Commodity funds offer investors access to raw material markets without directly trading physical goods. By allocating to energy, metals, and agricultural products through pooled investment vehicles, investors can hedge inflation, diversify portfolio risk, and participate in global resource cycles.

With commodity indices such as the Bloomberg Commodity Index posting solid gains over the past year, renewed attention has turned to the role these funds play in diversified portfolios.

Definition and Core Objectives of Commodity Funds

1. Definition

Commodity funds are investment vehicles—typically mutual funds, ETFs, or ETNs—that derive returns from commodity price movements. Exposure is achieved through:

Physical holdings (e.g., gold or silver)

Futures and swaps on commodity indices

Equity positions in commodity-producing firms

2. Investment Objectives

Inflation protection: Commodities often rise during inflationary cycles.

Diversification: Returns are imperfectly correlated with equities and bonds.

Return potential: Systematic factors such as carry and momentum can add value.

3. Typical Uses

Long-term allocation as part of a real assets sleeve

Tactical hedge during inflationary or supply-driven shocks

Speculative trading for short-term exposure

Structures and Types of Commodity Funds

| Fund Type |

Exposure Method |

Advantages |

Key Drawbacks |

| Physically-backed |

Holds tangible assets (e.g. gold) |

Precise spot tracking |

Storage and insurance costs |

| Futures-based |

Uses futures or swaps to track indices |

Broad, liquid exposure |

Roll yield risk in contango |

| Commodity equity |

Invests in resource companies |

Easier access, potential dividends |

Indirect exposure to commodity prices |

| Hybrid / multi-commodity |

Combines physical, futures, and equity |

Diversified approach |

Higher complexity and cost |

| Exchange-traded (ETF/ETN) |

Exchange-listed vehicles |

Liquidity, transparency |

Tracking error or credit exposure (ETNs) |

Futures-based funds dominate multi-commodity strategies, while physically backed products remain preferred for precious metals.

Performance Drivers and Return Components

Commodity fund returns depend on several elements beyond simple price movements:

Spot Return – The direct change in the commodity's market price.

Roll Return – The cost or gain from rolling futures contracts; positive in backwardation, negative in contango.

Collateral Return – Income generated from investing cash collateral in short-term instruments.

Illustrative Decomposition

| Component |

Typical Effect |

Description |

| Spot return |

+ |

Driven by commodity price trends |

| Roll return |

± |

Depends on futures curve shape |

| Collateral yield |

+ |

Based on interest rates and collateral efficiency |

Performance also varies by index construction. Production-weighted indices such as the S&P GSCI are energy-heavy, while the Bloomberg Commodity Index applies caps to enhance diversification.

Empirical Performance Overview

The Bloomberg Commodity Index (BCOMTR) recorded a ~12% one-year return in 2025. supported by energy and metals.

Gold ETFs remain dominant, with SPDR Gold Shares (GLD) managing over US$100 billion in assets.

Commodity ETF assets globally exceed US$250 billion, reflecting steady institutional and retail demand.

Performance dispersion across sectors is wide. Energy typically drives index-level returns, whereas precious metals act as defensive hedges. Agriculture and soft commodities remain more volatile and weather-sensitive.

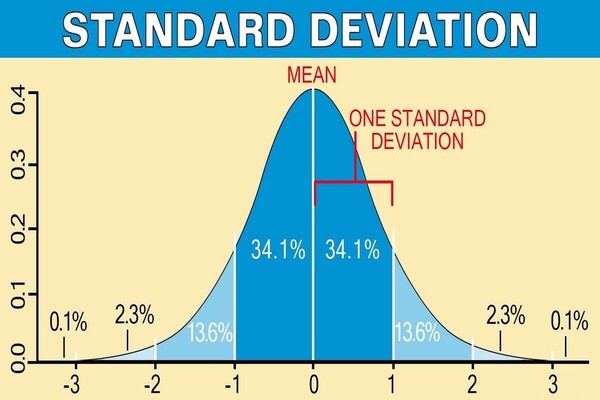

Key Risks and Structural Considerations

Roll and Curve Risk – Contango can erode long-term futures-based returns.

High Volatility – Commodities often move more sharply than equities or bonds.

Liquidity Risk – Smaller contracts can face thin trading volumes.

Counterparty and Credit Exposure – ETNs and swap-based products carry issuer or derivative risk.

Regulatory and Tax Variability – Differing tax rules apply across structures and jurisdictions.

These risks underline the importance of understanding a fund's replication method, curve exposure, and regulatory framework before investing.

Portfolio Role and Strategic Allocation

1. Diversification and Inflation Hedge

Empirical research (Vanguard, PIMCO) shows that a modest allocation (typically 2–7%) can reduce portfolio volatility and improve inflation protection.

2. Tactical Application

Investors often increase exposure during periods of rising inflation expectations or supply shocks in energy markets.

3. Portfolio Integration

Combining commodity funds with equities, bonds, and real estate can enhance real-return characteristics without materially increasing total portfolio risk.

Emerging Developments in Commodity Funds

Sustainability Integration: ESG-screened commodity strategies are gaining traction, particularly in metals linked to renewable energy.

Digitalisation: Tokenised commodity funds and blockchain settlement are improving transparency and efficiency.

Quantitative Approaches: Smart beta and factor-driven models increasingly guide commodity index construction.

Regulatory Evolution: Global regulators continue refining disclosure, leverage, and derivative-use requirements to enhance investor protection.

Conclusion

Commodity funds remain a specialised yet valuable component of diversified portfolios. They provide:

Exposure to real assets and inflation-sensitive sectors,

Low long-term correlation with traditional financial assets, and

Access to systematic return drivers unique to commodity markets.

However, effective implementation requires clarity about fund structure, index methodology, and the impact of roll yield. When managed with discipline and proper sizing, commodity funds can meaningfully strengthen portfolio resilience against inflation and cyclical shocks while offering measured participation in global resource trends.

Frequently Asked Questions

1. What exactly are commodity funds?

Commodity funds are pooled investment vehicles—such as mutual funds, ETFs, or ETNs—that offer exposure to commodity markets. They track prices of physical goods like oil, gold, or agricultural products either through futures contracts or direct holdings.

2. How do commodity funds differ from direct commodity trading?

Direct commodity trading involves buying and selling physical assets or futures contracts individually. Commodity funds, by contrast, offer diversified exposure through a managed portfolio, reducing the operational burden and complexity for investors.

3. How much of a portfolio should be allocated to commodity funds?

Institutional research (such as from PIMCO and Vanguard) suggests a 2–7% allocation can enhance diversification and inflation resilience, depending on risk appetite and investment objectives.

4. Are commodity funds appropriate for long-term investors?

They can be, but investors should understand that long-term returns depend heavily on futures structure, roll dynamics, and inflation trends. Commodities often perform best as part of a broader real-asset or inflation-hedging strategy rather than as standalone holdings.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.