Market volatility can be a double-edged sword. While frequent price swings pose risk, they also offer lucrative opportunities, but only to traders who know how to manage them.

By focusing on the most volatile stocks, traders can prepare for unexpected moves, manage risk, and potentially capture outsized returns.

This article spotlights eight high‑volatility equities dominating headlines and order books today, explores why they move so much, and explains how skilled traders can navigate them.

What Makes a Stock "Volatile"?

Volatility measures how much and how quickly a stock's price changes. Highly volatile stocks often see wide intraday swings and sharp one-day gains or losses.

Market chatter, speculative enthusiasm, earnings surprises, and shifting fundamentals can all spark volatility. Periods of broader market instability, such as April's trade-war-driven crash and renewed geopolitical uncertainty, often spotlight high-beta names.

Looking beyond single-day pumps, consistent technical metrics such as beta and implied volatility across options provide early clues to upcoming fluctuations. By monitoring these signs, traders can prepare for volatile environments and either exploit them or steer clear.

8 Most Volatile Stocks Today for High-Risk, High-Reward

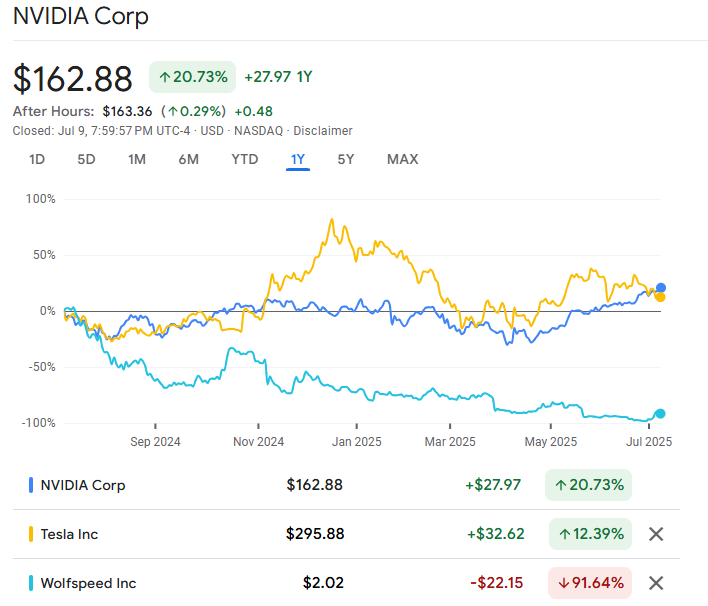

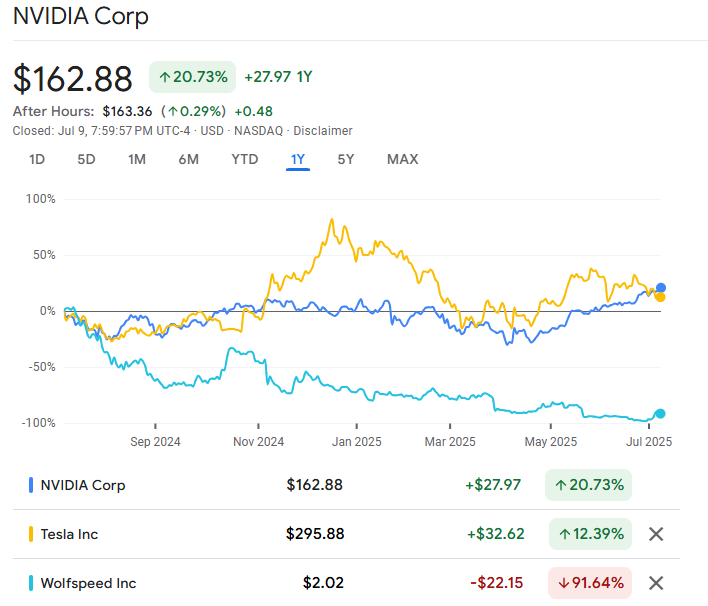

1. Nvidia (NVDA)

Nvidia has transformed from a gaming chip specialist into a global powerhouse in artificial intelligence, securing its place as the first company to exceed a $4 trillion market capitalisation. That milestone, achieved in early July, follows a year where shares surged nearly 300% as AI infrastructure boomed.

Due to this momentum, Nvidia experiences significant fluctuations, twice as much as anticipated by Nvidia's high valuation and the likelihood of swift profit-taking. Traders involved with NVDA focus on earnings surpassals, updates on chip supply, and overarching AI trends to predict significant movements.

Strategy: Employ momentum trading or pullback entry strategies during earnings periods or AI-related news releases. Maintain small position sizes because of significant daily fluctuations. Perfect for swing traders with a technology emphasis. Employ strict stop-loss limits and closely observe macro AI sentiment.

2. Tesla (TSLA)

Tesla's volatility stems from its tight trading range and the unpredictable influence of Elon Musk. The stock plunged nearly 7% in pre-market trading after Musk announced the formation of a new political party.

Such events push Tesla's price in dramatic directions, making it both a magnet and a minefield for active traders. Tesla's unique combination of high beta and high public visibility ensures near-daily headlines that spark trading opportunities.

Strategy: Trade around news catalysts such as earnings, product launches, or Elon Musk's statements. Utilise options trading (purchasing calls/puts) to mitigate risk. Short-term traders can utilise rapid sentiment shifts, but should remain nimble.

3. Plug Power (PLUG)

Plug Power ranks among the most volatile US equities, with daily price changes of +25% or more and elevated beta. These swings reflect its small‑cap status, capacity for energy sector earnings surprises, and interest from speculative traders.

High implied volatility in its options also highlights the swings available for swing and options traders prepared to manage unpredictability.

Strategy: Buy during oversold technical levels with reversal confirmation. Watch for government green energy stimulus news. Pair trades with trailing stops and watch sector peers like Bloom Energy or FuelCell Energy for correlation signals.

4. Wolfspeed (WOLF)

Wolfspeed experiences daily fluctuations around 30%, a hallmark feature of speculative materials stocks. As part of the broader semiconductor cycle, its fortunes hinge on macro demand trends, EV and renewable energy investments, and capacity expansions.

Short-term traders track production updates and sector chatter to position for sharp intraday spikes or slides.

Strategy: Enter on breakouts from consolidation zones supported by volume. Use trend-following indicators like EMA crossovers. Avoid holding through earnings unless hedged. This one suits swing traders focused on the semiconductor industry.

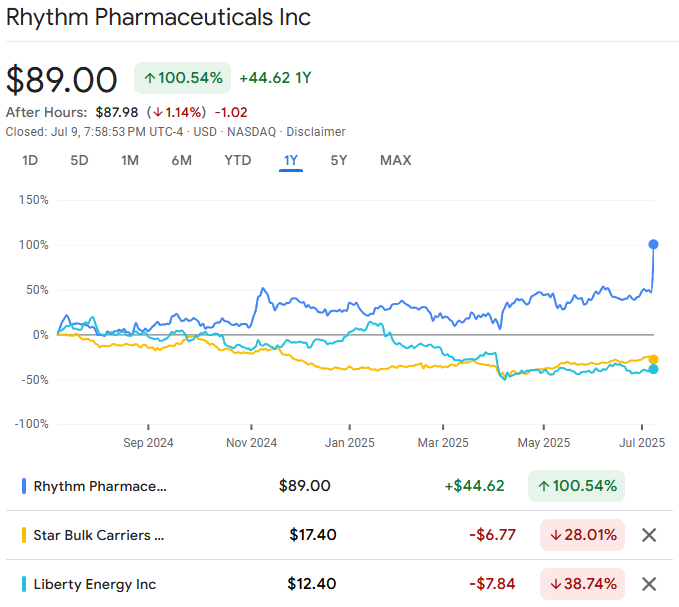

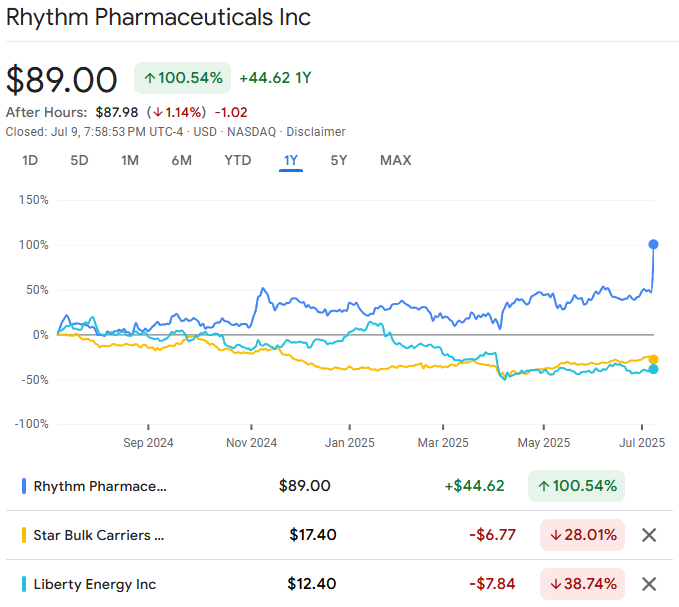

5. Rhythm Pharmaceuticals (RYTM)

RYTM, a small‑cap biotech with a recent 32% rally, typifies biotech volatility. These spikes frequently occur before trial results or FDA decisions, subsequently followed by equally strong downturns. Traders must grasp the event calendar to either capitalise on the excitement or counter the news.

Strategy: Focus on FDA approval calendars and phase data timelines. Enter pre-announcement with options or after confirmation if the trend is strong. Use risk capital only—biotech can swing 30%+ in either direction on trial results.

6. Star Bulk Carriers (SBLK)

Despite being in the blue-collar maritime sector, SBLK has exhibited significant monthly fluctuations, positioning it as the current leader in mid-cap volatility.

Its profits rely significantly on freight demand and changing global trade, resulting in large fluctuations when major data releases or OPEC statements influence marine transport.

Strategy: Engage in trading based on macroeconomic developments like port congestion or changes in the Baltic Dry Index. Entry timing should align with earnings guidance or dividend news. Income investors may hold short-term for dividend plays, while traders can ride the shipping cycle swings.

7. Agios Pharmaceuticals (AGIO)

A biotech investment, such as RYTM, AGIO, offers significant potential gains from trial developments. With a beta of 1.78 and frequent spikes around pipeline news, AGIO remains a volatile stock that demands specialised event-driven strategies.

Strategy: Use catalyst-based trading, focusing on drug trial phases or acquisition rumours. Long on confirmed success; short or hedge into major medical conferences. Monitor peer movements in oncology and rare disease treatment sectors.

8. Liberty Energy (LBRT)

LBRT, a mid-cap energy services provider, features a beta of 1.28 and sharp daily swings in line with oil prices. Traders here anticipate volatility around crude announcements, OPEC news, and broader energy demand dynamics.

Strategy: Use commodity-linked trading setups—track oil prices, EIA inventory reports, and OPEC decisions. Look for a correlation between WTI crude and LBRT stock. Evaluate sector rotation tactics during energy upswings or declines.

Why Trade the Most Volatile Stocks?

Highly volatile stocks present an exciting mix of potential. Traders willing to accept higher drawdowns can tap into large intraday gains. During fragmented markets such as recent tariff cycles, volatility has surged, making high-beta names attractive for active strategies.

Beyond speculation, volatility can improve a portfolio's Sharpe ratio when used with risk controls. But traders must remain disciplined—volatility magnifies mistakes as well as gains.

Tips to Maximise Reward While Limiting Risk

For all their excitement, high‑volatility stocks demand robust planning. Traders should define risk upfront, use stop-loss discipline, and consider scaling out if rallies form.

Position sizing should vary with volatility. Allocating 1%–2% of account equity per trade is common in stable names. For ultra-volatile stocks, 0.25% to 0.5% may be more prudent.

Spreading investments across different beta tiers can avoid a single poor trade from damaging overall results. Pairing a speculative biotech with more stable assets provides cushioning during unexpected biotech failures or market rotations.

Conclusion

In conclusion, Volatile stocks like Nvidia, Tesla, Plug Power, Wolfspeed, and biotech names deliver both promise and peril. For disciplined traders, they offer quick returns and strategic diversification.

But without careful entry criteria, robust risk management, and awareness of event risks, they can erode capital rapidly.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.