Oracle (NYSE: ORCL) just delivered its largest single-day gain in over three decades, but is this a sustainable turning point or just short-term AI euphoria?

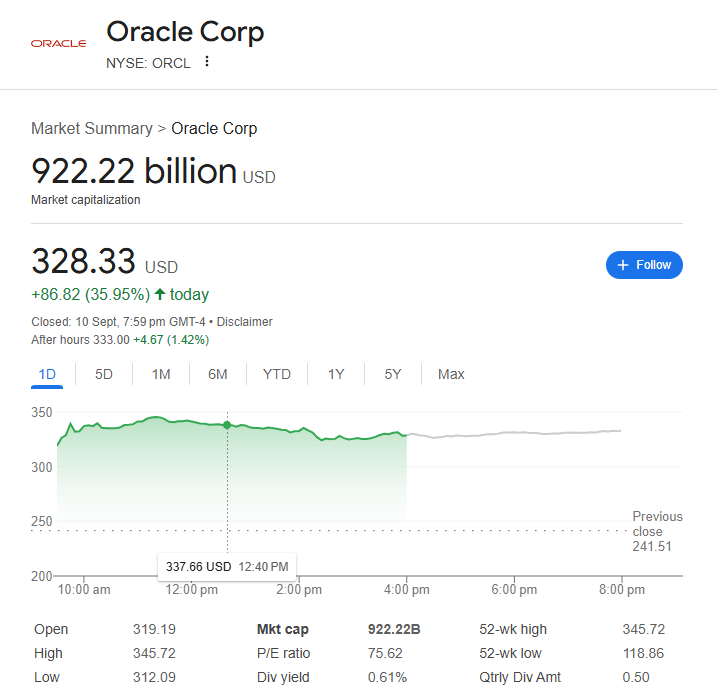

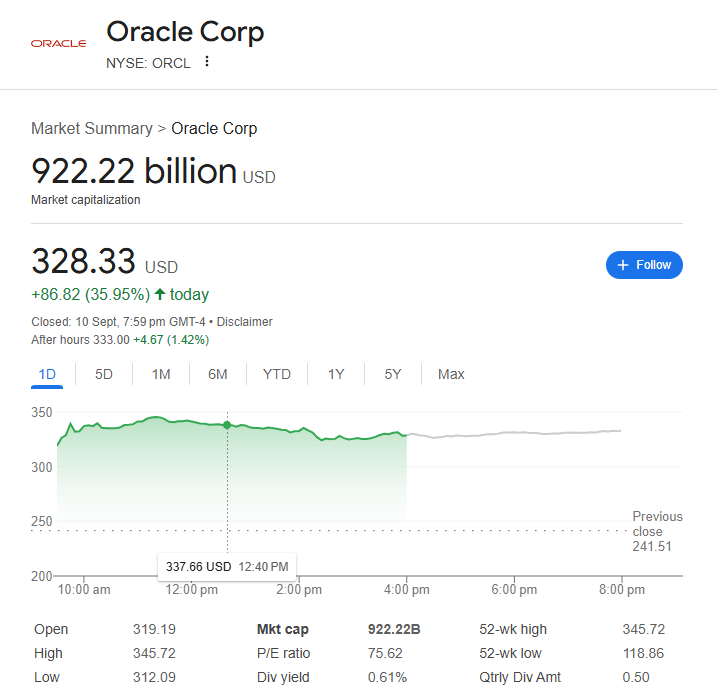

As of September 2025, ORCL stock surged approximately 36% in a single trading session, adding over $247 billion to its market value. Intraday, Oracle touched a $922 billion valuation, and its stock settled around $328.

This historic move reflects investor confidence in Oracle's massive AI-cloud contracts, ballooning backlog, and reborn market leadership, but it also raises questions about sustainability, valuation, and execution risk.

What Sparked ORCL Stock's 36% Rally?

As mentioned above, Oracle's stock skyrocketed 36% intraday, closing with its largest one-day jump since 1992. This surge added approximately $247 billion in market value, propelling the company to $913 billion valuation, closing in on the trillion-dollar milestone. [1]

Additionally, Oracle's rally lifted the S&P 500 and Nasdaq to record highs, with AI-related names like Nvidia and AMD also rallying. Gold spiked as inflation expectations cooled, a sign of optimism in rate markets.

What Sparked the Rally?

1) A $300 billion five-year cloud contract with OpenAI, one of multiple multibillion-dollar deals.

2) Oracle's RPO soared to $455 billion, up more than fourfold from last year.

3) AI infrastructure demand surged, reinforcing Oracle's leadership path in AI-cloud services.

Did Oracle's Post-Earnings Affected Its Surge?

While Oracle beat expectations in contract metrics, earnings were a mixed bag:

Revenue: $14.9B (slightly below $15B estimate)

Adjusted EPS: $1.47 vs. the $1.48 expectation

Nonetheless, the insane surge in RPO overshadowed earnings misses and fueled investor optimism.

Cloud revenue generated by AI is projected to rise from $18 billion in fiscal 2025 to an impressive $144 billion by 2030. CEO Safra Catz described the quarter as "brilliant," emphasising an ambitious growth vision backed by billion-dollar contracts.

Analyst Sentiment & ORCL Share Price Targets

Wall Street is uniformly bullish. Major firms raised price targets sharply:

These upgrades reflect recognition of Oracle's regained leadership in AI infrastructure and long-term booking visibility.

Oracle Stock: Bull Case vs Bear Case

ORCL Stock Bull Case

1) AI Alignment & Mega-Projects

Oracle is deeply embedded in OpenAI, SoftBank's Stargate, and xAI ecosystems.

2) Backlog Visibility

A $455B RPO offers reliable growth over several years.

3) Analyst Faith

Analysts' lofty price targets reflect expectations of sustained growth.

4) Market Leadership Reborn

Once a laggard in Cloud, Oracle is now a key player challenging AWS and Azure standards.

ORCL Stock Bear Case

1) Execution Risk

Capex is projected to exceed $35B in FY2026 (vs. $1.6B in 2020). Failure to deliver infrastructure buildouts could erode confidence. [3]

2) Valuation Stretch

A 36% one-day jump already prices in significant future growth.

3) Macroeconomic Headwinds

Inflation, rates, or AI overinvestment could shift sentiment quickly.

4) Competitive Pressure

Microsoft Azure and AWS continue to lead in scale, and Oracle's advantage in AI could diminish if competitors accelerate.

While Microsoft (Azure) and Amazon (AWS) remain leaders in cloud market share, Oracle's growth rate centred around AI has recently surpassed that of several competitors. Its enterprise-driven approach gives it a niche, but its scale still lags the leaders.

This dynamic positions Oracle as an AI growth challenger, though not yet the dominant cloud provider.

Investor Roadmap: ORCL Strategies by Investor Type

| Investor Type |

Strategy |

Notes |

| Long-Term Value |

Buy on pullbacks, hold for AI infrastructure expansion |

Multi-year growth if Oracle executes successfully |

| Momentum Trader |

Trade volatility on dips & breakouts |

High-risk; requires tight stops |

| Cautious / Income |

Wait for earnings stability & capex discipline |

Safer entry once fundamentals confirm growth |

What Investors Should Monitor Next About Oracle?

Execution: AI data centre buildouts and contract delivery.

Capex vs Free Cash Flow: Sustainability of heavy investment.

Oracle's October AI Event: Launch of the "Oracle AI Database" could be a major catalyst.

Investor Sentiment: The demand for technology and AI will determine short-term fluctuations.

How to Trade US Stocks with EBC?

For investors who want to capture the US stock's historic volatility but prefer flexibility over direct ownership, Contracts for Difference (CFDs) can be an effective tool. With CFDs, traders can speculate on both upward rallies and downside corrections in ORCL stock without needing to own the underlying shares.

At EBC Financial Group, clients gain access to:

Trading US stocks like Apple, Tesla and NVIDIA via CFDs, with competitive spreads and execution

Leverage options (within regulatory limits) that allow traders to control larger positions with smaller capital outlays.

Risk management tools, such as stop-loss and take-profit orders, can safeguard portfolios during unpredictable fluctuations induced by AI.

Diversification opportunities. Trade not only US equities but also forex, indices, and commodities from a single platform.

It means that whether US stocks sustain their AI-driven bull run or face short-term pullbacks, traders can position themselves to benefit from both scenarios.

Remember: Ensure you understand how CFDs work and consider whether you can afford to take the high risk before trading.

Frequently Asked Questions

1. Why Did Oracle (ORCL) Stock See Its Biggest Jump Since 1992?

A record $300B OpenAI contract, a $455B backlog, and rising AI demand drove the biggest one-day gain since 1992.

2. What Is Oracle's Current Valuation?

As of September 2025, Oracle's market capitalisation is approximately $922 billion, with shares trading at around $328 following the post-earnings rally.

3. How Does Oracle Compare to Competitors Like Microsoft and Amazon?

While AWS and Azure remain larger, Oracle's AI-focused growth has outpaced rivals in percentage terms, giving it renewed relevance in cloud competition.

4. Is ORCL Stock a Buy Now?

Analysts are divided: many see Oracle as a strong buy due to its expanding AI cloud business and solid earnings momentum. Others caution about its high valuation and competitive pressures from Microsoft and Amazon.

Conclusion

In conclusion, Oracle's record-breaking 36% rally highlights the market's hunger for AI-driven growth stories. With a $455B backlog, mega-contracts, and analyst upgrades, the bull case is compelling. However, risks around execution, capital intensity, and competition remain real.

For investors, the key is balance. Thus, participate in Oracle's AI upside, but hedge against volatility and macro shocks. The stock may be an AI winner, but its future trajectory depends on whether execution can keep pace with expectations.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.wsj.com/finance/stocks/global-stocks-markets-dow-news-09-10-2025-e7ad8639

[2] https://www.investopedia.com/why-wall-street-analysts-say-the-record-run-for-oracle-stock-is-just-getting-started-11807703

[3] https://www.barrons.com/articles/oracle-earnings-stock-price-c203c0ce