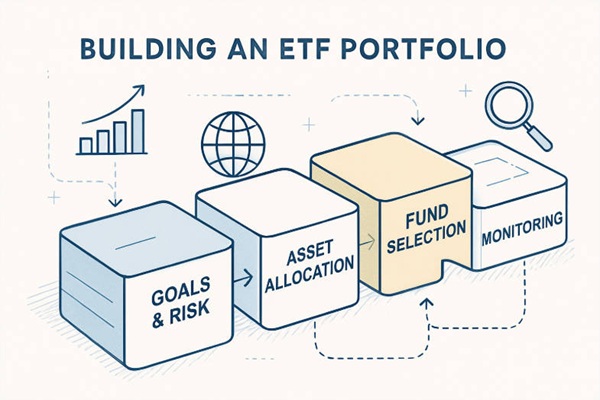

A well‑constructed ETF portfolio hinges on clear goals, appropriate asset allocation, smart fund selection, and disciplined monitoring.

From selecting the right allocation to implementing a structure that balances stability with growth, every decision matters.

This guide will walk you step by step through crafting an ETF portfolio designed for enduring performance in any market environment.

Defining Investment Goals and Risk Tolerance for Your ETF Portfolio

Before purchasing a single fund, your first task is to define why you are building the portfolio and how comfortable you are with fluctuations.

1. Investment objectives

Are you investing for long‑term accumulation (for example retirement many years ahead), or for a nearer‑term goal (e.g., buying a home within five years)?

Do you prioritise growth, income, or capital preservation?

How integral is this portfolio to your overall financial plan?

2. Time horizon and risk capacity

3. Risk tolerance

| Investment Objective |

Typical Time Horizon |

Suitable ETF Categories |

| Long-term growth |

10+ years |

Equity and thematic ETFs |

| Moderate growth |

5–10 years |

Balanced or multi-asset ETFs |

| Income generation |

3–5 years |

Bond and dividend ETFs |

| Capital preservation |

1–3 years |

Short-term bond or money market ETFs |

Determining Asset Allocation in Your ETF Portfolio

With goals and risk tolerance clarified, the next major step is to choose how your portfolio is divided among major asset classes.

1. Why asset allocation matters

Asset allocation is the cornerstone of long-term portfolio performance. Research consistently shows that allocation decisions—how much to hold in equities, bonds, and other asset classes—explain the majority of a portfolio's return variability.

A strategic allocation provides a stable long-term structure, while a tactical allocation allows adjustments based on short-term opportunities or macroeconomic conditions.

Typical asset classes & their roles

| Asset Class |

Function in Portfolio |

Example ETF Type |

Comments |

| Equity |

Capital growth |

Global, regional, or sector ETFs |

Provides exposure to corporate earnings and innovation. |

| Fixed Income |

Stability and income |

Sovereign, corporate, or inflation-linked bond ETFs |

Acts as a buffer during equity market declines. |

| Commodities |

Inflation hedge |

Gold, silver, or broad commodity ETFs

|

Offers diversification from financial assets. |

| Real Estate |

Yield and diversification |

REIT ETFs |

Provides exposure to physical assets and rental income. |

| Alternatives |

Risk reduction |

Infrastructure or multi-strategy ETFs |

Low correlation with traditional markets. |

True diversification should extend beyond asset classes to include geographies, industries, and investment factors.

Choosing a Portfolio Structure for Your ETF Strategy

With allocation decided, you must select a structure or "framework" by which you will organise the portfolio.

Common structural models

Core & Satellite:

A large "core" portion in broad‑market ETFs, with smaller "satellite" positions in specialised themes (for example tech, resources). This method offers stability and growth potential.

Equal‑Weight:

Each ETF receives similar weighting, which simplifies construction and avoids over‑reliance on one.

Goal‑Based Structure:

Allocate specific buckets for specific goals (income, growth, preservation).

All‑in‑One Solution:

For simplicity, one or two multi‑asset ETFs may cover broad exposure.

Selecting ETFs That Align With Your Strategy

Now comes the practical step of which ETFs to include.

1. Selection criteria

When choosing ETFs, prioritise:

Low expense ratio: keeping costs low helps returns.

Liquidity & size (assets under management): avoid tiny funds with risk of closure or poor execution.

Underlying holdings / methodology: understand what you hold rather than assuming all "broad‑market" funds are identical.

Fit with your asset allocation: avoid unintended overlap (for example two ETFs both holding the same stocks) and ensure global, sector, asset class diversification.

Example ETF Selection and Key Characteristics

| ETF Candidate |

Expense Ratio |

AUM / Liquidity |

Key Holdings / Focus |

Notes |

| Broad U.S. equity |

Very low |

High |

Large‑cap + mid/small cap stocks |

Good core equity exposure |

| International equity |

Low |

High |

Developed + emerging markets |

Global diversification |

| Bond market |

Low |

High |

Government + corporate bonds |

Balances equity risk |

| Theme / satellite |

Moderate |

Moderate |

e.g., tech, resources, gold |

Growth potential, higher risk |

2. Avoiding pitfalls

When selecting ETFs, be mindful of:

High fees compared to similar funds.

Low trading volume and wide bid/ask spreads which can increase cost.

Too much thematic overlap or over‑concentration in one sector/region.

Chasing recent performance and buying a fund at its peak.

Implementation: Investing and Entry Strategy

With structure and selection confirmed, now you put the plan into action.

1. Investment method

You may choose between:

Lump‑sum investing if you have a large amount ready.

Regular contributions (dollar‑cost averaging) which smooths entry and reduces timing risk.

Given you check valuations often and may be tempted to time entries, regular contributions aligned with your allocation may guard against emotional decision‑making.

2. Execution tips

Use limit orders rather than market orders to avoid paying wider spreads, especially at market open or close.

Phase your purchases rather than rushing all at once, especially for the satellite portion.

Document your target allocation and adhere to your plan rather than chasing every new "hot" fund.

Monitoring and Rebalancing Your ETF Portfolio

Once invested, the long‑term maintenance phase begins.

1. Monitoring

Review your portfolio at set intervals (for example quarterly or annually) rather than constantly reacting to daily movements. Research recommends annual or quarterly check‑up rather than frequent changes.

Monitor:

Performance of each ETF relative to its benchmark (tracking error).

Whether your allocation has drifted due to market moves.

Any changes in your own goals, risk tolerance or financial situation.

2. Rebalancing

If equity markets have surged and now your equity share exceeds target, you may need to rebalance by trimming equity and boosting bonds (or vice versa). Two common approaches:

3. Common pitfalls to avoid

Over‑trading: reacting to every market swing tends to reduce returns.

Ignoring fees, transaction costs or tax implications.

Allowing overlap to creep in (e.g., two funds expose you to the same stocks).

Losing sight of your strategic decisions due to short‑term noise.

Managing Tax Efficiency and Currency Exposure

Tax and currency considerations often distinguish average portfolios from optimal ones.

1. Tax efficiency:

Holding ETFs within tax-advantaged accounts (such as IRAs, ISAs, or SIPPs) can defer or reduce taxes.

Capital gains are only realised when units are sold, offering flexibility in timing.

Be aware of foreign withholding taxes on dividends from international ETFs.

2. Currency management:

ETFs tracking foreign markets carry currency exposure. Investors must decide whether to:

Hold unhedged ETFs to benefit from potential currency appreciation, or

Use currency-hedged ETFs to minimise exchange rate volatility.

The decision should align with the investor's base currency, time horizon, and tolerance for FX fluctuations.

Continuous Learning and Portfolio Evolution

An ETF portfolio is not a static construct. Economic regimes, interest rates, and global market leadership all evolve. Continuous learning helps investors refine strategy, embrace innovation, and maintain discipline.

Review portfolio performance annually, evaluate whether objectives or risk tolerance have changed, and stay updated on new ETF structures—such as active ETFs or fixed-maturity bond ETFs—that may enhance efficiency.

Frequently Asked Questions

Q1: What is the first step before investing in ETFs?

The first step is to define your investment goals, time horizon, and risk tolerance. Knowing whether you aim for long-term growth, near-term goals, income, or capital preservation helps guide every subsequent decision.

Q2: Why does asset allocation matter more than individual ETF selection?

Research shows that a portfolio's long-term performance is largely determined by how assets are allocated across equities, bonds, and alternatives. Correct allocation creates a foundation that can weather market ups and downs.

Q3: What is a core‑and‑satellite portfolio structure?

A core‑and‑satellite structure uses a large "core" of broad-market ETFs for stability, while smaller "satellite" positions target specific sectors, themes, or regions to enhance growth potential.

Q4: How do I select ETFs that align with my portfolio strategy?

Choose ETFs with low expense ratios, high liquidity, and transparent underlying holdings. Ensure they complement your allocation without causing sector or regional overlap, and avoid chasing recent performance.

Q5: How often should I monitor my ETF portfolio?

Set fixed review intervals, such as quarterly or annually. Frequent checking can lead to impulsive decisions. Focus on allocation drift, ETF performance relative to benchmarks, and any changes in your personal financial goals.

Conclusion

Building an ETF portfolio effectively is not about chasing the latest hot fund or timing the market perfectly. It is about starting with clear goals, translating those into the correct asset allocation, selecting a sensible structure, choosing quality ETFs, implementing your plan, and then maintaining it through discipline and regular review.

By aligning your portfolio with your long‑term horizon, working within your risk comfort and avoiding the distractions of daily market noise, you place yourself in the best position for sustained growth. Your success will stem more from consistency, structure and patience than from perfect timing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.