The answer is yes—Powell's speech at the Jackson Hole meeting is widely expected to move both stocks and FX markets. Traders and investors across the globe will be watching for any hints on rate cuts, changes in policy tone, or new economic forecasts. Even subtle shifts in Powell's language could trigger substantial reactions in key equity indices and currency pairs, making this one of the most anticipated events of the summer.

Timing for Powell's Jackson Hole Speech

Here are the scheduled timings for Powell's Jackson Hole speech in local times for major global financial centres:

| City |

Local Time |

Time Zone |

| New York |

10:00 AM, 22 Aug |

EDT (UTC-4) |

| London |

3:00 PM, 22 Aug |

BST (UTC+1) |

| Frankfurt |

4:00 PM, 22 Aug |

CEST (UTC+2) |

| Dubai |

6:00 PM, 22 Aug |

GST (UTC+4) |

| Mumbai |

7:30 PM, 22 Aug |

IST (UTC+5:30) |

| Singapore |

10:00 PM, 22 Aug |

SGT (UTC+8) |

| Tokyo |

11:00 PM, 22 Aug |

JST (UTC+9) |

| Sydney |

12:00 AM, 23 Aug |

AEST (UTC+10) |

What Makes Jackson Hole So Important for Markets?

The annual Jackson Hole Economic Policy Symposium is one of the most closely watched central bank events in the world. Central bankers, economists, and policy strategists gather in this Wyoming town to discuss global economic challenges and policy directions.

This year's meeting is particularly crucial because it will feature Federal Reserve Chair Jerome Powell's much-anticipated speech at a time when markets are hungry for clarity on the US central bank's interest rate plans. Inflation in the US eased slightly to 3.1% in July but remains above the Fed's 2% target. Meanwhile, sectors like technology have struggled, dragging major US indices downward.

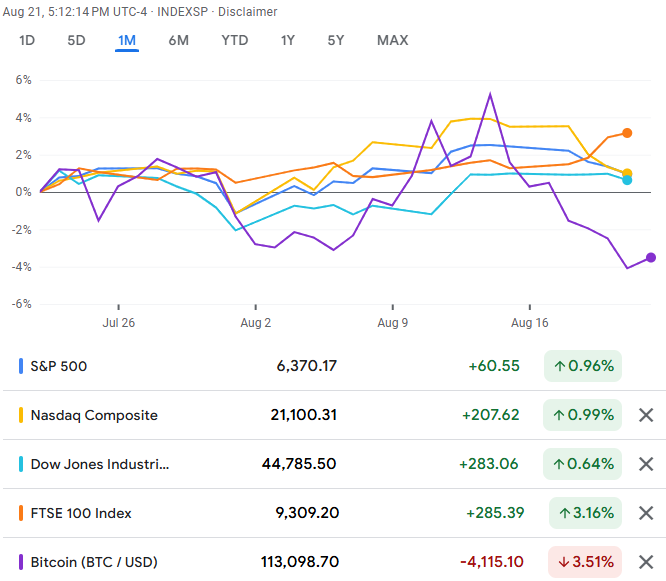

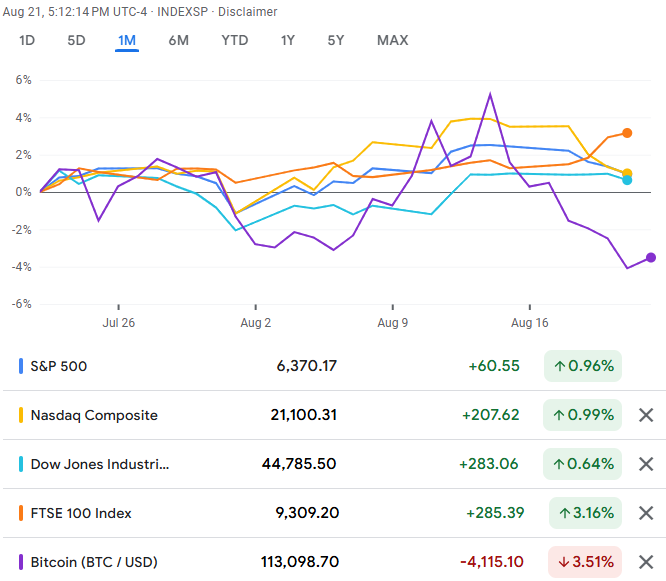

Stocks: Bracing for Powell's Direction

The week leading into Jackson Hole has seen US equity markets tread carefully. On Thursday, the S&P 500 closed at 5,198, down 0.38% for the day and marking a fourth consecutive day of declines. The Nasdaq Composite gave up 1.06% as tech giants, including Intel, Palantir, and Meta, saw shares dip sharply.

Investors will be looking to Powell's speech for clues about:

-

Whether the Fed plans to cut interest rates later in 2025.

-

How the Fed intends to balance inflation control with economic growth.

Potential shifts in sector leadership and market rotations.

Volatility remains elevated, with the VIX index sitting near 21.2, well above levels seen just last week.

Currencies: Dollar Strength Clash with Policy Outlook

Currency markets have been equally sensitive ahead of the speech. The US Dollar Index (DXY) has strengthened to around 104.9, a 1.2% gain week-to-date. The euro weakened slightly to $1.084, impacted by soft Eurozone economic data. The British pound hovered at about $1.272 after the Bank of England's steady policy stance, while the Japanese yen held near 143.6 per dollar, with authorities wary of excess volatility.

Emerging market currencies such as the Indian rupee (around 83.12) and Malaysian ringgit (near 4.677) softened amid risk aversion in global markets.

Traders are anticipating:

-

Affirmation or adjustment of the Fed's “higher-for-longer” rate messaging.

-

Any guidance on the dollar's sustained strength or potential pullback.

How shifts in US policy could influence carry trade flows and emerging market currencies.

What Are Investors Expecting from Powell?

Markets remain divided heading into the speech. Some investors expect Powell to maintain caution, emphasising that future moves will depend on incoming data and possible rate hikes if inflation persists. Others hope for hints of a transition to balancing growth support with inflation control, perhaps signalling peak rates or easing measures ahead.

Fed minutes released recently have shown a mix of hawkish and dovish views among policymakers, highlighting the importance of Powell's remarks in shaping the near-term outlook.

Key Market Data Ahead of Jackson Hole

Global Impact: More Than Just The US

While Powell's speech is the headline event, its impact will ripple globally. European markets remain alert to ECB policy signals and Eurozone inflation data. Asian investors focus on China's stimulus efforts and the Bank of Japan's cautious stance on monetary policy.

Commodities such as gold and oil remain sensitive to changing risk sentiment and the dollar's movements, while emerging markets watch closely for potential capital flows linked to Fed policy.

Post-Speech Market Moves: What Could Change?

Stocks

-

A dovish Fed tone or signalling of rate cuts could spark gains in tech and growth stocks as well as emerging market equities.

-

A hawkish stance may reinforce strength in banks and financial stocks but lead to broader market pullbacks, especially in tech.

Inflation concerns kept alive could increase overall market volatility.

Currencies

-

The dollar might rally further if Powell signals sustained higher rates.

-

The euro, pound, and yen might weaken against the dollar if Fed policy diverges from other central banks.

Emerging market currencies could experience pressure in risk-off scenarios.

What To Watch

Investors and traders will be watching for:

-

Key shifts in S&P 500, Nasdaq, and Dow Jones futures.

-

Movements in the US Dollar Index and currency pairs like EUR/USD, GBP/USD, and USD/JPY.

-

Reactions in bond yields and broader fixed income markets.

-

Gold and oil price trends post-speech as risk sentiment evolves.

-

Tech sector performance, especially stocks like Meta, Apple, Microsoft, Intel, and Palantir.

Responses from Asian and other international markets.

Final Thoughts: The Stakes for Stocks & FX at Jackson Hole

Jerome Powell's speech is arguably the highest-profile financial event this week, with the potential to reset market expectations. Given current volatility, even subtle shifts in tone or data interpretation could produce significant moves in global stocks and currencies. Traders must stay alert, recognising that Jackson Hole could be a turning point or a reaffirmation of the cautious status quo.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.