Technology ETF investing enters 2026 with two forces pulling in the same direction: easing discount rates and an unusually concentrated profit cycle tied to AI infrastructure and enterprise software spend.

With the Federal Funds Target Range lower limit at 3.50 percent in late January 2026, long-duration cash flows are no longer repriced quarterly.

The second force is weight and momentum. Information Technology represents 32.25 percent of the S&P 500 by market weight as of January 20, 2026, meaning portfolio outcomes increasingly hinge on a small set of platform and semiconductor leaders.

Semiconductor demand adds another tailwind: the global market is projected to surge in 2025 and sustain strong momentum into 2026, with forecasts framing 2026 as a path toward the $1 trillion level.

Quick Takeaway

With rates less restrictive, broad Technology ETF exposure looks more attractive than narrow, high-beta themes. However, investors should expect results to be driven by a concentrated set of mega-caps. Semiconductors are still the main performance engine, while software and thematic funds can diverge sharply depending on growth and valuation. Cybersecurity stands out as a steadier “must-spend” pocket that can behave differently from chip-cycle volatility.

The 10 Best Technology ETF Picks for 2026

Quick comparison table

| ETF |

Segment |

Total net assets |

Net expense ratio |

1-year change |

| VGT |

Core U.S. tech |

$129.96bn |

0.09% |

+21.67% |

| XLK |

Core U.S. tech (sector) |

$93.46bn |

0.08% |

+24.41% |

| FTEC |

Core U.S. tech |

$16.66bn |

0.08% |

+20.13% |

| QQQM |

Tech-heavy growth proxy |

$70.13bn |

0.15% |

+19.19% |

| SOXX |

Semiconductors |

$16.70bn |

0.34% |

+42.97% |

| SMH |

Semiconductors (more concentrated) |

$35.60bn |

0.35% |

+49.91% |

| IGV |

Software |

$8.19bn |

0.39% |

+2.13% |

| CIBR |

Cybersecurity |

$11.09bn |

0.59% |

+11.16% |

| AIQ |

AI and enabling tech |

$6.97bn |

0.68% |

+33.02% |

| CLOU |

Cloud computing |

$274.52m |

0.68% |

-8.32% |

*Data reflects the latest available “as of” dates shown on each fund page, with most total return figures shown as of December 31, 2025, and AUM/net assets shown around late January 2026.

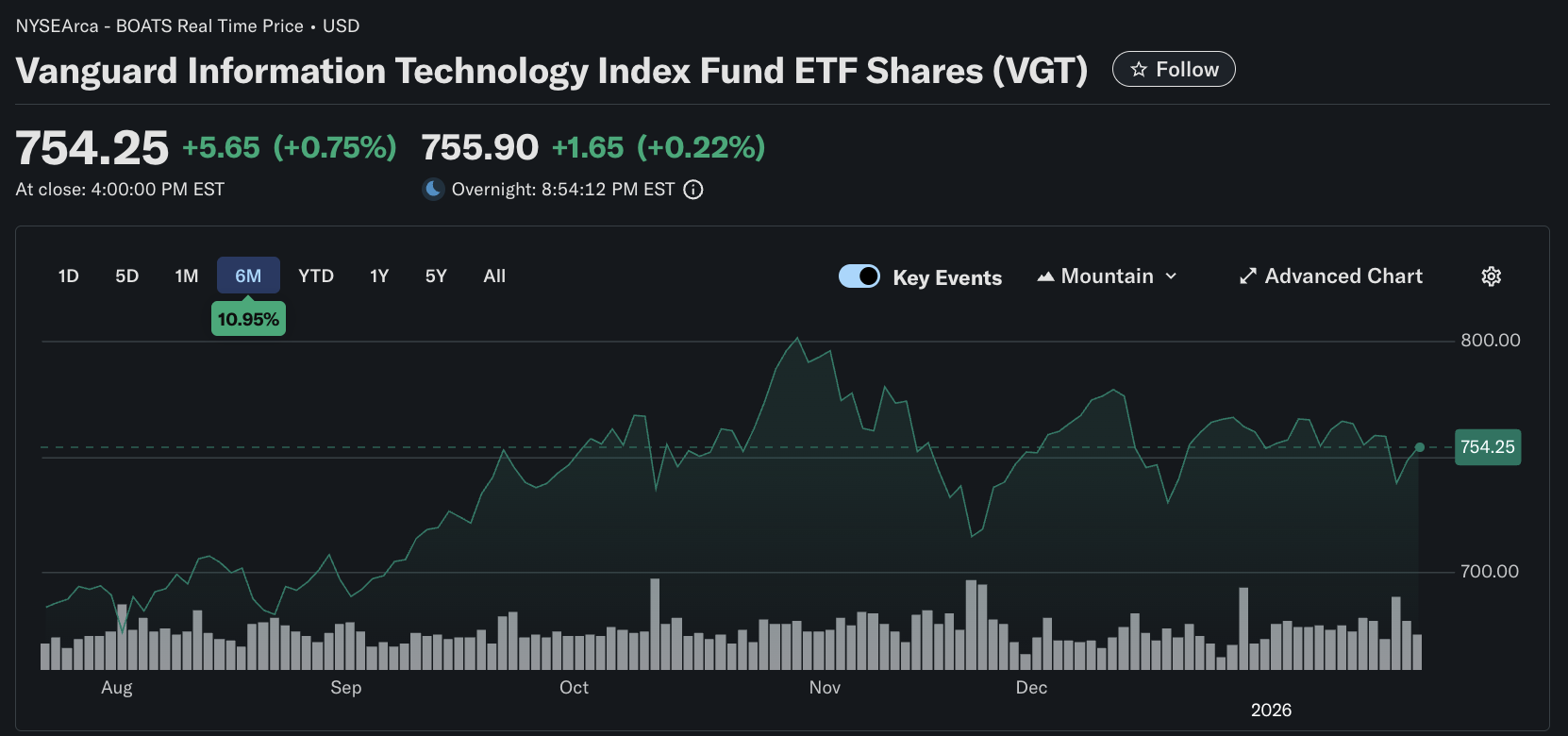

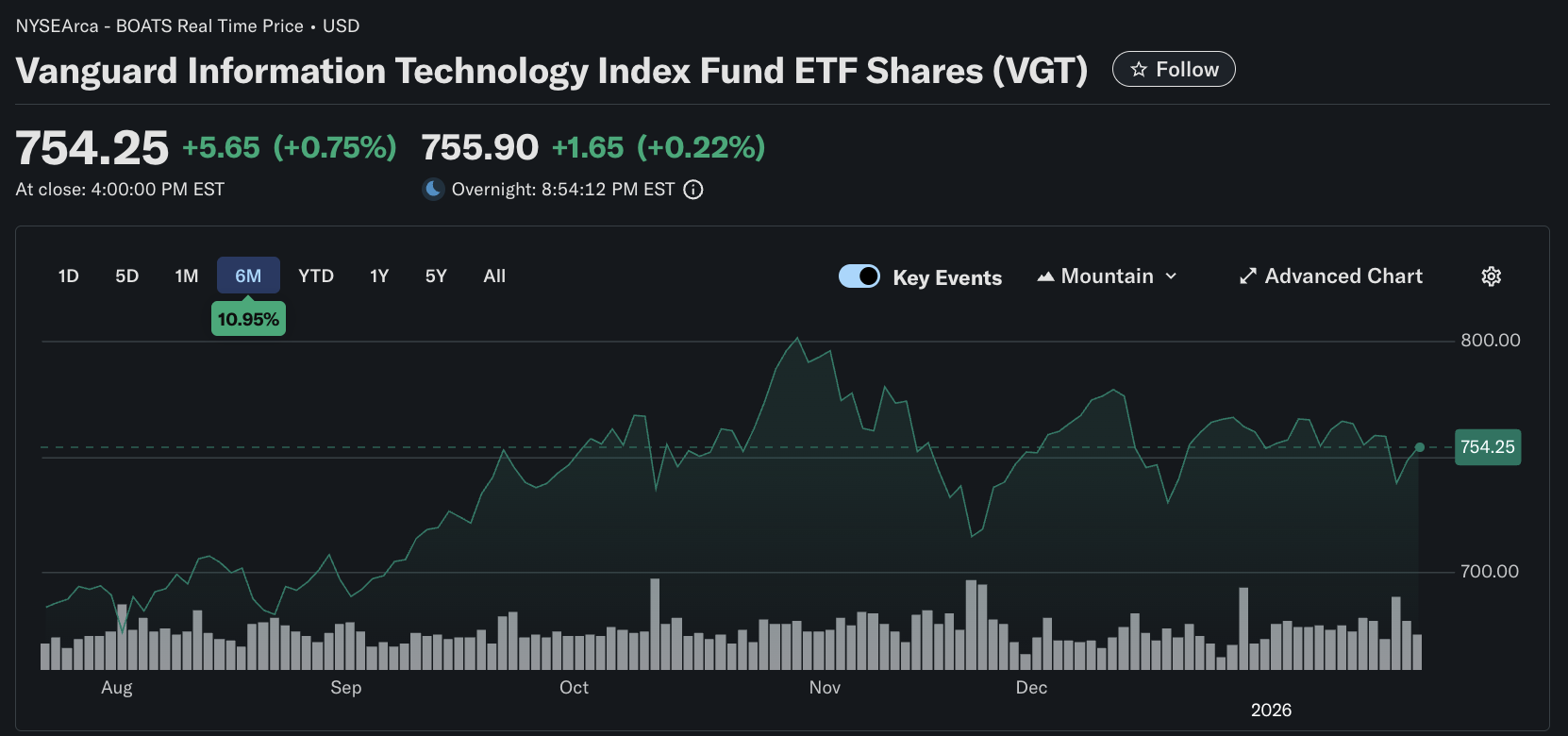

1) Vanguard Information Technology ETF (VGT)

VGT is the “clean” core holding for investors who want broad U.S. information technology exposure with low friction. Its cost structure is lean, and its scale supports tight execution.

Why it works in 2026: If rate cuts or stability persist, broad IT exposure tends to reward investors who hold through volatility rather than trade narratives. VGT also spreads exposure across semiconductors, systems software, IT services, and hardware, which matters when leadership rotates.

Key stats (latest shown): Expense ratio 0.09%; 1-year return 18.87%; 3-year 31.13%; 5-year 16.52%.

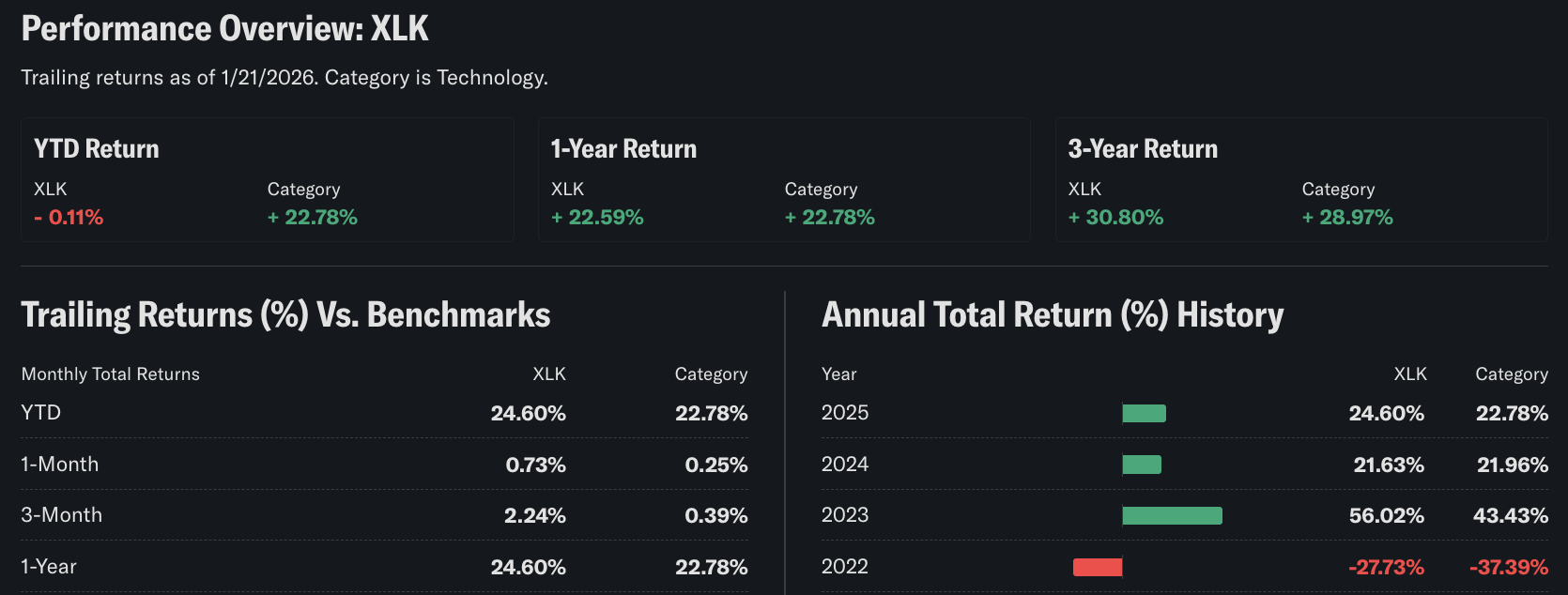

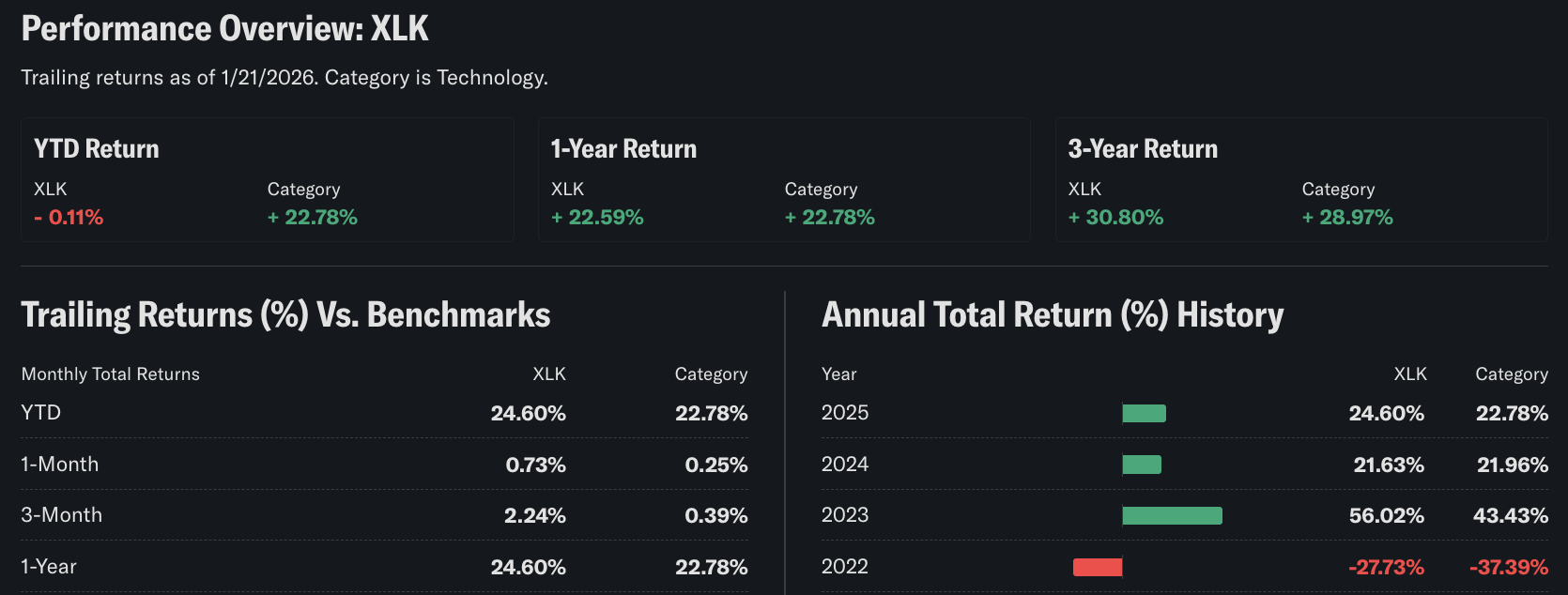

2) Technology Select Sector SPDR Fund (XLK)

XLK is the liquidity benchmark for large-cap U.S. tech exposure. It is a workhorse fund: highly tradable, widely held, and structurally positioned toward mega-cap leaders.

Why it works in 2026: When the market rewards platform economics, scale, and buyback capacity, XLK’s tilt can behave like a concentrated bet on the winners of enterprise spend and consumer ecosystems.

Concentration reality: XLK’s top-10 concentration sits around 61 percent, which increases upside in momentum regimes and increases drawdown risk when leadership breaks.

3) Invesco NASDAQ 100 ETF (QQQM)

QQQM is not strictly a technology ETF, but it serves as a “tech-plus” proxy because the Nasdaq-100's leadership is increasingly dominated by companies that benefit from platforms and AI. It also offers a more buy-and-hold-friendly share class in practice.

Why it works in 2026: If AI-driven capex and consumer platform monetization remain the primary equity story, QQQM captures that mix across software, semis, and adjacent growth industries.

Scale and liquidity: AUM is about $70.6B, with a large-cap, top-heavy structure, making it a single-ticket proxy for U.S. growth leadership.

4)VanEck Semiconductor ETF (SMH)

SMH tends to be more concentrated and global than SOXX, with a heavier weighting toward the most prominent industry leaders.

Why it works in 2026: If the winners keep winning, concentration can be an advantage. SMH has historically behaved like a “quality semiconductor beta” instrument when global leaders outperform smaller, higher-volatility names.

Returns snapshot: SMH shows average annual total returns of 49.15 percent (1Y), 53.17 percent (3Y), and 27.73 percent (5Y) as of December 31, 2025.

5) iShares Semiconductor ETF (SOXX)

SOXX is a targeted way to express a view on the semiconductor stack, from design through manufacturing and equipment. It is a sharper tool than a broad Technology ETF.

Why it works in 2026: The semiconductor cycle is increasingly tied to AI training and inference buildouts, memory normalization, and data center refresh cycles. SOXX offers relatively pure exposure to that engine.

Performance profile: Average annual total return shows 40.71 percent (1Y) and 19.94 percent (5Y) as of December 31, 2025, highlighting both the upside potential and the “cycle risk” embedded in the segment.

6) Fidelity MSCI Information Technology Index ETF (FTEC)

FTEC competes directly with VGT and XLK on cost, and it offers an appealing middle ground: broad coverage with a very low expense ratio.

Why it works in 2026: For long-horizon investors, cost and tracking consistency matter more than “story.” FTEC’s structure makes it a substantial default allocation when the goal is to own the sector, not forecast the next sub-theme.

Watch the top end: The top-10 weight is about 57.34 percent, which is lower than XLK but still high enough that a few names can dominate results.

7) First Trust Nasdaq Cybersecurity ETF (CIBR)

Cybersecurity spending is less discretionary than most IT line items. It functions as an insurance layer for digitized balance sheets and increasingly regulated infrastructure.

Why it works in 2026: Breaches, compliance requirements, and cloud migration keep security spend resilient across cycles. CIBR also diversifies tech allocation away from semiconductor capex sensitivity.

Scale and cost: Net assets are about $10.72B with a total expense ratio of 0.59 percent (as shown on the fund page).

8) iShares Expanded Tech-Software Sector ETF (IGV)

IGV isolates enterprise and application software and reflects a different earnings sensitivity than semiconductors. It is effectively a bet on the durability of recurring revenue and on IT budget allocation.

Why it works in 2026: If enterprises shift from infrastructure spend to productivity and automation, software can re-rate quickly. IGV’s composition also captures “software adjacent” AI beneficiaries within the application layer.

Reality check: IGV shows -6.42 percent (1Y) while maintaining 20.88 percent (3Y), a reminder that valuation, seat growth, and competition can overpower “sticky revenue” narratives over shorter windows.

9) Global X Artificial Intelligence & Technology ETF (AIQ)

AIQ is a broad expression of the AI ecosystem rather than a single bet on chipmakers. That can reduce single-node risk while still capturing AI-linked revenue pools.

Why it works in 2026: AI monetization is shifting from training capacity to application deployment, workflow automation, and inference efficiency. AIQ’s diversified approach can benefit when leadership rotates away from pure computers.

Key stats: Net assets $7.77B; expense ratio 0.68 percent; 1-year return 32.04 percent as of December 31, 2025.

10) Global X Cloud Computing ETF (CLOU)

CLOU is a narrower theme fund focused on cloud-oriented companies and application-layer beneficiaries. It is a satellite, not a core holding.

Why it works in 2026: As “agentic AI” and automation tooling expand, cloud platforms and adjacent software vendors can see bursts of demand. CLOU can capture that upside when the market rewards mid-cap cloud names.

Sizing matters: Net assets are $231.49M, with a 0.68 percent expense ratio, so investors should monitor liquidity more closely than with mega-funds.

How to Build a Technology ETF Portfolio for 2026

A practical 2026 framework is a core-satellite structure:

Core (60-80 percent of tech allocation): VGT, XLK, or FTEC. Choose one based on liquidity preference and index exposure, not short-term performance.

Cycle lever (10-25 percent): SOXX or SMH if semiconductors remain the dominant marginal driver of AI infrastructure. Keep sizing disciplined because volatility is structural.

Defensive growth (5-15 percent): CIBR can hedge the “capex boom-bust” nature of semis by allocating spend to a category that behaves more like a mandatory operating expense.

Thematics (0-10 percent): AIQ and CLOU are best treated as timing instruments with strict position limits and clear rebalancing rules.

The Risks Investors Underestimate in 2026

1) Concentration risk masquerading as diversification. With IT representing about 32 percent of the S&P 500 and broad tech ETFs dominated by a few names, single-stock risk can enter portfolios through index wrappers.

2) Semiconductor cyclicality. The industry can grow rapidly and still suffer sharp inventory corrections. Strong forecasts into 2026 do not eliminate the drawdown profile of the cycle.

3) Theme liquidity and tracking. Smaller theme funds can gap wider in stress, even when the underlying thesis is intact. CLOU’s asset base is a reminder to size positions to liquidity, not conviction.

Frequently Asked Questions (FAQ)

1. Which Technology ETF is best for a long-term core holding in 2026?

A broad, low-cost fund such as VGT or FTEC typically fits best as a core allocation because it spreads exposure across multiple technology industries while keeping fees low. XLK is also core-capable but tends to be more concentrated in mega-cap leaders.

2. Is XLK better than VGT?

Neither is universally better. XLK often provides higher liquidity and a more pronounced mega-cap tilt, while VGT offers broad IT coverage. The decision is usually about concentration tolerance, trading needs, and the extent of overlap elsewhere in the portfolio.

3. SOXX vs SMH: Which semiconductor ETF makes more sense for 2026?

SOXX offers targeted U.S.-listed semiconductor exposure, while SMH tends to concentrate more heavily on global industry leaders. If the thesis is “AI infrastructure winners keep compounding,” SMH’s concentration can help. If the thesis is “broad semi beta with value-chain spread,” SOXX may fit better.

4. Will AI-themed ETFs replace semiconductor ETFs?

Not usually. AI-themed ETFs like AIQ diversify across the ecosystem, which can reduce single-node risk, while semiconductor ETFs remain the purest expression of compute and memory demand. Many investors treat AIQ as a complement to semiconductors rather than a substitute.

5. Why own a cybersecurity ETF when broad tech already holds security stocks?

Cybersecurity is often underfunded within broader IT budgets, despite its strategic importance. A dedicated fund such as CIBR can increase exposure to “must-spend” security budgets and reduce reliance on semiconductor and consumer platform cycles.

6. How can one avoid overlap when investing in technology ETFs?

Check each fund’s top holdings and sector weights before layering positions. Broad tech ETFs often share the same mega-caps, so pair one core fund with one or two satellites, and keep thematics small to limit duplicate risk.

Conclusion

The best Technology ETF choices for 2026 are less about finding a single perfect fund and more about aligning structure with the market’s actual drivers: a lower-rate backdrop, index concentration, and a semiconductor-led AI capex cycle.

Broad, low-cost funds like VGT, XLK, and FTEC anchor exposure; SOXX and SMH express the compute cycle; IGV, CIBR, AIQ, and CLOU add targeted bets where fundamentals and market structure diverge. In a year where technology already dominates benchmark weight, disciplined sizing and rebalancing will matter as much as theme selection.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.