Gold slipped 0.53% to US$ 4.063.81 per ounce on Thursday as the US dollar surged to a two-week high and markets sharply reduced expectations for a December Fed rate cut.

The pullback comes as traders face limited economic signals and a more cautious Fed, prompting a quick repricing of risk and reducing appetite for non-yielding assets like gold.

Gold Price Slips Amid Firm Dollar and Diminished Fed Cut Expectations

1. Market Recap: Gold Eases on Hawkish Fed Signals

Gold steadied after a two-day rally, trading around US$ 4.075 per ounce, as investors dialled back expectations for a December rate cut from the Federal Reserve.

Minutes from the Fed's October meeting showed that many policymakers now lean toward keeping rates steady through 2025. which is a shift from more aggressive easing.

Compounding the pressure on gold, a firmer US dollar makes bullion more expensive for global buyers, reducing its relative appeal.

2. Macro Drivers: Dollar Strength and Policy Uncertainty

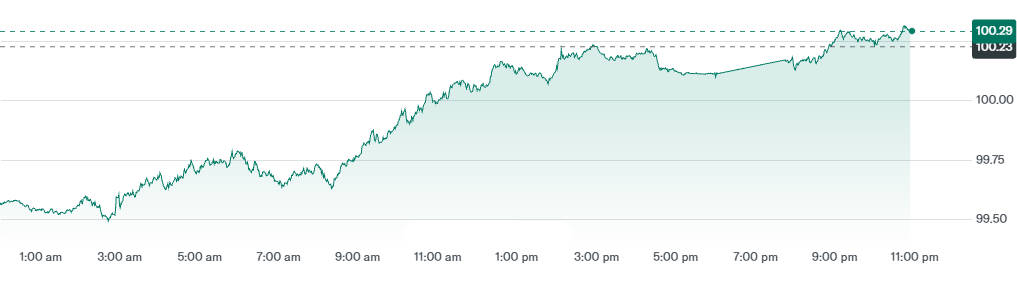

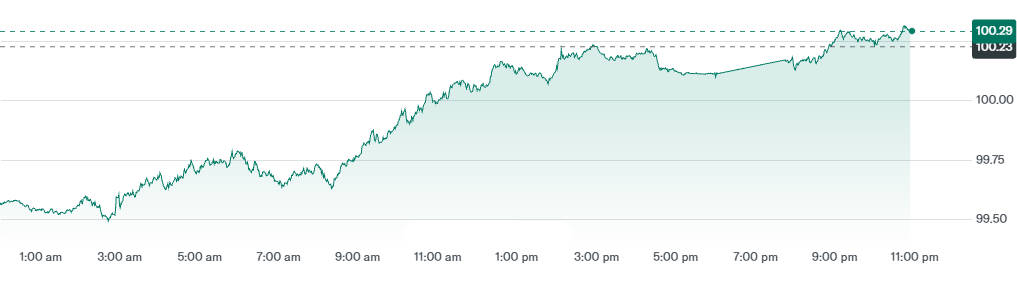

The US Dollar Index (DXY) rose significantly, compressing gold's demand as borrowing-cost expectations shifted.

Swaps markets now reflect roughly a 33–36% probability of a Fed rate cut in December, down from near-even odds earlier.

This repositioning comes amid a lack of fresh U.S. labour data: October's employment report has been delayed, depriving markets of a key gauge ahead of the Fed's year-end meeting.

Fed Rate-Cut Expectations

| Event |

Probability Before |

Probability Now |

Market Implication |

| December Rate Cut |

~50% |

33–36% |

Lowered expectations weaken gold |

| Fed Stance |

Mixed |

More cautious |

Minutes show preference to hold rates |

Structural Demand Still Supports Gold Price Momentum

Despite the short-term pullback, gold continues to benefit from strong long-term demand: central bank purchases, ETF inflows, and safe-haven considerations remain supportive.

Gold's non-yielding nature makes it especially attractive in a low-rate environment, but only if rate cuts materialize, hence why the current speculative reversal is closely watched.

Some analyses (e.g., WisdomTree) caution that if the Fed pauses or reverses course, gold could face downside pressures in more bearish scenarios.

Technical Outlook: Key Gold Price Levels to Watch

On the charts, gold is consolidating within a US$ 4.000–4.050 range, with significant support near $4.040 as investors test the strength of this floor.

If the metal breaks below this zone, it could revisit levels nearer $3.960–$4.000. potentially triggering fresh selling.

Conversely, a rebound could face resistance at ~$4.130–$4.180. where recent rallies were capped and momentum may fade without strong macro catalysts.

Forward-Looking Catalysts: What Could Move the Gold Price Next

Investors will closely watch the delayed U.S. non-farm payrolls report, which may reshape expectations for the Fed's December actions.

Any fresh Fed commentary (through speeches or minutes) may further clarify the central bank's rate philosophy for the rest of the year.

Also important will be inflation readings and global risk factors: renewed geopolitical stress or inflation surprises could reignite gold's safe-haven appeal.

Finally, revisits to ETF inflows and central bank buying will help determine whether investment demand can anchor prices even amid macro headwinds.

Key Gold Price Movements

| Metric |

Latest Value |

Previous Trend |

Notes |

| Gold Spot Price |

US$ 4,063.81/oz |

Down 0.4% on the day |

Pressured by stronger USD |

| 2-Day Performance |

+1% before decline |

Short rebound |

Momentum now fading |

| YTD Performance |

+50% |

Record highs in October |

Supported by earlier rate cuts |

Frequently Asked Questions

Q1: Why is the gold price declining now?

Gold is weakening because traders have sharply reduced expectations for a December Fed rate cut, while the US dollar has strengthened to a two-week high. Both developments reduce the appeal of non-yielding assets like gold and encourage short-term repositioning.

Q2: How likely is a Federal Reserve rate cut in December?

Market pricing now shows only about a 33–36% probability of a December rate cut, down from nearly 50% earlier. The shift reflects a cautious tone in the latest Fed minutes and the absence of key labour data.

Q3: What key levels should investors monitor for gold?

Investors are focused on support near US$4.040 and a deeper floor around US$3.960–4.000. On the upside, resistance sits between US$4.130 and US$4.180. Movements through these levels may signal stronger directional momentum as data uncertainty persists.

Q4: What factors continue to support gold in the longer term?

Despite recent pressure, long-term support remains firm due to sustained central bank purchases, steady ETF demand, and ongoing geopolitical risks. These structural drivers provide a foundation for gold even as short-term movements react to fluctuating US rate expectations.

Q5: What could push the gold price higher again?

Gold could regain momentum through weaker US economic data, especially payrolls; clearer dovish signals from the Fed; renewed geopolitical stress; or a pullback in the US dollar. Any shift that increases expectations for future rate cuts would likely boost demand.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.