XEQT ETF and VEQT ETF both aim to offer Canadian investors a single, globally diversified, all-equity portfolio with automatic rebalancing. In practice, three factors shape the investor experience: how closely each fund tracks its target exposure, the actual all-in costs after fees and trading friction, and the extent of allocation drift before rebalancing occurs.

This analysis of XEQT vs VEQT highlights factors that compound over time. While the late 2025 fee cuts affected headline costs, the main differences are structural: portfolio geography, index selection, rebalancing process, and the operational frictions that cause tracking differences.

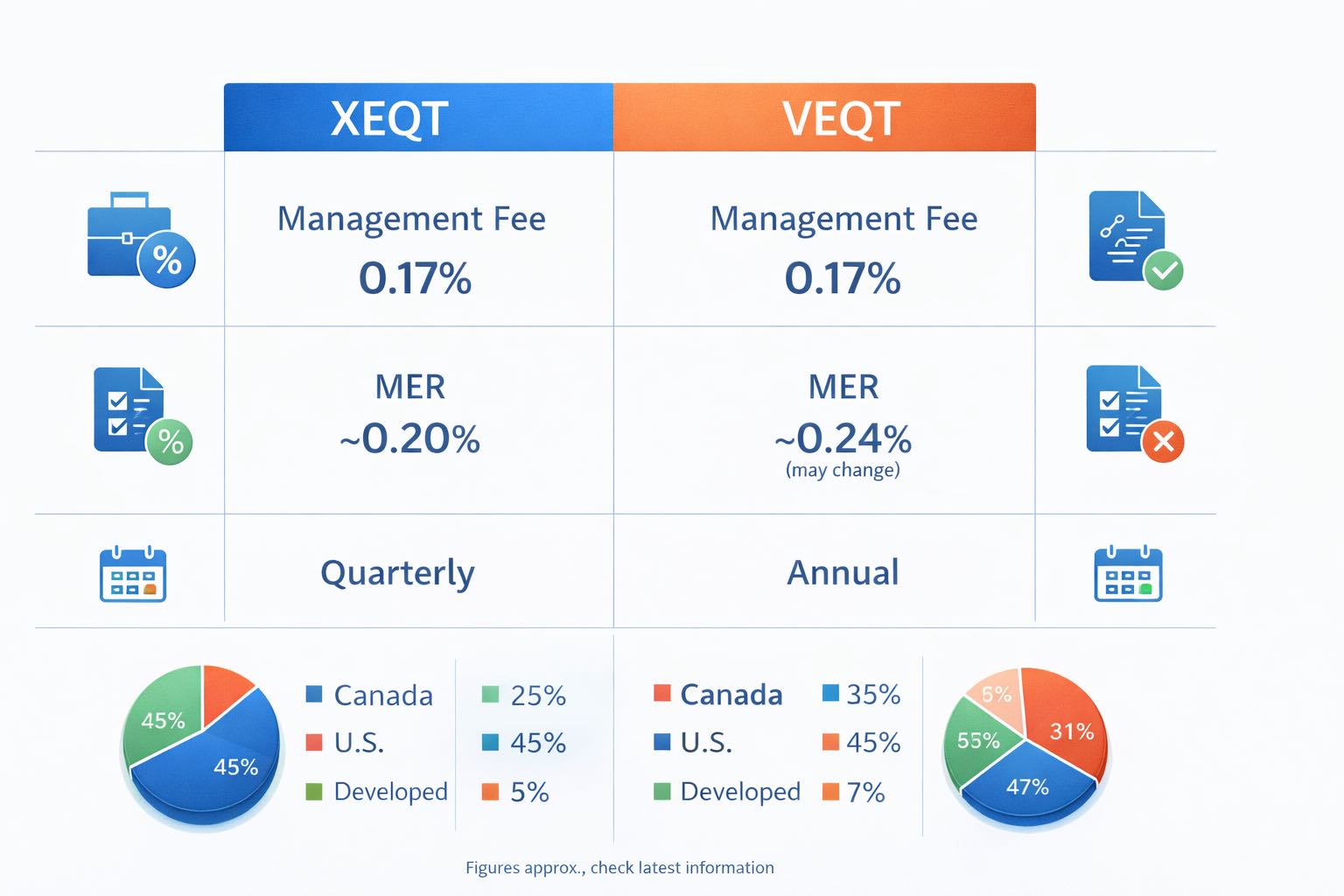

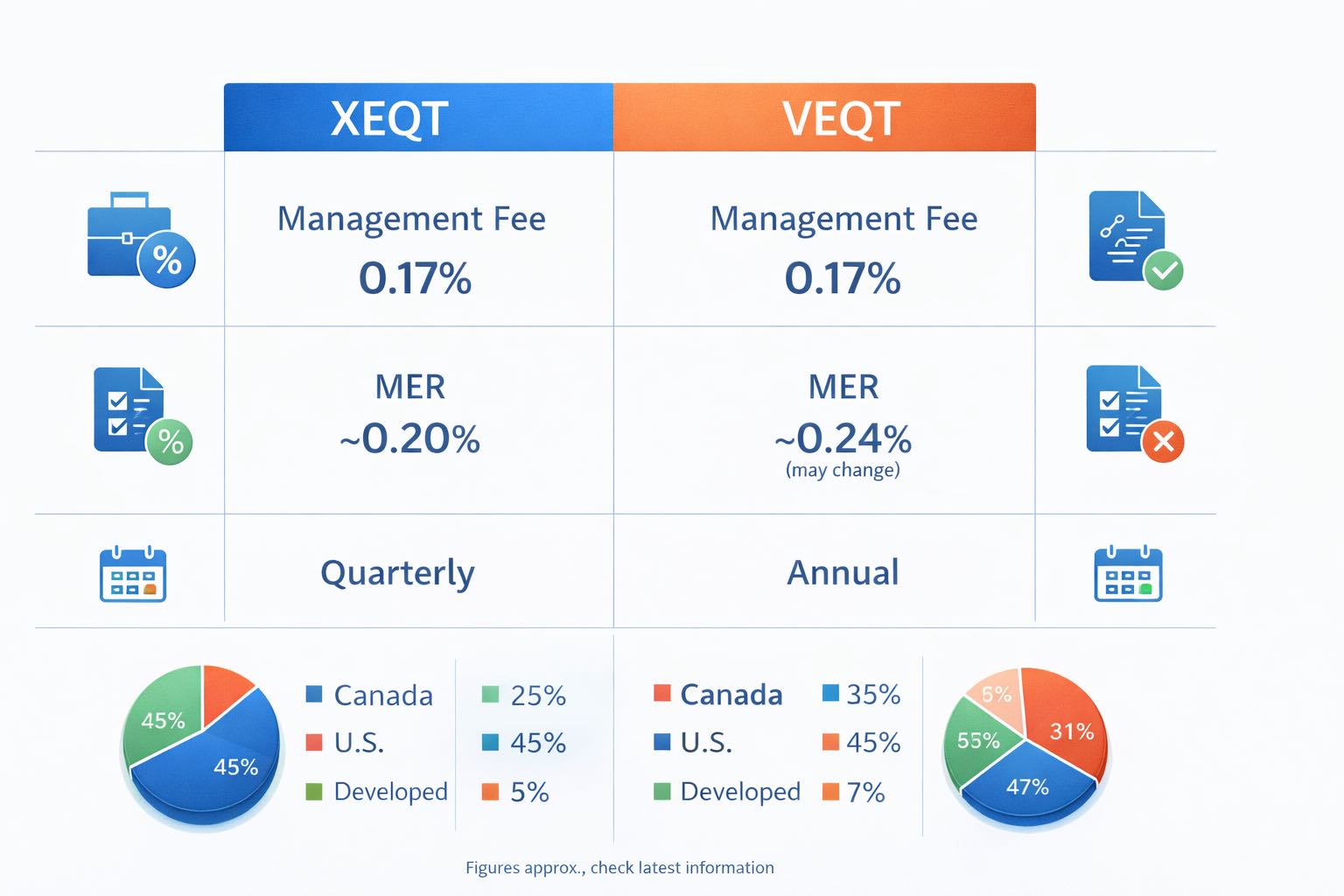

At a glance: Key facts table

| Feature |

XEQT ETF |

VEQT ETF |

| Inception |

Aug 7, 2019 |

Jan 29, 2019 |

| Equity exposure |

100% |

100% |

| Management fee |

0.17% (effective Dec 18, 2025) |

0.17% (effective Nov 18, 2025) |

| MER (recently reported) |

0.20% |

0.24% (does not yet reflect fee cut on fund page) |

| Trading expense ratio (TER) |

0.01% |

0.00% |

| Distribution frequency |

Quarterly |

Annually |

| Assets (approx.) |

CAD 11.75B (Nov 30, 2025) |

CAD 10.00B (Nov 30, 2025) |

| Avg bid-ask spread (12 months) |

0.04% |

0.028% |

What You Actually Own: Portfolio Construction And Index Exposure

Both funds are portfolio ETFs that primarily hold a limited number of underlying index ETFs. This structure is important because tracking differences result from both the underlying ETFs’ tracking and the portfolio ETF’s rebalancing and cash management.

XEQT ETF: target mix and underlying structure

XEQT maintains a long-term strategic allocation of 100% equities and is continuously monitored, with rebalancing as needed.

Its long-term equity target weights are commonly presented as:

A key implementation detail is the construction of the U.S. sleeve. U.S. exposure may be held through a combination of U.S.-domiciled and Canada-listed total market ETFs, due to operational constraints that sometimes restrict U.S.-domiciled ETF share sales to non-U.S. funds.

VEQT ETF: strategic mix and underlying structure

VEQT also targets 100% equity, but its disclosures state that the asset mix may be reconstituted and rebalanced periodically at the sub-advisor’s discretion.

As of late 2025, the fund’s allocation to underlying Vanguard equity ETFs was shown as:

The main distinction is that VEQT generally has higher allocations to Canada and emerging markets, while XEQT allocates more to developed international markets. These differences can influence performance cycles and volatility.

Costs: Management Fee vs MER vs Real-world Trading Friction

The three cost layers that actually reduce returns

Management fee: the stated fee to run the ETF.

MER: management fee plus operating expenses and applicable taxes, expressed as an annualized percentage of assets.

Trading friction: bid-ask spreads and any trading costs inside the fund (TER).

Cost comparison table (recent disclosures)

| Cost item |

XEQT ETF |

VEQT ETF |

What it means for investors |

| Management fee |

0.17% |

0.17% |

The headline fee is now identical after late-2025 fee cuts |

| MER (reported) |

0.20% |

0.24% |

VEQT’s reported MER is higher, though recent fee cuts may lower future MER once reflected |

| Trading expense ratio (TER) |

0.01% |

0.00% |

Small difference, but it contributes to long-term tracking variation |

| Avg bid-ask spread (ETF Facts period) |

0.04% |

0.028% |

One-time trading cost when buying or selling; lower spreads benefit frequent traders |

A simple compounding example

A 0.04% MER difference (0.20% vs 0.24%) may seem minor, but over 25 years, it can result in approximately $3,800 less on a $100,000 portfolio, depending on market returns. This illustrates the impact of compounding, not a specific forecast.

The practical interpretation:

If VEQT’s MER falls after the fee reduction flows through, the cost gap may narrow or disappear.

If current MERs remain unchanged, XEQT maintains a modest cost advantage.

Tracking Difference: Why Real Returns Differ From “The Benchmark.”

Tracking difference is the ongoing gap between a fund’s return and the return of its intended exposure. Unlike tracking error, which measures variability, tracking differences in portfolio ETFs like XEQT and VEQT usually result from identifiable frictions.

The main drivers of the tracking difference in XEQT vs VEQT

MER and operating costs (ongoing return drag).

Trading costs inside the fund (TER) and portfolio turnover related to rebalancing.

Withholding taxes on foreign dividends, which can differ depending on how foreign exposure is held (direct holdings vs fund-of-funds layers, and whether some sleeves are U.S.-domiciled or Canada-domiciled).

Cash drag from small cash balances used for operations and distributions.

Premiums and discounts to NAV, plus bid-ask spread at the time you trade (a trading effect, not an ongoing fee).

What to expect in practice

For diversified, index-based portfolio ETFs, tracking differences are typically small and mainly driven by costs. Exceptions occur when structural factors require implementation workarounds, such as using a blend of instruments to maintain exposure, as seen in XEQT’s U.S. sleeve.

From an investor’s perspective, the right way to monitor tracking differences is:

Compare the NAV total return (not just market price return) to a consistent reference exposure.

Evaluate across multi-year periods, not weeks or months.

Separate ongoing drag (MER, withholding) from one-time trading effects (spreads, premiums, discounts).

Allocation Drift And Rebalancing: How Tightly The Mix Stays On Target

Allocation drift happens when one region outperforms and increases its share of the portfolio. While not inherently negative, drift alters risk exposure. Rebalancing restores weights to the strategic mix.

XEQT ETF: explicit target weights and tight drift expectations

The portfolio is continuously monitored and rebalanced as needed. The manager expects allocations to remain close to targets, typically within one-tenth of the target weights.

How this shows up in holdings

As of November 30, 2025, the published holdings implied the following approximate regional exposure:

Compared to the long-term targets (25/45/25/5), the observed drift was modest. This controlled drift aligns with what most long-term investors seek in a set-and-hold portfolio ETF.

VEQT ETF: Strategic Mix Held Through Four Sleeves

VEQT’s disclosures show a stable four-sleeve structure (U.S., Canada, developed ex North America, emerging markets), with rebalancing done from time to time.

A useful way to see drift control is to compare two disclosure points:

Sep 30, 2025 (ETF Facts): U.S. 45.24%, Canada 30.43%, developed ex North America 16.94%, emerging markets 7.27%

Nov 30, 2025 (Fact sheet): U.S. 45.1%, Canada 30.9%, developed ex North America 16.9%, emerging markets 7.1%

The small changes indicate active maintenance of the strategic mix, even as market movements affect allocations.

The Choice Between XEQT And VEQT Depends On Your Preferred Exposure

For long-term investors, the decision is less about which fund is superior and more about which exposure you want to hold throughout market cycles.

Choose the XEQT ETF if you value

Slightly lower reported MER in recent disclosure, with the same headline management fee after the late-2025 reduction.

A global mix that typically allocates more to developed international equities compared to VEQT.

A rebalancing framework described as continuously monitored with explicit drift expectations in product materials.

Choose the VEQT ETF if you prefer

A portfolio with higher allocations to Canada and emerging markets, which may appeal to those seeking home bias and greater emerging market exposure.

The late-2025 fee cut to a 0.17% management fee, with the expectation that future MER reporting may move lower once the cut is fully reflected in MER reporting.

Annual distributions, which may suit investors who prefer fewer distribution events while focusing on total return.

Practical Tips That Reduce Tracking Friction

Use limit orders, especially for larger trades, to control the impact of bid-ask spreads.

Avoid trading at the open and close when spreads can widen.

View distributions as a mechanical aspect, not a measure of performance. Total return is the key metric.

Avoid evaluating tracking over short periods. Costs and taxes can cause short-term fluctuations, even when the fund operates as intended.

Frequently Asked Questions (FAQ)

1. Is XEQT cheaper than VEQT?

On the recently reported MER, XEQT ETF is lower (0.20%) than VEQT ETF (0.24%). However, both have a 0.17% management fee after late-2025 reductions, and VEQT’s future MER may decline once the fee cut is fully reflected in MER reporting.

2. What is the main difference in exposure in XEQT vs VEQT?

Both are 100% equity, but VEQT’s disclosed mix is more Canadian and more emerging markets, while XEQT’s mix has tended to carry more developed international equity.

3. How often do they rebalance?

XEQT is described as continuously monitored and automatically rebalanced as needed. VEQT describes rebalancing as needed at the sub-advisor’s discretion.

4. Why can my return differ from the fund’s NAV return?

If you buy or sell at a premium or discount to NAV, or you cross the bid-ask spread, your realized return can differ from NAV-based returns. This is a trading effect, not an ongoing fee.

5. Should you hold both XEQT ETF and VEQT ETF?

Holding both funds typically averages exposures and increases complexity. It is more effective to select the fund with your preferred geographic mix and mechanics, then remain consistent.

Conclusion

XEQT and VEQT are both well-designed, diversified, all-equity core holdings intended for long-term investment. The decision is clearer when considering key factors: tracking difference results from small frictions, costs compound over time to shape outcomes, and allocation drift is managed through rebalancing.

With both funds now offering a 0.17% management fee, the main differences are the reported MER, geographic mix, and rebalancing framework. Select the exposure you want to hold through a full market cycle, and rely on time and discipline for results.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.