Volmageddon is a market state where volatility shifts from a price measure to a driving force. Portfolios built on mean-reverting volatility may not experience the expected mean reversion.

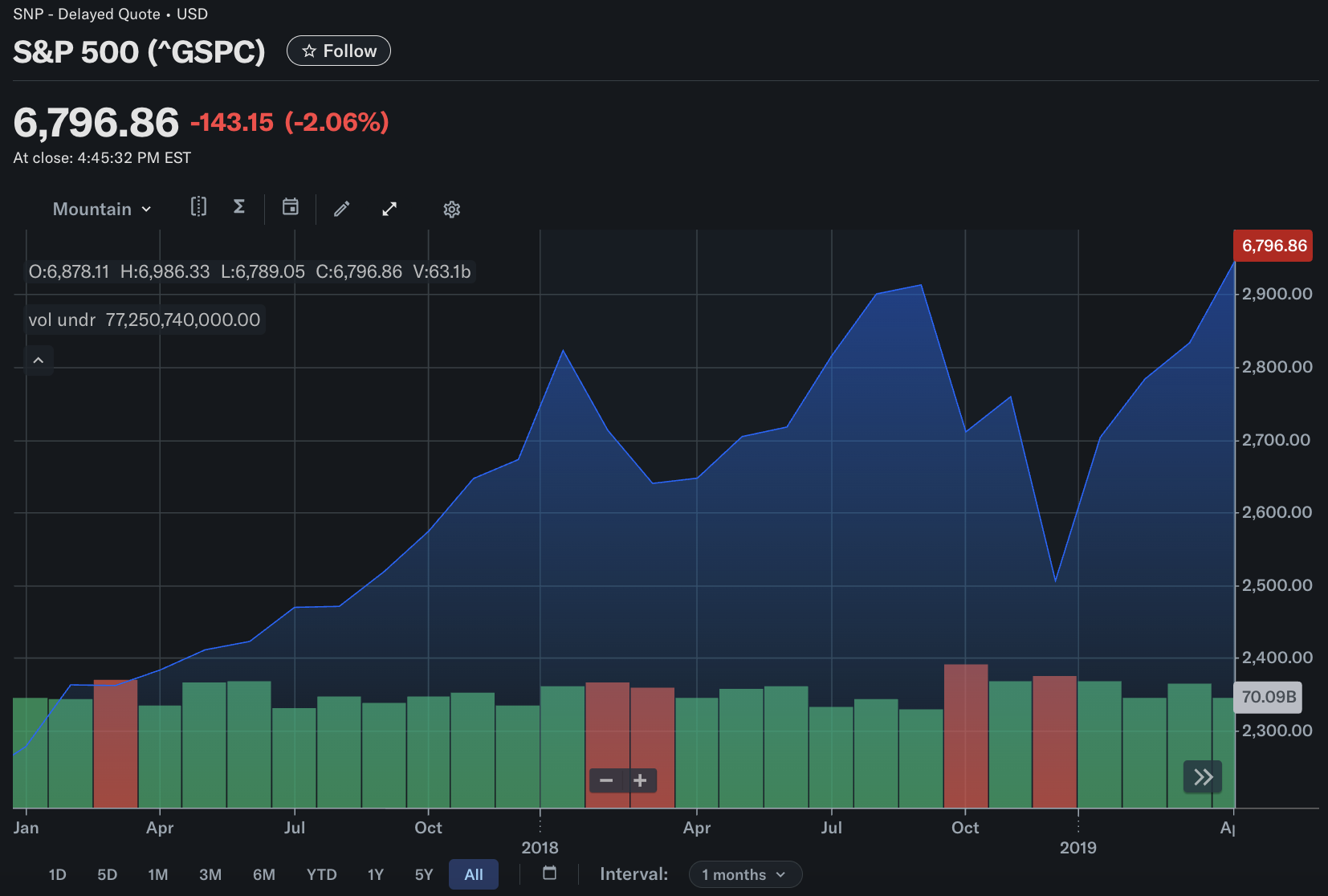

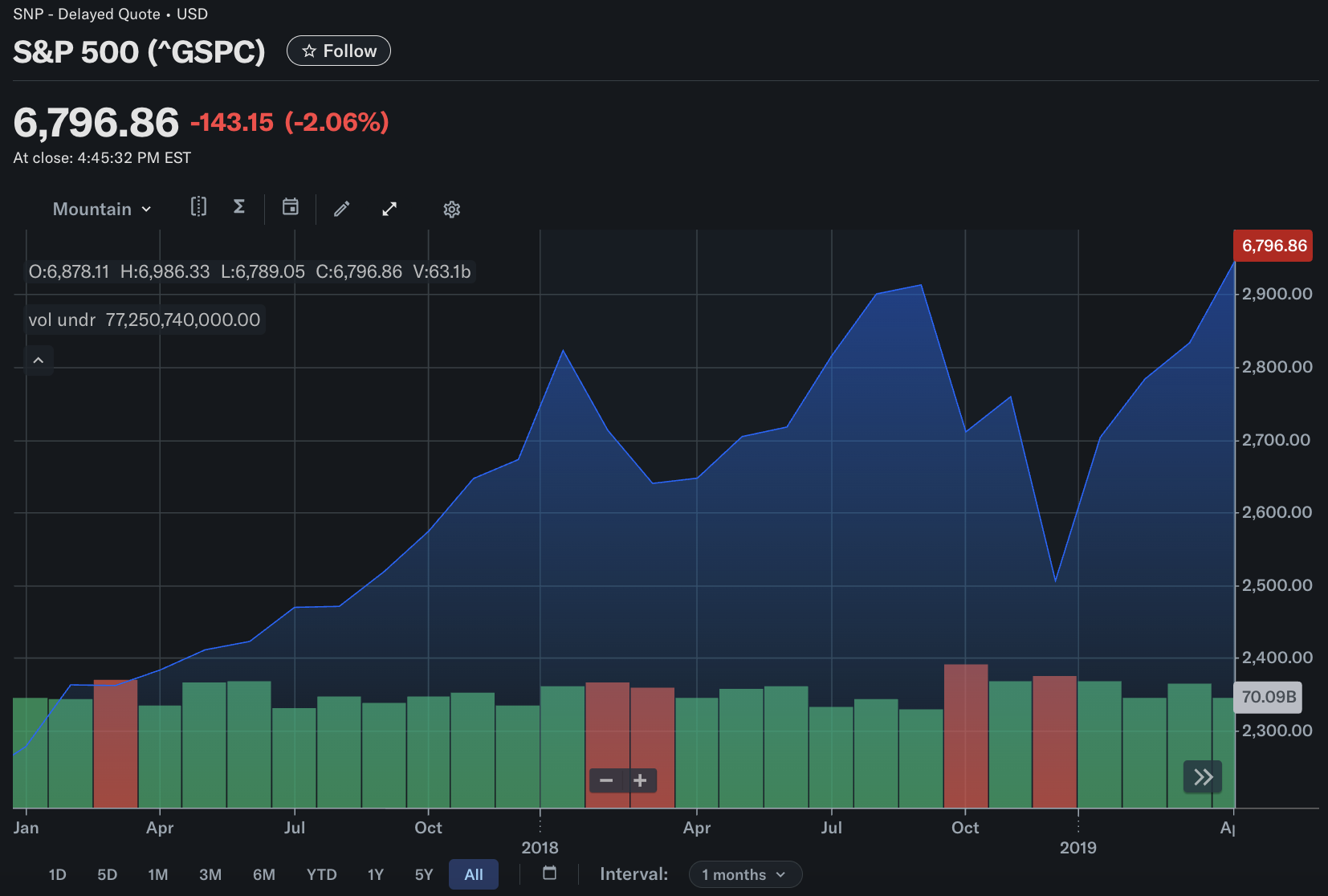

January 2026 events show how market stability can turn volatile in a matter of days. On January 20, the S&P 500 fell 2.06 percent, and the VIX jumped 26.67 percent to 20.09. Such moves drive systematic risk reduction and force rapid adjustment of short-volatility positions.

Key Takeaways:

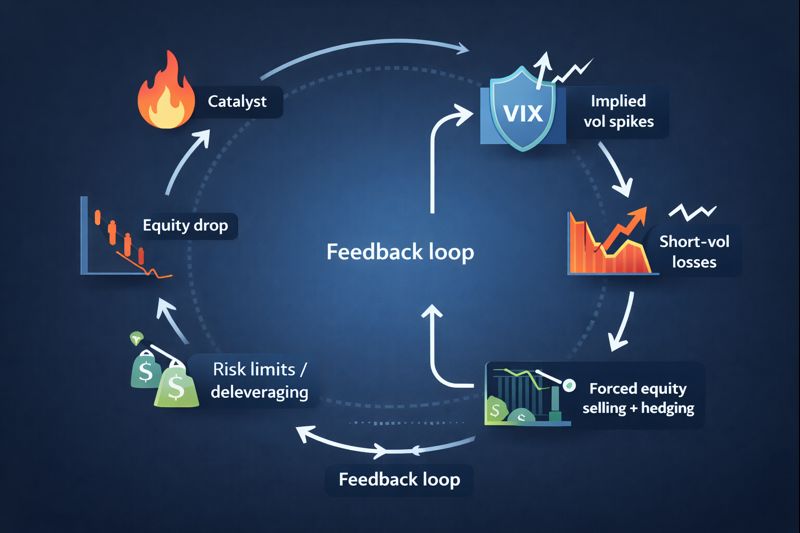

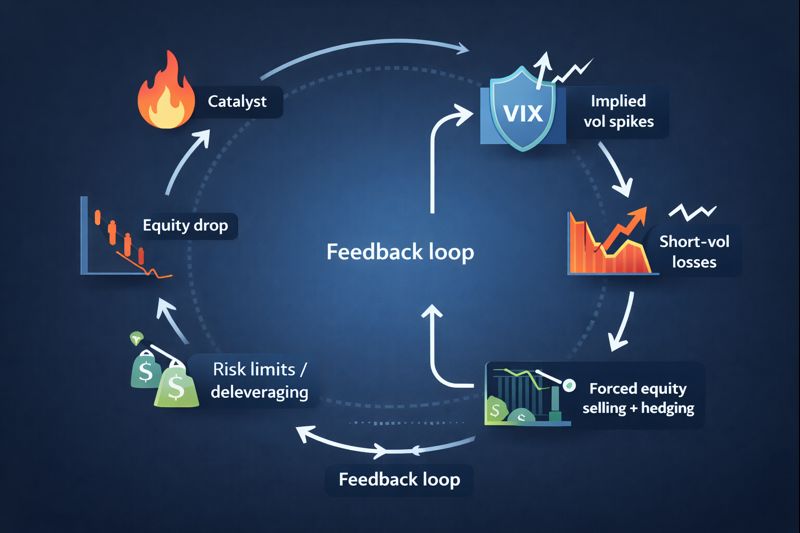

Volmageddon describes a feedback loop in which volatility, selling pressure, hedging demand, and forced deleveraging mutually reinforce and amplify one another, rather than representing a mere spike in the VIX.

In early February 2018, the VIX surged from 17.31 to 37.32, and inverse volatility products hit tripwires that accelerated losses.

The developments in January 2026 demonstrate the initial stages of similar risk dynamics. A single risk-related headline can elevate implied volatility sufficiently to pressure market positioning, particularly in environments with limited liquidity and asymmetric options hedging.

Volatility is quantified through options pricing rather than subjective sentiment. The VIX measures expected near-term volatility based on equity index option prices, enabling it to reprice more rapidly than cash markets.

What Volmageddon Means In Plain Market Language

Volmageddon refers to a severe volatility event in which market structure transforms a drawdown into a cascading decline. During typical sell-offs, volatility increases as investors seek protection. Under Volmageddon conditions, rising volatility compels additional selling, which in turn further elevates volatility.

The distinction lies in leverage and convexity. Short volatility positions generate modest, frequent gains by selling options, managing inverse volatility notes, or employing strategies that implicitly assume market stability.

These positions are exposed to nonlinear losses when implied volatility jumps. When risk limits bite, they must reduce exposure fast. The act of reducing exposure becomes another driver of volatility and another source of pressure on equities.

This feedback loop may be initiated by various catalysts, including inflation surprises, policy changes, geopolitical events, or concentrated market positioning. The underlying vulnerability is the market's reliance on persistently low volatility.

The Original Volmageddon: February 2018’s Structural Break

The 2018 Volmageddon was born out of an extended period where volatility was persistently low and short-vol trades became crowded. In early February, volatility repriced rapidly. The VIX closed moved from 17.31 on February 2 to 37.32 on February 5.

What made the episode memorable was not only the VIX. It was the product design sitting atop the VIX futures complex. The most notorious example was the VelocityShares Daily Inverse VIX Short Term ETN (XIV). Credit Suisse disclosed that XIV triggered an “acceleration event” because its intraday indicative value fell to 20 percent or less of the prior day’s closing indicative value.

The issuer then moved to an event acceleration timeline, including an expected last trading day and cash settlement based on the closing indicative value on the accelerated valuation date.

This matters because inverse volatility products are not simple “short the VIX” bets. They are often linked to short-term VIX futures indices that roll exposure across the front end of the curve. When volatility spikes, the front end of the VIX futures curve can gap higher, and inverse exposure can become mathematically unstable. If the product structure also includes hard triggers, the market can shift from orderly to mechanical in a single session.

The 2018 episode demonstrates that Volmageddon was not accidental but rather a foreseeable result of concentrated short-volatility exposure encountering a sudden shift in implied volatility.

January 2026 Volatility: Why The Setup Feels Familiar

In January 2026, though product concentration differs from 2018, the reflex remains: volatility was subdued, then sharply repriced on policy uncertainty. Selling pressure was tied to renewed tariff threats as traders responded to shifting growth and inflation expectations.

The numbers capture the shift. On January 20, the S&P 500 closed at 6,796.86, down 2.06 percent. Over the same session, the VIX closed at 20.09, up 26.67 percent. The VIX also pushed above 20, a level many desks treat as the boundary between “orderly risk” and “fragile risk,” and commentary noted it was the first time above 20 since late 2025.

Volmageddon risk starts with a volatility jump, not a crash. When implied volatility rises, hedging costs increase, risk budgets shrink, and systematic volatility-targeting strategies cut exposure.

US Equity Volatility Snapshot

| Date |

S&P 500 close |

Daily move |

VIX close |

Daily move |

| Jan 13, 2026 |

6,963.74 |

-0.19% |

15.98 |

+5.69% |

| Jan 14, 2026 |

6,926.60 |

-0.53% |

16.75 |

+4.82% |

| Jan 15, 2026 |

6,944.47 |

+0.26% |

15.84 |

-5.43% |

| Jan 16, 2026 |

6,940.01 |

-0.06% |

15.86 |

+0.13% |

| Jan 20, 2026 |

6,796.86 |

-2.06% |

20.09 |

+26.67% |

Stock Market Information For Barclays iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX)

Barclays iPath Series B S&P 500 VIX Short-Term Futures ETN is an equity in the USA market.

The price is currently 29.38 USD, up 3.05 USD (0.12%) from the previous close.

The latest open price was 28.73 USD, and the intraday volume is 24210510.

The intraday high is 29.88 USD, and the intraday low is 27.7 USD.

The latest trade time is Wednesday, January 21, 09:15:07 +0800.

The Mechanics That Turn A Volatility Spike Into Volmageddon

A volatility spike escalates into Volmageddon when market participants are compelled to take similar actions at the same time.

1) Dealer hedging and the gamma problem

Options dealers hedge dynamically. When markets fall and put demand rises, dealers can end up short gamma. In that regime, a down move forces them to sell more to stay hedged, which can deepen the move. When the market stabilizes, the same flows can flip, which is why Volmageddon sessions often feel like air pockets followed by violent rebounds.

2) Volatility targeting and systematic de-risking

Many institutional strategies adjust exposure based on realized volatility. An increase in volatility reduces target leverage, and the speed of this adjustment is critical. When volatility rises rapidly, model-driven responses may occur within a compressed timeframe, leading to a mechanical reduction in risk rather than a fear-driven reaction.

3) Short-vol carry trades and convexity

Short-volatility strategies generate carry during periods of stable volatility, but incur convex losses when volatility increases sharply. The shift from earning carry to experiencing convex losses distinguishes Volmageddon events. Losses become nonlinear, and liquidity may disappear when it is most needed.

4) Product structure still matters

The 2018 episode underlined a hard truth: product design can magnify market stress. Credit Suisse’s disclosure around XIV’s acceleration trigger shows how embedded rules can force rapid, unavoidable repositioning. Even if today’s market is less concentrated in one product, structure still matters across levered ETFs, volatility-linked notes, and option overlays.

What To Watch In 2026: Fault Lines, Not Forecasts

Volmageddon risk is most effectively conceptualized as a mapping of market vulnerabilities.

Implied volatility above key thresholds. When the VIX moves above 20 and stays there, hedging costs rise, and risk budgets tighten. January 2026 has already tested that boundary.

Speed of the move, not the level. A 25 percent one-day jump in implied volatility tends to matter more than the absolute VIX print because it forces positioning changes.

Cross-asset confirmation. Volmageddon is more likely when rates, volatility, credit spreads, and equity volatility rise together. That is when diversification fails, and leverage becomes visible.

Options-driven market microstructure. Heavy use of short-dated options can sharpen intraday hedging flows. The market can move faster than traditional cash liquidity can absorb.

The market does not need a repeat of 2018 to experience a Volmageddon-like dynamic. It only needs a sufficiently large volatility shock to trigger synchronized de-risking.

Frequently Asked Questions (FAQ)

1. What is Volmageddon?

Volmageddon is a sudden volatility shock that triggers a self-reinforcing loop: implied volatility rises, hedging demand increases, and forced deleveraging amplifies market moves. It is less about a single headline and more about positioning and market structure.

2. Why did Volmageddon happen in 2018?

In early February 2018, volatility jumped sharply, with the VIX closing at 37.32 on February 5, up from 17.31 on February 2. Inverse volatility products hit structural triggers, accelerating losses and forcing repositioning.

3. Is the VIX the same as market volatility?

The VIX is a measure of expected near-term volatility implied by equity index option prices. It is forward-looking and can reprice faster than realized volatility in the cash index.

4. Why does the level “20” matter for the VIX?

VIX 20 is not a law of finance, but it is a widely watched regime marker. Above it, hedging demand tends to increase, risk models often tighten, and investor behavior can become more defensive. Recent commentary highlighted the VIX moving back above 20 in January 2026.

5. Can Volmageddon happen without a crash?

Yes. Volmageddon describes the feedback loop between volatility and positioning. A sharp one-day repricing of implied volatility can be enough to trigger mechanical selling, even if the initial equity move is not extreme.

6. What is an inverse volatility ETN?

An inverse volatility ETN is a debt instrument that delivers inverse daily exposure to a volatility-linked index, often tied to short-term VIX futures. In 2018, XIV triggered an acceleration event after its indicative value fell to 20 percent or less of the prior day’s level.

Conclusion

Volmageddon serves as a reminder that volatility encompasses more than a numerical value; it reflects leverage, hedging flows, and risk appetite within a single price. The 2018 episode demonstrated how short-volatility positioning and product structure can transform a routine selloff into a structural event. Although January 2026 has not replicated that shock, the recent increase in implied volatility and sharp equity decline indicate that similar market mechanics persist.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.