How Geopolitics and Central Banks Are Driving Gold Higher

Gold breaking above 4,000 dollars an ounce in October 2025. and briefly pushing beyond 4,200 is more than just another bull run. It is a visible symptom of a world reshaped by tariff wars, sanctions, record central bank gold buying and recurring doubts about monetary and geopolitical stability.

By late October 2025, gold had gained roughly 60 percent year to date, its strongest performance since the late 1970s. This surge is not only about inflation worries or short term Federal Reserve expectations. It reflects a deeper shift in how governments, investors and central banks think about money, power and security.

Gold has moved from being a simple portfolio hedge to a strategic reserve asset sitting right at the intersection of geopolitics, sanctions policy and global reserves.

Key takeaways

Gold above 4,000 dollars an ounce signals a new price regime, not just a short term spike.

Central banks have become the most important structural buyers, adding over 3,000 tonnes in three years.

Trade wars, sanctions and conflicts have created a persistent geopolitical premium in the gold price.

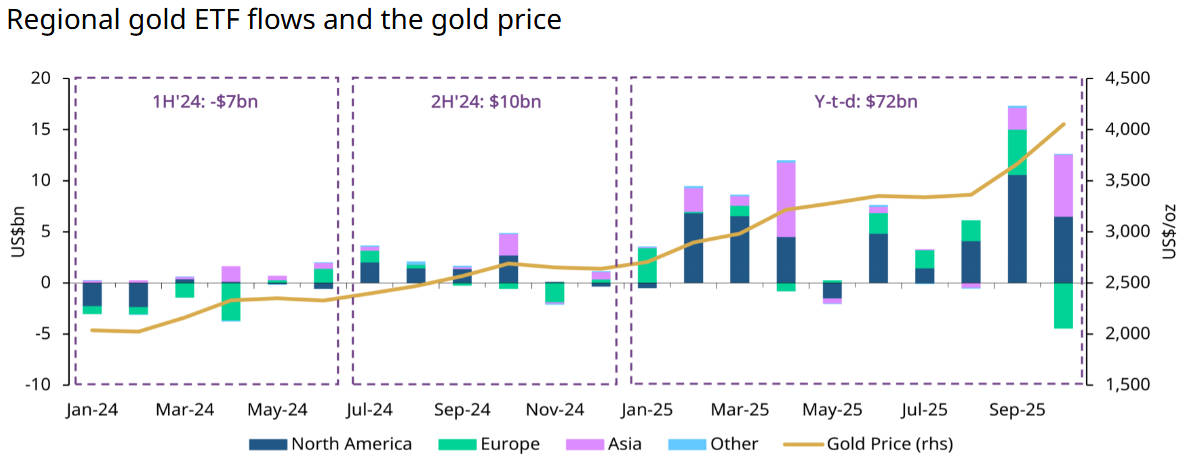

Investor flows into ETFs and futures are amplifying the move, turning macro and political fear into record prices.

Over the next 12–24 months, the outlook will hinge on central bank buying, tariffs and sanctions, real yields and ETF flows.

Gold in a new price regime: macro drivers behind the rally

The price action since 2024 shows that gold has likely shifted into a new regime rather than simply rallying within the old one.

In April 2024, as tensions in the Middle East escalated, gold briefly touched a then record near 2,430 dollars per ounce and barely paused to consolidate. By early 2025. it was setting fresh highs almost monthly, with an average price around 2,860 dollars in the first quarter – roughly 38 percent higher than a year earlier.

A new tariff wave from Washington in March and April 2025 pushed spot prices through 3,100 and 3,200 dollars and briefly towards 3,500 dollars per ounce, driven by safe haven demand and heavy exchange traded fund (ETF) inflows. By September 2025. prices were hovering near 3,700 dollars, up about 40 percent year to date and marking the steepest two year rise since the late 1970s.

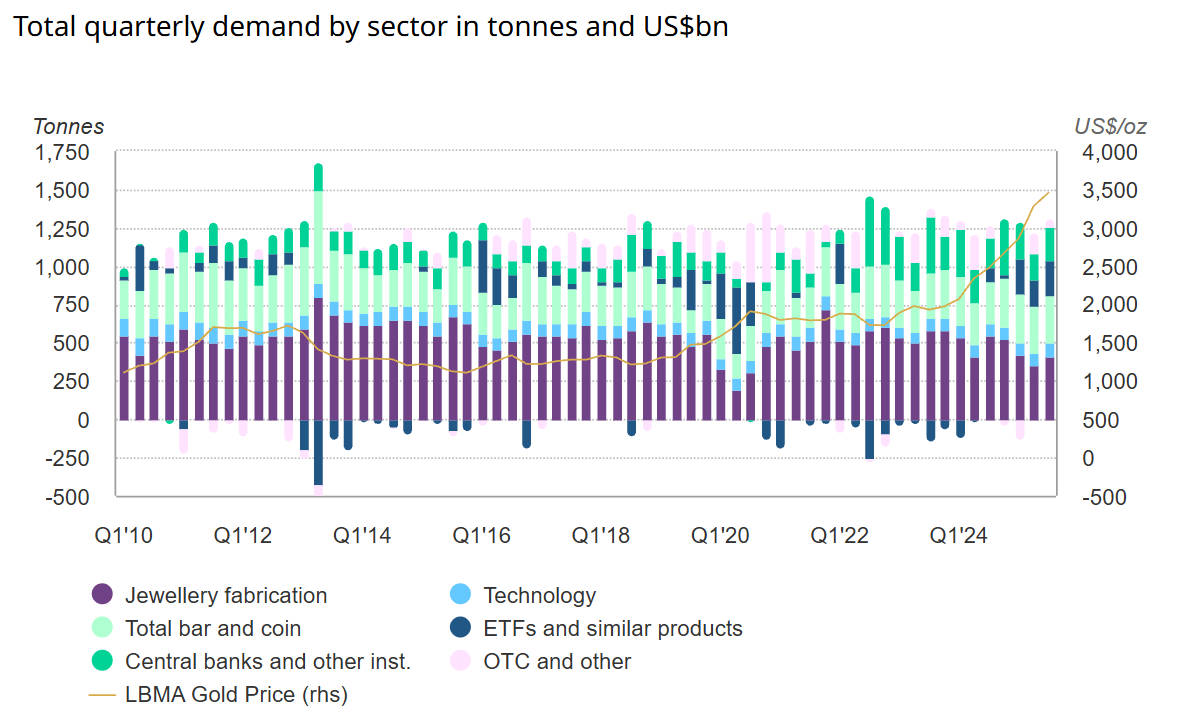

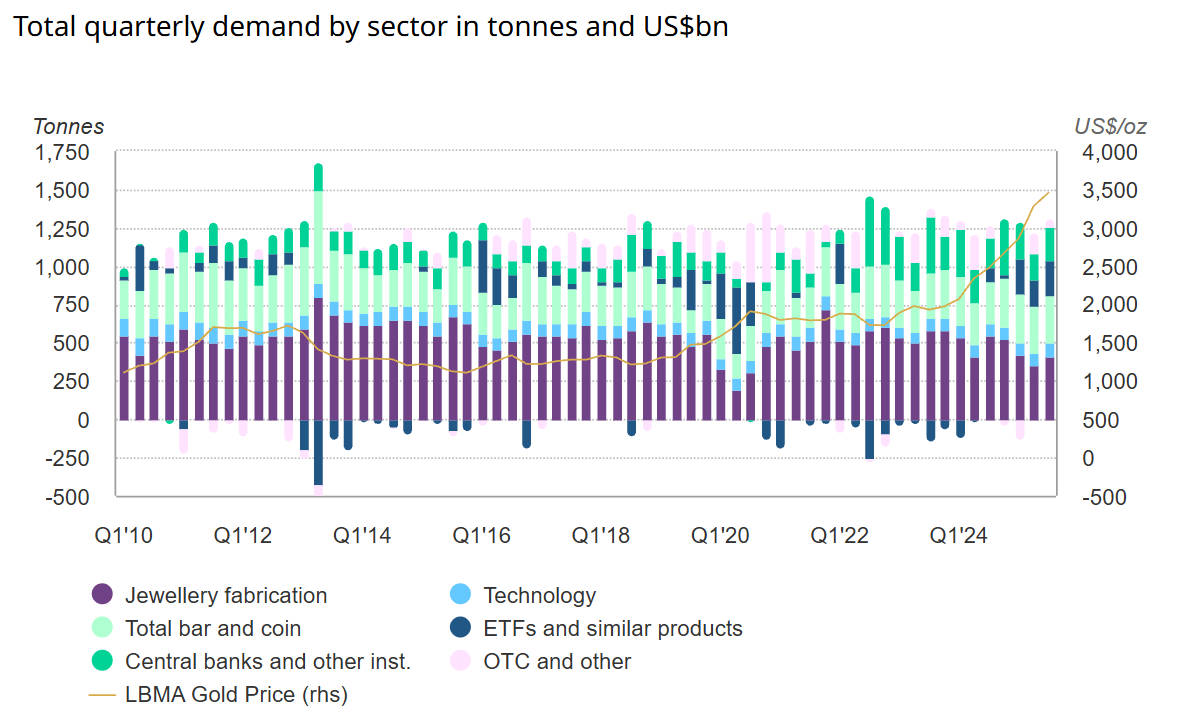

World Gold Council data show that in value terms, total gold demand in the second quarter of 2025 jumped about 45 percent year on year to roughly 132 billion dollars, even though volumes increased only modestly. That gap is classic "new regime" behaviour: prices are doing the heavy lifting.[1]

Three macro forces stand out:

Capped real interest rates High public debt levels make it politically and economically harder for major economies to run very restrictive monetary policy. Real interest rates are capped, and that supports non yielding assets like gold.

Gradual diversification away from the United States dollar The dollar still dominates global reserves and trade invoicing, but its share has drifted lower.

That encourages central banks and sovereign investors to diversify into alternative reserve assets, and gold is the oldest, most liquid neutral asset available.

Repeated growth scares and equity volatility The growth scares and equity sell offs of 2024 and 2025 have reinforced gold's role as portfolio insurance. Every spike in volatility and every whisper of recession has sent investors back into bullion and gold backed products.

Against this macro backdrop, the key difference in this cycle is who is buying.

Central bank gold buying: from marginal buyer to structural driver

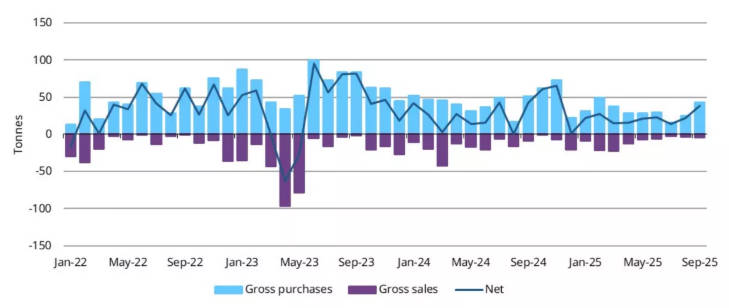

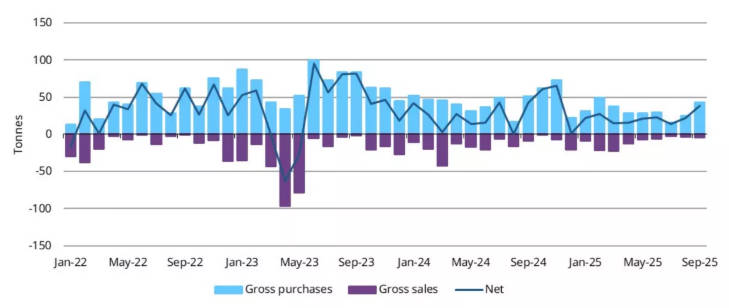

A three year official sector buying wave

Central banks have quietly become the most important marginal buyers of gold.

Between 2022 and 2024. they purchased more than 3,200 tonnes of bullion, a three year buying binge not seen since the 1960s. In 2022 alone, net official purchases reached about 1,136 tonnes, the highest annual figure in modern data. Central banks added another 1,037 tonnes in 2023 and around 1,045 tonnes in 2024. marking three consecutive years above the 1.000 tonne mark.

For context, global mine production in 2024 was roughly 3,661 tonnes, with total gold supply at about 4.974 tonnes. Central banks therefore absorbed around one fifth of new supply – more than double their average contribution a decade ago.

Global official gold holdings have climbed from about 26,000 tonnes in 2009 to around 32,000 tonnes in 2024. The top ten central banks hold more than three quarters of that stock.

By some estimates, gold now represents close to 20 percent of worldwide official reserve assets, making it the second largest reserve asset after the United States dollar and, in some calculations, putting it ahead of the euro.

Why central banks are rebuilding their gold reserves

This buying wave is not a random trade. It reflects a strategic reallocation.

World Gold Council surveys show that central banks increasingly see gold as:

A long term store of value and inflation hedge

A crisis performer that holds up in market stress

An effective portfolio diversifier that reduces reliance on a few major currencies

In a 2024 Central Bank Gold Reserves survey, 29 percent of respondents said they planned to increase their gold holdings over the following 12 months – the highest share since the survey began in 2018.

By 2025, about 44 percent of reserve managers reported that they now actively manage their gold books, with risk management, not just short term trading, as a key motive.

Academic and policy research backs this up: rising geopolitical risk has become a statistically significant driver of higher gold reserve shares. In plain language, the more uncertain the world looks, the more gold central banks want to hold.

A second, powerful driver is concern over the safety and neutrality of foreign currency reserves after Russia's invasion of Ukraine. Western sanctions in 2022 froze roughly half of Russia's foreign reserves, much of them held in dollars and euros.

That surprise event prompted many central banks to reconsider the legal and political risks of holding substantial reserves in the currencies of a small group of issuing countries, as well as keeping those assets under their jurisdiction.

Russia's own response has been to tilt its National Wealth Fund away from dollars and euros towards Chinese yuan and gold, with gold now making up more than 40 percent of its total reserves by value.

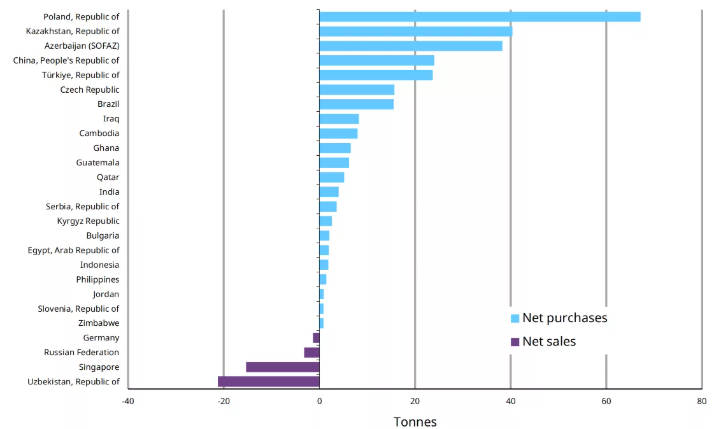

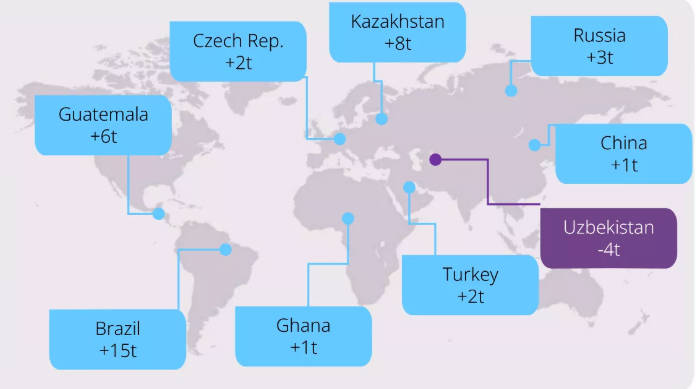

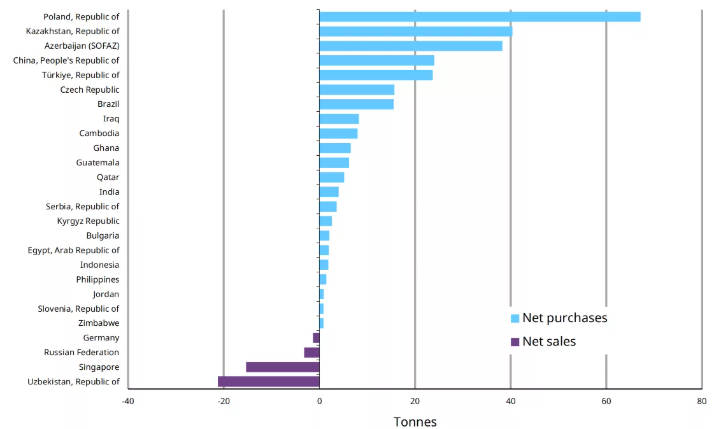

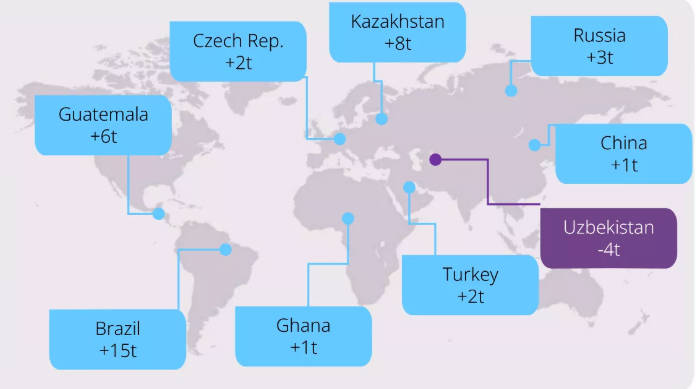

Other countries facing real or perceived sanctions risk, particularly in the emerging world, have followed a similar path, adding to their bullion holdings over time. Poland, Turkey, China and India have all ranked among the largest official buyers since 2022.

The big picture is clear: central banks are not simply chasing the price. They are building a larger, more permanent allocation to an asset that is neutral, highly liquid and less vulnerable to sanctions, freezes and currency debasement.

Geopolitical risks: why gold now carries a persistent premium

The other leg of this rally is geopolitics.

In 2024. gold set successive records as the conflict in Gaza escalated and tensions between Iran and Israel intensified. Prices briefly touched around 2.430 dollars in April as investors shifted into safe haven assets despite still strong United States economic data.

In 2025, attention swung back to great power rivalry:

A series of tariff announcements and counter measures between Washington and Beijing turned what had been a trade skirmish into a full blown tariff war.

Each escalation showed up almost instantly in the gold market. When China retaliated against new United States duties in early February, spot prices jumped to a then record near 2.858 dollars per ounce.

By late March and mid April, as tariffs widened and stagflation fears grew, gold surged beyond 3.100 and 3.200 dollars, rising more than 20 percent in less than four months.

The World Gold Council notes that in the first quarter of 2025, the average gold price climbed about 38 percent year on year, with key drivers including the threat of further United States tariffs, geopolitical uncertainty, equity volatility and a weaker dollar.

By the third quarter, its Gold Demand Trends report described a record quarter for demand, powered by safe haven buying and fear of missing out as gold repeatedly broke to new highs.[2]

European policy institutes reach similar conclusions. Analytical work on "record gold prices in a world in upheaval" links the 2025 surge to a combination of:

The continuing war in Ukraine

Persistent Middle East tensions

Rising doubts about global leadership and the stability of the rules based order

European Central Bank research likewise finds that official sector gold demand is heavily shaped by geopolitical risk, with bullion held as a hedge against both financial and political shocks.

The outcome is a structural geopolitical premium:

Each new flashpoint brings short term safe haven flows.

At the same time, it reinforces the longer term decision by central banks and sovereign funds to hold more gold and fewer potentially vulnerable foreign currency assets.

That combination makes geopolitical events a central, enduring driver of the gold price.

Investor flows and trader sentiment: how positioning amplifies the move

While geopolitics and central banks set the backdrop, private investors and traders have turned the gold rally into a powerful trend.

ETF inflows and investment demand

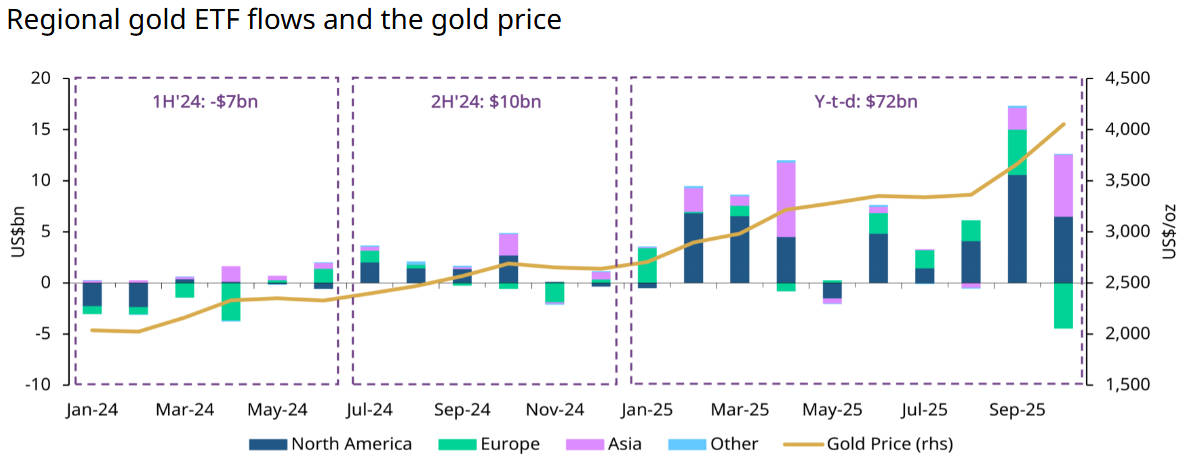

Gold ETFs, which allow investors to hold gold exposure in a liquid, exchange traded format, have seen big inflows:

In the first half of 2025. physically backed gold ETFs recorded their largest semi annual inflow since early 2020. taking in around 38 billion dollars and roughly 397 tonnes of gold.

A single month April 2025 saw ETF holdings jump by more than 115 tonnes as prices raced toward 3.500 dollars per ounce, driven heavily by China listed funds reacting to tariff headlines.

Wider investment demand has mirrored that pattern:

The value of gold investment demand (ETFs, bars and coins) surged nearly 80 percent year on year in the second quarter of 2025.

At the same time, jewelry demand in 2024 weakened under the weight of higher prices.

That rotation from jewelry to investment demand is classic late stage bull market behaviour and underscores the point that prices are increasingly set at the margin by investors and official buyers, not end consumers.

Futures positioning and regional trends

Futures data tell a similar story. On COMEX, net long positions held by hedge funds and other large speculators sit roughly in the 70th-plus percentile versus the last decade. That suggests:

There is also a growing regional dimension:

Asian investors, via both ETFs and physical demand, have played a rising role.

In the first half of 2025, Asia based gold ETFs accounted for nearly one third of net global inflows despite representing less than a tenth of worldwide ETF assets under management.

Indian gold ETFs, for example, increased their holdings by more than 40 percent year on year by mid 2025.

This broadening investor base makes the gold market less reliant on any single region's sentiment, and it adds another layer of resilience to the bull story.

Gold market outlook: what to watch in 2025–2026

The key question now is whether this is a blow off phase or a consolidation of a higher equilibrium for gold.

Major banks and institutions are divided:

Some houses see scope for gold to reach 5,000 dollars an ounce by the first half of 2026, citing ongoing geopolitical tensions, sustained central bank buying, ETF inflows and expectations of further United States rate cuts.

Others forecast more moderate gains but still expect prices to average well above 3,500 dollars into 2026.

A growing minority of analysts think gold could dip back below 4,000 dollars as policy uncertainty clears and trade tensions ease, at least temporarily. That would not erase the structural story but would imply higher volatility around a raised floor.

For investors, four signposts matter most over the next 12 to 24 months.

1. Central bank buying patterns

Watch whether annual official sector purchases remain near or above the 1,000 tonne mark. Survey evidence suggests that a very large majority of central bankers expect global official gold holdings to continue rising.

If that proves correct, it creates a persistent, price insensitive source of demand that can help anchor gold at higher levels.

2. The tariff and sanctions cycle

The trajectory of trade policy and sanctions will shape the geopolitical premium in gold:

De-escalation in the United States–China trade conflict or a durable peace framework in Ukraine would likely reduce safe haven demand and could trigger corrective phases.

Renewed tariff rounds, broader export controls or wider financial sanctions would reinforce the case for gold as a reserve asset and portfolio hedge.

For investors, tracking major trade announcements, sanctions packages and diplomatic breakthroughs is crucial.

3. Real interest rates and fiscal credibility

Gold typically struggles when:

Real yields rise decisively, and

Investors believe public debt trajectories are sustainable and under control.

At present, markets remain skeptical that advanced economies can deliver both tighter monetary policy and credible fiscal consolidation. That skepticism supports gold.

A genuine shift to higher real rates combined with convincing fiscal reforms in key economies would be a major risk to the bullish thesis.

4. Investor positioning and ETF flows

Record inflows into gold ETFs and elevated speculative long positions can leave the market vulnerable to sharp pullbacks when the news cycle turns.

Monitoring:

can provide early warnings of exhaustion or reversal, just as they flagged the current bull phase.

Frequently Asked Questions

Q1: Why are central banks buying so much gold now?

Central banks are buying gold to diversify away from concentrated exposure to the dollar and euro, to hedge against inflation and currency debasement and to reduce the legal and political risks highlighted by the freezing of Russian reserves in 2022. Gold is a neutral, sanction resistant asset that can be held outside the control of any single foreign government.

Q2: How do trade wars and sanctions affect the gold price?

Tariff wars and sanctions create uncertainty about growth, trade flows and the stability of the global financial system. That uncertainty pushes investors towards safe haven assets like gold in the short term and encourages central banks to increase their long term allocations to bullion.

Q3: Is gold still just an inflation hedge?

Gold does respond to inflation expectations, but in the current cycle it is much more than an inflation hedge. It is a hedge against geopolitical fragmentation, sanctions risk and doubts about central bank independence and fiscal credibility. Those structural forces have been at least as important as inflation itself.

Q4: Could gold prices fall sharply from here?

Yes. If real interest rates rise, trade tensions ease, sanctions risks recede or ETF flows reverse, gold could correct, potentially falling back below 4,000 dollars an ounce. However, as long as central banks keep buying and geopolitical risk remains elevated, many analysts believe the long term floor for gold is now significantly higher than in past cycles.

Conclusion

Gold's latest surge is best understood not as a simple inflation trade, but as a response to a world where economic power is fragmenting, sanctions risk has become central to reserve management and investors are searching for assets that sit outside any single country's legal or political reach.

As long as that world persists, geopolitics and central banks will remain at the heart of the gold story. The task for investors is to track those structural forces, separate them from short term noise and decide how much of their portfolio they want to anchor in the one asset that has repeatedly bridged the gap between money and power: gold.

Sources:

[1] https://www.gold.org/goldhub/gold-focus/2025/11/central-bank-gold-statistics-september-2025

[2] https://www.gold.org/goldhub/research/gold-demand-trends/us-gold-demand-trends-q3-2025

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.