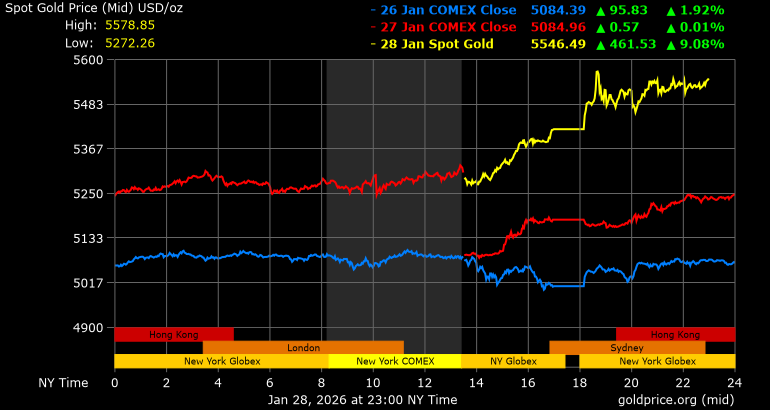

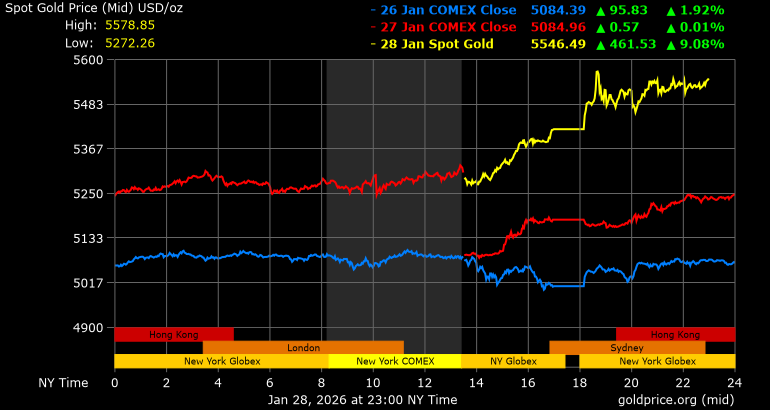

Gold is making it harder for traders to ignore in 2026. Prices have surpassed $5,300 following a significant drop in the U.S. dollar and an increased demand for safe havens. The market is now viewing $5,000 as a previous ceiling rather than merely a psychological barrier.

As of the time of writing, XAU/USD was trading around $5,531 on, with the day's range stretching roughly from $5,417 to $5,595.

Against that backdrop, the question "Can gold reach $6,000/oz in 2026?" is no longer a fringe headline. At $5,531, $6,000 represents an additional gain of about 8.5%, which is significant but not extraordinary for a market already posting multi-percentage daily swings.

The best way to address the question is to distinguish what is possible from what is required. Gold can reach $6,000 in 2026, but it likely requires one of two things: a more profound loss of confidence in paper safe havens, or a fresh wave of institutional and central bank buying that turns a strong trend into a late-cycle momentum phase.

Can Gold Reach $6,000 in 2026? A Realistic Answer

Yes, it is possible. From today's levels, gold does not need a macro miracle to reach $6,000. It requires an environment where the dollar remains weak, central banks remain steady buyers, and investor flows do not fade.

What makes $6,000 difficult is not arithmetic. What makes it difficult is that, at extreme prices, gold begins to compete with itself. Each additional leg higher tends to invite profit-taking, policy responses, and volatility that shake out weak hands.

If the current regime persists, $6,000 looks more like a "when" question than an "if" question. If the regime shifts to reflation, higher yields, and a firmer dollar, gold can spend much of 2026 consolidating instead.

Gold Price Outlook 2026: A Reality Check Using Inflation-Adjusted History

Gold's famous 1980 peak is near $850/oz.

Using CPI data, the Consumer Price Index (CPI) for January 1980 is 77.8, and the CPI for December 2025 is 324.054. Therefore, the inflation factor is approximately 4.17.

That puts the 1980 peak in today's money at roughly:

So gold above $5,500 is not just "new highs." It is meaningfully above the old inflation-adjusted peak. That helps explain why volatility has increased. It also explains why the market is paying so much attention to the following macro turning point.

Where Gold Stands Right Now?

Gold has already printed fresh records this week. For example, gold reached a record close of $5,301.60 on January 28, alongside one of the strongest one-day gains in years, amid geopolitical tensions, a weaker dollar, and concerns about policy credibility.

The Three Biggest Drivers for Gold So Far in 2026

1) Real Yields: The "Quiet Boss" of Gold

Gold does not pay interest. So when inflation-adjusted yields are high, gold often faces a more challenging backdrop. When real yields fall, gold tends to breathe easier.

The 10-year inflation-indexed Treasury yield has recently been around 1.90%.

That is not a low number. Yet gold has rallied anyway, which tells you something important: the market is not buying gold only for rate reasons. People are also purchasing gold for reasons of confidence and diversification.

Still, for a sustained push toward $6,000, gold usually benefits if real yields soften from here.

What Could Pull Real Yields Lower in 2026?

More unmistakable evidence that inflation is cooling.

The slower economic growth is leading the Federal Reserve to adopt a more supportive approach.

A shift in risk sentiment that increases demand for duration.

2) The U.S. Dollar: The Fastest Transmission Channel

Gold is priced in dollars, so a weaker dollar typically increases gold prices, all else being equal.

For example, gold's recent record run was tied to a sharp depreciation in the U.S. dollar and stronger safe-haven flows.

For traders, the key point is practical: you do not need a gold "story" if the dollar trend is doing the heavy lifting. But if the dollar stabilises or snaps back, gold can lose momentum quickly.

Dollar Signals Worth Watching

The trend of the Dollar Index and whether it continues to make lower highs.

U.S. rate expectations versus Europe and Japan.

Any meaningful change in "strong dollar" messaging versus policy outcomes.

3) Central Banks and Investment Flows: The Structural Bid

The World Gold Council has reported that central banks increased global gold reserves by approximately 1,045 tonnes in 2024. This marks the third consecutive year in which purchases have exceeded 1,000 tonnes.

That matters because central bank demand tends to be:

Large

Less price-sensitive

Persistent over time

On the supply side, the World Gold Council's data indicates that the total gold supply in 2024 was around 4,974 tonnes. This includes mine production of roughly 3,661 tonnes and the recycled supply of about 1,370 tonnes.

Simply put, supply moves slowly, while demand can surge fast. When that happens, price does the balancing.

Gold Price Outlook 2026: What Would Likely Need to Happen for $6,000?

A move to $6,000 can come from different paths, but the cleanest is a "stacking" of supportive factors.

| Driver |

What you watch |

Why it matters for $6,000 |

| Dollar credibility and policy uncertainty |

Dollar trend and policy headlines |

A sliding dollar mechanically lifts gold and also signals demand for alternatives. |

| Central bank accumulation |

Reserve management signals and structural buying trends |

Persistent official-sector buying can absorb supply and reduce downside liquidity. |

| Investor flows |

ETF inflows and positioning indicators |

When investors chase, gold can overshoot "fair value" estimates quickly. |

| Rates and real yields |

Fed tone and longer-end yield behavior |

Gold rallies are harder to sustain if real yields rise sharply. |

What Top Institutions Are Saying About Gold Price Outlook 2026?

Forecasts have been moving quickly because gold has already outrun many 2025 and early-2026 projections.

Goldman Sachs Research has raised its Dec 2026 forecast to $5,400/oz (from $4,900/oz previously)

The Bank of America has raised its near-term target to $6,000.

Regardless, you do not need to agree with anyone's forecast to trade or invest in gold. What matters is understanding which macro regime makes each forecast internally consistent.

Our Gold Price Outlook Scenario Map for 2026: Base Case vs. $6,000 Case

This is not a price prediction. It is a trigger map that shows what tends to line up with each outcome.

| 2026 scenario |

What the data would likely show |

What gold often does |

| Consolidation |

Dollar steadies, real yields stay firm |

Range trade with sharp pullbacks |

| Grind higher |

Dollar weakens slowly, real yields drift lower |

Higher highs, but choppy |

| $6,000 push |

Dollar stays heavy, real yields drop, demand stays strong |

Momentum breakout into new zone |

XAU/USD Technical Analysis: Gold Is Bullish, but Stretched

| Indicator |

Level |

How traders typically use it |

| Spot |

$5,531 |

This is the current battleground, and it is sensitive to headlines. |

| MA20 |

5,330.80 |

A first “trend support” zone if momentum cools. |

| MA50 |

5,197.25 |

A deeper retracement area that often attracts dip buyers in strong trends. |

| MA200 |

4,918.37 |

A long-term trend anchor that defines whether the bull market remains intact. |

| RSI (14) |

87.252 |

Overbought, which raises correction risk even in a bull trend. |

Technically, the trend is still strong, but the market is visibly overbought.

The daily technical read shows a "Strong Buy" summary, with every major moving average from MA5 through MA200 signaling a buy.

At the same time, the RSI (14) at 87.252 is firmly in overbought territory, which is a classic setup for fast pullbacks that do not necessarily break the broader trend.

Pivot Map

| Level |

Price |

| Support 1 |

$5,474.21 |

| Pivot |

$5,500.63 |

| Resistance 1 |

$5,547.32 |

| Resistance 3 |

$5,620.43 |

Key Takeaway:

If gold can sustain trade above the $5,500 pivot zone while volatility remains high, the market often starts to "magnetize" toward round-number objectives.

If gold slips below support and RSI cools, corrections can be sharp because crowded momentum positions unwind quickly.

The Main Risks to a $6,000 Call

Even in a bull market, these are the risks that can knock gold back:

A sustained rebound in the dollar that reduces the urgency of holding gold.

A rise in yields that restores confidence in bonds as a hedge.

A sentiment washout, because the daily RSI is already extreme, and mean reversion can be violent.

A reflationary growth rebound that shifts capital back into cyclical assets, which is explicitly part of the WGC downside scenario framework.

Frequently Asked Questions

1. Is $6,000 Gold Realistic in 2026?

Yes, it is realistic from today’s levels because $6,000 is less than 10% above the current spot reference. It becomes most plausible if the dollar stays weak and central bank and investor demand remain strong throughout 2026.

2. Can Gold Hit $6,000 Without Fed Rate Cuts?

Yes, it can, especially if dollar weakness and safe-haven demand are strong. Still, gold usually finds it easier when real yields are falling.

3. What Is the Biggest Risk to a $6,000 Gold Call?

A sustained rebound in the U.S. dollar or a period where real yields stay high and keep rising.

Conclusion

In conclusion, reaching $6,000 for gold in 2026 is no longer an outlandish call, as the market is already trading above $5,500, and the remaining distance is manageable in percentage terms.

The bigger issue is not whether gold can print $6,000 at some point. The bigger issue is whether the conditions can stay supportive long enough for that price to hold.

Real yields, the dollar trend, and continued large-scale buying from central banks and investors are the three pillars to watch. If two of those pillars weaken at the same time, gold can still be expensive, but it can stop going up.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.