Gold has the potential to reach $4.000 by mid-2026. driven by economic uncertainty, central bank buying, and strong investor demand.

Gold as a Barometer of Emotion

The term XAUUSD sentiment captures more than just price chatter—it reflects the collective psyche of global traders, investors, and policymakers. In September 2025. this sentiment has taken centre stage, with gold becoming a canvas for fears, hopes, and geopolitical unease.

The Current Mood: Fear, Doubt, and Record Highs

Gold is trading near $3.646.84 per ounce, having surged over 38% year-to-date. The mood is unmistakably bullish—but tinged with anxiety. Investors find themselves straddling expectations of Fed rate cuts, soaring inflation, and central bank credibility crises. In essence, XAUUSD sentiment is bullish—but nervous.

Fed Independence Under Fire – The Spark Behind the Sentiment

Political interference poses a direct threat to the Federal Reserve's autonomy. President Trump's attacks on Fed leadership—and even attempts to remove Governor Lisa Cook—have rocked investor confidence.

Goldman Sachs, in a particularly striking warning, forecasts that a mere 1% shift in U.S. Treasury holdings into gold could propel prices toward $5.000 per ounce, should Fed credibility truly falter. Their base case projects a rise to $4.000 by mid-2026. with a "tail-risk" scenario reaching $4.500. This threat to central bank independence has become the emotional fulcrum for today's gold rally.

Sentiment Indicators to Watch

| Indicator |

Current Reading |

What It Suggests |

| COT Reports |

Hedge funds heavily long, retail mixed |

Institutional confidence in continued rally |

| ETF Flows (SPDR Gold Trust) |

~991 tonnes, multi-year high |

Robust inflows signal bullish sentiment |

| RSI (Daily) |

Overbought (>70) |

Risk of short-term correction |

| OANDA Positioning |

~68% long vs 32% short |

Retail skew towards bullish side |

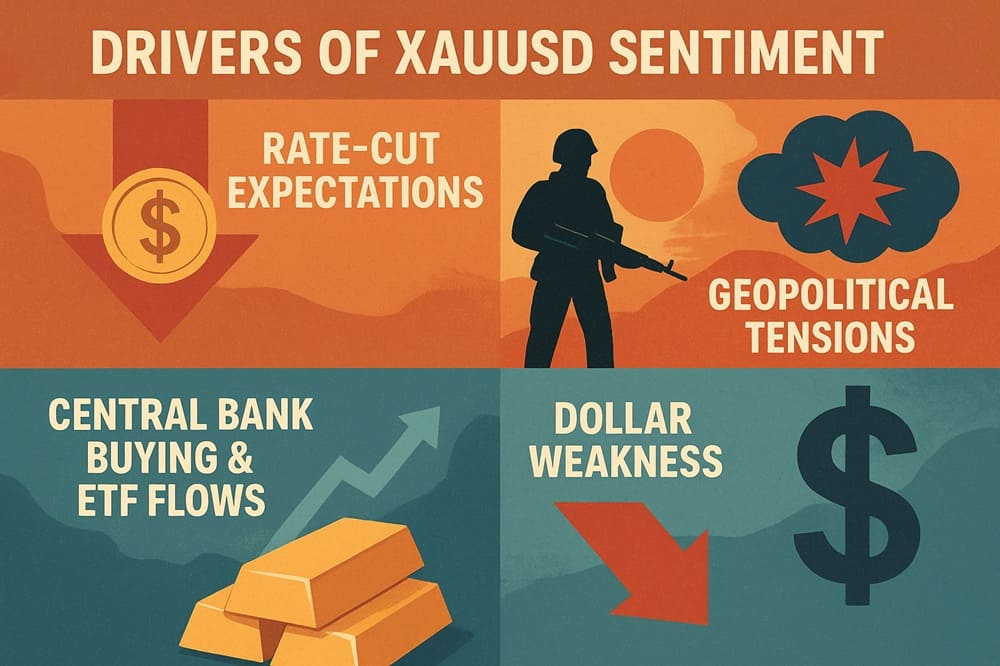

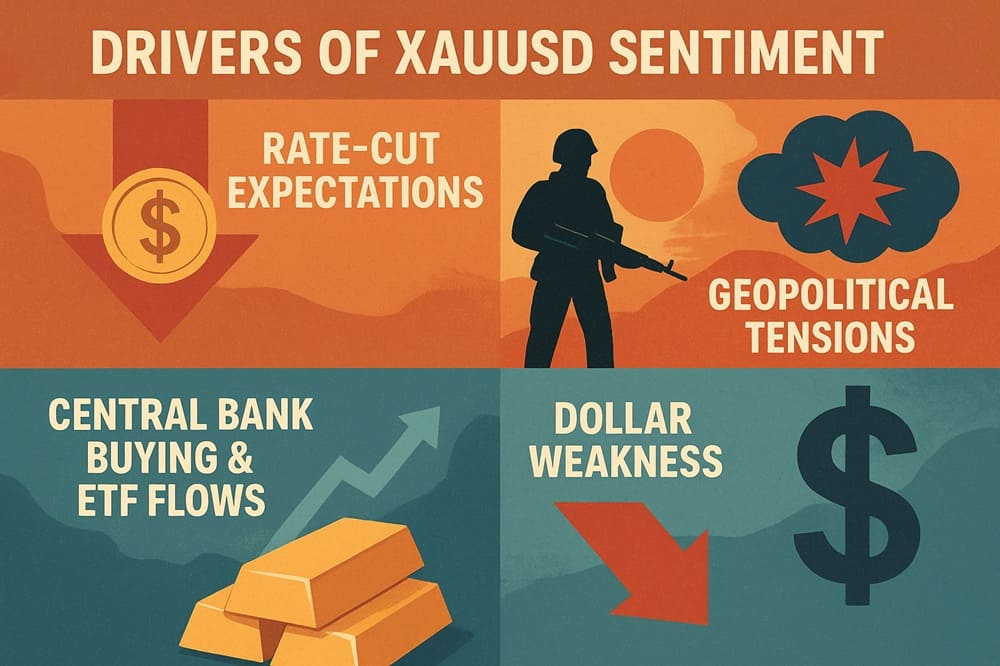

Beyond the Fed: Other Drivers of XAUUSD Sentiment

1) Rate-cut expectations:

Weak U.S. jobs data and rising unemployment—now at a near four-year high of 4.3%—have significantly bolstered bets on imminent easing.

2) Geopolitical tensions:

Heightened conflicts across the Middle East and Ukraine continue to stoke safe-haven demand.

3) Central Bank Buying & ETF Flows:

Institutional demand, especially from China, remains robust—gold ETFs like SPDR Gold Trust are seeing record inflows, with holdings nearing 991 tonnes.

4) Dollar weakness:

The U.S. dollar has declined nearly 11% since Trump's return—a tailwind for gold pricing.

Key Drivers of XAUUSD Sentiment (September 2025)

| Factor |

Current Status |

Sentiment Impact |

| Fed Independence Concerns |

Political interference; Trump criticises policymakers; attempt to oust Lisa Cook |

Strongly bullish (loss of trust in fiat / institutions) |

| Rate-Cut Expectations |

Markets pricing 50–75 bps cut in September |

Bullish (lower yields, weaker USD) |

| U.S. Jobs Market |

Unemployment at 4.3%, highest since 2021 |

Bullish (signals economic slowdown) |

| Dollar Performance |

USD Index down ~11% YTD |

Bullish (gold priced higher vs weaker dollar) |

| Geopolitical Tensions |

Escalations in Middle East & Ukraine |

Bullish (safe-haven demand) |

| Central Bank Buying |

China, India, and Turkey increasing reserves |

Bullish (structural demand support) |

Tools to Track Sentiment in Real Time

Commitment of Traders (COT) reports reveal how institutional positions stack up against retail sentiment.

Sentiment dashboards, such as those on goldprice.org and Investing.com, show real-time long vs short ratios.

Social chatter—forums and trading communities reveal spikes of fear and greed, often before they appear in data.

These tools allow traders to peer beyond charts into the emotional drivers behind XAUUSD sentiment.

Sentiment vs Reality: Where Psychology Meets Resistance

Technically, gold has broken past key resistance near $3.650. riding high on momentum.

Yet, caution is warranted. Indicators such as the RSI signal an overbought landscape—market psychology suggests traders will keep buying dips even as technical warning signs accumulate. This tug-of-war between bullish conviction and technical caution defines today's XAUUSD sentiment.

Outlook – Mapping Possible Sentiment Shifts

Bullish Continuation: If Fed pressure persists, gold's sentiment may stay buoyant, nudging toward $4.000 and beyond.

Extreme Rally: In a dramatic erosion of Fed independence, prices could surge toward $5.000 under a flight-to-safety scenario.

Correction Risk: Should policy stabilise, if geopolitical tensions ease, or if fundamentals soften, sentiment could reverse—pulling gold back toward the $3.500–$3.600 range.

Gold Price Milestones & Projections

| Scenario |

Price Target |

Basis |

| Current Level |

$3,674/oz |

Record high (9 Sept 2025) |

| Base Case |

$4,000 by mid-2026 |

Rate cuts + continued geopolitical risk |

| Upside Risk |

$4,500 |

Stronger institutional flows + persistent Fed interference |

| Extreme Case |

$5,000 |

1% shift from U.S. Treasuries to gold (Goldman Sachs estimate) |

Conclusion – Trading Gold Through the Lens of Sentiment

At its core, XAUUSD sentiment is today's invisible driving force. While fundamentals and charts remain essential, sentiment reveals the emotional undertow that powers volatility and extremes.

Traders must learn to read the mood, not just the metrics—because sentiment, more than supply or rates, often dictates gold's most dramatic moves.

Frequently Asked Questions (FAQ)

1. Why is XAU/USD sentiment so important?

Because sentiment reveals how traders feel about economic data, politics, and risk. It explains sudden spikes and reversals better than charts alone. Ignoring sentiment often means missing the emotional forces driving the market.

2. Is gold being manipulated?

Many traders believe gold is prone to manipulation because of sudden reversals and stop hunts. However, most of these moves can be explained by crowded positions and market psychology. Volatility is natural in XAU/USD, and not every sharp move is artificial.

3. Could gold realistically reach $5.000?

Analysts disagree. Some institutions argue it is possible if Federal Reserve independence is compromised and trust in fiat currencies collapses. A more conservative outlook places gold between $4.000 and $4.500 over the coming years. $5.000 is extreme, but not impossible in a worst-case scenario.

4. How do I use sentiment in trading XAU/USD?

Use sentiment as a filter alongside fundamentals and technicals. If charts show a breakout, check whether sentiment supports the move. If fundamentals suggest weakness but sentiment is euphoric, expect volatility. Sentiment is not a signal on its own, but a context tool that helps you judge risk.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.