India's semiconductor sector is experiencing a significant surge in 2025, propelled by robust government initiatives, escalating domestic demand, and strategic investments from both local and global players.

The market, valued at approximately USD 38 billion in 2023, is projected to expand to between USD 45–50 billion by the end of 2025 and further grow to USD 100–110 billion by 2030.

This article highlights the importance of these ten semiconductor stocks, the driving factors, and examines the risks associated with long-term investment in these selections.

What are Semiconductor Stocks?

Semiconductor stocks represent companies involved in the design, manufacturing, and distribution of semiconductors, also known as “chips.”

Semiconductors are essential components in virtually all electronic devices from smartphones, computers, and servers to automobiles, industrial machines, and IoT devices.

Investing in semiconductor stocks means putting capital into firms that either produce the physical chips (chipmakers or fab companies), provide related manufacturing services (like OSAT, outsourced semiconductor assembly and testing), or develop the intellectual property (IP) for chip designs.

Top 10 Best Semiconductor Stocks in India to Invest in for Long-Term Growth

| Company Name |

Shortform |

Revenue (FY 2025) |

| MosChip Technologies |

MosChip |

₹466.84 crore |

| Kaynes Technology India |

Kaynes |

₹673.50 crore |

| Dixon Technologies |

Dixon |

₹1,485.50 crore |

| SPEL Semiconductor |

SPEL |

₹2.45 crore |

| Tata Elxsi |

Tata Elxsi |

₹3,729 crore |

| Bharat Electronics Ltd |

BEL |

₹27,300 crore |

| Tejas Networks |

Tejas |

₹1,200 crore (approx) |

| ASM Technologies |

ASM |

₹288.81 crore |

| Syrma SGS Technology |

Syrma |

Not publicly disclosed |

| Vedanta Limited |

Vedanta |

₹1,07,000 crore |

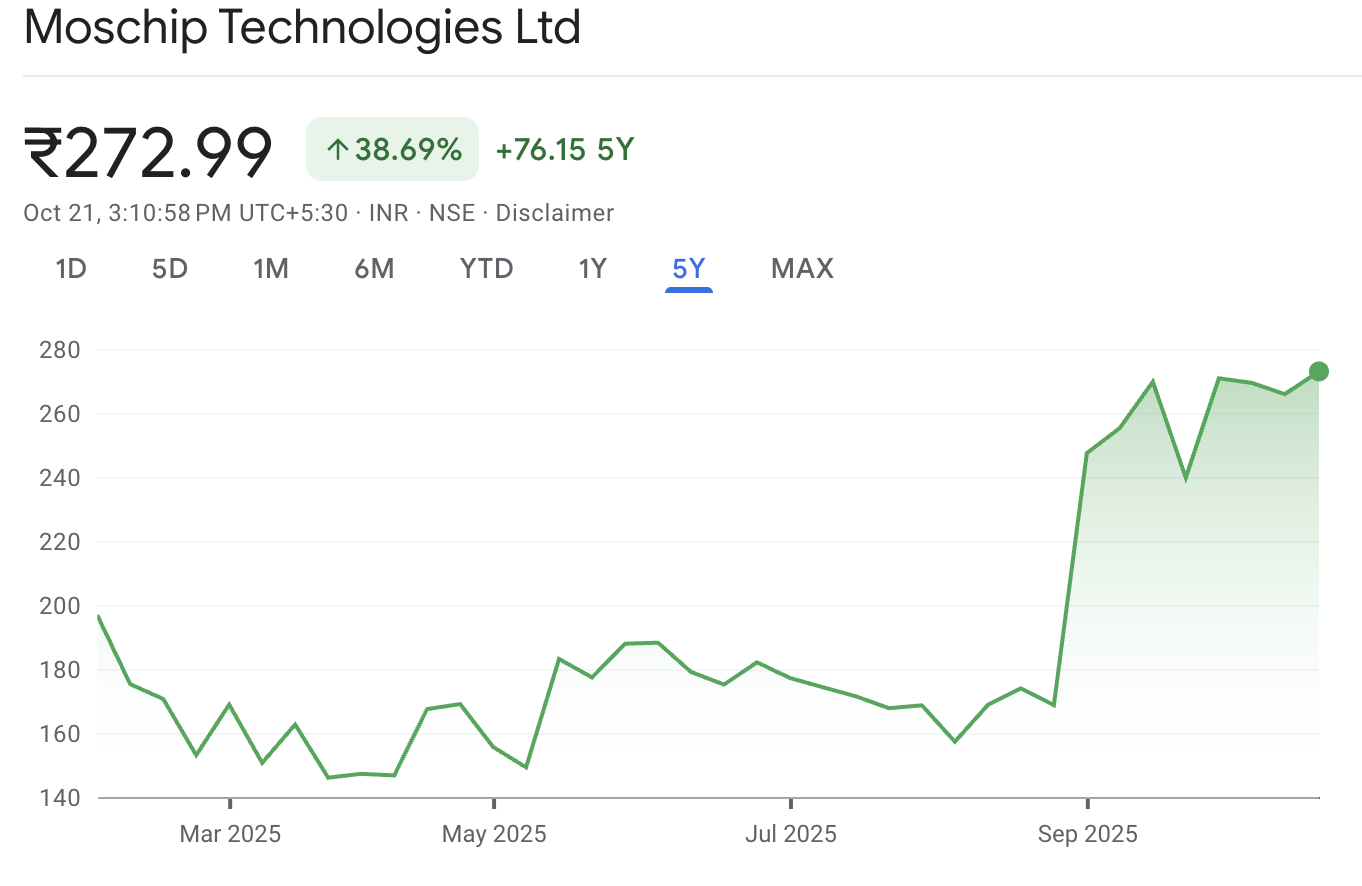

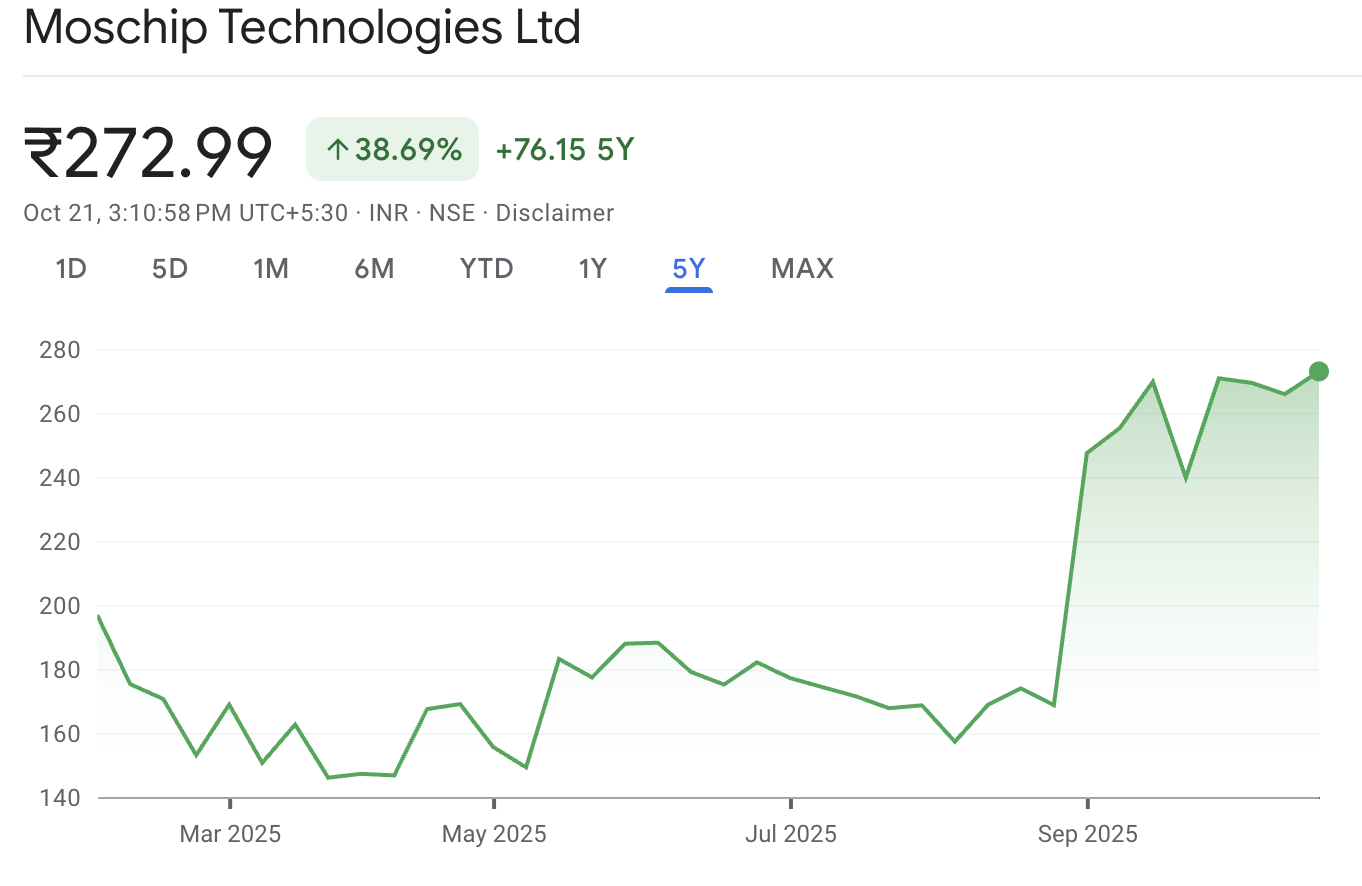

1. MosChip Technologies (MosChip)

Market Cap: ₹5,199 crore

Q1 FY26 Revenue: ₹136.16 crore (66% YoY growth)

Net Profit: ₹10.9 crore (173.9% YoY growth)

Stock Price: ₹135.60

MosChip's strong performance in Q1 FY26 underscores its growing footprint in the semiconductor design services sector. The company's focus on custom SoCs and IoT chips positions it to benefit from the expanding semiconductor ecosystem in India.

Risks: Revenue concentration among a few clients may pose dependency risks.

2. Kaynes Technology India (KAYNES)

Market Cap: ₹45,998 crore

Q1 FY26 Revenue: ₹673.50 crore (34% YoY growth)

EBITDA: ₹113 crore (69% YoY growth)

Stock Price: ₹1,200

Kaynes' robust order book and significant investments in OSAT facilities align with the government's push for semiconductor manufacturing, positioning the company for sustained growth.

Risks: High capital expenditure and working capital intensity could impact margins.

3. Dixon Technologies (DIXON)

Market Cap: ₹97,560 crore

Q2 FY26 Revenue: ₹15,351 crore (33% YoY growth)

Net Profit: ₹746 crore (81% YoY growth)

Stock Price: ₹7,500

Dixon's expansion into component manufacturing and plans for a ₹3,000 crore investment in electronics components position it as a key player in India's electronics manufacturing sector.

Risks: Exposure to product composition and input cost fluctuations may impact profitability.

4. SPEL Semiconductor (SPEL)

Market Cap: ₹953 crore

Revenue: ₹7.66 crore

Stock Price: ₹206.70

SPEL's specialization in IC packaging and testing services places it in a critical segment of the semiconductor value chain, benefiting from the industry's growth.

Risks: Dependency on a few clients and the need for continuous technological upgrades may affect growth.

5. Tata Elxsi (TATAELXSI)

Market Cap: ₹36,890 crore

FY25 Revenue: ₹3,729 crore

Net Profit Margin: 26.3%

Stock Price: ₹3,500

Tata Elxsi's expertise in embedded design and software services positions it to benefit from the growing demand for semiconductor-related services across various sectors.

Risks: Slow hardware capex cycles or global IT downturns may reduce demand for services.

6. Bharat Electronics Ltd (BEL)

Market Cap: ₹3,05,256 crore

FY25 Revenue: ₹27,300 crore

Stock Price: ₹417.70

As a state-owned enterprise, BEL is well-positioned to benefit from government initiatives aimed at boosting domestic semiconductor production.

Risks: Revenue is closely tied to defense budgets and long procurement cycles; limited pure semiconductor exposure compared to peers.

7.Tejas Networks (Tejas)

Market Cap: ₹9,704 crore

TTM Revenue: ₹840 million

Stock Price: ₹100

Tejas Networks' focus on indigenous telecom equipment aligns with India's push for self-reliance in semiconductor manufacturing.

Risks: Highly competitive telecom market and dependency on operator spending cycles may impact growth.

8. ASM Technologies (ASMTEC)

Market Cap: ₹4,182.96 crore

Q1 FY26 Revenue: ₹111.94 crore

Net Profit: ₹16.33 crore

Stock Price: ₹3,552.65

ASM Technologies' engineering services cater to the semiconductor design and validation sector, positioning it to benefit from the industry's growth.

Risks: Concentrated revenue streams and pricing pressure from global competitors may affect margins.

9. Syrma SGS Technology (SYRMA)

Syrma's established EMS capabilities position it well to secure design wins as global OEMs look for alternative manufacturing locations.

Risks: Working capital-intensive operations and reliance on a limited set of global clients may pose financial volatility.

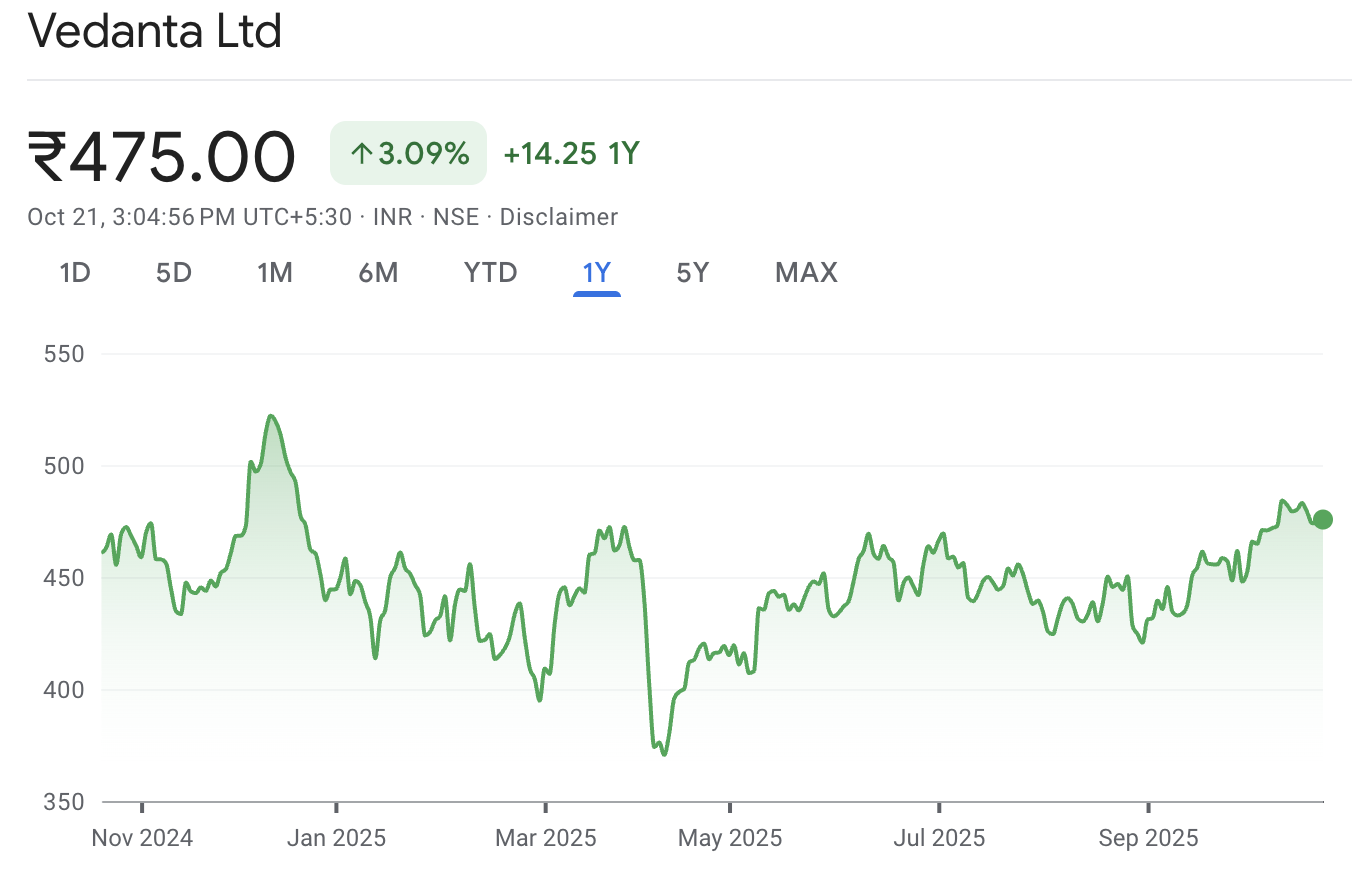

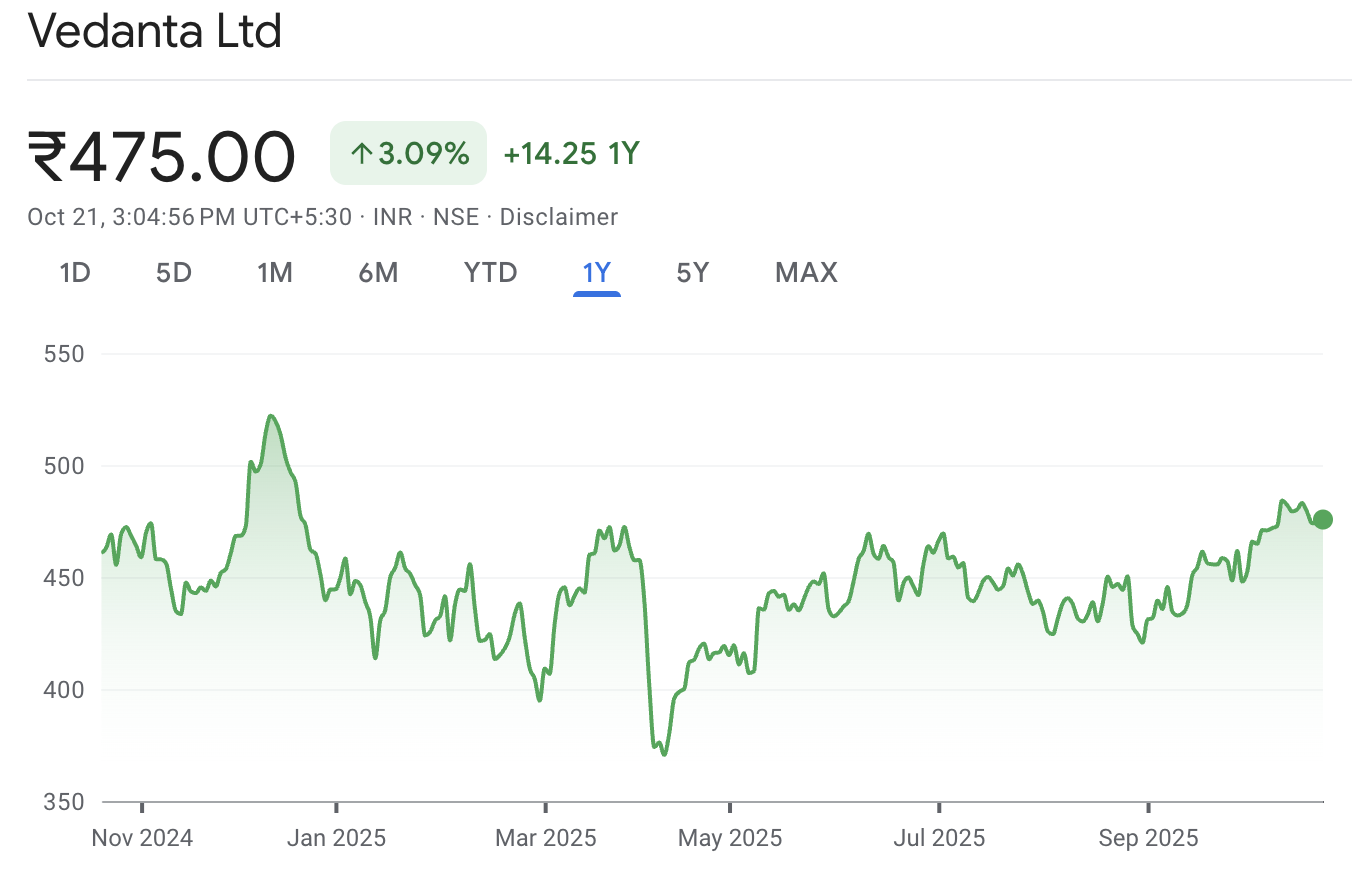

10.Vedanta Limited (Vedanta)

Market Cap: ₹1,07,000 crore

Q2 FY26 Profit: ₹2,649 crore

Stock Price: ₹250

Vedanta's investment in infrastructure and potential involvement in semiconductor-related projects could provide long-term growth opportunities.

Risks: High capital intensity and exposure to the cyclical metals industry may limit near-term returns.

Key Drivers for Semiconductor Stocks in India (2025)

1.Government Policy & PLI

The Indian government’s Production-Linked Incentives (PLI) and the India Semiconductor Mission provide direct subsidies, tax breaks, and financial support for packaging, testing, and fabrication projects.

These incentives improve project economics, attract global partners, and accelerate the establishment of local semiconductor capabilities.

2.OSAT / Packaging Capacity Build-Up

Outsourced Semiconductor Assembly & Testing (OSAT) is a critical bottleneck in the semiconductor value chain.

Companies such as Kaynes Technology and SPEL Semiconductor are setting up OSAT facilities, reducing dependency on foreign suppliers and capturing additional profit margins. Recent MoUs and plant timelines indicate tangible progress in capacity expansion.

3.Design Wins & IP Monetisation

Firms focused on ASICs (Application-Specific Integrated Circuits), SoCs (System-on-Chips), and embedded system design like MosChip Technologies, Tata Elxsi, and ASM Technologies benefit from higher value added per chip.

Recurring design service revenue and monetisation of IP create a more resilient, growth-oriented business model.

4.Global Supply-Chain Diversification

Global OEMs are diversifying production away from China, creating new order flows for Indian EMS (Electronics Manufacturing Services) and PCB players.

Companies like Dixon Technologies, Syrma SGS, and Kaynes are positioned to capture this shift, benefiting from demand for localised manufacturing.

Sample Portfolio Approaches for Investors

| Portfolio Type |

Allocation |

Companies & Rationale |

| Conservative Core |

60% large-cap / strategic exposure |

BEL, Vedanta – stable, lower-risk, long-term strategic plays |

|

40% high-growth services / EMS |

Tata Elxsi, Dixon – benefit from design and manufacturing growth |

| Balanced Growth |

40% design & services |

Tata Elxsi, MosChip, ASM – exposure to IP, SoC design, engineering services |

|

40% EMS / OSAT |

Kaynes, Dixon, Syrma – capturing manufacturing and packaging growth |

|

20% pure OSAT / packaging small caps |

SPEL, MosChip – high-growth, higher-risk opportunities |

| High-Conviction Small-Cap Play |

Equal-weight small-cap basket |

Kaynes, SPEL, MosChip, ASM – limited to 5–10% of total portfolio due to higher risk |

2026 Outlook for Indian Semiconductor Stocks

India’s semiconductor sector is set for strong growth in 2026, supported by government PLI incentives, the India Semiconductor Mission, and rising domestic demand.

The market could reach USD 55–60 billion by year-end, driven by consumer electronics, EVs, telecom, and industrial automation.

Design-focused firms like MosChip, Tata Elxsi, and ASM will benefit from recurring IP revenue, while OSAT and manufacturing players such as Kaynes, SPEL, Dixon, and Syrma are poised to capture global orders as companies diversify production away from China.

Risks include global economic volatility, commodity price swings, and the need for continuous tech upgrades. A diversified approach, combining large-cap stability with high-growth mid- and small-cap exposure, is recommended for investors.

Frequently Asked Questions (FAQ)

1.What are semiconductor stocks?

Companies that design, manufacture, or test chips used in electronics, telecom, and automotive sectors.

2. Why invest in Indian semiconductor stocks?

Strong government incentives, rising domestic demand, and global supply-chain shifts boost growth potential.

3. What are the main risks?

Global economic swings, input cost changes, client concentration, and tech obsolescence.

Conclusion

The semiconductor sector in India is experiencing significant growth, driven by government initiatives and increasing demand across various industries.

The companies listed above are well-positioned to capitalize on these opportunities. Investors should consider these stocks as part of a diversified portfolio, keeping in mind the associated risks and potential rewards.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.