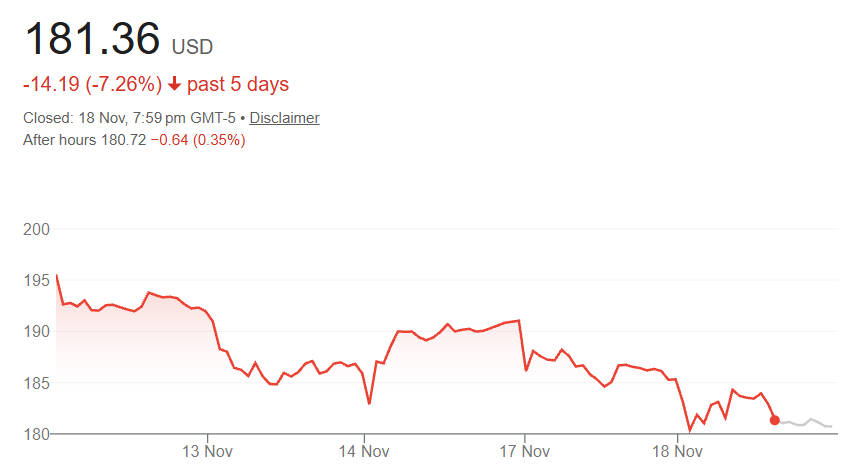

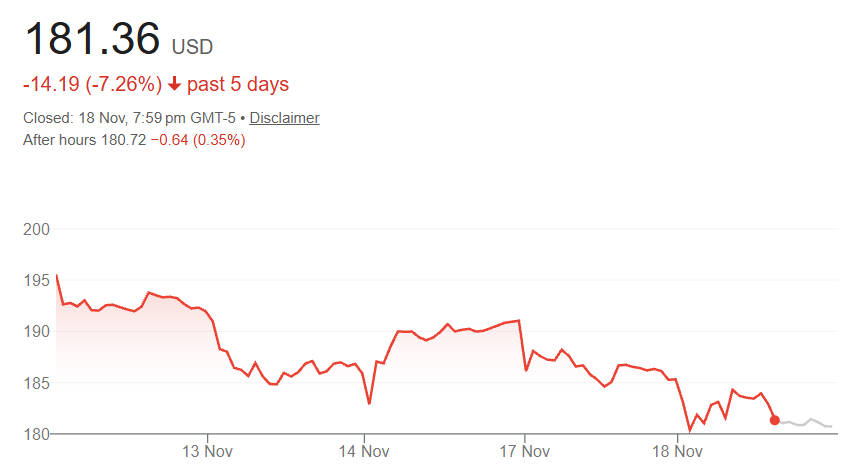

Nvidia is on the verge of what could be its largest-ever one-day post-earnings market-value swing. Options-market data suggest that traders are pricing in a roughly 7% move in either direction after the company's earnings release.

At Nvidia's current valuation of roughly US$4.6 trillion, such a move would translate into an estimated US$320 billion swing in market capitalisation. This degree of implied volatility highlights just how pivotal Nvidia remains in shaping investment narratives surrounding AI infrastructure.

Expected Earnings and Their Significance for the AI Growth Narrative

1. Analyst Projections

Analysts widely anticipate robust top-line growth: consensus estimates place Q3 FY2026 revenue around US$54.8 – 54.9 billion, representing a year-over-year increase of approximately 56%.

On the profitability side, adjusted earnings per share (EPS) are forecast at US$1.24–1.25. up ~54% from the prior year.

2. Key Driver: Data-Centre Segment

Much of the expected revenue strength is rooted in Nvidia's data-centre business, particularly its Blackwell architecture. According to forecasts, the data-centre segment could account for the vast majority of Q3 revenue, driven by continued capex from large cloud service providers and enterprises.

This aligns with Nvidia's own prior disclosures: in Q2 FY2026. the company reported US$41.1 billion in data-centre revenue, up 56% year-over-year, with Blackwell-based data-centre sales increasing 17% sequentially.[1]

Strategic Risks Shaping Nvidia's Near-Term and Long-Term Outlook

1. Supply Constraints and Geographic Exposure

While demand remains strong, several structural risks could weigh on Nvidia's ability to sustain its momentum.

Analysts have have highlighted challenges including supply-chain constraints, power and infrastructure shortages, and geopolitical pressures, especially those linked to chip exports to China.

Notably, Nvidia's Q3 outlook does not assume any sales of its H200 (H20) chips into China, reflecting ongoing regulatory and export control uncertainty.[2]

2. Margin Pressure and Capital Expenditure Sustainability

Even assuming a beat, investors will scrutinise not just headline numbers, but margin trends. Nvidia's prior guidance predicted non-GAAP gross margins around 73.5%, ± 50 basis points.

Moreover, there is a growing debate over how sustainable the AI capex cycle is. While Nvidia's Blackwell platform remains a critical driver of demand, investors will be eager for clarity on long-term spending from hyperscalers.

Broader Implications of Nvidia's Results for Global AI and Semiconductor Markets

1. AI Boom Sentiment

Because Nvidia occupies such a pivotal role in the AI infrastructure stack, its earnings report is being viewed as more than just a financial update: it's a proxy for the health of the AI investment cycle.

A strong beat and confident guidance may reinforce the narrative that the AI buildout is still in its early innings; a cautious outlook or softenings could trigger a broader re-evaluation of the capex strategy in the tech sector.

2. Impact on Market Flows

Given Nvidia's scale, which accounts for a significant share of major indices, its post-earnings reaction has the potential to ripple through correlated trades in the semiconductor, cloud, and AI industries.

This implies that the company's results may influence far more than its own share price, potentially redirecting capital flows, shifting risk appetite, and altering investor positioning across the wider technology sector.

Key Metrics to Watch During the Earnings Call

Revenue vs. Guidance:

Whether actual top-line results beat or miss the ~US$54 B outlook.

EPS and Margin Profile:

Any surprises in earnings or gross margin could reshape valuation narratives.

Data-Centre Demand Detail:

Breakdown of Blackwell vs other architectures, hyperscaler order strength, and supply constraints.

Capital-Expenditure Commentary:

Management's tone and guidance on long-term AI infrastructure spending.

China Exposure:

Discussion on H200/H20 shipments to China, regulatory risk, and demand outlook.

Liquidity/Capex Efficiency:

How Nvidia plans to scale production (and profitability) amidst high demand and cost pressures.

Frequently Asked Questions

1. Why Is Nvidia's Earnings Report Considered So Important to the Market?

Nvidia's results act as a real-time gauge of global AI infrastructure spending. Because its GPUs dominate advanced computing, any shift in demand, margins, or guidance can reshape expectations for the broader semiconductor and technology sectors.

2. What Is Driving Expectations for Strong Revenue Growth This Quarter?

Analysts expect robust data-centre demand, driven by cloud providers expanding AI training capacity. Nvidia's Blackwell architecture is also accelerating upgrade cycles, leading to significant year-on-year revenue and earnings increases relative to other large-cap technology companies.

3. Why Are Options Traders Anticipating Such a Large Post-Earnings Price Move?

Options markets imply unusually high volatility because Nvidia's valuation is heavily tied to AI capital-expenditure cycles. Even small surprises in revenue, margins, or guidance could trigger large swings given its outsized weight in major stock indices.

4. What Are the Main Risks Nvidia Faces Despite Its Strong Growth?

Key risks include supply-chain constraints, geopolitical uncertainty, particularly involving China—and potential slowdowns in hyperscaler AI budgets. Any pressure on margins or capacity could challenge Nvidia's ability to maintain its current growth trajectory.

5. How Could Nvidia's Results Influence Other Tech Stocks?

Because Nvidia anchors the AI hardware ecosystem, its earnings often move the entire semiconductor and cloud-computing sectors. Strong results could lift industry sentiment, while cautious guidance might spark broader reassessments of AI-related valuations and spending.

Conclusion

Nvidia's upcoming earnings release is emerging as a pivotal moment for the company and for the wider AI ecosystem. The market's expectation of a US$320 billion valuation swing underscores both the excitement and risk baked into its current valuation.

If Nvidia delivers strong results with bullish guidance, it could reinforce the idea that the AI revolution is far from its peak, potentially reigniting investment in infrastructure globally. But if it signals caution, it may provoke a broader reassessment of how much more capex hyperscalers are willing to deploy.

For investors, analysts, and market watchers, the event is a high-stakes test. Can Nvidia prove that its lofty valuation is supported by strong execution and lasting demand, or will this moment mark the point where enthusiasm around AI spending starts to cool?

Sources:

[1]https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-second-quarter-fiscal-2026

[2]https://www.cnbc.com/2025/08/27/nvidia-nvda-earnings-report-q2-2026.html

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.