U.S. stocks ended lower and the dollar lost ground on Friday as negotiations

to raise the U.S. debt ceiling were put on hold. Oil prices fell on renewed fuel

demand.

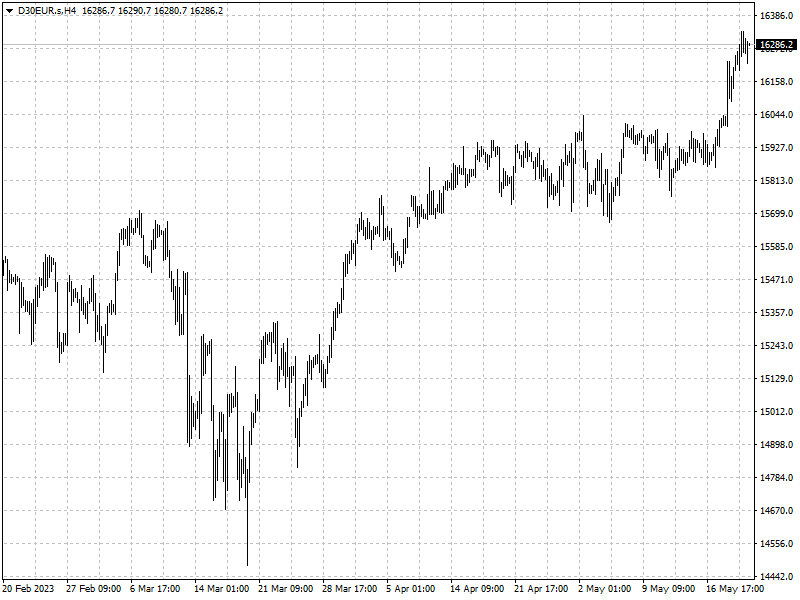

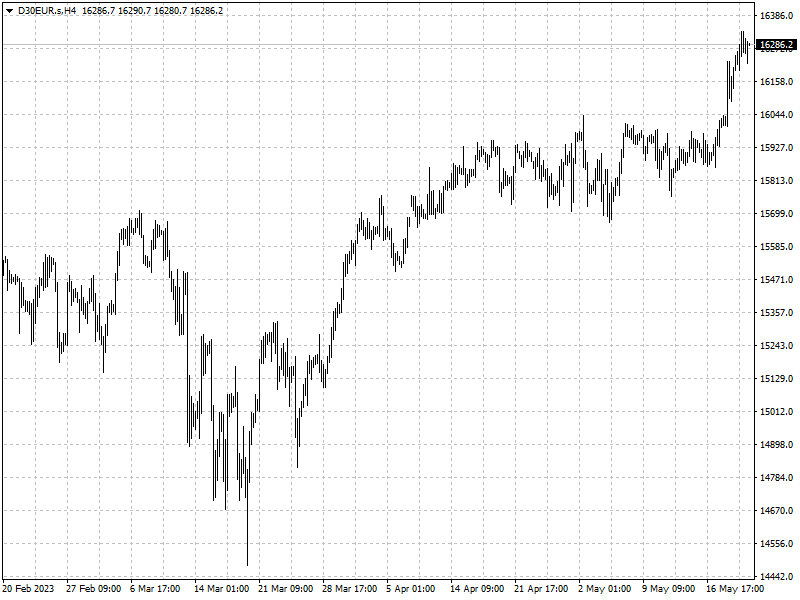

European shares closed higher and the German DAX reached a record high prior

to reports that the talks had stalled. Paris and London's stock markets hit

record highs earlier this year.

Gold prices advanced as traders slashed bets on another rate hike following

Powell's remarks that uncertainties surrounding the lagging impact of past rate

hikes and recent bank credit tightening made it unclear whether more monetary

tightening will be necessary.

Commodities

Brent and U.S. crude prices notched their first weekly gains in a month, with

the both benchmarks rising about 2%.

The Treasury Department has warned the government could be unable to pay all

its bills by June 1 though a White House official said a deal remained

possible.

U.S. oil rig count, an indicator of future production, fell by 11 to 575 last

week, the biggest weekly drop since September 2021, energy services firm Baker

Hughes said.

Money managers cut their net long U.S. crude futures and options positions in

the week to May 16, the U.S. Commodity Futures Trading Commission (CFTC)

said.

Forex

Treasury Secretary Janet Yellen told bank CEOs that more mergers may be

necessary to staunch the banking liquidity crisis, according to CNN.

Powell reiterated that the central bank would now make decisions "meeting by

meeting," but also flagged that after a year of aggressive rate increases,

officials can afford to make "careful assessments" of the impact of rate hikes

on the economic outlook.

Fed officials last week had more or less pushed against rate-pause bets for

June given persistently high inflation.

‘Powell was not overtly dovish, but he definitely was not hawkish,’ said Erik

Bregar, director, FX & Precious metals risk management, at silver Gold Bull

in Toronto.