The recent decline in gold and silver prices is primarily attributable to a sharp repricing of real interest rates and the U.S. dollar, rather than to a sudden loss of confidence in precious metals. As real yields increase, gold and silver must justify their inclusion in portfolios relative to higher risk-free returns, a dynamic that the market enforces rapidly. The current downturn represents a typical rates-driven correction within a period of structurally elevated volatility for metals.

Recent price movements have been notably asymmetrical, with silver exhibiting characteristics of leveraged gold due to its dual role as a monetary hedge and an industrial commodity. In the latest session, gold futures declined approximately -7.2% to around $4,952.36, while silver futures fell about -15.55% to approximately $95.14. This divergence typically indicates tightening financial conditions and a shift toward risk reduction, rather than a straightforward unwinding of safe-haven positions.

Key Takeaways on Why Gold and Silver Are Dropping

Real yields remain restrictive: The 10-year nominal yield is around 4.26% while the 10-year real yield is near 1.90%, keeping opportunity costs elevated for non-yielding metals.

Inflation expectations are steady, not accelerating: the 10-year breakeven inflation rate is about 2.34%, suggesting the recent yield move is not just “inflation fear” but also real-rate and term-premium pressure.

The dollar channel still matters, even when DXY is not surging: The trade-weighted broad US dollar index is elevated near 119.29, and the Dollar Index reading in the same market snapshot is around 96.39, reinforcing a headwind for non-US marginal buyers.

Positioning was crowded and is now being stress-tested: COMEX open interest remains large (about 528,004 contracts in gold and 152,020 in silver), with non-commercial net longs still sizeable, creating air pockets when momentum flips.

Silver is dropping faster because it is both a monetary asset and an industrial metal: In a tightening impulse, the market discounts industrial cyclicality first, and silver’s higher volatility amplifies liquidation.

Technicals confirm a momentum break: Gold’s RSI is about 33.5, and silver’s RSI is about 29.6, with both markets trading below key short-to-medium exponential moving averages, consistent with forced selling and CTA deleveraging dynamics.

Rates Are The First Driver: Opportunity Cost Is Repricing Fast

Gold and silver do not produce cash flow. That simple fact is not a weakness in normal conditions, but it becomes a pricing constraint when investors can earn a high real return in government bonds. The cleanest way to see the pressure is to compare nominal yields, real yields, and inflation expectations:

The 10-year Treasury yield is about 4.26%.

The 10-year real yield is about 1.90%.

The 10-year breakeven inflation rate is about 2.34%.

These levels collectively indicate that markets are not anticipating a period of runaway inflation. Inflation expectations remain anchored in the low-to-mid 2% range. Consequently, the pressure on metals arises from the increased real compensation required for holding duration and cash. Historically, such a real-rate environment is unfavorable for gold and silver, as it elevates the threshold for defensive allocations.

This dynamic explains why metals frequently decline despite continued investor confidence in their long-term prospects. When real yields rise or remain elevated, gold prices typically decrease unless new buyers emerge whose motivations are not primarily financial, such as central banks or retail investors less sensitive to price. In the short term, financial actors generally determine marginal pricing.

The Term Premium Is Doing Quiet Damage

An additional consideration is the composition of yields. Even if policy rates remain stable, long-term yields can increase when investors require greater term premium. This is significant because gold and silver valuations depend on the discounting of future cash flows, rather than solely on current policy rates. An increase in term premium acts as a tightening shock to all long-duration stores of value, including precious metals.

The dollar impact: FX Translation Is A Fundamental Constraint On Demand

Gold and silver are globally traded, but they are primarily invoiced in US dollars. When the dollar is firm relative to trading partners, it mechanically reduces the buying power of non-US buyers unless local prices rise. Two current markers show that the dollar channel remains relevant:

Gold and silver are globally traded, but they are primarily invoiced in US dollars. When the dollar is firm relative to trading partners, it mechanically reduces the buying power of non-US buyers unless local prices rise. Two current markers show that the dollar channel remains relevant:

Even moderate US dollar strength can significantly impact precious metals when prices are elevated. Gold’s 52-week high is approximately $5,625, while silver’s is about $121.76. At these levels, sensitivity to foreign exchange and financing conditions increases, as marginal buyers become more responsive to price changes.

When the US dollar is strong and real yields are elevated, gold and silver typically require an additional catalyst to appreciate. Such catalysts may include a marked decline in economic growth, renewed inflation concerns, or a significant geopolitical event that outweighs carry considerations. In the absence of these factors, price corrections are both possible and statistically normal.

Why Silver Is Dropping Harder Than Gold: The Hybrid Metal Problem

Gold functions primarily as a monetary asset, whereas silver serves both monetary and industrial purposes. During periods of risk aversion or financial tightening, silver’s dual identity heightens its vulnerability.

As financial conditions tighten, markets rapidly adjust industrial demand expectations, often based on indicators such as manufacturing activity, capital expenditures, and inventory cycles. Simultaneously, silver’s investor base is more sensitive to momentum, and its higher volatility can trigger mechanical deleveraging by systematic investment strategies.

The current divergence captures that dynamic well:

The current divergence captures that dynamic well:

| Latest snapshot (Jan 30, 2026) |

Gold futures |

Silver futures |

| Last price |

$4,952.36 |

$95.14 |

| Session change |

-7.20% |

-15.55% |

| 52-week high |

$5,625.16 |

$121.755 |

If the decline were solely due to diminishing safe-haven demand, silver would not typically underperform to this extent. The current situation reflects a tightening impulse affecting both the monetary hedge and the growth-sensitive aspects of silver, with silver declining more due to its greater sensitivity to market fluctuations.

Positioning And Liquidity: When Crowded Longs Meet A Momentum Break

Metals are deep markets, but even in marginal pricing, positioning can still dominate, especially after extended rallies. The Commitment of Traders data for COMEX gives a clear sense of how large the speculative footprint remains:

COMEX Positioning (Futures only, as of Jan 20, 2026)

| Market |

Open interest |

Non-commercial long |

Non-commercial short |

Non-commercial net |

| Gold |

528,004 |

295,772 |

51,002 |

+244,770 |

| Silver |

152,020 |

42,965 |

17,751 |

+25,214 |

These remain substantial net long positions. When a shock in interest rates or currency values reverses short-term trend signals, holders of crowded long positions tend to exit rapidly, often through futures markets, which directly impacts prices.

Two microstructure effects matter here:

Margin and volatility feedback loops: As volatility increases, margin requirements and risk limits become binding, which accelerates liquidation. Silver is typically more affected due to its inherently higher volatility.

Systematic selling and CTA behavior: Trend-following models generally increase exposure during market strength and reduce it during weakness. When key moving averages are breached, these flows can become self-reinforcing.

Technical Snapshot: What The Indicators Say About The Gold and Silver Selloff

While technical conditions do not account for the underlying macroeconomic causes, they do explain the speed and magnitude of the decline. Currently, both metals exhibit oversold or near-oversold momentum and a bearish short-term alignment relative to exponential moving averages.

Gold Futures Technical Analysis Table (Apr 26 contract snapshot)

| Indicator |

Reading |

Signal |

| RSI (14) |

33.48 |

Weak momentum |

| MACD (12,26) |

-66.97 |

Bearish |

| EMA 20 |

5,323.49 |

Price below |

| EMA 50 |

5,350.27 |

Price below |

| EMA 200 |

5,112.11 |

Price near/above |

| Support (Classic S1 / S2 / S3) |

5,164.60 / 5,119.50 / 5,094.75 |

Key downside zones |

| Resistance (Classic R1 / R2 / R3) |

5,234.45 / 5,259.20 / 5,304.30 |

Recovery hurdles |

| Trend |

Short-term down, long-term mixed |

Repair needed |

| Momentum |

Negative |

Deleveraging risk |

Gold’s RSI in the low 30s indicates that sellers currently dominate, though it does not yet reflect a classic capitulation scenario. More notably, the price remains below the 20- and 50-day exponential moving averages and is near the 200-day EMA, a level that often serves as a point of contention between long-term buyers and macro-driven sellers.

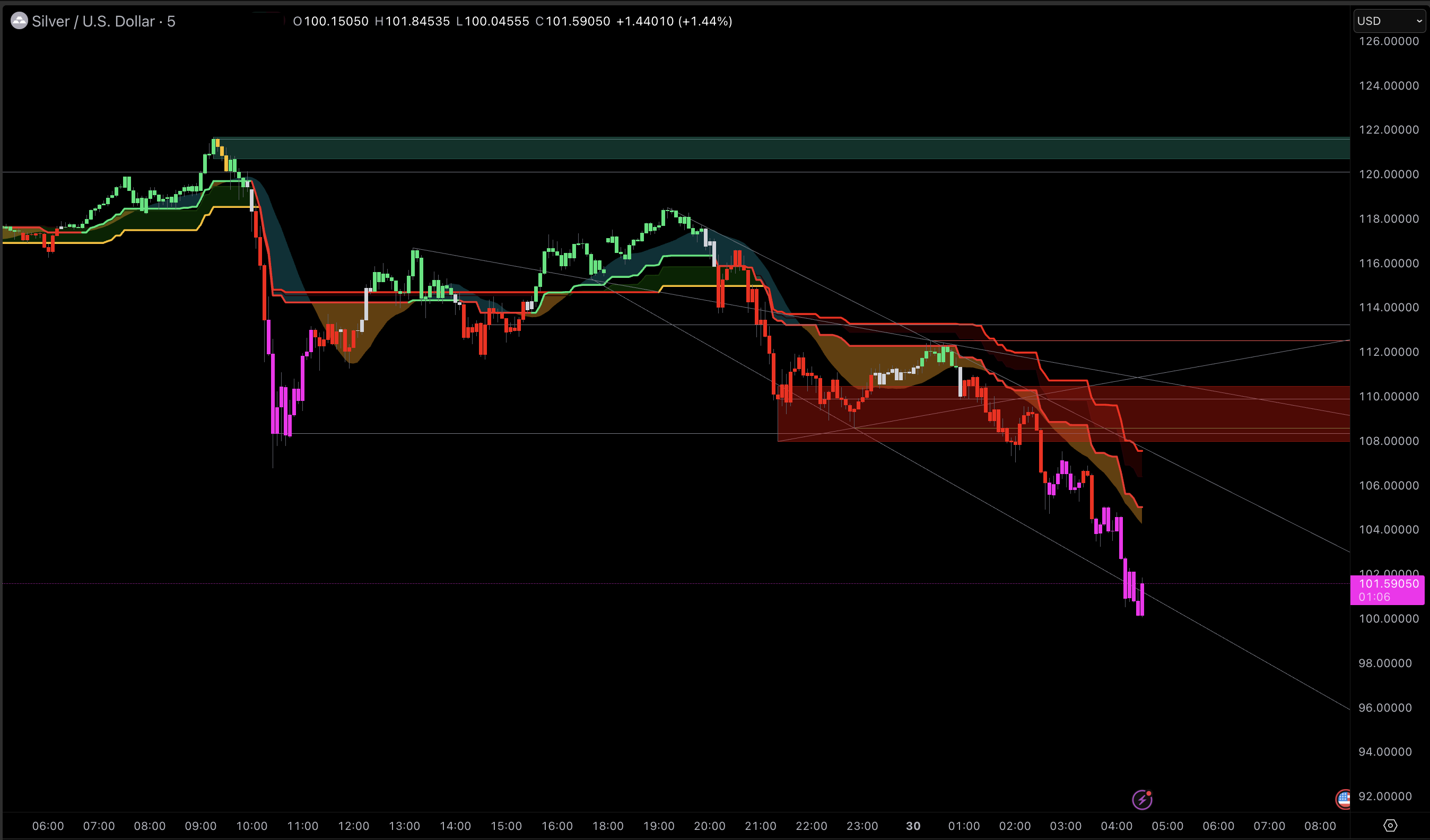

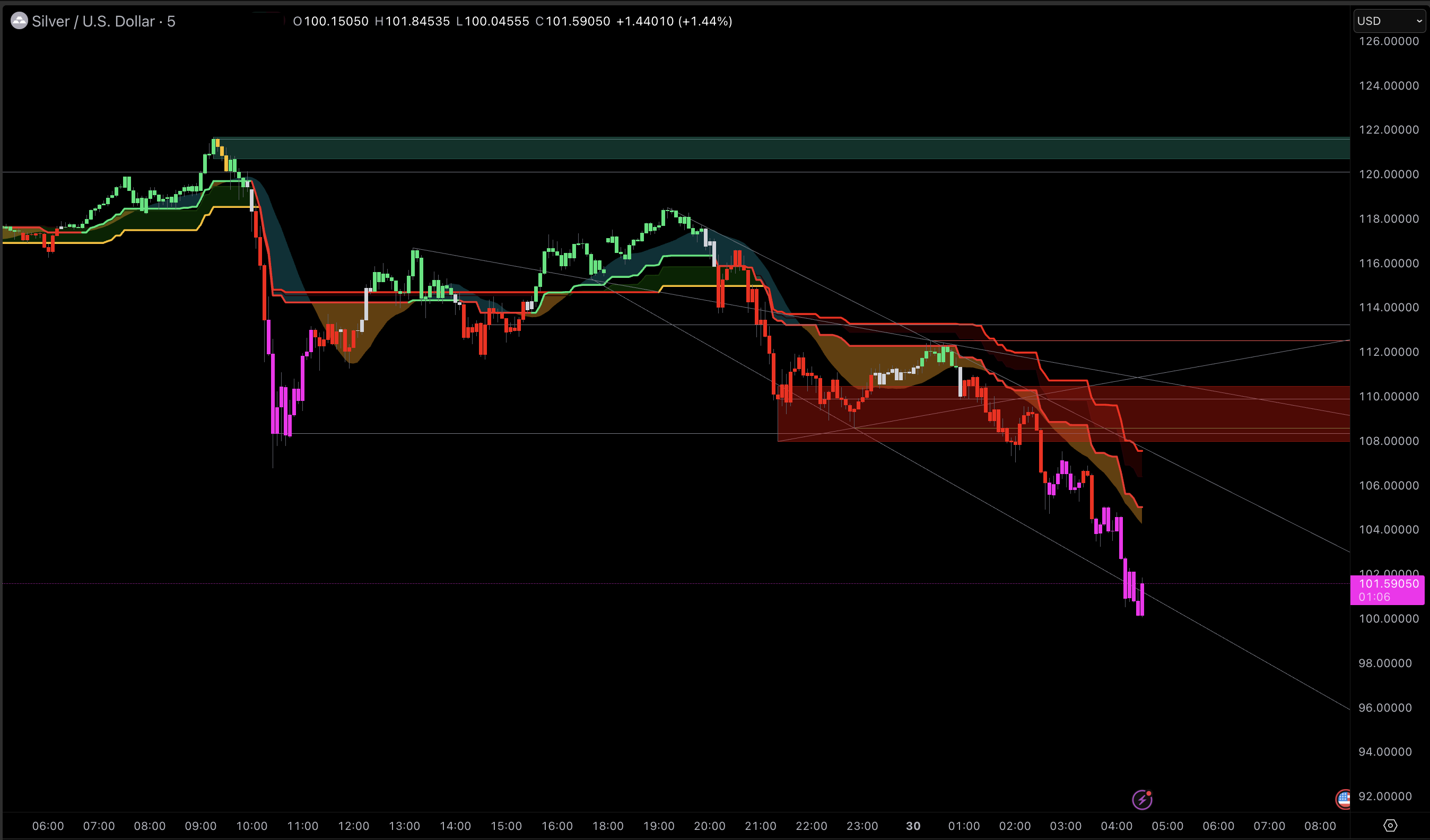

Silver Futures Technical Analysis Table (SIH6 snapshot)

| Indicator |

Reading |

Signal |

| RSI (14) |

29.583 |

Oversold risk |

| MACD (12,26) |

-2.353 |

Bearish |

| EMA 20 |

112.096 |

Price below |

| EMA 50 |

113.520 |

Price below |

| EMA 200 |

105.782 |

Price below |

| Support (Classic S1 / S2 / S3) |

104.635 / 102.290 / 99.965 |

Fragile downside zones |

| Resistance (Classic R1 / R2 / R3) |

109.305 / 111.630 / 113.975 |

Heavy overhead supply |

| Trend |

Down |

Trend followers aligned |

| Momentum |

Strongly negative |

Liquidation-prone |

Silver’s RSI below 30 is indicative of forced selling. Importantly, silver is trading below its 200-day exponential moving average in this snapshot, signaling a more significant technical breakdown than gold and contributing to the larger decline.

A Real-Yield Shock Plus A Positioning Unwind

Putting the pieces together, the best “most accurate reasons” for the drop are not exotic:

Real yields are high enough to compete with bullion. A near-1.90% real yield over the 10-year horizon is a meaningful alternative to holding a non-yielding asset.

Inflation expectations are not rising fast enough to offset nominal yields. With breakevens around 2.34%, the market is not granting gold an “inflation acceleration” premium at the moment.

The dollar is not providing relief. Elevated trade-weighted levels and a firm Dollar Index reading keep FX translation pressure in place.

Speculative positioning remains large, making momentum breaks costly. Gold and silver still carry sizeable net long positions among non-commercial traders.

Silver’s industrial beta is being repriced. The metal is responding not just to rates, but to a tightening of financial conditions that hits cyclical demand expectations first.

The current environment can be characterized as tightening without panic. Financial conditions have become restrictive enough to penalize assets with negative carry, but not to the extent that they generate a strong flight-to-safety response. Under these circumstances, metals may decline even if their long-term investment case remains valid.

Frequently Asked Questions (FAQ)

1) Why do higher interest rates push gold and silver down?

Higher rates increase the opportunity cost of holding non-yielding assets. When real yields rise, investors can earn more inflation-adjusted returns in bonds or cash, which forces gold and silver to reprice lower unless another catalyst offsets the carry disadvantage.

2) What is the relationship between the US dollar and precious metals?

Because gold and silver are priced in US dollars, a firmer dollar reduces buying power for non-US investors and can weaken demand at the margin. Even without a surge, an elevated dollar backdrop can cap rebounds when prices are already high.

3) Why is silver more volatile than gold during selloffs?

Silver has a smaller market, higher volatility, and a significant industrial demand component. In tightening episodes, markets often discount cyclical demand and enforce risk limits more quickly, leading to steeper drawdowns and more liquidation-driven price action than in gold.

4) Are gold and silver “oversold” right now?

Silver looks technically oversold with an RSI near 29.6, while gold is weak but less extreme with an RSI near 33.5. Oversold conditions can support short-term bounces, but sustained recoveries usually require stabilization in yields, the dollar, or positioning.

5) Does futures positioning matter for spot prices?

Yes. Futures often set the marginal price, especially during fast moves. When non-commercial net longs are large, a momentum break can trigger systematic selling and margin-driven liquidation, quickly spreading to both futures and spot-linked pricing.

Conclusion

The decline in precious metals is most accurately interpreted as a correction driven by interest rates and the US dollar, further intensified by positioning and technical factors. With the 10-year yield at approximately 4.26% and real yields near 1.90%, investors have a viable real-return alternative to bullion. Meanwhile, inflation expectations around 2.34% are insufficient to offset the adjustment in gold and silver prices.

Gold is acting as a monetary asset, adjusting to higher real yields, whereas silver is responding as a leveraged monetary asset with additional cyclical risk, leading to a steeper decline. Technical indicators confirm a momentum break, and positioning data elucidates the rapidity of the selloff beyond what fundamentals alone would predict. In the near term, stabilization of real yields and a less volatile US dollar are essential to establishing a durable price base.

Sources:

The current divergence captures that dynamic well:

The current divergence captures that dynamic well: