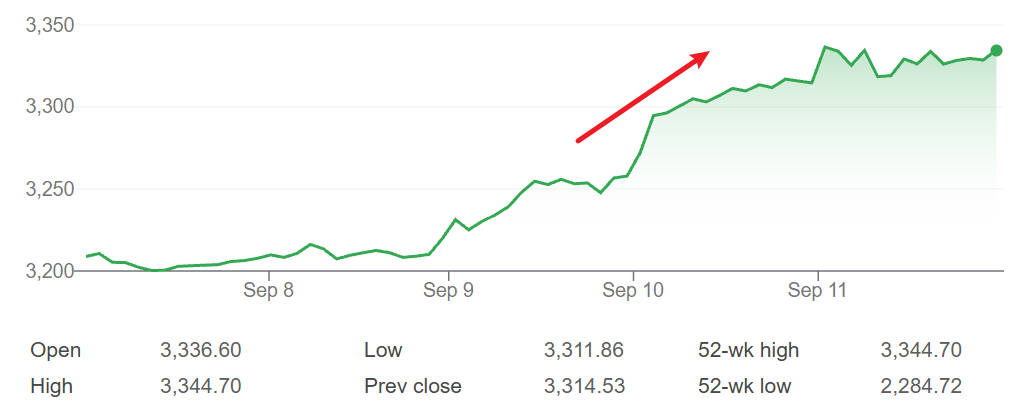

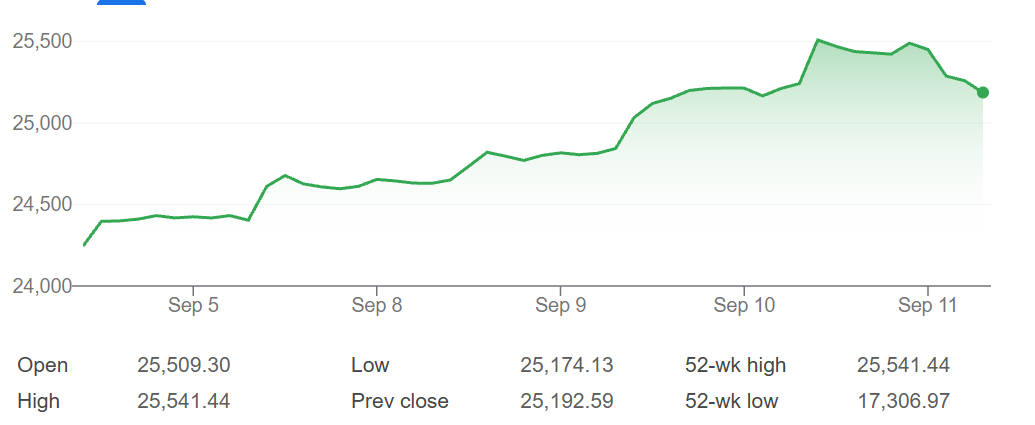

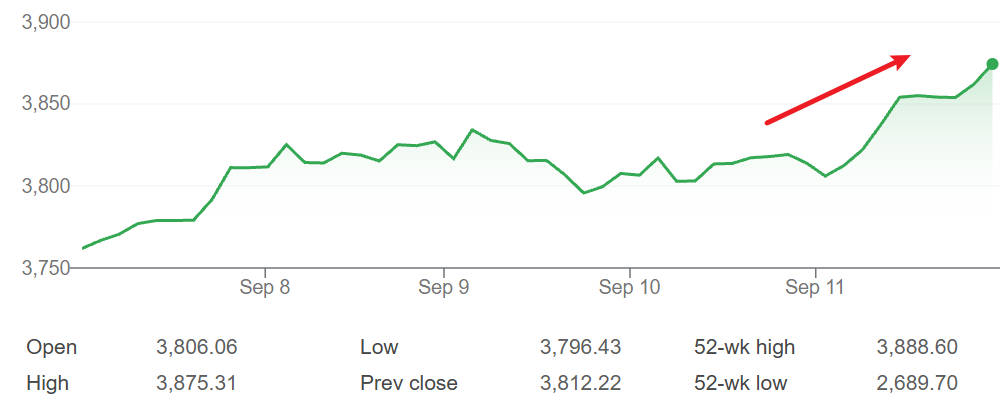

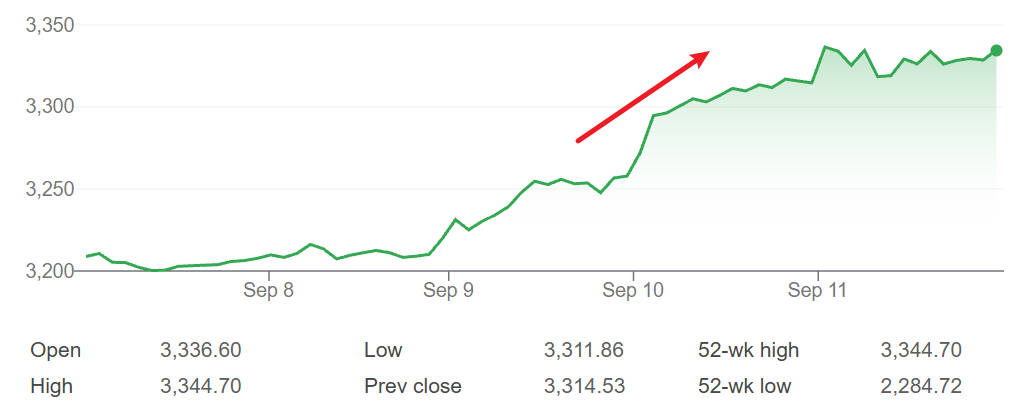

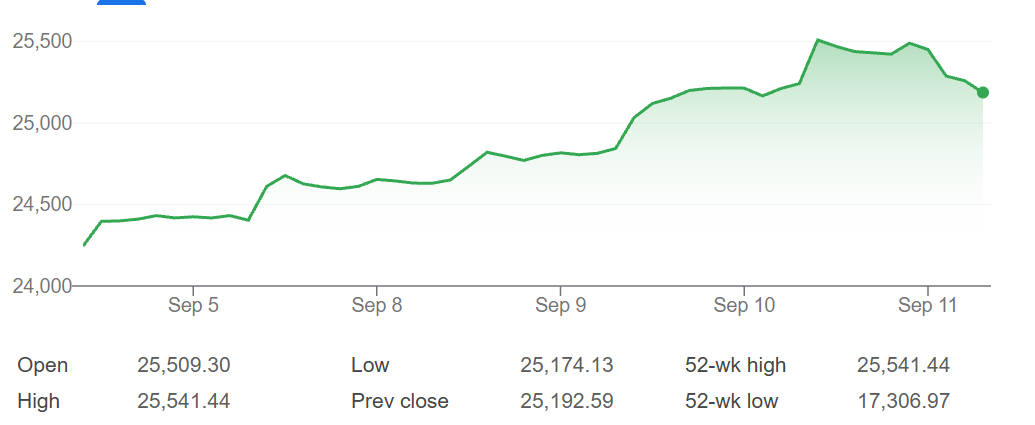

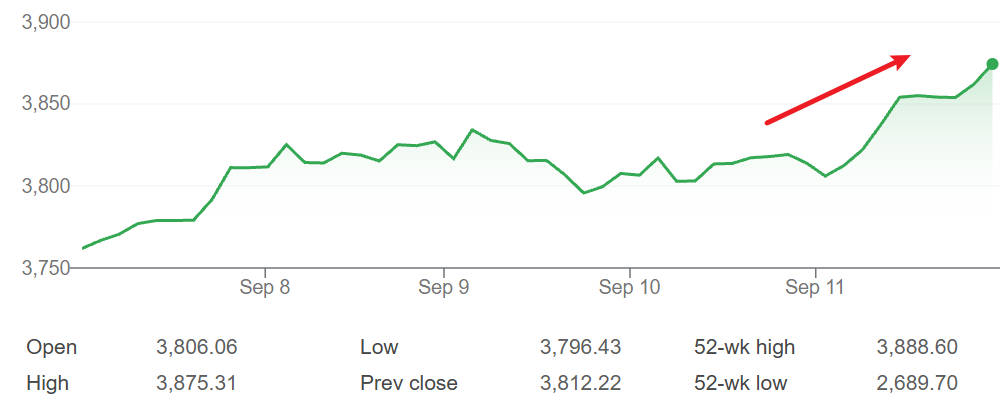

Asian equities extended their rally this week, with several major indices touching record highs as optimism over forthcoming U.S. Federal Reserve rate cuts strengthened. Softer-than-expected U.S. inflation data and surging demand for technology shares have fuelled the bullish mood across the region.

Record-Breaking Performances

China's CSI 300 and Shanghai Composite posted moderate gains, buoyed by renewed optimism in the AI sector and cautious policy support, though lingering concerns over property and debt kept upside in check.

What's Driving the Rally?

Several key factors explain the current momentum in Asian stock markets:

1) U.S. inflation cooling:

Softer U.S. producer price data has reinforced expectations that the Fed could soon begin cutting rates. Lower U.S. borrowing costs typically weaken the dollar and encourage flows into riskier assets, including Asian equities.

2) Tech-led strength:

Robust demand for AI and semiconductors has boosted chipmakers in South Korea and Taiwan, while Japan has benefitted from global interest in automation and robotics.

3) Policy clarity:

Japan's political transition and South Korea's decision to delay a controversial capital gains tax on stocks have reassured investors.

4) Global sentiment:

Overnight gains on Wall Street, where the Nasdaq hit record highs, provided a positive backdrop.

Risks and Challenges Regarding Asian Stock Market

Despite the upbeat tone, analysts caution against complacency.

1) Inflation uncertainty:

If U.S. inflation proves stickier than expected, the Fed could delay or scale back cuts, reducing investor appetite for Asian risk assets.

2) China's headwinds:

Debt concerns, property market weakness, and regulatory uncertainty continue to weigh on mainland equities.

3) Geopolitical tension:

U.S.–China trade disputes and ongoing conflicts in Eastern Europe and the Middle East remain wildcards.

4) Capital flows:

Foreign investors have been active buyers, but a reversal could spark volatility, particularly in emerging Asian markets.

Opportunities for Investors

Global banks such as Goldman Sachs have issued bullish calls on the region, particularly highlighting Hong Kong, Japan, and South Korea.

Investors are watching opportunities in:

ETFs and index funds tracking Asian equities.

Semiconductor and AI-related firms in Taiwan and Korea.

Export-oriented Japanese firms, benefiting from the weaker yen.

Hong Kong equities, which remain relatively undervalued compared with regional peers.

What's Next?

All eyes are now on upcoming U.S. consumer inflation data (CPI). A softer reading could cement expectations of a Fed cut as early as next quarter, potentially sending Asian indices even higher. Conversely, any surprise on the upside may trigger profit-taking.

Investors are also monitoring corporate earnings in Asia, especially within the semiconductor and technology sectors, for further confirmation of the region's growth potential.

FAQs about Asian Stock Market

Q1. Are U.S. rate cuts the main reason for the surge?

Yes, they're a major driver, as lower U.S. rates encourage global capital to flow into higher-yielding assets, including Asian equities.

Q2. Which Asian markets are strongest right now?

Japan, South Korea, and Taiwan are leading gains, particularly in tech-related sectors.

Q3. What risks should investors watch?

Persistent inflation, geopolitical tensions, and policy uncertainty in China remain the biggest threats.

Q4. Is this rally sustainable?

It depends on the Fed's actions, global growth, and sector-specific demand. For now, momentum looks strong, but volatility is likely.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.