QQQ and QQQM both deliver the same core exposure: the Nasdaq-100, a concentrated basket of the largest nonfinancial companies listed on Nasdaq. The real decision in QQQ vs QQQM is not about holdings. It is about how you pay for that exposure and how efficiently you can trade it when execution quality matters.

In practice, QQQ serves as the primary trading vehicle for the Nasdaq-100, designed for high turnover, precise execution, and robust options activity. QQQM, by contrast, is a newer, lower-cost alternative intended for long-term investors seeking lower annual expenses. Although recent structural changes to QQQ have narrowed the fee differential, the liquidity hierarchy remains unchanged.

QQQ Vs QQQM Key Takeaways

Both QQQ and QQQM track the Nasdaq-100, resulting in fundamentally identical return drivers, including mega-cap growth leadership, earnings revisions, and sensitivity to long-term interest rates.

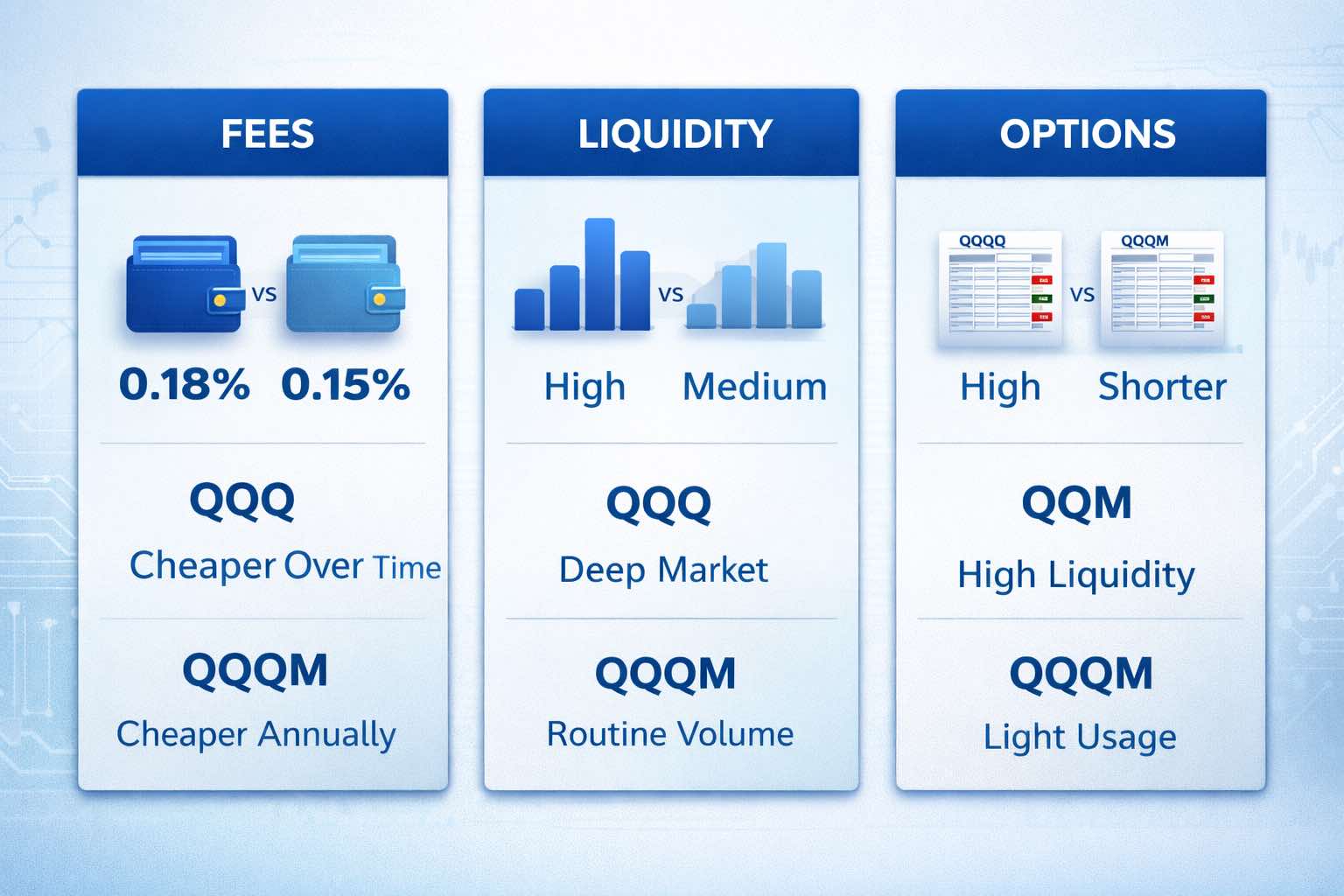

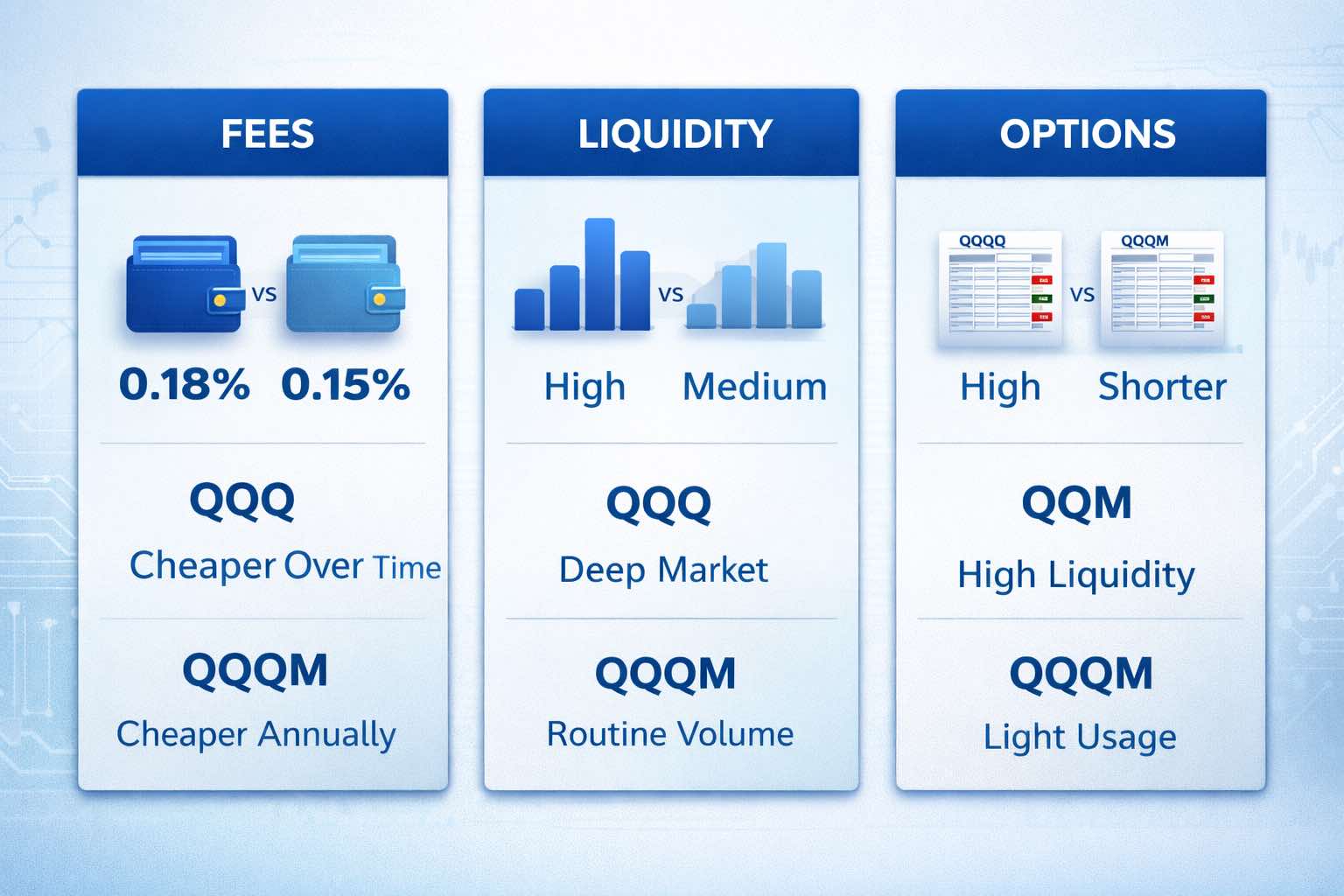

Fees Favor QQQM, But By A Smaller Margin Than Before: QQQ’s expense ratio is 0.18%, and QQQM’s is 0.15%, a 0.03% annual difference. That gap is real, but it is not large enough to offset poor trade execution.

Liquidity is significantly greater in QQQ, with a 10-day average volume of approximately 71.9 million shares compared to 5.78 million for QQQM. For active traders, this liquidity advantage often outweighs the fee differential.

Spreads Are Tight In Both, Tightest In QQQ: Representative quotes show penny-level efficiency, but QQQ typically clears size with less slippage in stress.

Options liquidity is substantially higher for QQQ, which serves as a dominant underlying for options with multi-million contract days and elevated average daily volume. In contrast, QQQM’s options activity is considerably lower, affecting hedging costs and execution quality.

What Is QQQM? And What Is The Difference Between QQQ And QQQM?

QQQM is an exchange-traded fund (ETF) that tracks the Nasdaq-100 while offering a lower expense ratio than QQQ. It is positioned as the buy-and-hold alternative within the QQQM and QQQ suite, providing identical benchmark exposure, reduced annual fees, and generally lower trading volume.

The primary differences between QQQ and QQQM are evident in market microstructure rather than in portfolio composition.

Metric |

QQQ |

QQQM |

| Net Expense Ratio |

0.18% |

0.15% |

| Inception Date |

03/10/1999 |

10/13/2020 |

| Total Assets |

$411.8B |

$73.4B |

| Avg Volume (10 Day) |

71.9M Shares |

5.78M Shares |

| SEC Yield |

0.47% |

0.51% |

| Distribution Yield |

0.45% |

0.49% |

| Representative Bid-Ask Spread |

$0.08 |

$0.06 |

The metrics above reflect published fund profiles and representative market quotes as of February 2026.

Fees And Tracking: Where The Return Gap Actually Comes From

Expense Ratio: 3 Basis Points, Small Annually, Persistent Over Decades

The most straightforward advantage in the QQQ versus QQQM comparison is cost. QQQM’s expense ratio is 0.15%, compared to 0.18% for QQQ, resulting in a 0.03% annual benefit before accounting for trading costs.

Although the annual fee difference appears minor, compounding can make it significant over time. For a $100,000 investment, the initial annual fee gap is approximately $30. Assuming an 8% annual gross market return, the cumulative difference in ending value is as follows:

10 Years: about $592

20 Years: about $2,515

30 Years: about $8,022

This is the core case for QQQM: when you intend to hold through full cycles, minimizing predictable drag is rational.

QQQ’s Modernization Tightened The Gap

QQQ historically carried structural constraints tied to its older format. That changed when it began trading as an open-end fund ETF on December 22, 2025, alongside a fee reduction from 0.20% to 0.18%, with added flexibility, including the ability to reinvest income and participate in securities lending. The conversion was explicitly framed as having no tax implications for investors.

This development is significant in the QQQ versus QQQM comparison, as it diminishes the argument regarding structural drag against QQQ. QQQM’s primary remaining advantage is its lower expense ratio, rather than a fundamentally different operational structure.

Liquidity And Execution: The Cost You Feel Immediately

Secondary Liquidity: Volume And Depth

For traders, reallocators, hedgers, or those employing stop orders, liquidity is a quantifiable factor that directly influences implementation shortfall.

QQQ’s 10-day average volume was about 71.9 million shares, versus about 5.78 million for QQQM. In normal markets, both can be executed efficiently. In fast markets, QQQ’s depth tends to translate into cleaner fills and lower slippage for size.

A longer window metric tells the same story: QQQ’s 3-month average daily volume was about 55.56 million shares.

Bid-Ask Spreads: Tight In Both, But Not Identical In Practice

Representative quotes show $0.08 spread for QQQ around a ~$605 handle and $0.06 spread for QQQM around a ~$247 handle. In percentage terms, both are tight, but QQQ’s depth often matters more than the printed spread when you scale size or trade through volatility.

In practice, for larger orders, marketable limit orders, or trades executed near market open or close, QQQ’s liquidity profile offers greater flexibility and reduced execution risk.

Options Liquidity: Where QQQ Dominates

QQQ is one of the most actively used ETFs for options-based positioning and hedging. A representative snapshot shows QQQ options average daily volume around 5,751,129 contracts, with single-day volume regularly in the millions.

While QQQM options are available, their lower liquidity often results in wider bid-ask spreads, reduced fill quality, and less efficient execution of complex orders. For strategies involving collars, covered calls, put spreads, or intraday delta hedging, QQQ generally provides superior execution.

Returns And Risk: Similar Exposure, Slightly Different Net Results

Total Returns: The Numbers Are Almost On Top Of Each Other

Because both products track the same benchmark, the performance spread is typically “fee math plus noise.” Standardized annualized returns show:

The slight five-year performance advantage observed for QQQM aligns with expectations based on its modestly lower fee, rather than any portfolio differences.

Yield: Not A Differentiator, But Worth Noting

Nasdaq-100 exposure is not designed for high income. Still, published yields show modest differences that can fluctuate with distributions and market levels:

Yield should be considered a secondary factor in this context. The primary investment rationale is exposure to equity duration and growth sensitivity, rather than cash flow generation.

QQQM Vs QQQ: Which One Fits Which Investor?

For long-term core exposure, such as retirement accounts, dollar-cost averaging, or buy-and-hold strategies, QQQM is often preferable by design. Its fee advantage, though modest, is consistent, and daily trading volume remains sufficient for routine investment needs.

For active traders and tactical allocators, QQQ is generally the superior instrument. Its higher share volume, deeper order books, and tighter execution during periods of market stress can quickly offset the fee differential.

Options Users and Hedgers: QQQ is the default because its options market is far more liquid and efficient.

Large Orders and Institutional-Style Rebalancing: QQQ’s scale typically results in lower implementation shortfall, especially when trading outside the calmest hours.

In other words, the QQQ vs QQQM difference is best framed as: pay slightly less every year (QQQM) or trade more efficiently every time (QQQ).

Frequently Asked Questions

Is QQQM The Same As QQQ?

Both QQQM and QQQ track the Nasdaq-100, resulting in similar holdings and risk drivers. The primary differences are expense ratio, trading volume, and derivatives liquidity. For long-term investors, the lower fee may be significant, while for frequent traders, liquidity considerations are often more important.

Why Does QQQ Trade More Than QQQM?

QQQ has served as the flagship Nasdaq-100 ETF since 1999, establishing a strong presence in trading, hedging, and options markets. This network effect has concentrated liquidity in QQQ. In contrast, QQQM, launched in 2020, is still developing comparable market depth.

Does QQQM Always Outperform Because It Is Cheaper?

While QQQM does not always outperform solely due to its lower fee, the expected advantage is realized over time. Actual outcomes may be influenced by bid-ask spreads, order timing, and taxable events. For buy-and-hold investors, lower fees generally provide a long-term benefit.

Are QQQ And QQQM Tax-Efficient ETFs?

Both use the ETF creation and redemption mechanism, which generally supports tax efficiency compared to traditional mutual funds. QQQ’s 2025 modernization was explicitly described as having no tax implications for investors from the conversion itself.

Should Long-Term Investors Switch From QQQ To QQQM?

For genuinely long-term positions with infrequent trading, transitioning to the lower-fee wrapper may be a logical choice. The decision should consider individual tax circumstances, trading costs, and the potential need for QQQ’s superior options liquidity for overlays or hedging strategies.

Does The Share Price Difference Matter In QQQM Vs QQQ?

The share price difference does not affect percentage returns. While a lower share price may facilitate position sizing in whole-share accounts, many brokers now offer fractional shares. The more significant practical distinction is that QQQ options contracts require greater capital, as they are based on a higher-priced underlying asset.

Conclusion

QQQ and QQQM can be understood as two wrappers that provide access to the same underlying index. QQQM is optimized for long-term compounding by minimizing costs over time, while QQQ is designed for efficient implementation, offering superior liquidity and a dominant options market that can reduce trading friction.

For strategic, infrequently adjusted positions, QQQM’s lower fee represents a rational default choice. For tactical, actively managed, or options-linked strategies, QQQ’s liquidity advantage typically provides a more compelling benefit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.