The Australian dollar was largely muted on Tuesday after Trump said most

trading partners that do not negotiate separate trade deals would soon face

tariffs of 15% to 20%.

Higher tariffs have worsened the economic outlook for developing Asia and the

Pacific, the Asian Development Bank said in a report as it lowered its growth

forecasts for the region for this year and next.

Domestic demand is expected to weaken as factors including geopolitics,

supply chain disruptions, rising energy prices and uncertainty in China's

property market linger in the region, the report said.

Australia and India are likely to expand their free trade agreement,

according to Australia's trade minister. The countries signed an initial FTA

in2022, which eliminated tariffs on a large proportion of goods and

services.

The country's goods exports saw a month-over-month decrease of 2.7% in May,

reaching a 3-month low. This decline is partly driven by demand disruptions

China that was grappling with Trump's tariff threats.

The Reserve Bank is wary of cutting interest rates until it has gathered more

evidence that inflation remains on a path back towards the 2.5% target, said the

RBA governor Michele Bullock.

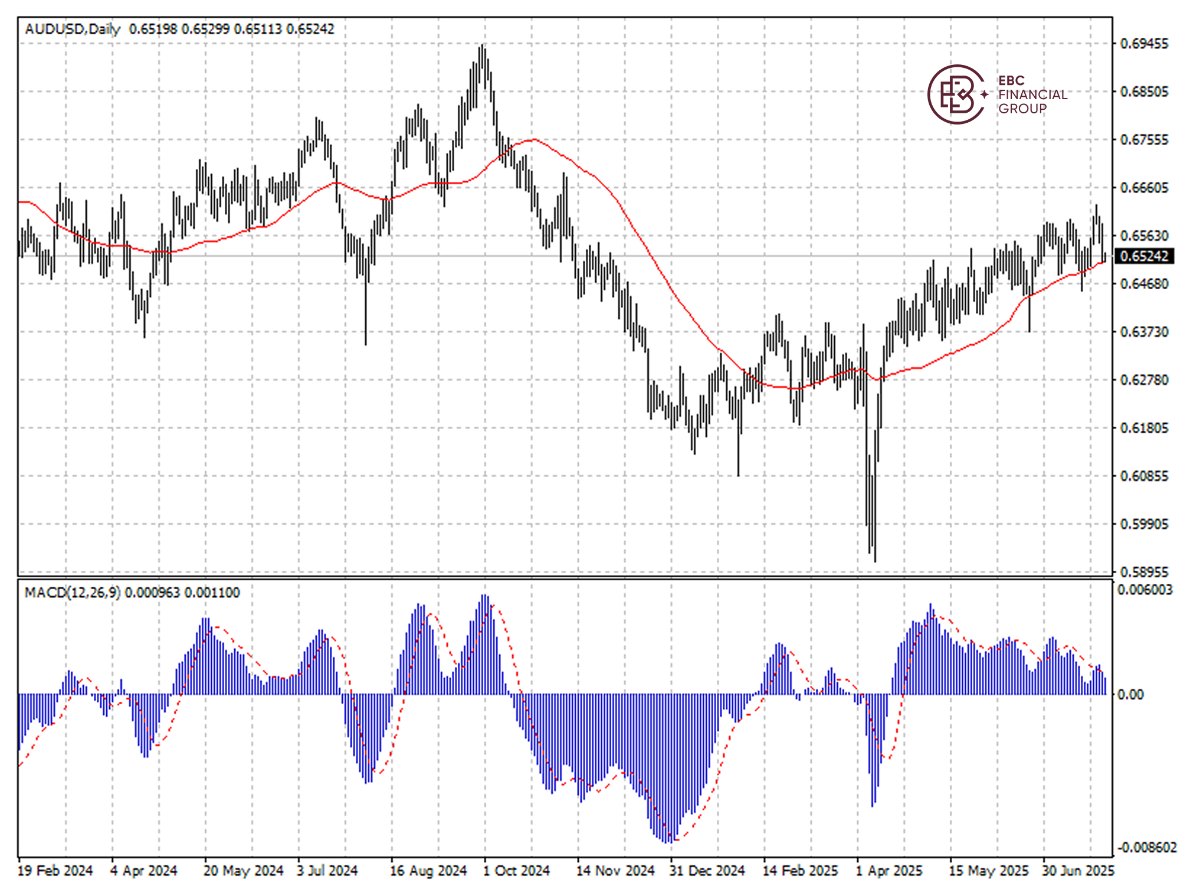

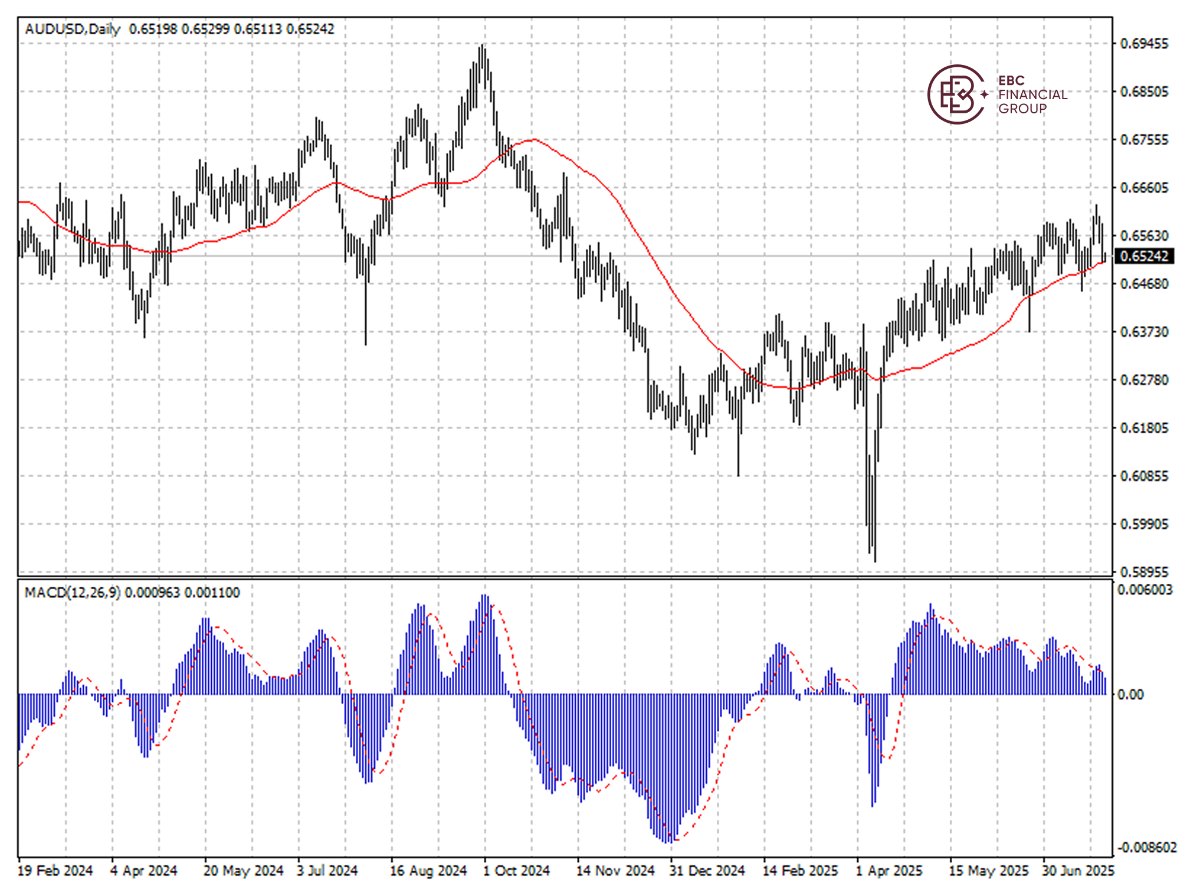

The Aussie moved along the ascending trendline above 50 SMA, but bearish MACD

divergence points to an immediate pullback towards the support level.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.