Adobe Inc. (NASDAQ: ADBE) surged over 3% in pre-market trading on Friday after reporting third-quarter earnings that exceeded analysts' expectations.

The company also raised its full-year revenue guidance, signalling strong momentum in its digital media and AI-driven offerings. Investors responded positively to robust subscription growth, record annual recurring revenue (ARR), and growing adoption of Adobe's AI tools among enterprise clients.

Financial Performance: Q3 FY2025 Highlights

Adobe reported robust financial results for the third quarter of fiscal year 2025. ending August 29. 2025:

Revenue: $5.99 billion, marking an 11% year-over-year increase.

Adjusted Earnings Per Share (EPS): $5.31. surpassing analyst expectations.

Digital Media Annual Recurring Revenue (ARR): $18.59 billion, with AI-driven ARR exceeding $5 billion.

AI-First ARR: Over $250 million, surpassing the company's initial target.

In response to these strong results, Adobe raised its full-year fiscal 2025 guidance:

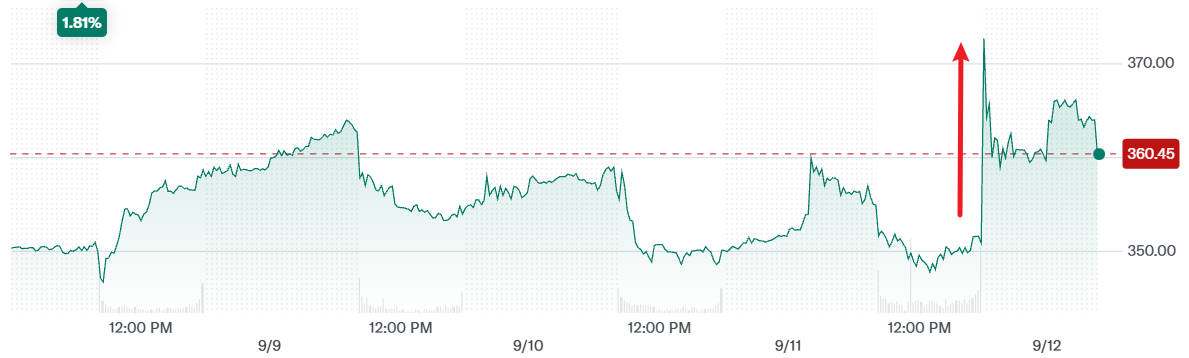

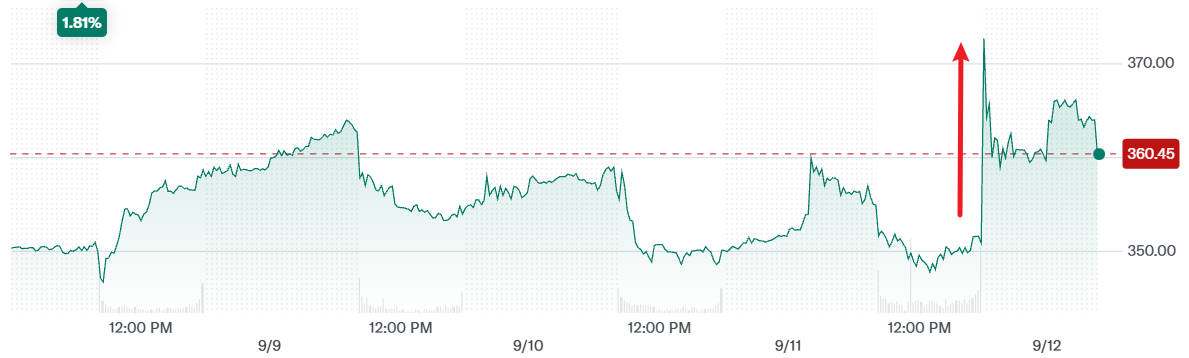

Market Performance of Adobe

As of September 11. 2025. Adobe's stock price closed at $350.55. reflecting a 0.11% increase from the previous close. Despite a more than 21% decline in share value earlier in the year, the recent earnings report led to a positive market response, with shares rising approximately 3% in after-hours trading.

Analyst sentiment remains cautiously optimistic, with a consensus "Buy" rating and a 12-month price target ranging from $444.89 to $474.07. suggesting potential upside from current levels.

Strategic Initiatives and Growth Drivers

1) AI Integration and Product Innovation

Adobe's strategic focus on AI is evident through its Firefly product, which enables users to generate images and videos from text prompts. This innovation has been integrated into core applications like Photoshop and Illustrator, enhancing user experience and driving adoption.

The company has also partnered with AI models such as Gemini and GPT to bolster its AI capabilities, positioning itself as a trusted partner for enterprise clients.

2) Enterprise Adoption and Customer Engagement

Adobe's AI tools have seen significant uptake among large enterprises:

Fortune 100 Adoption: Nearly 90% of Fortune 100 companies have incorporated Adobe's AI tools into their operations.

Enterprise ARR Growth: Over 40% of Adobe's top 50 enterprise accounts have doubled their ARR since early fiscal 2023.

These metrics underscore Adobe's strong position in the enterprise market and its ability to drive recurring revenue through AI-driven solutions.

Competitive Landscape and Challenges

Despite its strong performance, Adobe faces competition from emerging players in the AI space, such as OpenAI and Canva. These companies are developing innovative tools that challenge Adobe's market share in creative software.

Additionally, investor sentiment remains cautious due to concerns over the pace of AI adoption and the potential for increased competition. Adobe's ability to execute its AI strategy effectively will be crucial in maintaining its market leadership.

Analyst Perspectives

Analysts maintain a positive outlook on Adobe's stock, with a consensus "Buy" rating. The average 12-month price target is approximately $471.35. indicating a potential upside of over 34% from current levels.

However, forecasts vary, with some analysts projecting a maximum price of $600 and others estimating a minimum price of $280. reflecting differing views on Adobe's growth prospects and market conditions.

Frequently Asked Questions (FAQ)

1. What is Adobe's current stock price?

As of September 11. 2025. Adobe's stock price is $350.55.

2. How did Adobe perform in Q3 FY2025?

Adobe reported $5.99 billion in revenue and adjusted EPS of $5.31. exceeding analyst expectations.

3. What is Adobe's outlook for the remainder of fiscal 2025?

The company has raised its full-year guidance to a revenue range of $23.65 billion to $23.70 billion and adjusted EPS of $20.80 to $20.85.

4. What are the key factors driving Adobe's growth?

Adobe's growth is driven by strong enterprise adoption of AI tools, product innovation, and strategic partnerships with AI models like Gemini and GPT.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.