In the world of finance, a stock market index is more than just a number on a screen—it is a powerful tool that reflects the health, trends, and overall sentiment of the market. By tracking the performance of a selected group of stocks, indexes help investors, analysts, and traders make sense of complex market movements, compare investment returns, and gauge economic conditions. Understanding what an index is, how it works, and why it matters is essential for anyone looking to navigate the world of equities with confidence.

Definition & Purpose of a Stock Market Index

A stock market index is essentially a statistical measure designed to track the performance of a specific section of the stock market. It aggregates the prices or market values of a selection of shares to provide a single representative number.

Indexes serve several important purposes:

Benchmarking: They allow investors to compare the performance of individual stocks or portfolios against the market.

Market Sentiment Indicator: They reflect the overall mood of the market—whether it is bullish or bearish.

Economic Gauge: Many investors and analysts use indexes to get a sense of the broader economy's health.

In short, indexes simplify complex market movements into a single, easily interpretable figure, helping both professionals and casual investors gauge market trends.

How Stock Market Indexes Are Constructed

Building an index is not simply a matter of picking a few stocks at random. The process involves careful selection and weighting:

Selection of Stocks: Stocks are chosen based on criteria such as market capitalisation, liquidity, sector representation, and geographic location.

Price-Weighted: Shares with higher prices have greater influence on the index.

Capitalisation-Weighted: Companies with higher market value carry more weight.

Fundamentally Weighted: Weights are based on metrics like earnings, revenue, or dividends.

The choice of weighting method directly affects how the index reacts to market movements. A high-priced stock in a price-weighted index, for example, can disproportionately influence the overall value.

Major Types of Stock Market Indexes

Indexes come in various forms, each designed to measure different aspects of the market:

Price-Weighted Indexes: Focus on the share price; high-priced stocks have more impact. Example: Dow Jones Industrial Average (DJIA)

Capitalisation-Weighted Indexes: Focus on company size; larger firms dominate. Example: S&P 500. FTSE 100

Sectoral or Industry Indexes: Track a specific sector, such as technology, healthcare, or energy.

Regional or Country Indexes: Represent stocks from a particular country or region, e.g., Nikkei 225 (Japan) or DAX (Germany).

Equal-Weighted Indexes: All constituent stocks have the same weight, offering a different perspective on performance.

Understanding the type of index is crucial, as it determines which companies influence its movements and how investors interpret its signals.

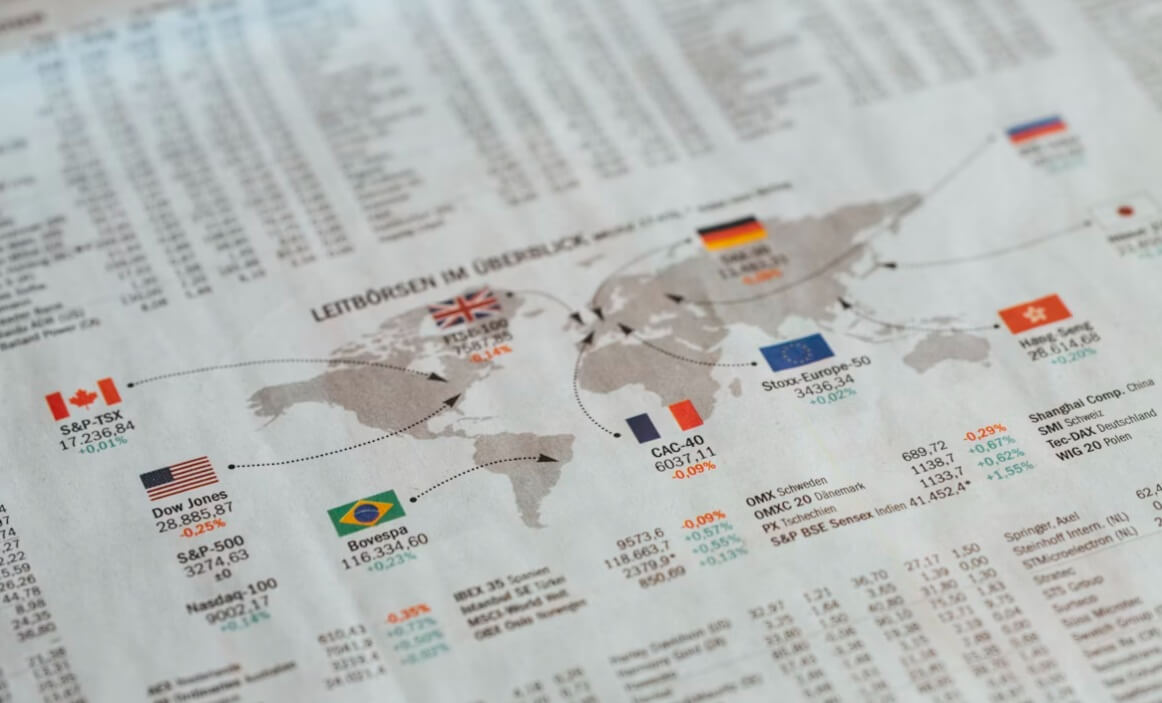

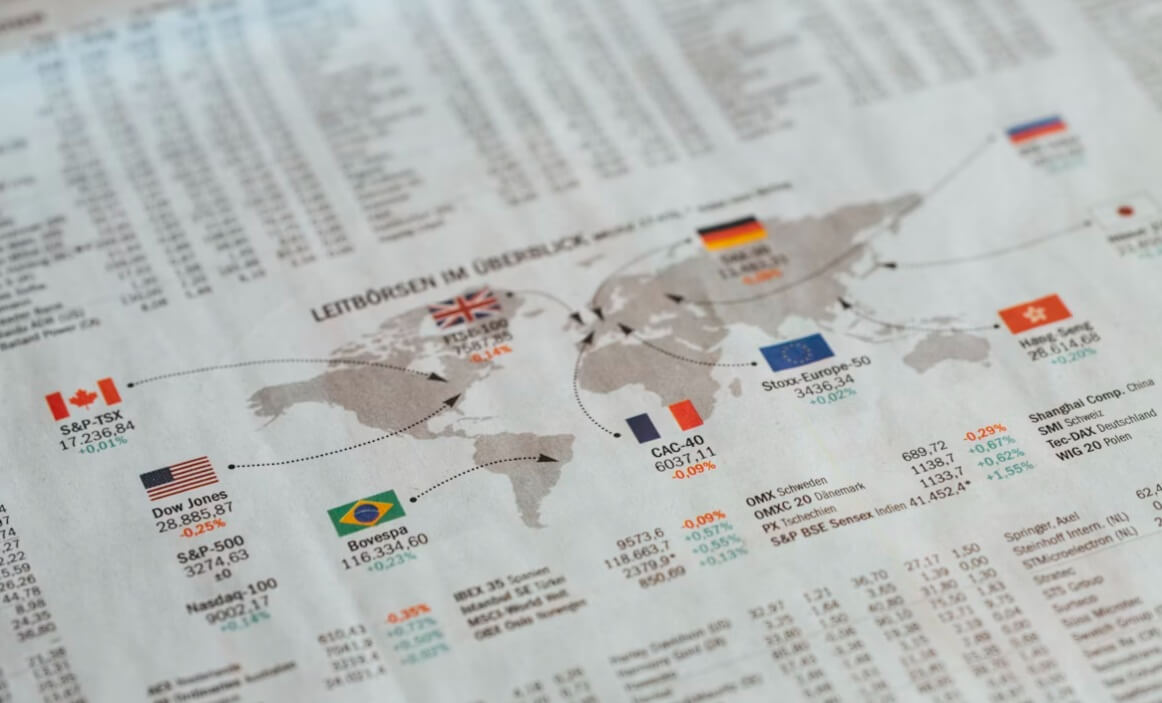

Popular Global Stock Market Indexes

Several stock market indexes are widely followed worldwide, each serving as a benchmark for markets or investment strategies:

S&P 500 (US): Tracks 500 of the largest US companies by market capitalisation, widely regarded as a measure of the overall US equity market.

Dow Jones Industrial Average (US): Price-weighted index of 30 major US companies, historically significant for market trends.

Nasdaq Composite (US): Primarily technology-focused, including over 3.000 stocks listed on the Nasdaq exchange.

FTSE 100 (UK): Top 100 companies on the London Stock Exchange by market capitalisation.

Nikkei 225 (Japan): Price-weighted index representing 225 major Japanese companies.

These indexes provide investors with benchmarks to gauge market performance, assess risk, and guide investment decisions.

Key Roles and Uses of Stock Market Indexes

Indexes are far more than passive indicators; they play active roles in financial markets:

Benchmarking Investment Performance: Fund managers compare their returns against relevant indexes to demonstrate skill or track performance.

Market Analysis: Analysts and economists use indexes to identify trends, volatility, and overall market health.

Investment Vehicles: Indexes serve as the foundation for index funds and exchange-traded funds (ETFs), offering low-cost exposure to a market segment.

Portfolio Diversification: Tracking an index allows investors to gain broad exposure without needing to pick individual stocks.

In essence, indexes act as both a yardstick and a strategic tool for investors.

Investing via Index Funds & ETFs

One of the most popular ways investors engage with indexes is through index funds and exchange-traded funds (ETFs):

Index Funds: Mutual funds that aim to replicate the performance of a particular index, typically at low cost.

ETFs: Tradeable on exchanges like individual stocks, they track the performance of an index while providing liquidity and flexibility.

Investing in these products allows individuals to mirror the performance of the broader market, benefiting from diversification, lower fees, and historically stable long-term returns.

For example, an investor seeking broad exposure to the US market might buy an S&P 500 ETF, thereby investing in 500 large US companies in a single transaction.

Conclusion

A stock market index is a fundamental pillar of modern investing. It simplifies the complexity of thousands of individual stocks into a single, meaningful number, providing insights into market trends, economic health, and investment performance. By understanding how indexes are constructed, their types, and their practical applications, investors can make more informed decisions and navigate financial markets with greater confidence.

Whether used as a benchmark, an investment vehicle, or a guide to market sentiment, stock market indexes remain essential tools for anyone looking to understand or participate in the world of equities.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.