Overnight, the US chipmaker delivered another quarter of robust revenue growth and firm guidance, easing immediate concerns about a slowdown in the global AI investment cycle.

The reaction in Asia was swift and targeted.

Asian stocks opened higher following Nvidia’s latest AI-focused earnings report, as investors reassessed risk in regional technology and semiconductor sectors.

Markets most closely integrated into Nvidia’s supply chain saw meaningful gains as capital rotated back into high-quality tech names, while investors remained more cautious toward economies still weighed down by domestic macro and policy risks.

Nvidia’s AI Earnings Beat: The Spark Behind The Rally

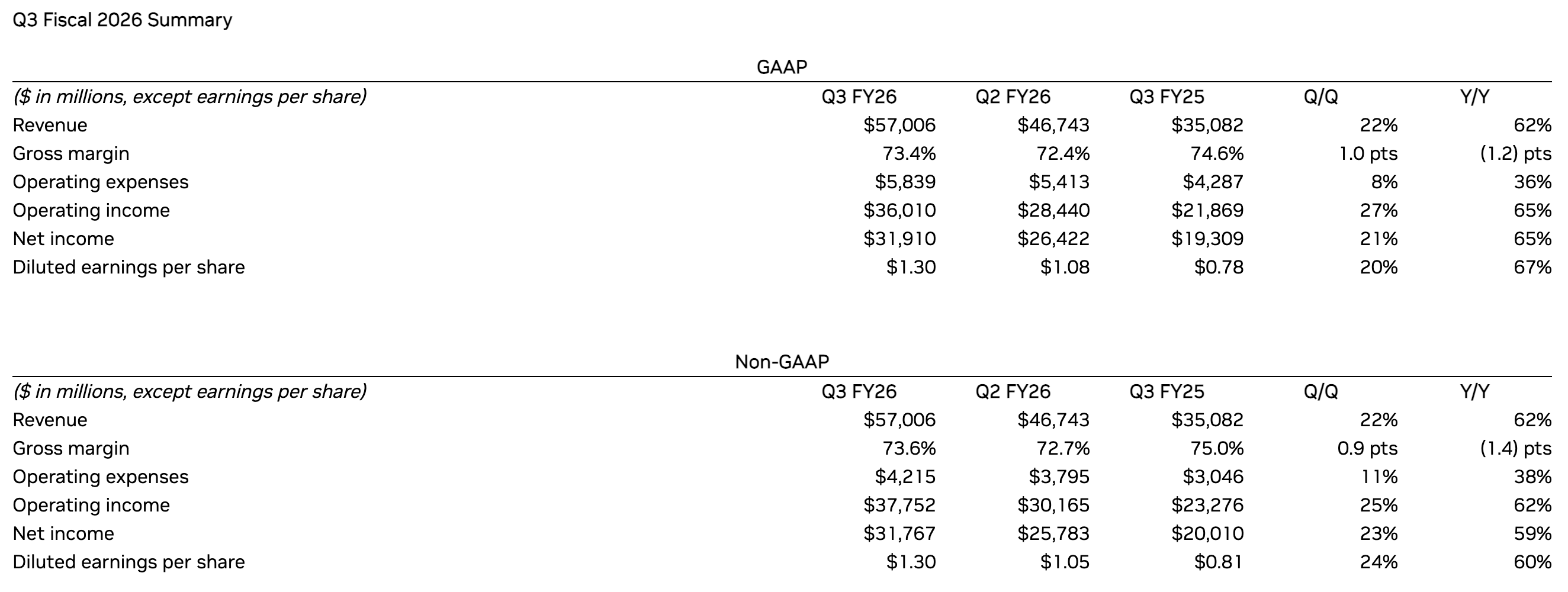

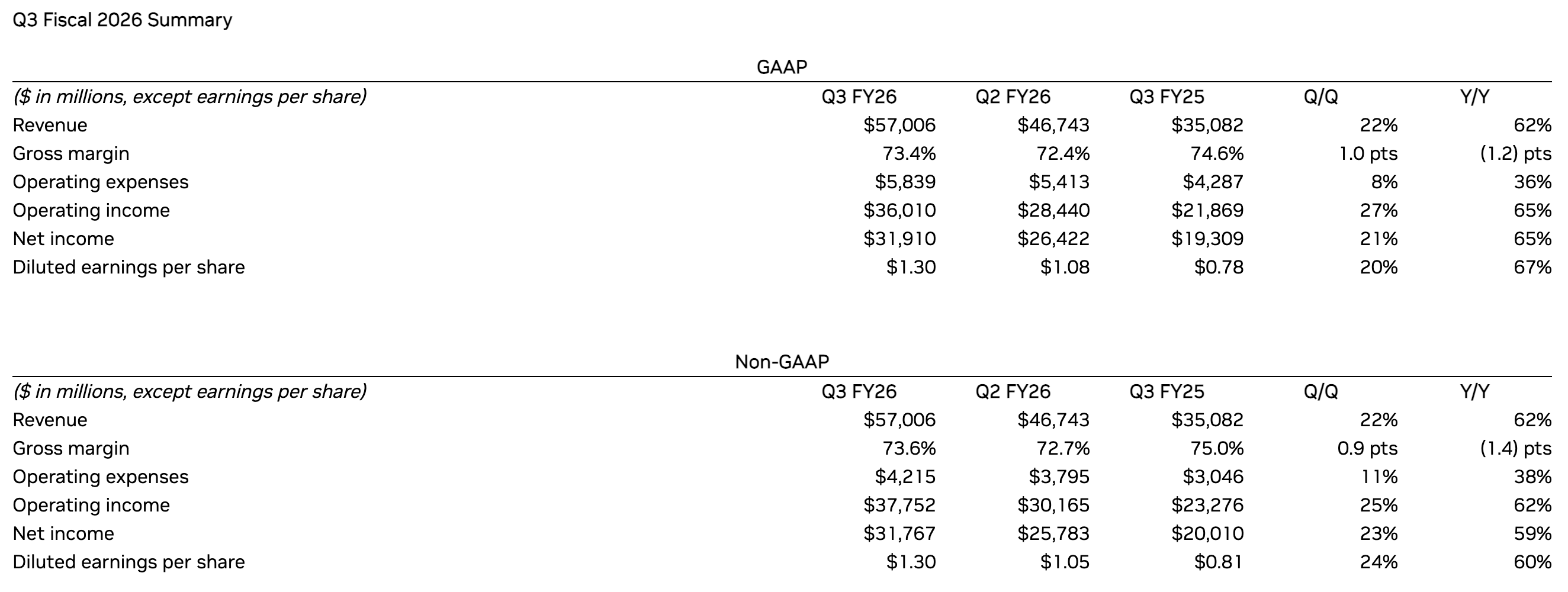

Nvidia reported record quarterly revenue of around 57 billion dollars for its fiscal third quarter, up more than 60% year on year, with roughly 51 billion dollars coming from its data center business alone.

The company also projected about 65 billion dollars in revenue for the next quarter, a guidance band that comfortably sits above prior market expectations. [1]

Crucially for sentiment, management described demand for its Blackwell AI platform as “off the charts,” stressing that GPU supply is still struggling to keep up with orders from cloud providers and AI firms.

That narrative directly challenged the idea that AI spending is topping out, and instead framed current conditions as an ongoing capacity build-out.

In extended US trading after the announcement, Nvidia’s share price jumped roughly 5%, adding hundreds of billions of dollars to its market value in a single session.

That after-hours surge set the tone for global risk assets, with equity futures and AI-linked names rallying before Asia even opened.

How Fast Did The Asian Markets React?

Nvidia’s results were published in the US afternoon on Wednesday, with written commentary going live before a scheduled earnings call later that day.

By the time traders in Tokyo and Seoul were logging in for Thursday’s session, the numbers, guidance and key AI soundbites had already been fully digested.

Equity futures reflected that handover. Contracts linked to major US indices were up around 1-2%, while a broad Asia-Pacific benchmark outside Japan climbed roughly 0.6-1.2% in early dealing as the region moved off recent lows.

The message was clear: if Nvidia’s AI engine is still running hot, the global tech trade has room to breathe.

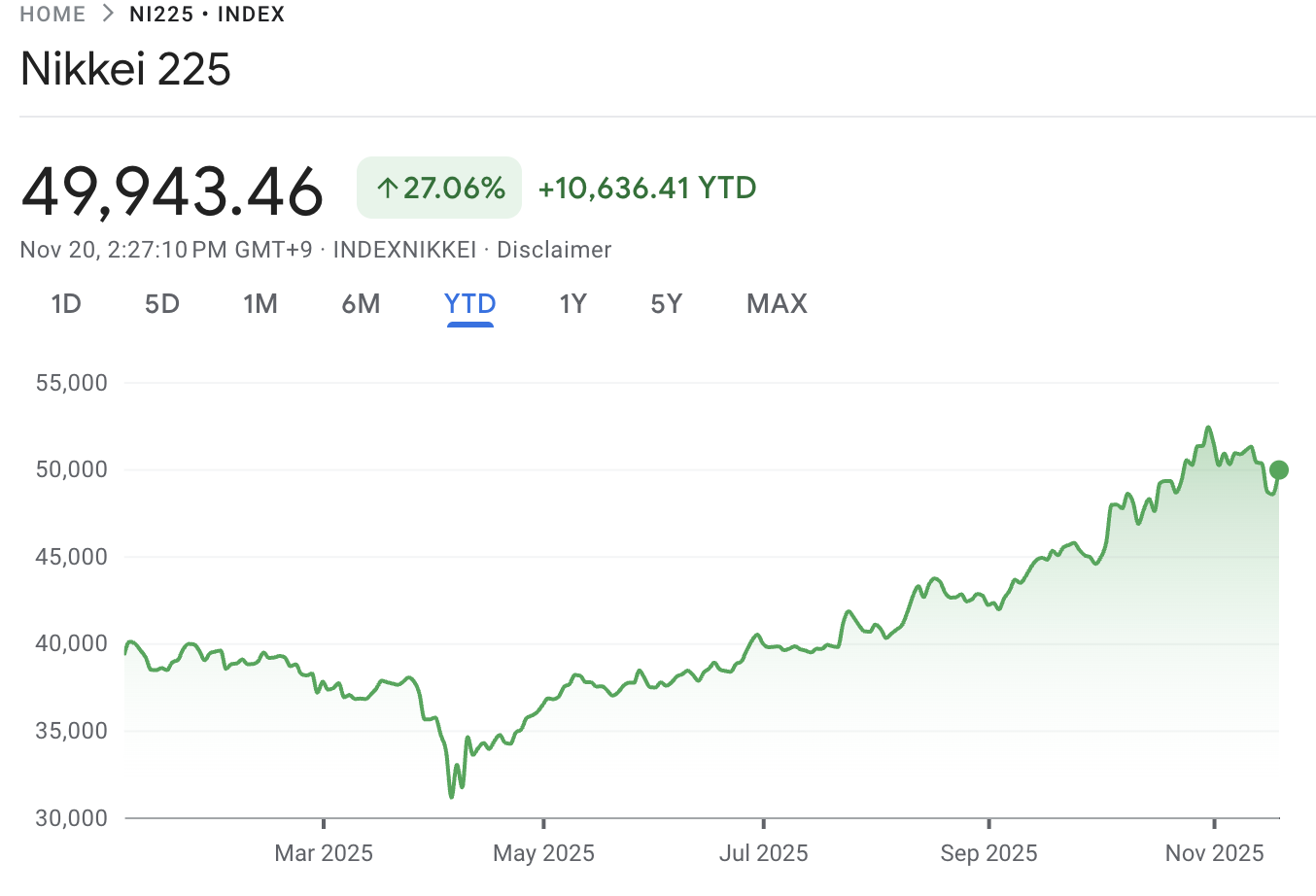

Japan Stock Market: Nikkei Rises After Nvidia AI Earnings

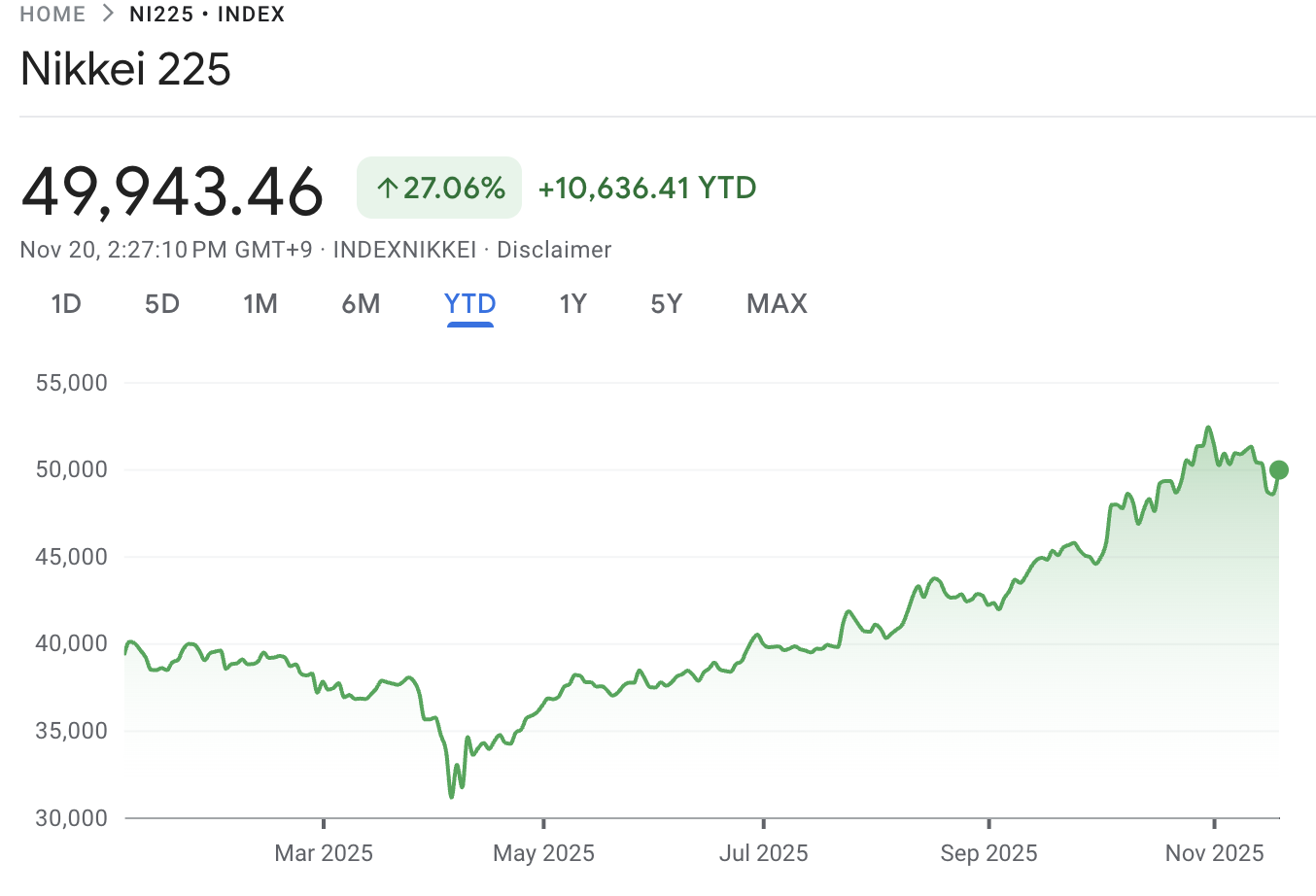

Japan saw one of the sharpest reactions. The Nikkei 225 jumped as much as about 4.2% intraday, reclaiming the 50,000 level after a bruising tech sell-off in prior sessions.

Chip-related heavyweights led the move. Major semiconductor equipment makers and AI-linked conglomerates rallied between roughly 4% and 9%, reflecting their role in Nvidia’s global supply chain and the broader AI infrastructure build-out.

For Japan, the rebound was also psychological. A market that had been at the center of AI valuation worries suddenly had fresh evidence that earnings are still backing the story, helping restore confidence in the tech-led bull phase.

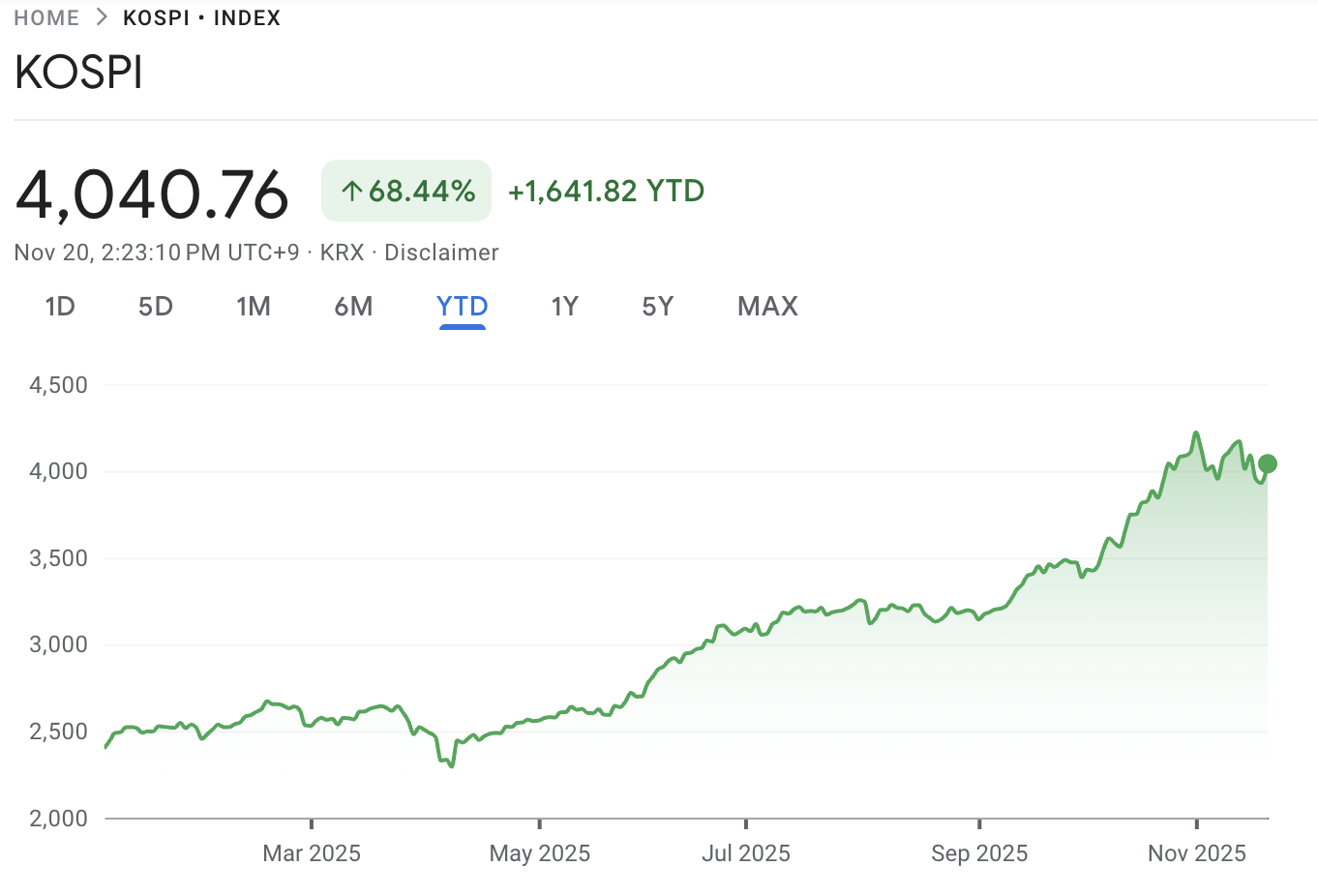

South Korea Stock Market: Kospi Gains As Chip Stocks Rise

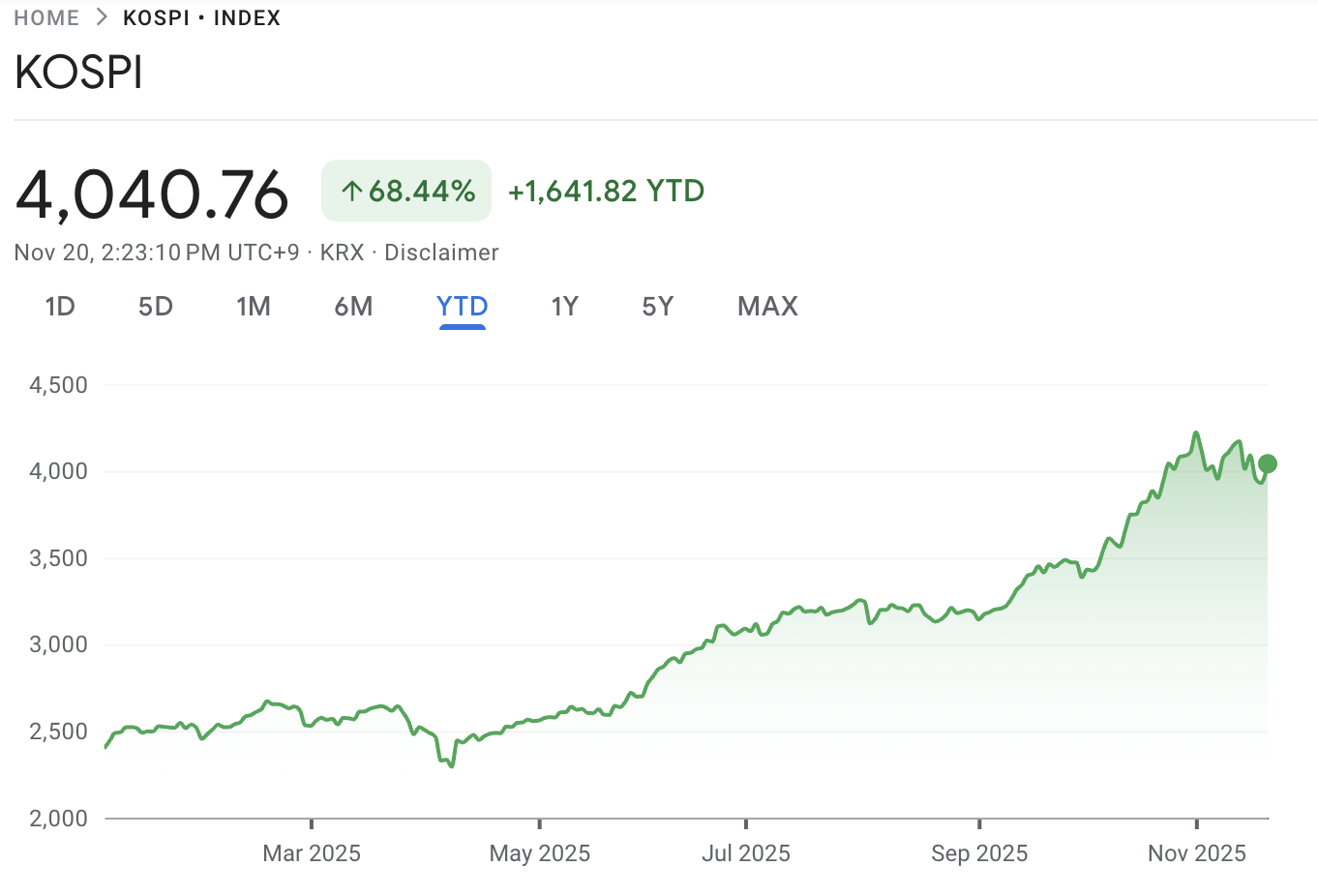

South Korea’s Kospi index climbed about 3.3% as traders rotated aggressively back into large semiconductor names.

Key memory and foundry players surged between roughly 4% and 5%, reversing part of the steep declines seen earlier in the week when investors were pricing in the risk of an AI spending slowdown.

Given how tightly Korea’s equity performance is tied to the global chip cycle, a strong Nvidia print did more than lift prices for a day. It helped stabilise expectations around order visibility and pricing power in high-bandwidth memory and advanced process nodes.

Taiwan Stock Market: TSMC Leads Tech Stocks After Nvidia Results

In Taiwan, the main equity benchmark rallied around 3-3.5%, with the move concentrated in the semiconductor complex.

TSMC, a key manufacturing partner for Nvidia’s latest AI chips, jumped more than 4%, while other fabless and equipment suppliers also posted strong gains.

For traders, this underlined how closely Taiwan’s market is tethered to the health of the global AI capex cycle.

The rebound also followed several sessions of risk reduction as investors braced for a possible disappointment. With that downside scenario avoided, short-term positioning swung back in favour of high-beta chip names sensitive to Nvidia’s guidance path.

China and Hong Kong Stocks: Small Nvidia Impact, Local Risks Stay

The reaction in Greater China was more nuanced. Mainland indices, including a major blue-chip benchmark, managed modest gains of around 0.1%, helped by a slightly better tone in tech and policy-sensitive sectors.

Hong Kong’s headline index was roughly flat to marginally negative intraday, even as some local tech and chip-related stocks ticked higher. Ongoing concerns about domestic growth, property stress and regulatory uncertainty continued to cap enthusiasm.

In other words, Nvidia’s strong AI narrative did improve sentiment, but it was not enough on its own to overpower structural headwinds facing China-linked assets. That leaves this part of the region more dependent on local policy signals than on global tech alone.

Singapore Stock Market: STI Edges Higher On Global Tech Gains

Singapore’s Straits Times Index rose about 0.3%, a more measured response than the explosive rallies in North Asia.

The market’s sector mix explains a lot. With heavier weights in banks, industrials and REITs and a smaller pure-play semiconductor component, Singapore tends to reflect global risk appetite rather than direct AI supply-chain leverage.

That said, local tech, data-center and digital infrastructure names still benefited at the margin as investors priced in ongoing demand for cloud capacity and AI workloads anchored in the city-state.

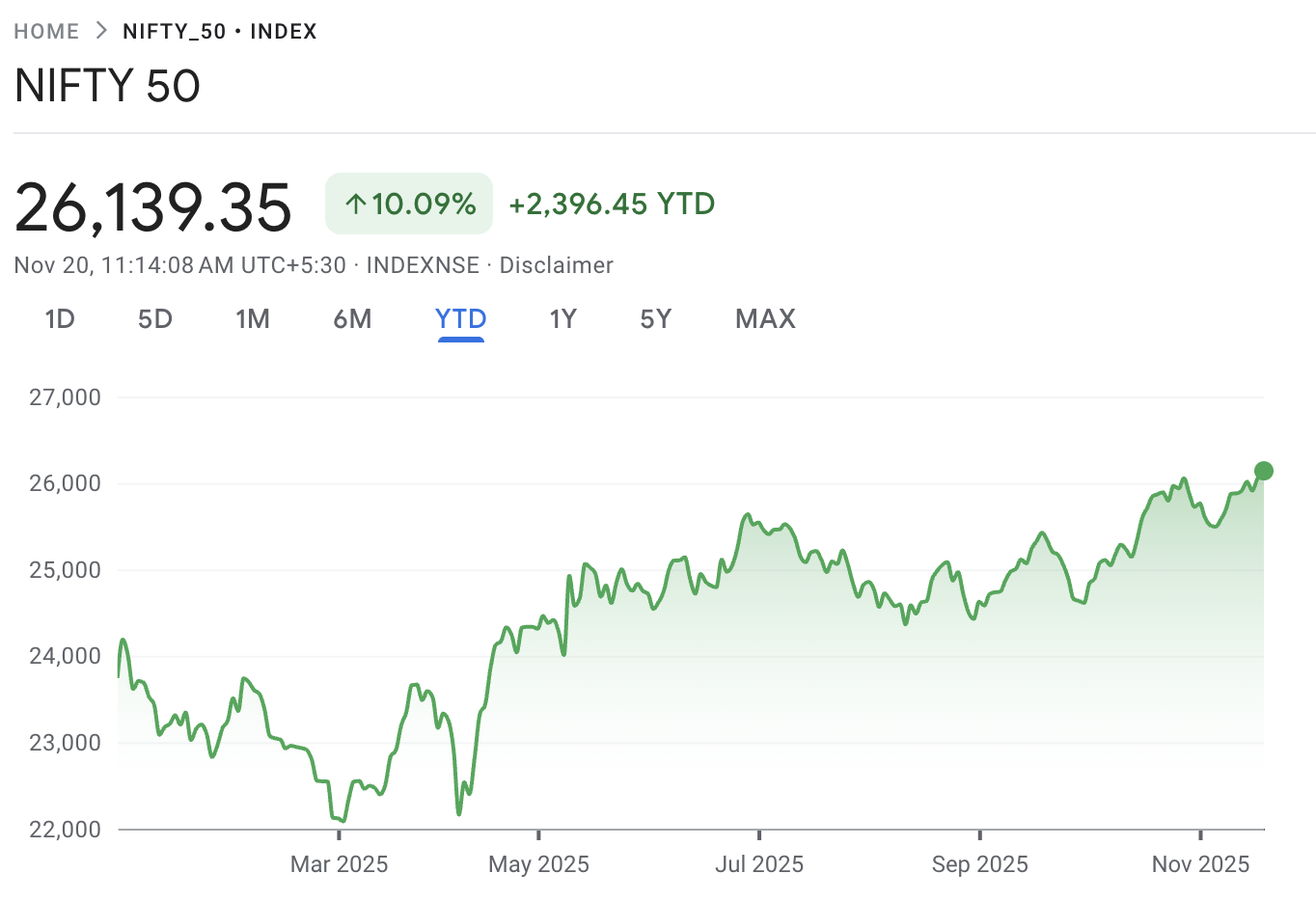

India Stock Market: Nifty Shows Modest Gain From Global Tech Rise

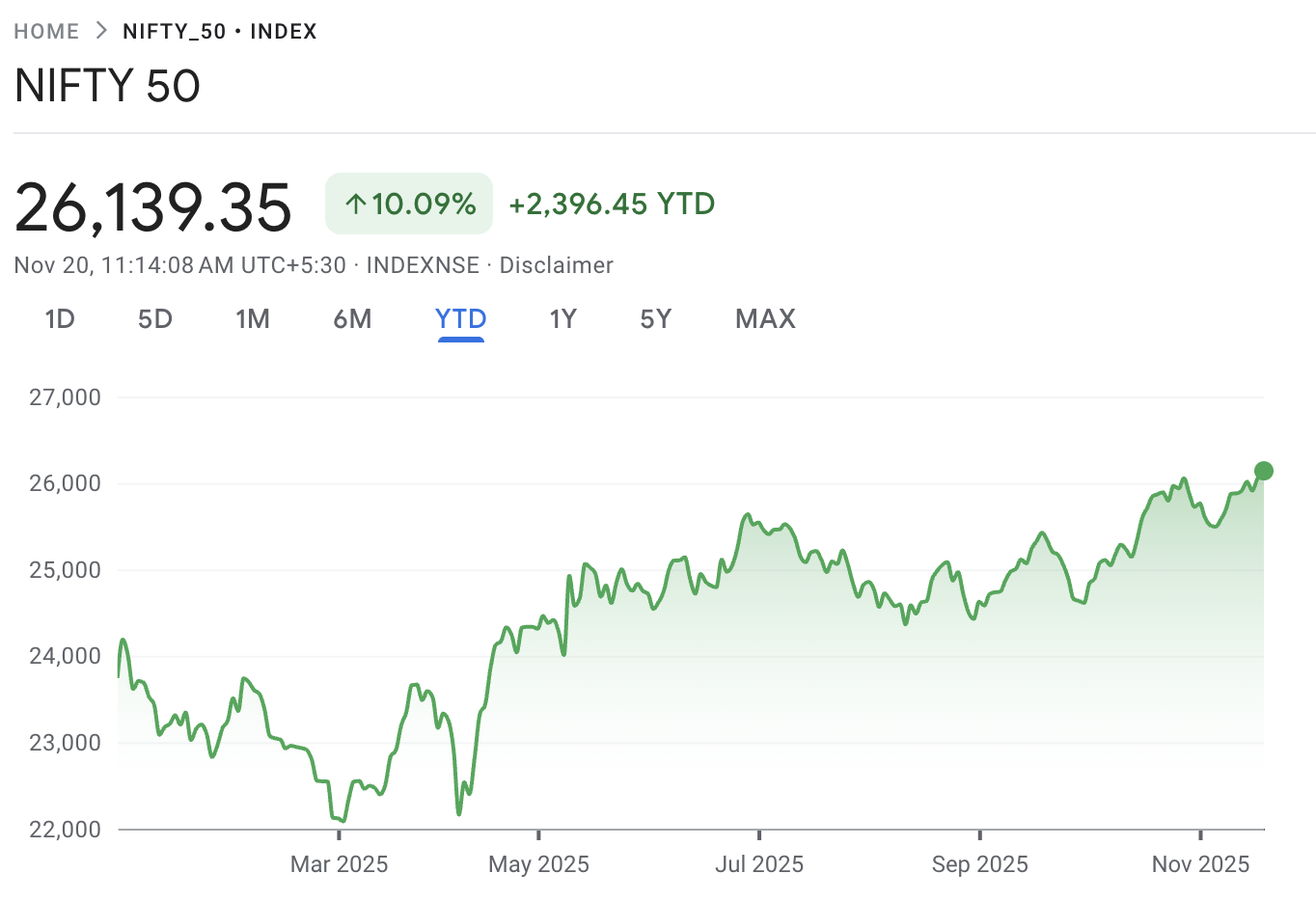

In India, the immediate impact showed up first in derivatives. Gift Nifty futures traded roughly 0.25-0.3% above the previous close, signalling a firmer open for the Nifty 50 as traders tracked the global tech rebound.

Cash indices had already closed the prior session with solid gains, driven largely by domestic IT names and renewed foreign inflows.

As a result, the Nvidia surprise acted more as confirmation than a fresh catalyst, reinforcing the view that India sits slightly insulated compared with highly AI-concentrated markets like Korea and Taiwan.

Going forward, India’s linkage to the AI theme is likely to be expressed through demand for IT services, cloud migration and digital infrastructure rather than direct chip manufacturing.

That makes the reaction more gradual, but still meaningfully tied to Nvidia’s spending and capex roadmap.

Other Regions: Moderate Increase After Nvidia Results

Beyond the main North Asian centers, equity markets in parts of Southeast Asia and European countries also traded higher. Indices in Sydney, Singapore, Wellington and Jakarta were all reported in positive territory as the Nvidia news filtered across the region.

The gains were smaller in percentage terms, reflecting these markets’ more diversified sector structures and shallower direct exposure to the AI chip cycle.

Australia’s ASX 200 also advanced roughly 1.2% as the Nvidia-driven shift in global risk sentiment intersected with strength in miners and financials. For the ASX, Nvidia’s print matters less as a direct earnings read-through and more as a barometer for global growth expectations, commodity demand and cross-asset risk appetite..

Still, for global allocators, the session signalled that broad Asia risk was stabilising after several days of de-risking ahead of the earnings release.

What This Nvidia Shockwave Means For Traders

For active traders, the takeaway is that a single mega-cap AI earnings report can still act like a macro event for Asia. Record revenue, strong guidance and firm language against the “AI bubble” narrative reset positioning across multiple markets in a matter of hours.

At the same time, the reaction was not uniform. Markets that sit closest to Nvidia’s hardware supply chain saw outsized moves, while markets driven more by domestic macro or policy remained cautious.

That differentiation is likely to persist across future AI-linked catalysts, creating opportunities in both index trading and relative-value approaches.

Frequently Asked Questions (FAQ)

1. How long can the Nvidia-driven rally in Asian stocks last?

The rally’s duration hinges on whether Nvidia’s outlook is supported by ongoing AI spending, cloud investment, and broader macro trends. Strong earnings from other AI-related firms could extend the move, but any slowdown or guidance cuts may quickly trigger volatility.

2. Which Asian markets are most sensitive to Nvidia’s future earnings?

Japan, South Korea, and Taiwan are most exposed due to their semiconductor ecosystems tied to Nvidia. Australia, Singapore, and India feel the impact indirectly through global risk sentiment, IT demand, and sector rotations.

3. What should traders watch next after this earnings-driven move?

Focus on Nvidia updates, US jobs and inflation data affecting rate expectations, and Asian indicators like China policy signals, currency moves in yen and won, and potential profit-taking after sharp gains.

Key Takeaways For Active Traders

Nvidia’s Q3 numbers confirmed that AI chip demand remains exceptionally strong, with record revenue and aggressive guidance challenging fears of an immediate AI bust.

Tech-heavy markets in Japan, South Korea and Taiwan led the Asian rally, with headline indices gaining roughly 3-4% and key chipmakers rising 4-9%.

Hong Kong and mainland China lagged as structural growth concerns, property stress and policy uncertainty offset some of the global AI optimism.

Singapore, Australia and India participated more moderately, reflecting their sector mix and a greater focus on domestic drivers and rate expectations.

For traders, future Nvidia and big-tech earnings dates now sit alongside central bank meetings and inflation releases as high-impact events for Asian equity, FX and index markets.

Disclaimer: This article is provided for general information only and does not constitute financial, investment or trading advice. Any trading decision should be based on your own judgement, risk tolerance and independent research.

Sources

[1] https://investor.nvidia.com/financial-info/financial-reports/