Commodities ETFs have become a go-to tool for traders and investors seeking to diversify their portfolios and hedge against inflation. With global markets facing persistent volatility and shifting macroeconomic trends in 2025, understanding how to use these ETFs—and which ones offer the best diversification—is more important than ever.

Here's a comprehensive guide to the best commodities ETFs for diversification, along with practical tips for traders.

Why Diversify with Commodities ETFs?

Commodities ETFs invest in raw materials such as energy, metals, and agricultural products. Unlike equities or bonds, commodities often move independently of traditional asset classes. This negative or low correlation means that adding commodities ETFs to a portfolio can help reduce overall risk and smooth returns, especially during periods of high inflation or geopolitical uncertainty.

A small allocation—often just 5%—to commodities can improve portfolio performance and resilience. ETFs make it easy to gain this exposure without the complexities of direct commodity trading, storage, or futures contracts.

Types of Commodities ETFs

-

Broad Commodities ETFs: Track a basket of commodities across sectors like energy, metals, and agriculture, offering inherent diversification and lower risk compared to single-commodity funds.

Focused Commodities ETFs: Invest in a specific commodity or sector, such as gold, oil, or agriculture. These can offer higher returns but carry more volatility and concentration risk.

For most traders seeking diversification, broad commodities ETFs are the preferred choice.

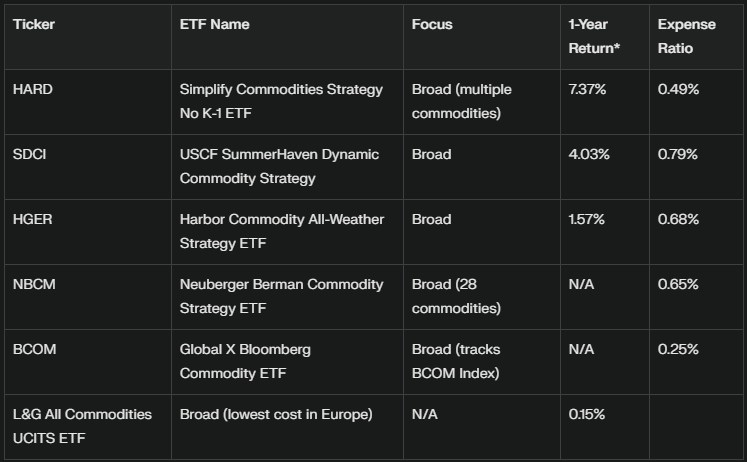

Top Commodities ETFs for Diversification in 2025

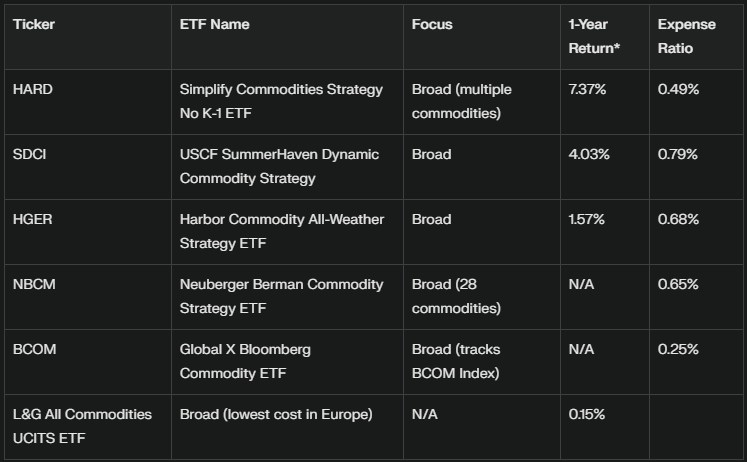

Below are some of the best-performing and most diversified commodities ETFs, based on recent returns, fund size, and sector coverage:

*Performance data as of June 2025 or latest available.

Notable mentions for focused exposure:

-

FGDL (Franklin Responsibly Sourced Gold ETF): Top performer over the past year at 43.64%.

DBA (Invesco DB Agriculture): Diversified agriculture focus, with a 23.72% YTD return.

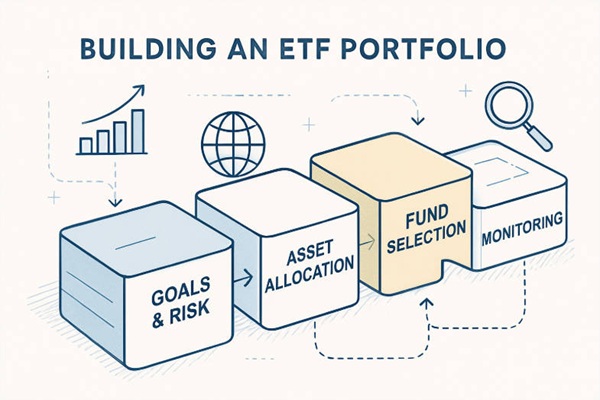

How to Choose the Right Commodities ETF

1. Diversification:

For broad portfolio protection, choose ETFs tracking major indices like the Bloomberg Commodity Index (BCOM) or those holding a wide range of commodities.

2. Liquidity and Size:

Larger funds with higher trading volumes (e.g., SDCI, HARD) offer tighter spreads and easier trade execution.

3. Expense Ratio:

Lower fees (e.g., L&G All Commodities UCITS ETF at 0.15%) help maximise net returns, especially for long-term holds.

4. Strategy and Structure:

Some ETFs use futures, swaps, or physical holdings. Understand the fund's structure and whether it suits your trading style and risk tolerance.

5. Geographic Access:

Choose ETFs listed on exchanges you can access through your broker, such as EBC.

Strategies for Trading Commodities ETFs

Use technical analysis to trade broad or focused commodities ETFs in line with prevailing trends in energy, metals, or agriculture.

Allocate a portion of your portfolio to commodities ETFs during periods of rising inflation, as commodities often outperform in such environments.

Regularly review and adjust your commodities ETF allocation to maintain your desired risk profile, especially after strong moves in equities or bonds.

Monitor economic data, geopolitical events, and supply-demand shocks that can impact commodity prices, and adjust ETF positions accordingly.

Risks and Considerations

Commodities can be highly volatile, especially focused ETFs tied to a single commodity or sector.

ETFs using futures may face performance drag due to the structure of commodity markets.

International ETFs may expose traders to currency fluctuations, affecting returns.

Accessing ETFs with EBC

EBC offers a wide range of ETFs and ETF CFDs, allowing traders to diversify portfolios, hedge risk, and capitalise on global trends. Whether you seek broad exposure or want to target specific sectors, EBC's platform provides the tools and access you need for effective commodities trading.

Conclusion

Commodities ETFs are powerful diversification tools for traders and investors in 2025. By choosing broad-based, low-cost funds and employing disciplined trading strategies, you can enhance your portfolio's resilience and tap into global growth and inflation trends. Explore EBC's offering of ETFs to find the right fit for your trading goals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.