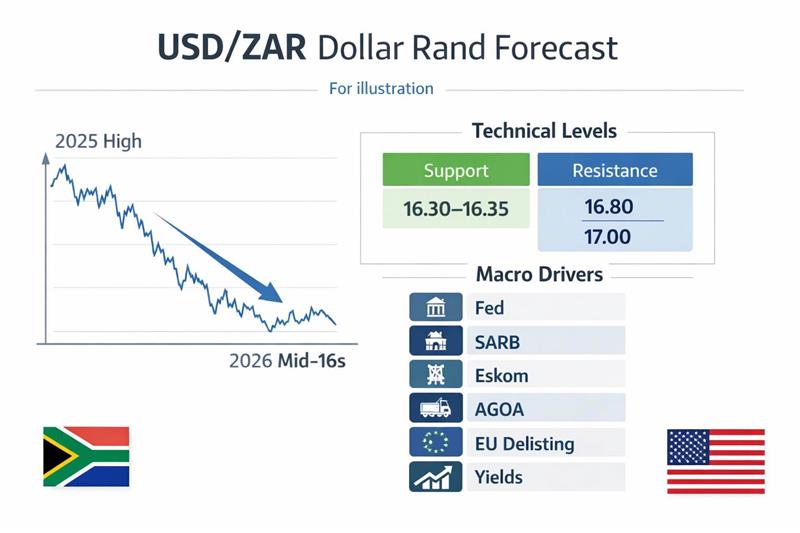

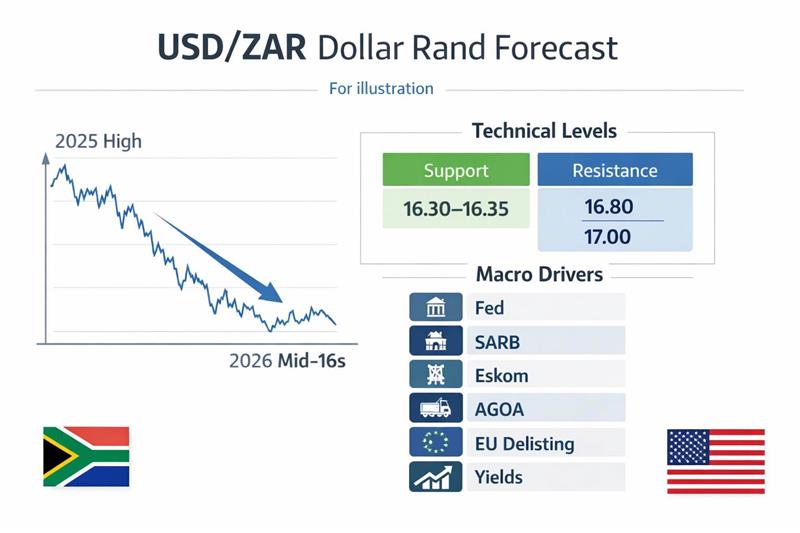

USD/ZAR has started 2026 with the Rand holding onto most of its post-2025 recovery, after the pair retreated sharply from the April 2025 peak near 19.93 into the mid-16s. The market is now trading a tug-of-war between softer US rate momentum and improving South African risk optics, and fresh geopolitical noise that periodically restores demand for the US dollar.

The near-term setup is range-driven but fragile. USD/ZAR is sitting close to a major compression zone built around the 16.30 to 16.60 area, where incremental shifts in rate expectations, risk appetite, and South Africa-specific headlines can still produce outsized moves. The next few weeks matter because key policy events arrive almost back-to-back, and they often reset the market’s “fair value” for the Dollar Rand pair.

Dollar Rand Key Takeaways

USD/ZAR is trading around the mid-16s, with the past year’s range spanning roughly 15.43 to 19.93, which confirms that the market remains structurally volatile even when the short-term tape looks calm.

The core macro spread still supports the rand on carry because South Africa’s repo rate is 6.75% while the Fed’s target range is 3.50% to 3.75%, but that advantage weakens quickly during risk-off shocks.

South Africa’s inflation framework has shifted to a 3% target with a ±1% tolerance band, which raises the probability of policy remaining disciplined even if growth stays soft, and it also improves the credibility premium priced into the rand over time.

The rand’s domestic backdrop has improved at the margin through regulatory and perception upgrades, including South Africa’s removal from the EU’s “high-risk third country jurisdictions” list, which reduces friction for cross-border finance as the change takes effect later in January.

Eskom’s operating metrics improved in December, but the year-to-date energy availability factor remains materially below a level that would anchor a durable growth upswing, which is why the rand still behaves like a high-beta currency during global stress.

Trade access risk remains a live Dollar Rand driver because the US House has passed legislation to extend AGOA, but the process still needs Senate approval, and South Africa’s standing remains politically sensitive.

Dollar Rand Technical Analysis for USD/ZAR

Trend and market structure

On a medium-term lens, USD/ZAR remains in a broad corrective downtrend from the April 2025 high near 19.93, with the market carving lower swing highs as the rand recovered from a severe risk-premium episode. That high is not only a psychological anchor, but also the reference point many participants use to judge whether the 2025 move was a one-off shock or the start of a new long-cycle depreciation regime.

On the short-term lens, price action has compressed into a more balanced structure, and that is typical after a large trend move when the market is waiting for a new catalyst. In practice, this means technical levels are likely to matter more than usual because flows become reactive, with stops clustered around obvious round numbers and recent swing points.

Daily map: support and resistance zones that matter

The most actionable levels are the ones that combine psychology (round numbers), recent swing points, and retracement confluence from the 18.2174 high to the 16.3591 low.

USD/ZAR technical level map

| Zone |

Level area |

Why it matters |

| Immediate support |

16.35 to 16.40 |

Current cycle low and the area where dip-buying has recently appeared. |

| Breakdown support |

16.00 |

Round-number magnet where option strikes and hedging activity often cluster. |

| Medium-term support |

15.80 to 15.90 |

Plausible extension zone if risk stays constructive and South Africa’s premium compresses further. |

| Immediate resistance |

16.55 to 16.60 |

Recent weekly ceiling and a natural liquidity pocket above the current range. |

| Fib resistance (23.6%) |

16.80 |

First meaningful retracement from the 2025 high-to-2026 low swing. |

| Fib resistance (38.2%) |

17.07 |

A key pivot zone where many corrective rallies stall. |

| Fib resistance (50%) |

17.29 |

Midpoint of the entire decline, which often behaves like a “decision” level. |

| Fib resistance (61.8%) |

17.51 |

High-conviction sell zone if the broader downshift remains intact. |

| Upper resistance |

17.80 to 18.20 |

The zone that would likely require a clear risk-off shock to revisit.

|

What would confirm a breakout, and what would invalidate it?

Bullish USD/ZAR breakout trigger: A daily close above 16.60 that is followed by acceptance above 16.80 would signal that the market is repricing risk premium wider again, with 17.07 and 17.29 as the next upside liquidity targets.

Bearish USD/ZAR continuation trigger: A sustained daily close below 16.35 would expose 16.00 as the next magnet, especially if global yields fall and risk appetite stays firm.

Fundamental Drivers Behind the Dollar-Rand Outlook

Federal Reserve policy and US data

The Fed’s current target range is 3.50% to 3.75%, and that level matters for USD/ZAR because it governs the opportunity cost of holding dollars relative to high-carry EM currencies.

The next major event risk is the January 27 to 28 FOMC meeting, which is the first policy decision of 2026 and a typical volatility trigger across the dollar complex. If the Fed signals patience and keeps a steady hand, the dollar tends to lose support against higher-yielders, but if it leans hawkish because inflation proves sticky, the dollar can regain broad strength.

US rates also transmit through the long end. The US 10-year yield has been trading around the low-4% area in mid-January, and that matters because higher real yields often tighten global financial conditions and reduce the market’s appetite for rand carry exposure.

South African Reserve Bank, inflation target reset, and real yields

The SARB’s repo rate is 6.75% after the November 2025 cut, and the next policy announcement is scheduled for January 29, 2026.

The bigger story is the inflation framework reset. South Africa has shifted toward a 3% target with a ±1% tolerance band, phased in over time, which is a material credibility upgrade because it lowers the “acceptable” inflation ceiling and strengthens the case for a structurally lower risk premium in long-dated rates if implementation remains consistent.

Inflation has also been behaving. Headline CPI printed 3.5% year on year in November 2025, which places it close to the new midpoint and gives the SARB space to stay data-dependent rather than defensive.

South Africa's fiscal and political risk premium

The rand’s medium-term valuation still carries a fiscal risk component because investors price South Africa’s debt trajectory and governance capacity directly into the currency. Even when the current account is manageable, a high and rising debt ratio can keep USD/ZAR from sustaining a clean appreciation trend because foreign capital typically demands a higher premium to fund that path.

Budget politics also matter more than usual after the instability seen in 2025. Markets tend to punish any signal that fiscal consolidation will slip, especially if the adjustment path relies on distortionary tax hikes or unpredictable coalition bargaining that undermines policy visibility.

External balance, commodities, and terms of trade

South Africa’s external position is not currently an acute pressure point, which is constructive for the rand. The current account deficit was reported at 0.7% of GDP in the third quarter of 2025, which is modest by emerging market standards and reduces the need for persistent foreign inflows to “plug” the balance.

Commodity sensitivity remains central to Dollar Rand dynamics. When gold and platinum prices surge, they often provide a short-term cushion for the rand through terms-of-trade expectations and sentiment, but that support can reverse quickly if the move is driven by global fear rather than real demand.

Oil is the opposite input. Brent has been trading in the mid-$60s in mid-January, and renewed upside in energy prices can widen South Africa’s import bill and nudge inflation expectations higher, which tends to reintroduce a depreciation bias over a medium horizon.

Power supply and growth sensitivity

Eskom’s latest operational metrics show improvement, with the energy availability factor reaching 69.14% in December 2025, but the year-to-date figure was still 64.35%, which remains too low to guarantee a sustained rebound in trend growth.

This matters for USD/ZAR because weak growth constrains fiscal revenue, discourages fixed investment, and keeps the currency reliant on portfolio flows rather than broad-based inflows from long-term capital expenditure.

Market access, regulation, and cross-border friction

Two structural items have become more supportive at the margin.

First, South Africa has been removed from the EU list of “High-Risk Third Country Jurisdictions,” with the change scheduled to take effect later in January 2026, which should gradually reduce compliance friction for EU-linked transactions and may help sentiment around inward financial flows.

Second, AGOA remains a meaningful swing factor. The US House has passed legislation to extend AGOA through 2028, but it still requires Senate approval, and South Africa’s inclusion is politically sensitive, which keeps a risk premium embedded in the rand’s forward expectations.

Short-Term Dollar Rand Forecast (1 to 4 weeks)

The short-term Dollar Rand view is best framed as a range with event-driven break risks. The calendar is dense: the FOMC meets January 27 to 28, and the SARB announces January 29, and both decisions interact through global risk sentiment and rate differentials.

Base case range: USD/ZAR trades mostly between 16.30 and 16.80, with mean reversion dominating unless a catalyst forces repricing.

| Scenario |

What happens |

USD/ZAR implication |

| Rand-supportive risk-on |

The Fed signals patience, risk appetite stabilises, and South Africa headlines remain constructive. |

The pair leans toward 16.30 support, with risk of a brief probe lower. |

| Dollar-supportive risk-off |

Global stress rises and the dollar catches a safe-haven bid, with EM FX de-risking. |

The pair pushes into 16.80 to 17.00, where breakout risk increases. |

| SA-specific shock |

Fiscal or trade-access headlines deteriorate, or load-shedding risk reappears abruptly. |

The pair can gap higher even if the global dollar is not broadly strong. |

Tactical note: A sustained daily close below 16.30 raises the probability of a deeper rand extension, while repeated failures to break lower typically create the conditions for a sharp snapback toward 16.80 as hedging demand rebuilds.

Medium-Term Dollar Rand Forecast (3 to 6 months)

The medium-term Dollar Rand outlook hinges on whether South Africa can convert improved credibility signals into measurable growth traction, while the US rate cycle stays on a gradual easing path rather than re-tightening.

Base case

In the base case, USD/ZAR trades in a broad 16.00 to 17.50 band. The carry advantage remains real, but it is not sufficient on its own to force sustained appreciation unless the domestic growth story improves and political risk stays contained.

Upside and downside risks

A bullish rand outcome becomes more likely if South Africa’s inflation stays anchored near the new 3% midpoint, the SARB retains credibility, and cross-border friction continues to fall as delistings and compliance improvements filter into real capital decisions.

A bearish rand outcome becomes more likely if trade access uncertainty escalates, if fiscal slippage becomes visible in funding plans, or if global risk conditions deteriorate sharply and force EM outflows.

What would change the medium-term regime?

USD/ZAR would be more likely to shift into a durable rand-strength regime if two conditions are met at the same time: South Africa delivers a credible growth upgrade through improved electricity reliability and investment traction, and the US yield curve trends lower without a resurgence in inflation. If only one of those conditions is met, the market typically reverts to range trading.

Dollar Rand Trading and Hedging Checklist

Traders should track the US 10-year yield and the dollar index daily because they often lead USD/ZAR during global risk swings.

Hedgers should pay attention to 16.30 and 17.00 because these levels tend to attract option activity and trigger changes in corporate hedging ratios.

Investors should monitor the SARB meeting on January 29 and the FOMC meeting on January 27 to 28 because policy tone, not only the decision itself, often drives the next leg in the Dollar Rand move.

South Africa-specific risk should be tracked through electricity performance updates, budget credibility signals, and any change in trade-access expectations around AGOA.

Frequently Asked Question (FAQ)

1. What is the current Dollar Rand exchange rate?

USD/ZAR has been trading in the mid-16s in mid-January 2026, with recent sessions fluctuating within a relatively tight intraday range compared with the broader past-year band. The 52-week range has spanned roughly 15.43 to 19.93, which highlights the pair’s underlying volatility.

2. What are the most important drivers of USD/ZAR in 2026?

The dominant drivers are the Fed and SARB policy paths, global risk appetite, South Africa’s fiscal credibility, electricity reliability, and trade-access headlines. The rand can outperform in stable risk conditions, but it often weakens quickly when global stress triggers dollar demand.

3. How does the interest-rate differential affect the Dollar Rand?

A higher South African policy rate supports the rand through carry, especially when volatility is low, and investors are comfortable owning emerging market risk. The SARB repo rate is 6.75% while the Fed’s target range is 3.50% to 3.75%, which is supportive in calm markets but less protective during risk-off shocks.

4. Why does Eskom matter for USD/ZAR?

Electricity reliability shapes growth, fiscal revenue, and investor confidence. Eskom’s December availability improved, but year-to-date performance remains weaker than what is typically needed for a sustained growth re-acceleration. That keeps the rand sensitive to global risk swings because domestic fundamentals are not strong enough to dominate the price action.

5. Could AGOA developments move USD/ZAR materially?

Yes, because trade access affects investment confidence and export-linked growth expectations. Legislation to extend AGOA has advanced in the US House, but it still requires Senate approval, and South Africa’s status remains politically sensitive. That uncertainty can widen the risk premium and lift USD/ZAR during periods of stress.

Conclusion

USD/ZAR is entering 2026 in a technically compressed range after a large reversal from the 2025 extremes, but the pair remains a high-volatility macro instrument where the next catalyst can quickly overpower the recent calm. In the short term, the balance of risks points to range trading between 16.30 and 16.80, with break potential around the late-January Fed and SARB decisions.

In the medium term, the rand’s path depends on whether credibility gains, regulatory delistings, and policy discipline translate into stronger growth and steadier capital formation, while the US rate cycle continues to normalise without reigniting inflation.

If those conditions align, the Dollar Rand trend can extend lower, but if global risk deteriorates or South Africa-specific trade and fiscal risks flare up, USD/ZAR can still reprice higher quickly.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.