The Japanese yen weakened on Wednesday as disappointing domestic data combined with a rebound in the US dollar, sending USD/JPY to retest the 147.00 level.

Japanese Data Disappoints

Fresh figures showed that Japan's core machinery orders in July fell 4.6% month-on-month, a far sharper decline than markets had anticipated.

On an annual basis, growth slowed to 4.9%, down from 7.6% in June. The weak reading underlined ongoing fragility in Japan's corporate investment outlook, pressuring the yen.

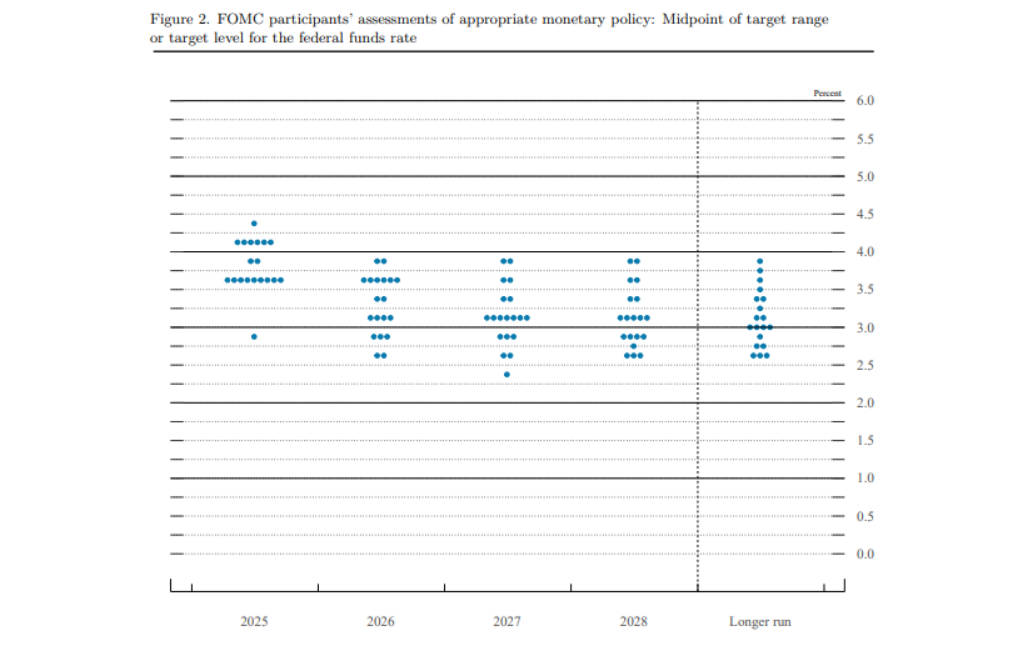

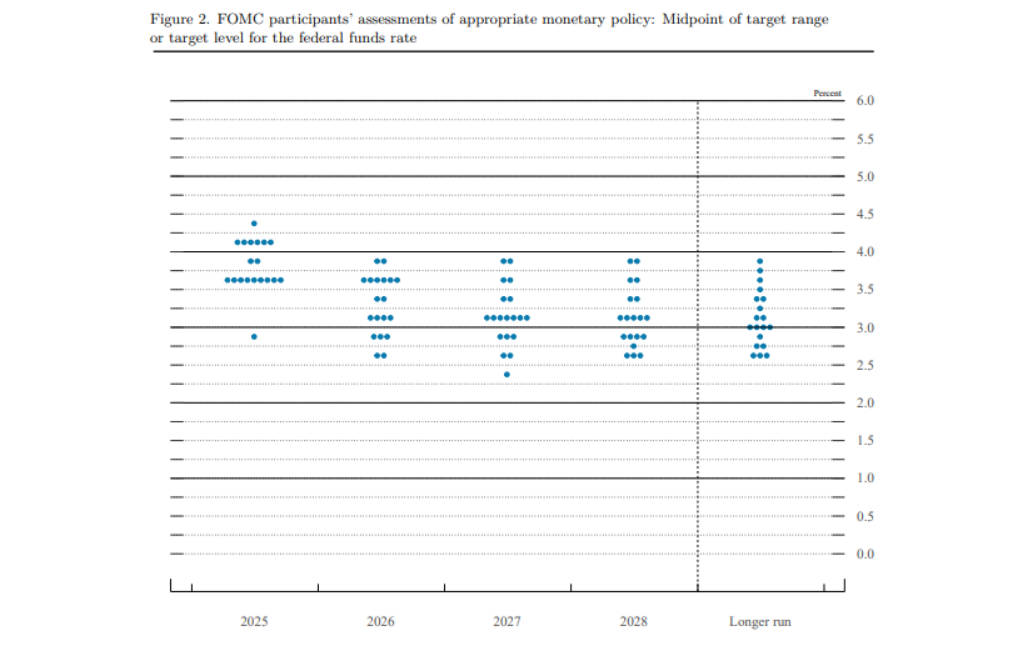

Fed Delivers First Rate Cut Since December 2024

In contrast, the Federal Reserve announced its first rate cut since December 2024, lowering the federal funds rate by 25 basis points to a range of 4.00%–4.25%.

Despite the easing move, Fed Chair Jerome Powell stressed that "inflation risks remain skewed to the upside", a remark that sparked significant short-covering in the dollar.

As a result, USD/JPY rebounded sharply from 145.50 to above 147.00. gaining more than 150 pips in a matter of hours.

Market Outlook: Diverging Policy Paths

While the yen weakened in the short term, investors still expect the Bank of Japan (BoJ) to consider tightening policy later this year. Rising wage pressures, resilient labour market conditions and a rebound in inflation are fuelling speculation that Japan may finally step away from ultra-loose policy.

At the same time, a recent easing of US–Japan trade frictions has reduced downside risks to Japan's growth outlook, providing some scope for the BoJ to act. These expectations are helping to limit the scale of yen depreciation.

Technical Levels to Watch

Daily price action shows USD/JPY briefly slipping below 146.20 before rebounding strongly, suggesting a potential false breakout. The pair has since reclaimed the 147 handle.

Technical Levels to Watch Regarding USD/JPY

| Level |

Type |

Market Implication |

| 147.40–147.50 |

Resistance |

Breakout here may target 148.00 and the 200-day moving average near 148.75 |

| 149.00–149.15 |

Resistance |

Monthly highs; potential if momentum extends |

| 146.2 |

Support |

A decisive break could accelerate losses towards 145.50–145.00 |

| 145 |

Support |

Psychological level and potential medium-term floor |

Technical indicators such as MACD and RSI have yet to confirm sustained bullish momentum, leaving upside potential subject to further validation.

Short-Term vs. Medium-Term View

Short-term (days to a week): USD/JPY is expected to consolidate within a 146.00–148.00 range. A clear break above 147.50 could pave the way for 148.75 and beyond, while a fall below 146.00 would expose 145.00.

Medium-term (weeks to months): Dollar strength could persist if US data remain robust and inflation proves sticky. However, should the BoJ surprise with rate increases or should US easing accelerate, the yen may regain lost ground.

Conclusion

The current rebound in USD/JPY reflects both the dollar's resilience following the Fed's rate decision and the yen's vulnerability after weak domestic data. While near-term momentum favours the dollar, the prospect of BoJ normalisation and the yen's safe-haven role suggest that further depreciation is likely to be contained.

USD/JPY traders should prepare for continued volatility, with 146.00 and 147.50 acting as key pivot levels in the days ahead.

Key FAQs on USD/JPY

1. What does USD/JPY represent?

It shows how many Japanese yen are needed to buy one US dollar, making it one of the most traded forex pairs globally.

2. What drives USD/JPY the most?

The interest rate gap between the Federal Reserve and the Bank of Japan, along with inflation data and global risk sentiment.

3. Why is the yen considered a safe-haven currency?

In periods of global uncertainty, investors often buy yen due to Japan's stable financial system and strong current account surplus.

4. How do Fed decisions affect USD/JPY?

Rate hikes in the US typically strengthen the dollar and push USD/JPY higher, while rate cuts usually weaken it.

5. What is the short-term outlook for USD/JPY?

The pair is expected to trade between 146.00 and 148.00. with a break above 147.50 opening room towards 148.75–149.00.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.